Stockwatch: wait until pubs open before ordering this AIM share

It’s a good company, but our shares analyst is inclined to go with his gut feel. But what is it?

30th June 2020 15:04

by Edmond Jackson from interactive investor

It’s a good company, but our shares analyst is inclined to go with his gut feel. But what is it?

Despite high hopes for British pubs re-opening from Saturday, I’m cautious that the hospitality industry can achieve meaningful shareholder value. Simply covering costs would be a fine thing.

The challenge is exemplified by the AIM-listed non-voting shares in Young & Co’s Brewery (LSE:YNGA) which, at 1,035p, remain down on 1,680p last 24 February, although they are propped up for the time being by net tangible assets of 955p a share despite an £88.4 million placing at 735p just recently. The fundraising increased shares in issue from 49 million to 58.5 million.

- Shares round-up: Shell, Redrow, InterContinental Hotels, Cineworld

- Chart of the week: are the FAANGS finally losing their teeth?

- Ian Cowie: sticking with 10 winning trusts

“You can’t step into the same river twice”

According to such proverb, the underlying currents within this business have changed, and it is eight years since I drew attention to Young’s shares as a ‘buy’ at 600p. Young’s is also no brewery, despite retaining such name: it actually divested the Wandsworth operation 11 years ago, and is nowadays an estate of 276 outlets chiefly in London and the South. Its long-term track record and asset-backing contrasts with most speculative AIM stocks, hence virtue as a means to mitigate inheritance tax (IHT) under the AIM rules.

In July 2012, net asset value per share was 70% higher than the market price, and business was picking up. But in recent years I’ve become cautious of a gamut of rising costs – from business rates to employment, food and energy. Also, of the scope to enhance and extend Young’s’ asset base; whether enough sites would become available in its London/South East territory which may also be exposed to Brexit risks.

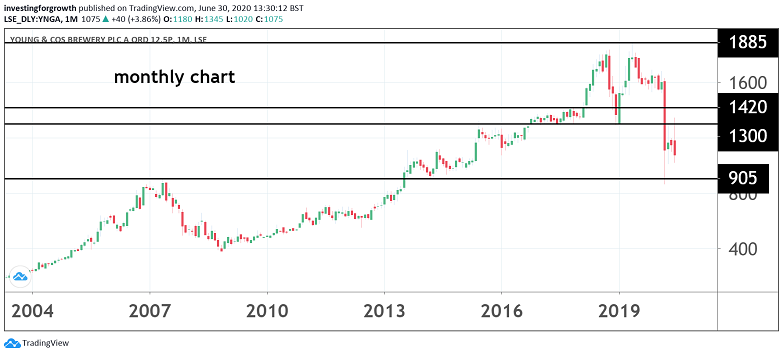

And yet two years ago Young’s shares were on a rip. Market price had risen 28% in the first half of 2018 to a valuation of 25x earnings in its 2018 financial year, a scant 1% yield and a 50% premium to net assets. I suggested taking profits at 1,685p as I am more fundamentals-oriented, despite Young’s’ chart implying a perfect momentum play.

Prices did trend higher over the next four months, reaching 1,830p, then a volatile sideways consolidation set in until a sharp plunge from 1,650p late last February as Covid-19 manifested.

Asset value then propped the stock at 920p, and a recovery near 1,300p ensued, yet the board has had to resort to 40%-plus discounted equity placing, raising £88.4 million at the cost of near-20% dilution.

Source: TradingView. Past performance is not a guide to future performance.

Negotiation by institutions likely had much to do with the placing price (versus some recently struck nearer market price). Fund managers would have weighed the risks of ploughing in more capital to support their investment, versus the dilutive cost of a true “deep discount”.

A declared rationale to “restart investments in Young’s’ estate”

I suspect this board is like many others, rushing to bolster its balance sheet after the market rebounded from March lows, and while investor appetite is keen. Pub re-openings may not work out as hoped.

It is certainly true how Young’s offers high standards, hence has significant ongoing refurbishment (see relatively high capital expenditure in the table).

Some £140 million has been spent in the last five years – boosting the estate in London, Surrey and the South West. But since like-for-like annual revenue growth from Young’s’ managed houses has still been only 5% over 2011 to 2019, management is somewhat reliant on acquisitions to deliver the kind of growth, investors hope for.

