Stockwatch: time to back this roller-coaster cyclical?

This small-cap share has picked up over the past month, and as a broker issues a high price target, analyst Edmond Jackson believes a bull run looks ready to continue.

11th February 2025 12:14

by Edmond Jackson from interactive investor

Shares in Gulf Marine Services (LSE:GMS) are at an interesting stage. This circa £200 million company is a leader in its specialist area of self-propelled, self-elevated support vessels - chiefly for offshore oil & gas operations in the Middle East, South-East Asia, West Africa and Europe. In a relatively smaller way, it also supports offshore wind projects, so can adjust to whether energy policy and big groups shift between fossil fuels and renewables.

On 17 December, the company made another upward tweak to guidance for adjusted EBITDA, which is not the same as earnings, but GMS looks net-profitable at well over $40 million (low £30 million area equivalent) for 2025 if industry trends continue.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

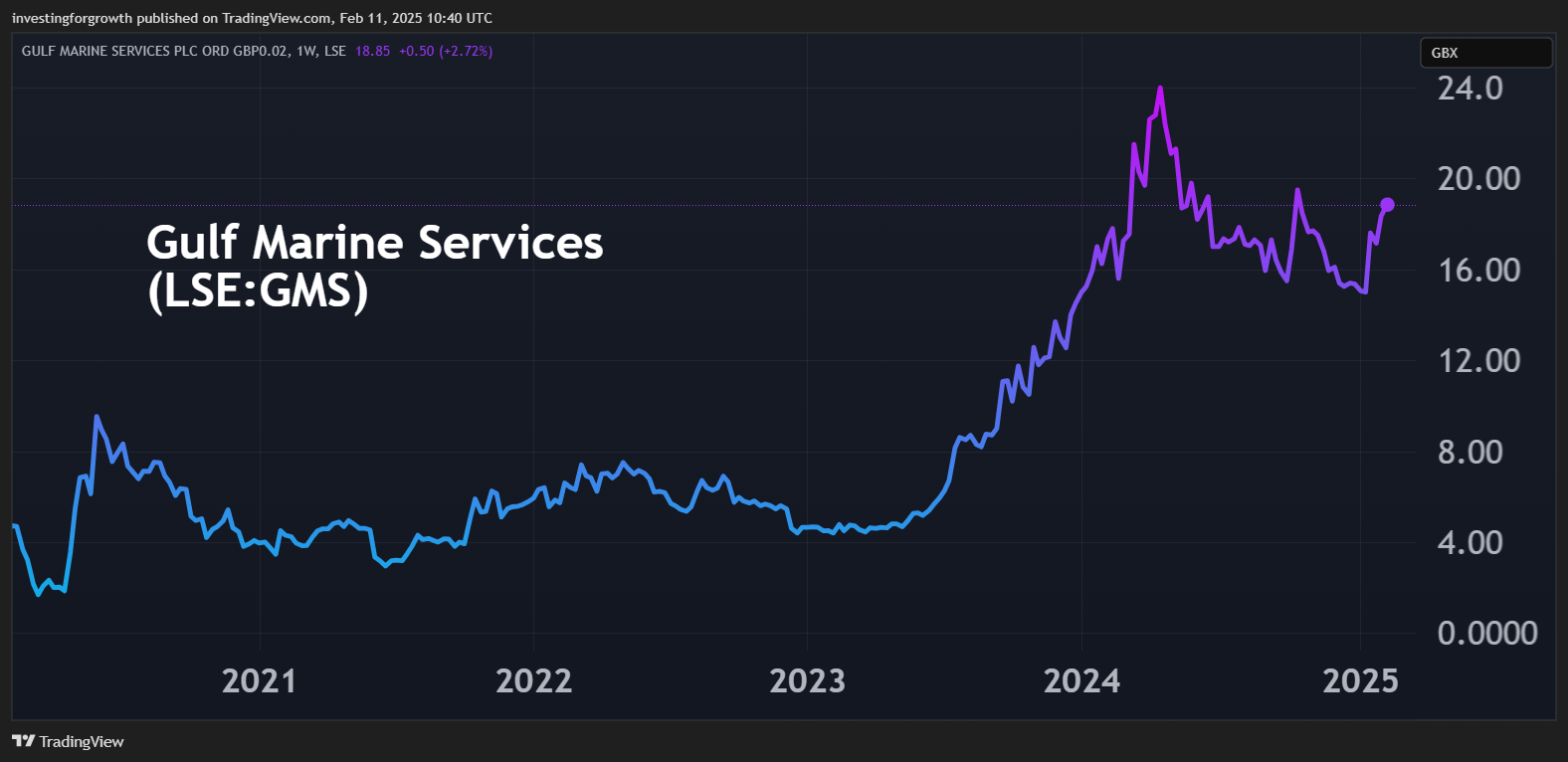

When things are going well, this company has very strong operating margins and cash flow; and its shares were helped 5% yesterday to 19.3p – today 18.8p – after a broker note targeted 30p. The near-term chart therefore looks as if profit-taking after January’s rebound has been absorbed and a bull run is ready to continue.

Source: TradingView. Past performance is not a guide to future performance.

Fortunes relate to energy prices affecting industry activity

If we can believe President Trump’s promise to “drill, baby, drill” and bring down oil prices to end war in Ukraine with help from Arab nations, the scenario for industry activity may be positive. However, oilfield services can be notoriously volatile, and historically have reacted more so than producers to price changes in the commodity.

