Stockwatch: time to buy these two blue-chip shares?

Analyst Edmond Jackson considers FTSE 100 big pharma in light of recent rallies and various headwinds.

7th February 2025 13:24

by Edmond Jackson from interactive investor

Positive reactions to annual results from GSK (LSE:GSK) and AstraZeneca (LSE:AZN) have seen both stocks extend their rallies from recent lows, with GSK up 10% and AstraZeneca by 6.5%.

Since GSK trades on nearly half AstraZeneca’s earning rating, it’s a reminder on how the more respected share is not necessarily the best performer. GSK shares rose more due to a better-than-expected outcome.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

GSK

AstraZeneca

Source: interactive investor. Past performance is not a guide to future performance.

These major companies also suggest that trend-following and mean-reversion may also be involved, rather than a reasonably “efficient” stock market.

Government issues have adversely affected both shares

A chief depressant on pharmaceutical shares lately has been the accession of vaccine sceptic Robert F. Kennedy Jr to Donald Trump’s preference as US health secretary. Amid fears that he would cancel recommended vaccine programmes, all international drugs companies serving the US – which is 44% of AstraZeneca’s revenues and 52% of GSK’s – have seen their shares pressured.

Yet recovery by these two has coincided with RFK last Tuesday winning all Republican votes on the Senate finance committee that they control – 14-13 – for his appointment, versus all Democratic votes against. Kennedy has also given a commitment to a senior Republican senator to protect existing vaccine programmes. While raising a question as to what could happen to those in future, it suggests the realities of attaining power may imbue a more considered approach than some of his whacky warnings, for example, suggesting that “autism comes from vaccines”.

- AstraZeneca recovery continues after results boost

- GSK annual results get warm reception

- Stockwatch: a better 2025 for GSK, or best to sell now?

Kennedy also makes contentious claims against fluoride in drinking water. Yet I tend to agree with his campaign against ultra-processed foods (UPFs) as a source of obesity; that Americans should eat a simpler, healthier diet. But it does show that he is plenty willing to challenge corporate interests, not what you usually expect of a Republican. Anyway, the JFK factor does look to have brought market valuations back usefully for strong annual results to play into. Might this constitute an inflection point and new positive trend in the shares?

Downside in AstraZeneca was also accentuated last October by a situation in China where the operation’s president and other managers were detained on allegations of illegally importing cancer medicines involving suspected unpaid importation taxes. China accounted for 12% of group sales in 2024, so it has needed to avoid any sanctioning. However, yesterday the shares closed up nearly 6% partly because management reassured with the results, the fact that the upshot of several probes there could be minor, and the fine being $4.5 million (£3.6 million), which is negligible.

Yet this has helped create more attractive valuations

I variously drew attention to AstraZeneca as a “buy” from 7,100p in February 2021, on grounds of strength in faster-growing new treatments with big applications such as cancer. But the shares became a victim of success with a full rating; over 1,300p last August, on a price-to-earnings (P/E) that has turned out 20x core earnings per share (EPS) for 2024, or just below 18x at the current 11,785p price. Hence, I had defaulted to “hold” and indeed the stock has been sideways-volatile over the past two years, and looking quite fully valued but with a superior growth record and attractive narrative.

AstraZeneca’s performance is certainly distinguished: a 38% advance in pre-tax profit to $8.7 billion on revenue up 21% to $54.1 billion. This was broadly in line with expectations, but the market is encouraged into a 6% advance due to the group’s strategic positioning. Not only is revenue from cancer and respiratory/immunology treatments up by around a quarter, the CEO cites “the beginning of an unprecedented, catalyst-rich period”, for example, seven new medicines in late-stage testing this year.

- 10 shares to give you a £10,000 annual income in 2025

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

While 2025 revenue growth is indicated to be softer (no surprise) at high single digits, with core EPS growth at low double digits, this maintains intrigue as to AstraZeneca being a quality-growth share. It might not have the consistent earnings dynamism of big-cap US tech, but it is without such an extent of valuation risk.

Rising quite consistently from last November’s 9,725p low affirms a bull chart, yet the price is below the 200-day moving average.

Shareholders can therefore take comfort; the question is whether such a context warrants an upgrade to “buy”. On a multi-year view, I believe so. If you slightly twist a Warren Buffett adage about how a supertanker is hard to turn, well, in a positive sense AstraZeneca has strong momentum in innovation, besides financially, for it to sail on.

My caveat is that the CEO, in place since 2012 and having reached 65 years old, is perceived as largely responsible for a strong record; hence a succession issue, at least for market confidence.

It all makes the short to medium-term stance tricky. Further out, I am inclined to look past the current situation where expected 2025 earnings imply a 16x P/E, albeit earnings growth more modest at around 12% possibly.

The shares have opened down nearly 2% around 11,600p, albeit GSK similarly, as if yesterday’s exuberance is due consolidation. Overall, I think US senators are likely to keep a grip on Kennedy’s less-than-scientific impulses, therefore it’s a long-term “buy”.

Is GSK finally affirmed as a contrarian ‘buy’?

