Stockwatch: too late to sell, too early to buy?

21st June 2022 15:05

by Edmond Jackson from interactive investor

This company appears to be defying the gloomy outlook, but the shares have still fallen sharply from last year’s peak. Analyst Edmond Jackson tells us what he thinks about prospects.

Despite darkening macro-economic clouds, a trend continues of recruiters reporting strong progress - at least regarding demand for professionals.

After PageGroup (LSE:PAGE) and Robert Walters (LSE:RWA) gave bullish updates in April, small cap SThree (LSE:STEM) has cited like-for-like net fees up 23% in its second quarter to end-May “against a non-Covid impacted, comparative period, demonstrating excellent new placement activity”.

This is a UK-based, international recruiter specialising in life sciences, technology, engineering and mathematics – where technological advance and skills shortages potentially make demand less susceptible to downturn.

With net fees up 25% to £203 million in respect of the first half, profit for the full year to end-November is guided at least 5% above market consensus for £66 million.

In early dealings yesterday, the stock jumped over 9% to near 350p but is currently 340p which capitalises SThree at £455 million. This shows one element of investors responding to a sense of “value” while another sells into any rise. Which constituency is likely to be proven right?

No material difference in valuation from PageGroup and Walters

SThree’s story comes across as a purple patch of growth in the economy generally. Recalling the early 1990s recession, a few surprise growth stocks did flourish, based on “something new” in their commercial mix, such as Next (LSE:NXT) and the then-listed Domestic & General insurance group.

So it is at least interesting to note SThree’s progress, while cautious sentiment maintains a potentially attractive entry point.

Upgrading November 2022 annual earnings per share (EPS) expectations from around 33p to near 35p implies a sub-10x price/earnings (PE) with a dividend per share of around 12p offering a 3.6% yield. The table shows an operating margin that has struggled to reach 5% despite “a people business” making for high returns on capital employed.

Yet this is broadly in line with the other two executive/professionals recruitment groups. At around 400p, PageGroup trades a tad below 9x expected earnings for the 2022 calendar year, yields over 5% and a 10%-plus operating margin could be seen as a superior performance ratio.

At around 460p, Walters is similarly on a sub-9x PE and offers a near 5% yield – though, like SThree, has a mid-single-digit operating margin.

In basic financial terms, these stocks are rated similarly, hence buyers assume the economic outlook is too dire and regarding SThree a special emphasis on its skills’ provision.

A 35% year-on-year rise in the contractor order book

A big increase in the contractor order book is akin to the “backlog” cited by sub-contracting groups and seen as a leading indicator of such businesses.

It certainly flags momentum, reflected at Robert Walters by a remarkable 9% increase in its workforce to 3,784 during the first quarter of 2022 alone.

SThree simply cites: “planned investment in our people, talent acquisition and digital investment moving forward…”

This is a bit of a left-field comparison, but mind how building insulation specialist Kingspan Group (LSE:KGP) said on 18 February how a large order backlog meant “cautious optimism” about its 2022 outlook. Then yesterday, its stock dropped 11% to 60p after management said: “We have seen the mood in most end markets deteriorate over the last two months with order intake down significantly on May and June 2021…”

But the trend could turn in due course…

My wariness towards recruiters has a macro dimension: how they are part benefiting because central banks over-did monetary stimulus, especially through 2021 when they should have wound back once it became clear that Covid vaccines were a success.

Monetary policy is being radically changed, the US Federal Reserve having taken a lead last week, raising its benchmark interest rate by 0.75%. Recalling the 1980s, a series of 1% increases became required.

If the Fed is serious about cutting inflation back to its 2% target, it probably has no alternative than to cause some extent of recession, which is not going to happen in isolation. “When the US economy sneezes, everyone else catches a cold.”

The stock market is thus justifiably rating international recruiters with caution, given a likely lag effect from central bank policies on the wider economy. Trading updates impress for now, but how might they come across in six months time?

Barely a month ago, UK housebuilders were looking oversold on low PEs and fat yields, but Kingspan’s update took them even lower yesterday.

