Stockwatch: two coronavirus stocks where momentum favours the brave

Our analyst’s view on a drug stock in the race for a Covid-19 cure and on test kit favourite Novacyt.

14th April 2020 13:06

by Edmond Jackson from interactive investor

Our analyst’s view on a drug stock in the race for a Covid-19 cure and on test kit favourite Novacyt.

After its strongest week since 1974, the S&P 500 index kicked off Monday with a 2.2% fall, though that had reduced to a 1% deficit by the close. Sentiment has turned somewhat, questioning whether the extent of lockdowns will lead to a morass of re-infections.

However, there has been a very strong performance by the FAANG tech stocks where, after Monday, its dedicated index is amazingly up for the year as expectations rise for permanently re-rated demand for such technology/services. Yet there’s plenty of conflict for the market to chew.

A veritable stand-off for investor sentiment

Bulls can take heart that the Covid-19 story has moved not only to declines in new infections but various European economies preparing to emerge from shutdown. All eyes will be on whether the proclaimed “testing, tracing and quarantining” can contain any new rise in overall infections.

Moreover, oil prices – often regarded as a proxy for stocks generally – enjoyed some reprieve as an agreement on production cuts perhaps paves the way for more (outside of OPEC) in the weeks ahead.

The recovery fizzled Monday, however, as fear soon returned that demand will remain too weak – a crux issue for sustainability of cash dividends in big oil stocks such as Royal Dutch Shell (LSE:RDSB) and BP (LSE:BP.) – and also recovery in those highly leveraged such as Premier Oil (LSE:PMO) and Tullow Oil (LSE:TLW).

There is still a sense among investors raised on “buy the drop” since the 2008 crisis, about how once again the US Federal Reserve will protect their backs with massive injections of liquidity, this time to support credit/bond markets but which is also boosting risk assets.

Bears meanwhile will fear serial lockdowns, that social distancing cannot genuinely lift until a vaccine is developed, tested and administered. The sight of a gaunt UK Prime Minister and lengthy spaced-out supermarkets queues may also keep Brits hunkered down.

The global economy has never experienced such a synchronised shut-down: economists speculate about a 10-15% hit to second quarter GDP, though I’d be surprised if it’s less than 20%.

Morgan Stanley has suggested the US economy won’t return to pre-Covid-19 levels until the fourth quarter of 2021. I suspect it will test bulls’ nerve, to hold through months of catastrophic earnings updates offering negligible guidance.

Easter weekend boost for Gilead’s remdesivir

On Good Friday, the New England Journal of Medicine revealed a study where an additional 53 severely ill Covid-19 patients had been treated with the remdesivir drug developed by Gilead Sciences (NASDAQ:GILD), initially for Ebola and SARS, taking the total to over 1,700 people across nine countries.

The latest 53 patients studied were between the ages of 23 to 82, admitted to hospitals in the US, Canada, Europe and Japan, with 34 being on respirators.

After an average 18 days, 36, or 68%, of patients needed less oxygen or respirator support while eight worsened and seven (virtually all over 70) died.

So, while the broad interpretation is positive – Gilead closed yesterday up 2.4% to $75.3 albeit a substantial capitalisation near $95 billion (£75.5 billion) – strictly this is a small study whose mortality rate is strictly hard to link to the drug.

It is impossible to know what would have happened without administering the drug, yet more rigorous studies are expected to conclude this month, and remdesivir remains the leading hope at a time when there are no proven treatments.

It is possible that authorities may relax testing periods, so the stock should at least be kept in the frame.