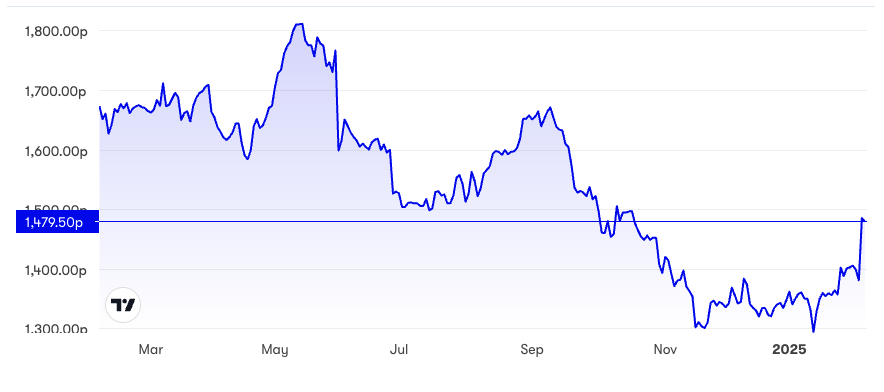

Barely a month ago, I made a “buy” case at 1360p on a rationale that the shares were anyway due a mean-reversion after plunging from 1,800p in the second half of last year.

Despite today’s early 2% fall to 1,450p, a spike remains on the 2025 chart, as if consensus on GSK is jolted positively.

Mind you, we are essentially back near the 1,440p level where I also made a “buy” case in January 2024, asking if GSK could finally break out of a 20-year trading range. At least a 4% dividend yield has protected capital in inflation terms.

GSK - financial summary

Year-end 31 Dec

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Turnover (£ million) | 27,889 | 30,186 | 30,821 | 33,754 | 24,354 | 24,696 | 29,324 | 30,328 | 31,376 |

| Operating margin (%) | 9.3 | 13.9 | 17.8 | 20.6 | 24.6 | 17.5 | 21.9 | 22.2 | 12.8 |

| Operating profit (£m) | 2,598 | 4,181 | 5,486 | 6,961 | 5,979 | 4,321 | 6,433 | 6,746 | 4,027 |

| Net profit (£m) | 912.0 | 1,532.0 | 3,623 | 4,645 | 5,749 | 4,385 | 14,956 | 4,928 | 2,575 |

| EPS - reported (p) | 23.3 | 66.0 | 88.0 | 116 | 111 | 69.2 | 104 | 120 | 62.2 |

| EPS - normalised (p) | 40.9 | 118 | 107 | 169 | 78.9 | 68.1 | 114 | 140 | 144 |

| Operating cashflow/share (p) | 165 | 175 | 212 | 200 | 209 | 196 | 181 | 165 | 158 |

| Capital expenditure/share (p) | 59.9 | 55.7 | 45.2 | 53.9 | 55.6 | 72.3 | 55.3 | 57.0 | 72.0 |

| Free cashflow/share (p) | 105 | 119 | 167 | 146 | 154 | 124 | 126 | 108 | 86.0 |

| Dividends per share (p) | 80.0 | 100 | 100 | 100 | 100 | 100 | 61.3 | 58.0 | 61.0 |

| Covered by earnings (x) | 0.5 | 0.7 | 0.9 | 1.2 | 1.1 | 0.7 | 1.7 | 2.1 | 1.0 |

| Return on total capital (%) | 6.5 | 14.0 | 15.4 | 12.5 | 10.3 | 7.8 | 17.2 | 17.8 | 10.7 |

| Cash (£m) | 4,986 | 3,911 | 3,958 | 4,786 | 6,370 | 4,335 | 7,877 | 4,992 | 3,891 |

| Net debt (£m) | 13,804 | 13,178 | 22,106 | 25,722 | 20,780 | 19,838 | 13,110 | 13,026 | 13,095 |

| Net assets (£m) | 1,124 | -68.0 | 4,360 | 11,405 | 14,587 | 15,055 | 10,598 | 13,347 | 13,671 |

| Net assets per share (p) | 28.6 | -1.7 | 111 | 288 | 363 | 374 | 263 | 329 | 330 |

Source: historic company REFS and company accounts.

It is GSK’s overall financial package swaying opinion: revenue growth of 7% is well behind AstraZeneca for 2024, yet the long-term revenue scenario is upgraded. Strength of cash generation – year-end cash is up 32% to £3.9 billion – has helped net debt fall from £20 billion in 2021 to around £13 billion, enabling a £2 billion share buyback scheme and 2025 dividend growth guided at 5% to 64p.

The qualitative narrative gets closer to AstraZeneca by way of “accelerating momentum of our specialty medicines portfolio...outstanding phase III pipeline...increasing and prioritising R&D to promising new long-acting and specialty medicines in respiratory, immunology and inflammation”. This edges GSK closer to a proverbial, longed-for “blockbuster” drug (or maybe several).

Versus 2024 revenue of £31.4 billion, the 2031 target was £33 billion four years ago and is now upgraded from £38 billion to over £40 billion. Speciality medicines at 38% of sales grew 19% last year; and among 71 in development, 19 are late stage.

So, despite vaccines at 29% of sales, easing 4% overall, there is an increasing “growth” theme to GSK.

Yes, there is yet another class action by US lawyers on behalf of GSK shareholders, albeit standard American hyper-litigation that the market is not taking seriously. Last October heralded news of a £1.8 billion equivalent settlement over alleged cancer liability for the Zantac heartburn drug. This was declared payable from existing resource without compromising growth. It should now be possible for GSK to move on from what cast a pall over its shares. Last December, two insiders bought around £27,000 worth at just over 1,300p.

I therefore retain a “buy” stance on GSK and believe a case exists to hold both these shares. A possible spoiler is to what extent they may get caught by US trade tariffs; yet potentially there is also upside if President Trump spares Britain from those planned on the European Union.

It’s a pity Britain did not nail down a free trade deal, allegedly offered by the US soon after Brexit, and instead got bogged down by the May government’s version of “leaving” the EU. At least Keir Starmer appears to be managing Britain’s delicate balance between US and EU interests pretty well.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.