SThree - financial summary

Year-end 30 Nov

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

| Turnover (£ million) | 960 | 1,115 | 1,258 | 1,325 | 1,203 | 1,331 |

| Operating margin (%) | 3.9 | 3.4 | 3.8 | 4.4 | 2.6 | 4.6 |

| Operating profit (£m) | 37.8 | 38.2 | 47.5 | 57.8 | 31.8 | 61.0 |

| Net profit (£m) | 27.2 | 27.6 | 34.3 | 41.3 | 17.0 | 42.0 |

| EPS - reported (p) | 20.6 | 20.8 | 25.7 | 30.9 | 13.8 | 30.9 |

| EPS - normalised (p) | 20.7 | 27.4 | 31.9 | 34.7 | 17.0 | 33.1 |

| Operating cashflow/share (p) | 25.6 | 22.1 | 11.8 | 30.1 | 48.8 | 27.6 |

| Capital expenditure/share (p) | 5.5 | 4.4 | 3.9 | 3.4 | 3.9 | 1.9 |

| Free cashflow/share (p) | 20.1 | 17.7 | 7.9 | 26.7 | 44.9 | 25.7 |

| Dividends per share (p) | 14.0 | 14.0 | 14.5 | 5.1 | 5.0 | 11.0 |

| Covered by earnings (x) | 1.5 | 1.5 | 1.8 | 6.1 | 2.8 | 2.8 |

| Return on total capital (%) | 49.3 | 46.1 | 46.0 | 48.9 | 20.6 | 33.5 |

| Cash (£m) | 15.7 | 21.3 | 50.8 | 15.1 | 50.4 | 57.5 |

| Net debt (£m) | -10 | -5.6 | 4.1 | -10.6 | -14.4 | -22.4 |

| Net assets (£m) | 75.7 | 80.7 | 102 | 117 | 129 | 158 |

| Net assets per share (p) | 58.6 | 63.0 | 78.4 | 88.2 | 96.7 | 118 |

Source: historic company REFS and company accounts. Past performance is not a guide to future performance.

Stock chart essentially conveys mean reversion

The one-year share price chart shows a near-halving in market price from around 600p last September. Yet SThree has broadly mean-reverted to a level it has traded around since floating at 200p in 2012. The stock reached 414p in early 2014 then traded sideways with a 215p low in April 2020. Price only rocketed to near 600p during what could be described as a rarefied time – with industry demand supported both by a hastening of the digital economy during the pandemic, also monetary stimulus.

A stock fall has therefore appeared reasonable, even for a science–based recruiter. What beckons - grinding stagflation, where yes, technology and related industries still prosper, or a wider recession?

Mind how visibility in recruitment can be short. If the SThree board was truly confident and respecting near £58 million balance sheet cash (as of last November), then it might raise the annual dividend by more than consensus for near 12p a share this financial year – costing around £15 million. See from the table below how SThree’s free cash flow profile is fundamentally strong.