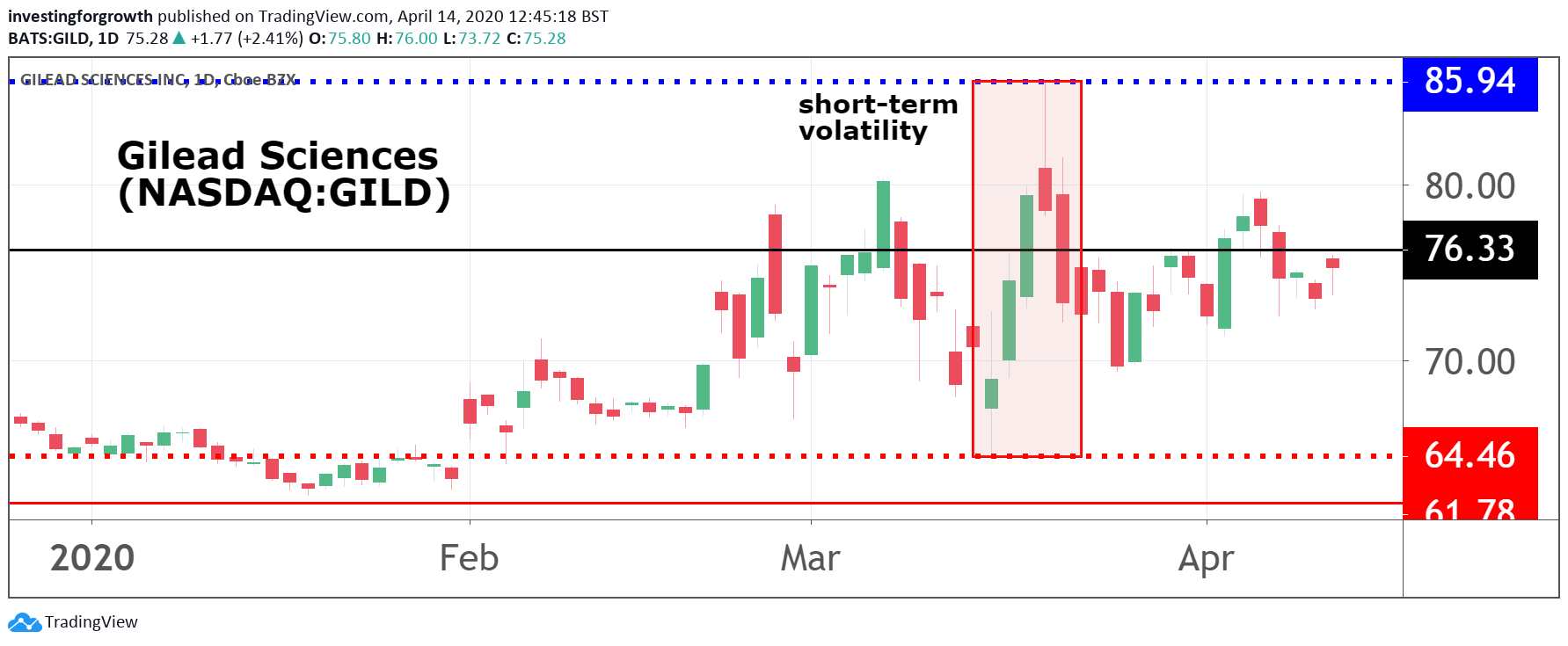

Source: TradingView Past performance is not a guide to future performance

It had traded at over $84 on 19 March then been volatile sideways. I drew attention to it at $66 on 4 February as “the current front-runner” for a Covid-19 cure based on an initial test for its drug on 270 patients suffering pneumonia caused by Covid-19, in the Chinese city of Wuhan. “There is a speculative case for Gilead based on fast-track approval by the Chinese authorities,” I wrote.

In terms of follow-through, analysts at Jefferies are saying in response to this latest test, its results “suggest remdesivir may work and is generally safe”.

- Coronavirus cures: this stock is the current front-runner

- Want to buy and sell international shares? It’s easy to do. Here’s how

I also noted a 223% leap to 48p, for shares in France-based AIM-listed clinical diagnostics company Novacyt (LSE:NCYT) that’s also traded on the Euronext Growth market (ALNOV).

Source: TradingView Past performance is not a guide to future performance

On 31 March Novacyt launched a specific test for Covid-19 that offered various advantages and the stock’s smaller capitalisation has helped it soar currently to a value over £180 million with its price currently around 480p.

Recalling similar euphoria as the pre-2000 boom in technology stocks, Novacyt’s parabolic chart soared to over 500p last Thursday. Gilead can’t compete with this, given its much larger size, though should be less volatile.

