Stockwatch: US vs UK tech - the outlook for Nvidia and three key shares

Analyst Edmond Jackson explores high valuations for US tech and what they might imply for a possible market top, as well as whether to favour ‘growth’.

24th December 2024 08:52

by Edmond Jackson from interactive investor

A standout feature of 2024 has been the ongoing strength of US technology stocks, with the Nasdaq index up 36%, in the context of a compound annual growth rate near 17% over the past 17 years.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

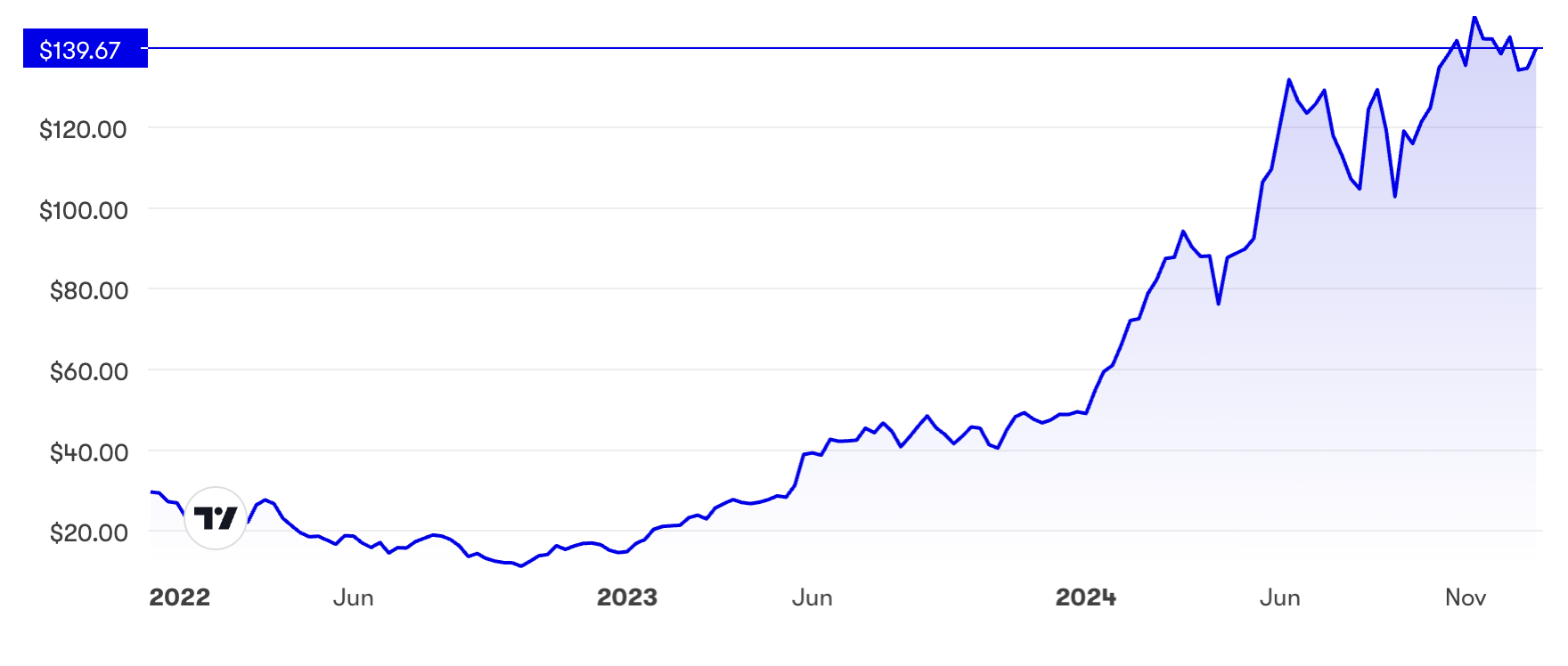

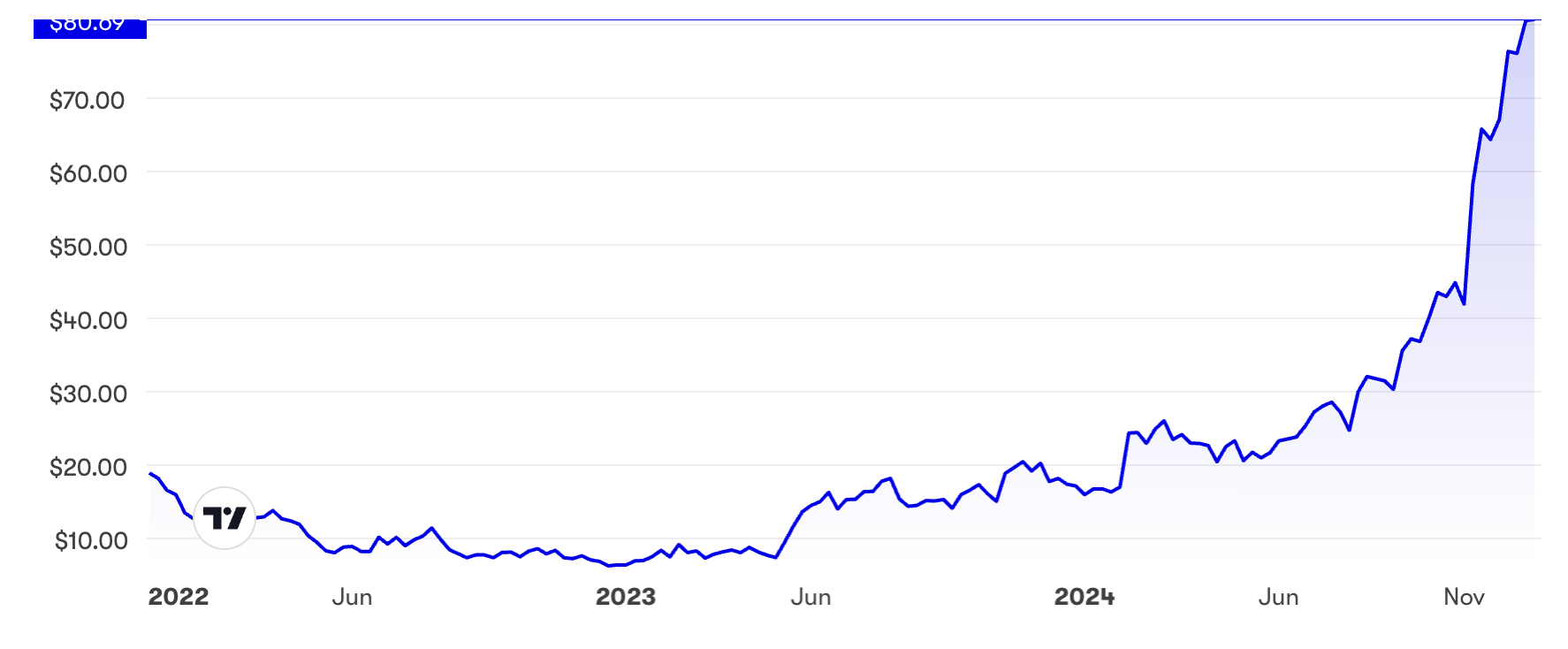

Indeed, the two best-performing stocks I have drawn attention to – and it did not take much sifting of US stocks – were artificial intelligence (AI) chip-maker NVIDIA Corp (NASDAQ:NVDA), up around 200% to $135 over the year, or over 250% since I rated it “buy” at $40 equivalent (before a 10-for 1 stock split) in June 2023; and data analytics group Palantir Technologies Inc Ordinary Shares - Class A (NASDAQ:PLTR), which is up 265% since I drew attention last April to its potentially transformative partnership with Oracle Corp (NYSE:ORCL).

Is this a signal to prioritise US tech for its dynamism and global competitiveness? How the giants especially are churning out strong reliable cash flows given their margins and sales momentum. Or is it a warning sign on how tech is outperforming in the late stage of a bull market? The past six months or so has seen various stocks double amid rosy comments and projections.

- Stockwatch: why there could be more pain ahead for US shares

- Stockwatch: should you own Nvidia at an all-time high?

Undoubtedly, AI is real and here to stay, compared, say, with the “Year 2000 problem” hype behind various tech stock rallies in 1999, and when the internet was far earlier stage for commercial adoption. Inevitably there were a great many failures among “dotcom” stocks, which contributed to the tech valuation bubble bursting.

Let us not forget, however, the aftermath when a bubble bursts and speculative capital unwinds. Hedge fund leverage is back to record highs. From March 2000, the Nasdaq lost 76% of its value, the S&P 500 45% and Amazon.com Inc (NASDAQ:AMZN) plunged 90%.

Possibly what is different this time is the Federal Reserve’s appreciation, asset prices nowadays are critical to the economy, and there would be a swift and major stimulus response. By all means cringe at “different this time”.