A potential litmus test of the global economy

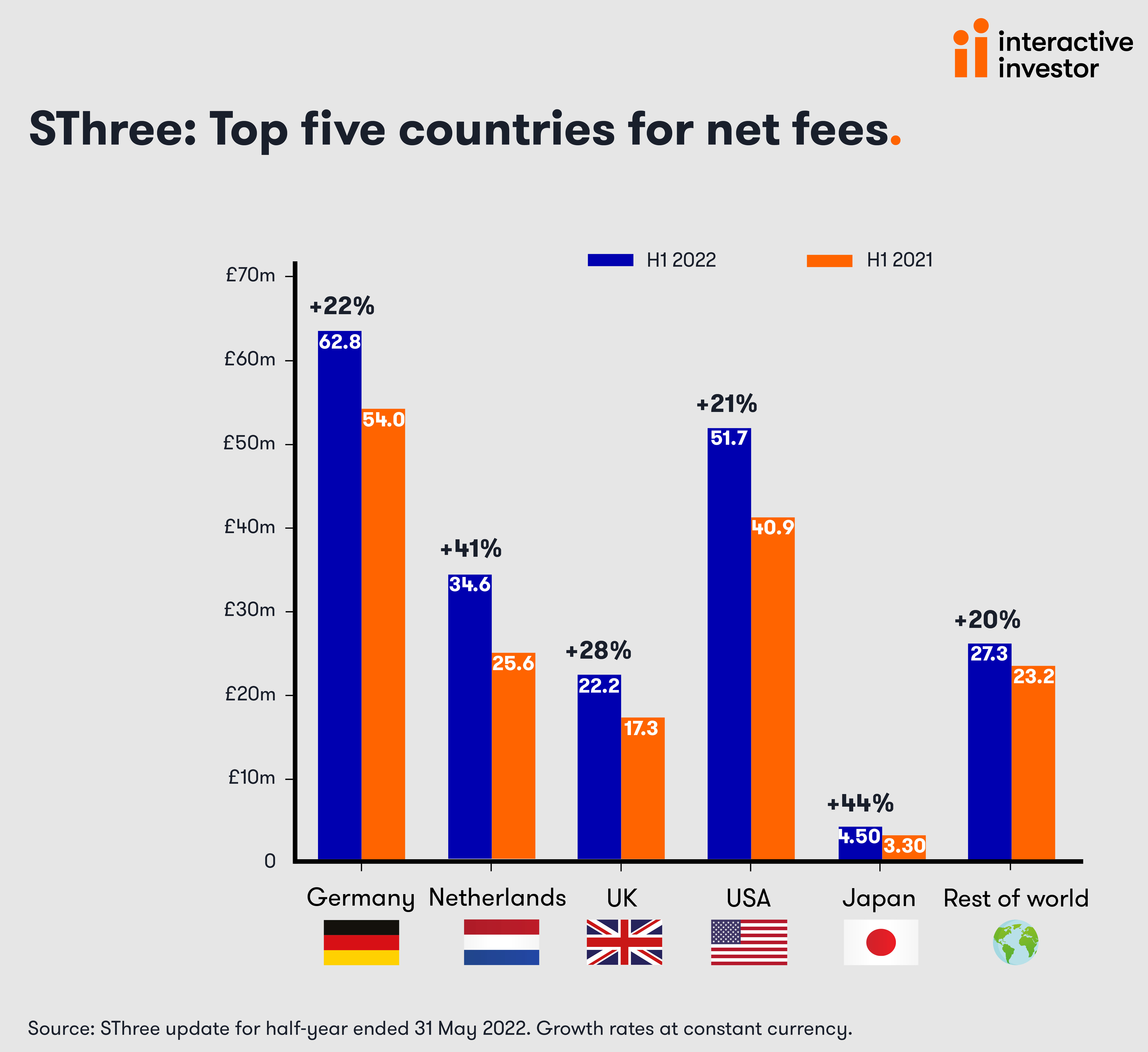

From this chart using data in the latest trading update, it is possible to note Germany as SThree’s largest generator of fees at 31% followed by the US at 26%, Netherlands 17%, Rest-of-world 13% - with the UK only 11% and Japan 2%.

The stock thus offers quite a hedge against UK-specific risks although so does PageGroup where the UK is 14% of net fee income, also Robert Walters at 18%. Walters is also 45% oriented to Asia-Pacific, quite whether that region withstands a downturn relatively better.

In a latest Bank of America survey, 54% of investment managers expect continental Europe to enter recession in the next 12 months, as central banks tighten monetary policy. The Ukraine conflict adds to risks.

With 77% of net fee income represented by contract as opposed to permanent personnel, and overall 47% exposed to technology, if IT spending gets cut in a downturn then SThree is exposed.

I therefore tend to view such recruiters as behind the underlying economic trend; where even taking into account how surveys are sentiment than reality-based, these businesses appear still to be capitalising on buoyant times for tech – helped by the pandemic. Effects of higher interest rates are only starting to bite, and quite whether rates are anywhere near high enough to curb inflation remains to be seen.

Too late to sell, too early to buy?

This would appear to sum up a prudent stance towards quality cyclical stocks, currently.

A contrast between economic prospects and bullish updates from recruiters is liable to mean those narratives temper in due course.

SThree merits following as industries it serves could make it a resilient if not winning stock. Timing could however be premature. Hold.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.