It would also make current sense to have a war chest for when other well-located pubs throw in the towel – given Covid-19 looks likely to persist. But I can’t help feel this capital raising is as much about ensuring a lifeboat for a pubs’ operator – for the financial year ahead – as investment for growth.

| Young & Co's Brewery - financial summary | ||||||

|---|---|---|---|---|---|---|

| year end 30 Mar | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

| Turnover (£ million) | 227 | 246 | 269 | 279 | 204 | 312 |

| Operating profit (£m) | 41.5 | 38.4 | 42.7 | 43.5 | 44.6 | 37.9 |

| Operating margin (%) | 18.3 | 15.6 | 15.9 | 15.6 | 14.7 | 12.2 |

| Net profit (£m) | 26.7 | 26.6 | 30.0 | 30.1 | 31.5 | 19.3 |

| Reported earnings/share (p) | 55.1 | 54.7 | 61.5 | 61.6 | 64.3 | 39.4 |

| Normalised earnings/share (p) | 42.7 | 59.0 | 68.6 | 69.3 | 72.5 | 51.0 |

| Operating cashflow/share (p) | 89.8 | 108 | 115 | 107 | 122 | 120 |

| Capital expenditure/share (p) | 66.9 | 85.6 | 70.7 | 62.2 | 69.2 | 67.1 |

| Free cashflow/share (p) | 22.9 | 22.6 | 43.9 | 44.8 | 53.3 | 53.2 |

| Dividend per share (p) | 16.5 | 17.5 | 18.5 | 19.6 | 10 | 21.4 |

| Covered by earnings (x) | 3.4 | 3.1 | 3.3 | 3.1 | 6.5 | 1.8 |

| Cash (£m) | 0.2 | 13.2 | 6.6 | 7.2 | 8.5 | 1.1 |

| Net debt (£m) | 129 | 130 | 127 | 141 | 164.0 | 280 |

| Net assets (£m) | 407 | 453 | 493 | 549 | 593 | 591 |

| Net assets per share (p) | 840 | 930 | 1010 | 1124 | 1212 | 1205 |

| Source: historic Company REFS and company accounts |

Shocking plunge in the last month of Young’s financial year

Results for the latest year to 1 April 2020 showed that closing pubs only for last 10 days of the financial year – admittedly with some preceding fall in trade – meant a £13.0 million revenue shortfall hence compromising annual growth to 2.6% to £311.6 million, and a £7.7 million profits hit.

Such profits’ damage shows also why the government is so keen to get the UK hospitality industry back on its feet – at least to some extent – than allow deeper damage from which many (jobs) won’t bounce back.

- AIM at 25: all grown up and outperforming the big boys

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

It’s heroic of Young’s and others to face the challenges head-on, raising capital for conservation and potential growth. But from an investing perspective, I’m far from convinced we’re looking at a value-enhancing equation, as yet.

Probably, there will be an initial rush out to venues this weekend, similarly as keen queues formed outside department stores re-opening. But if these punters are obeying any social distancing then they should be in their restricted “bubble groups” of near family/friends. Yes, it can work in beer gardens if the weather holds, although quite how popular staff will be when they tell drinkers their time is up – to allow more customers in.

If indoors, then babbling breath risks the perfect environment for virus to flourish, and you can see already many younger people are not respecting distancing. So, to me, it’s 50:50 whether this re-opening can work. I agree, it’s vital the industry doesn’t fester, including brewers, but from an investing perspective I see a fair chance of negative returns for shareholders – on a 12 months’ view.

I’d write off realistic expectations to next springtime

Autumn and winter is going to compromise safe seating indoors, although if hospitality stocks suffer again they could possibly represent a good buy in the depths of winter gloom. Young’s asset value ought to mitigate downside risk however renewed lockdowns in Texas and Leicester exemplify risks to the industry. There’s also a scare story about how a woman went to a Florida bar and ended up infecting 15 people.

See from the table also, how the operating margin has struggled to hold around 15.5% having de-rated from high-teen percentage then plunged to 12.2% and must surely go lower, adjusting for lower customers being the “new normal”. I’m thinking on a multi-year view here, not just the damage this financial year which may see margin wiped out (hence the capital-raising).

Shutdown suspended £36 million of planned capital expenditure and Young’s say they want a rate of £40 million a year in the medium term, with a targeted return on capital no less than 15% - targeting 17% from key development projects. That seems highly optimistic and speculative unless Covid-19 peters out.

Re-fuelling with cash has been essential

The final dividend was omitted in a bid for cash conservation, with balance sheet cash down to £1.1 million (from £8.5 million), £149.2 million long-term debt also £50 million short-term – which has swelled current liabilities to £91 million, versus £13.8 million current assets.

Trade payables were £33.3 million versus £9.3 million trade receivables. The placing particulars cited year-end net debt rising from £199 million to £227 million as of 18 June.

So despite the £88 million placing being presented chiefly as supporting investment, a good portion of that was needed anyway as balance sheet support – in a tough year, or more. Leverage had been kept at 2x net debt/EBITDA for the last five years, based on £152 million average net debt; however at the financial year-end it was 2.8x.

Pubs’ precariousness is shown also by Young’s reliance on the government’s job retention scheme to October, also £14.5 million business rates holiday relief.

Still a fair deal for existing shareholders

If holding Young’s I would still have participated in the placing, which was extended to private investors and backed also by directors/management. A 27% discount even to pro-forma net tangible assets made it sensible, and I don’t mean to knock Young’s as ‘Hold’ for those having just added.

But for fresh investing at market price around 1,050p currently I want to see how realistic British pubs’ re-opening proves, the rest of this year, and how Young’s entertaining a 15%-plus return on capital – versus 5% underlying annual growth from pubs since 2011 – is to be achieved. Avoid.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.