Why buyers are likely to continue for Nvidia’s drops

On present insights I do feel relatively more confident about Nvidia. It initially attracted me due to a sense of parallel with ARM Holdings ADR (NASDAQ:ARM) on the London market some 25 years ago. Nvidia’s dominance – for example, around 95% of the AI accelerator market – is even stronger than ARM’s (back then or now) and a week ago it launched a $249 nano computer – a tiny device that can run AI models locally.

A latest revelation is Microsoft Corp (NASDAQ:MSFT) as Nvidia’s biggest customer, ordering twice the number of chips as Meta Platforms Inc Class A (NASDAQ:META) this year. Nvidia is feeding off strong growth of other US tech oligopolists.

- Watch our video: £100 million of profit on Nvidia: here’s our latest ideas

- Will London IPO market stage a recovery in 2025?

This is a bit of a short to medium-term view, but even if Nvidia’s growth does slow from around 50% in annual revenue and earnings to 2026, its price/earnings (PE) multiple is reducing from over 50x to 29x based on consensus earnings.

I recall ARM Holdings typically rated at 30-40x forward earnings, which stretched over 100x from 1999 into 2000. Yet in the very long run and despite being taken off-market some years, it has proven a growth company par excellence. The kind of stock to buy in a panic.

Obviously we cannot always depend on “buy the drop”, or be sure what extent works, but 2024 shows this working two or three times, therefore if Trump’s second presidency soon become chaotic then Nvidia might be one stock to prioritise.

Source: TradingView. Past performance is not a guide to future performance.

Around $135, it is capitalised at $3.3 trillion, snapping at the heels of Apple Inc (NASDAQ:AAPL) near $3.8 trillion. Apple trades at just over 40x trailing earnings, slipping below 30x on 12-month forecasts. Since ARM re-listed on Nasdaq, its annual earnings growth trend has been around 30% growth yet its forward P/E is towards 70x.

It is impossible to say if stretched valuations meant the Nasdaq peaked in mid-December; rational analysis is no help if exuberance takes over; yet I think some exception can be made for Nvidia given its dominance and pace of innovation.

Palantir’s aggressively parabolic chart looks a worry sign

Exuberance is indeed manifesting:

Source: TradingView. Past performance is not a guide to future performance.

Around $81 currently, Palantir is capitalised at $184 billion, which is over 50 times projected sales and 150x consensus 2025 earnings. While I remain positive on Palantir’s prospects, it is valuation risk that concerns me, also the chart is reminiscent of various from 1999.

The company may indeed grow into this valuation in the long run; quite what may be its risk/reward profile for 2025, however, if markets turn volatile, remains to be seen. Palantir has strong links with the US military and defence agencies, it would be difficult to undo; there also are three key rivals each with a circa 15% market share, not the same dominance as Nvidia.

While Palantir could continue to set new highs, it looks prudent to lock in at least some gains.

UK comparisons are dramatically smaller businesses

Relative to the late 1990s boom, it has got a lot harder to source sustainable winners, as if Cambridge’s Silicon Fen is not on par with California’s Silicon Valley for mass-market tech. And/or, UK businesses opt for private equity funding instead.

While it was not too hard to alight on Nvidia and Palantir as peak examples from a huge depth of US tech, in recent years I have been challenged to find just two quality performers on the UK market. The listed terrain looks barren for exciting tech versus 25 years ago.