Expectations are likely to remain elevated for both stocks given this pandemic will last months at best, these companies being at the forefront of development – hence there is a case to retain holdings, or even buy dips.

| Gilead Sciences Inc - income statement | |||||

|---|---|---|---|---|---|

| year to end-Dec | |||||

| $ billion | 2015 | 2016 | 2017 | 2018 | 2019 |

| Total revenue | 32.0 | 30.3 | 26.1 | 22.2 | 22.3 |

| Cost of revenue | -4.1 | -4.4 | -4.5 | -4.9 | -4.7 |

| Gross profit | 27.9 | 25.9 | 21.6 | 17.3 | 17.6 |

| Research & development | -3.1 | -4.7 | -3.6 | -4.2 | -8.3 |

| Selling & administrative | -3.3 | -3.3 | -3.7 | -4.1 | -4.4 |

| Operating profit | 21.5 | 17.9 | 14.3 | 9.0 | 4.9 |

| Pre-tax profit | 21.7 | 17.1 | 13.5 | 7.8 | 5.2 |

| Taxation | -3.6 | -3.6 | -8.9 | -2.3 | 0.2 |

| Net profit | 18.1 | 13.5 | 4.6 | 5.5 | 5.4 |

| EPS basic ($) | 12.4 | 10.1 | 3.5 | 4.2 | 4.2 |

| EPS diluted ($) | 11.9 | 9.9 | 3.5 | 4.2 | 4.2 |

| Source: Gilead accounts |

Revenue/profit growth unexciting, yet bumper cash reserves

The chief issue any Gilead shareholder would seek to fathom is the extent and capability of other drivers in its drugs portfolio, lest hopes for remdesivir are unfulfilled and for when expectations begin to look beyond the virus.

Novacyt is riskier in this regard, its previous work yet to prove earning power, although its reputation will enjoy a boost from Covid-19 and attention will shift to whether management can be similarly adept with new projects.

As the summary table of income statements shows, Gilead’s operating profit has fallen sharply in the last two years: in 2018 due to revenue 15% lower together with higher costs all-round, then in 2019 principally due to the R&D charge doubling.

Both setbacks could be seen as inherent dilemmas for pharma stocks however. Its third-quarter 2018 revenue was also hit by competition for hepatitis C drugs, where those sales fell over 50% to send net profit down 22%.

Its antiviral and HIV drugs enjoyed rising sales and R&D investment can be seen as a positive in such context.

2019 revenues rose just 1.5% and diluted earnings per share (EPS) measures were effectively flat, as if Gilead has marked time and needed a fresh impetus for sales.

Its HIV-related products were boosted primarily by the Biktarvy drug, and Yescarta which treats large B-cell lymphoma, soaring 73% albeit to $456 million relative to $16.4 billion for the HIV products. Meanwhile, hepatitis C sales eased 22%, continuing down to $2.9 billion.

So, it’s a mixed narrative that doesn’t altogether amount to a “hold” stance without the potential kicker from remdesivir.

Prior to Covid-19, consensus expectations were for only mid-single-digit annual earnings growth in 2020, putting Gilead on an expensive PEG ratio (price/earnings-to-growth) over 2.5x when optimally you are looking for sub 1.0.

More positively, the group enjoys a very strong rate of conversion of operating profit to free cashflow – nearing 100% in the last three years – supporting a meaningful yield around 4%, while also enabling debt reduction, which fell by $2.7 billion to $24.6 billion last year.

Remarkably, it also holds $24.7 billion cash, hence is nearly $100 million cash-positive; which underwrites substantial R&D investment besides payout potential.

Additionally, at end-2019 Gilead had $3.6 billion receivables due within 12 months, versus $9.8 billion liabilities within 12 months and $29.2 liabilities longer-term – for net liabilities of $10.7 billion. A balance sheet effectively bailed out by bumper cash.

Momentum is still likely to favour the brave

Such key fundamentals are why Gilead shares have bumped along in a quite volatile-sideways trend for the last three years.

Their downside risk is not as great as Novacyt from 480p – which faces reality checks first in terms of whatever revenue/profit actually arises for its tests, and then their duration.

The crux for both companies will be duration of Covid-19, where a global challenge over 12 months can quite easily sustain Novacyt’s valuation of £180 million even higher, also Gilead may benefit from further positive news on remdesivir.

Mind how Novacyt especially has attracted hot money. For now, and on both stocks: Hold.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.