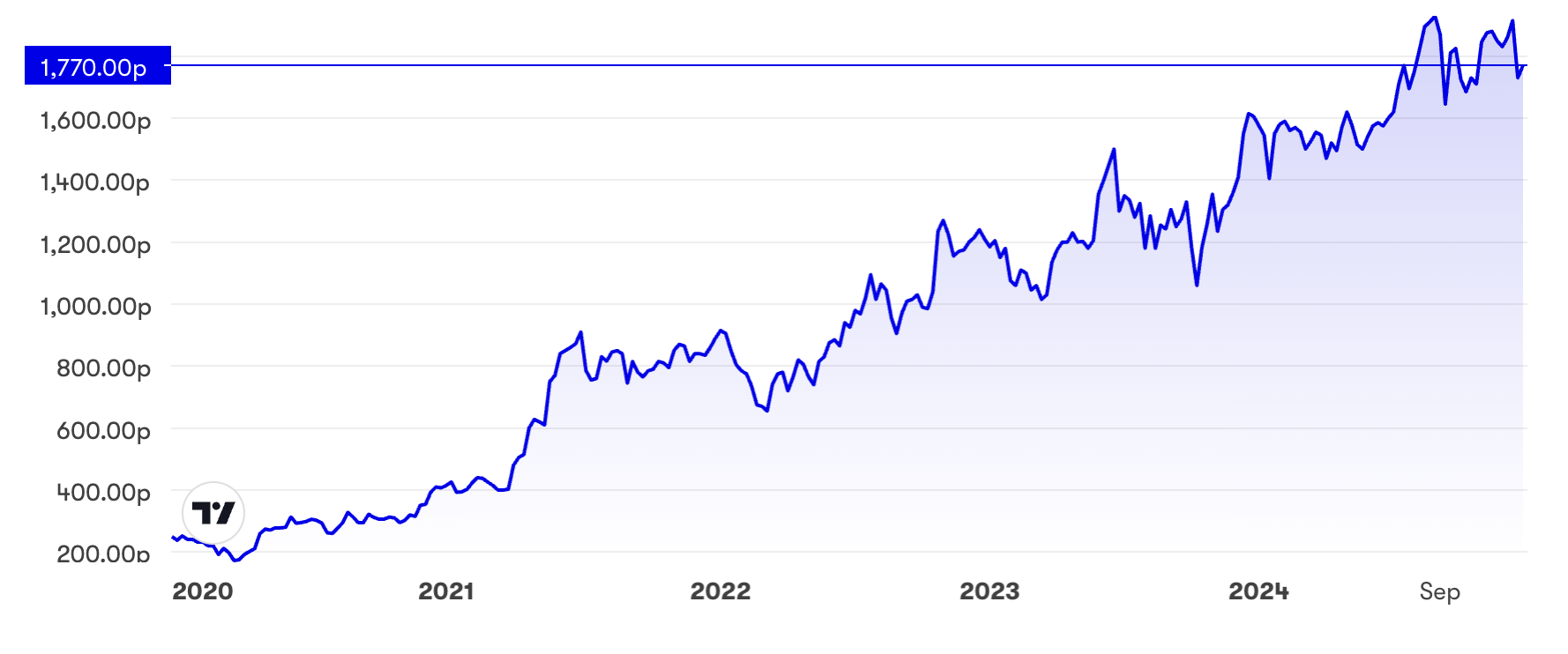

I was early to Beeks Financial Cloud Group (LSE:BKS) and relatively late in the rise of Cerillion (LSE:CER), although Beeks has nearly trebled in 2024 and Cerillion continued its long-term rise if more volatile.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Stockwatch: time to take profits after 600% gain?

Again in terms of déjà vu like with Nvidia/ARM, I initially drew attention to Beeks as a “buy” at 80p in 2018 given some parallels with Fidessa that floated in the 1990s and was acquired for £1.5 billion also in 2018. Both are financial software-type companies but Fidessa’s systems supported fund managers for equities, while Beeks offers cloud infrastructure in support of financial trading exchanges.

It took until 2021 for Beeks to rally – over 200p in 2022, albeit back near 90p by September 2023. I re-iterated “buy” last February at 140p after profits were guided higher for the June 2025 year, furthermore a contract was struck with one of the largest exchange groups globally. The stock finally caught the market’s attention and hit 300p earlier this month.

Source: TradingView. Past performance is not a guide to future performance.

At 275p currently, Beeks trades on 37x consensus earnings for its year to next June and 31x to 2026. That may also reflect some justifiable premium for scarcity value in the London market plus long-term takeover potential. The company has also proven it can re-rate net profit from bumping around £1 million near £7.5 million expected for the year to June 2025.

Cerillion I drew attention to as a “buy” at 820p in April 2022 and last April moderated to “hold” at 1,600p versus a forward P/E of 31x, easing to 27x for its expected year to September 2025.

Source: TradingView. Past performance is not a guide to future performance.

Interestingly, this and other UK tech stocks are suddenly down on mid-December highs; Cerillion by nearly 10% to 1,730p – mirroring both the timing and magnitude of US drops. It is why the dynamics on Wall Street remain vital to understand.

At this level, Cerillion is on 32x expected earnings for its year to September 2025, however, only 4% underlying growth would be involved; then 11% to 2026, according to projections. Rising staff costs and giving customers longer to pay (for competitive reasons?) are concerns, otherwise, the new order book was reportedly up 21%.

A £510 million market valuation represents around 10x expected sales but there is a circa 40% operating margin. My chief concern is where the next growth wave derives after 5G and full fibre broadband roll-out have provided impetus.

Since mid-year, this stock is in volatile consolidation as if needing fresh stimulus. “Hold” at best then, the valuation part-reflecting scarcity of quality tech on the London market.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.