GMS was founded in Abu Dhabi in 1977 and listed on the stock market early in 2014 on bullish progress and prospects. Its adjusted 2014 net profit was up 13% to $81 million on near $200 million revenue, and a new-build programme was set to expand the fleet by two-thirds. Yet a slump in oil prices saw the shares fall progressively from over 100p in September to 6p before Covid struck. Borrowings were blamed, although 2014 net gearing was not excessive at 53%. The company did, however, end up issuing 370 million shares at 3p in 2021 to cut debt amid the downturn, dilution helping explain a “penny-share” status despite strong earning power. More positively, GMS sought to take advantage of improving market conditions in oil & gas in the Middle East and also renewables in Europe.

Top management has changed since the post-flotation disappointment, for example, a new and executive chair from end-2020. GMS can be perceived as “cheap as chips” on a forward price/earnings (PE) ratio below six times, and the board signalling scope to pay out 20-30% of net profit as dividends also engage buybacks – such is the strength of cash flow.

This assumes the macro context remains reasonably favourable, certainly not to thwart even the presently strong management.

Debt reduction is the perceived current bull case

A bull case is seen on continued steady debt reduction cutting financial risk, and if the current outlook reasonably holds then, yes, a path appears to assert a break with the relatively recent past, with dividends and buybacks to steadily reduce from over 1 billion shares issued.

Refinancing debt at the end of last year involves a $250 million term loan plus $50 million working capital facility. Given 80% of the term loan will require quarterly payback over five years, then a final 20% repayment, GMS needs to avoid a slump as before.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Shares for the future: stuck in a technological arms race

Net debt of $160 million is targeted by end-2025 versus $239 million as of last June and $406 million at end-2020. The refinancing is estimated to reduce annual interest costs by over $1 million, hence of modest effect. While GMS was on a respectable downward path for net interest payment - £17.5 million in the first half of 2023, reduced to £12.3 million in first-half 2024 – the last interim net profit was compromised below $10 million given a $7.5 million impact of change in fair value of a derivative.

The existential question is thus whether President Trump’s aim to bring down oil prices, helping the US economy and pressuring Russia, is just one among various grandiose claims he makes – with little chance of succeeding versus political-economic realities. While the US is the world’s largest oil producer, it is around 20%, and Arab nations seem unlikely to co-operate.

Meanwhile, the current industry context is improving demand for all sizes of vessels coinciding with tight supply, which is supportive for hire rates.

Gulf Marine Services - financial summary

Year end 31 Dec

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Turnover ($ million) | 123 | 109 | 102 | 115 | 133 | 152 |

| Operating margin (%) | 23.1 | -45.1 | -72.0 | 42.0 | 35.5 | 58.2 |

| Operating profit ($m) | 28.5 | -49.1 | -73.7 | 48.4 | 47.3 | 88.2 |

| Net profit ($m) | -6.1 | -85.8 | -124 | 31.0 | 25.3 | 41.3 |

| Reported earnings/share (US cents) | -1.2 | -16.2 | -23.5 | 4.5 | 2.5 | 3.9 |

| Normalised earnings/share (cents) | -1.2 | -8.2 | -11.6 | 2.4 | 1.8 | 1.0 |

| Operating cash flow/share (cents) | 5.5 | 9.7 | 8.4 | 5.8 | 8.1 | 9.0 |

| Capital expenditure/share (cents) | 4.4 | 1.8 | 2.5 | 1.7 | 0.6 | 1.2 |

| Free cash flow/share (cents) | 1.1 | 7.9 | 5.9 | 4.1 | 7.5 | 7.7 |

| Return on Total Capital (%) | 6.8 | -14.8 | -12.4 | 7.8 | 8.0 | 15.5 |

| Cash $m) | 11.0 | 8.4 | 3.8 | 8.3 | 12.3 | 8.7 |

| Net debt ($m) | 400 | 392 | 410 | 374 | 319 | 271 |

| Net assets/share (cents) | 78.4 | 61.9 | 38.7 | 25.7 | 28.1 | 32.2 |

Source: company accounts.

Discount to net asset value with young fleet of vessels

Another aspect to an attractive risk/reward profile is net tangible assets of $352 million equivalent to 26.6p a share, hence a 29% discount in the shares.

While a business’ assets are strictly worth what they can earn, the fleet average age is around 15 years – skewed by one at 28 years – with an average life around 40 years albeit depreciated at 30. One therefore needs to take a cyclically adjusted view of their earning power than any one, or few, years. Overall, it is a plus point.

- Stockwatch: time to buy these two blue-chip shares?

- 10 shares to give you a £10,000 annual income in 2025

The 30 June balance sheet valued the vessels at near $600 million having been bought for $900 million. Otherwise, there were only modest trade payables/receivables, each below $40 million, with net assets of $665 million reduced chiefly by $256 million near-term bank debt.

Such vessels engage for offshore platform maintenance and refurbishment, well intervention work, platform installation and decommissioning, also offshore wind turbine installation.

Share overhang from Seafox is largely cleared

This is a similar operation that once owned around 20% of GMS and indicated a possible offer at 10p a share in May 2020. A relatively recent concern has been shares sold, which probably affected bear trends, for example, from 25p last April, down to 15p last September; then a rebound to near 20p in the October followed by another slide to 15p this January.

A 7 February announcement cited Seafox International’s stake down from 5.8% to just below 5%, hence further to go; and if the stock market goes “risk-averse” then, yes, there could be further downside. But this is what makes the share currently interesting versus its risk/reward profile on fundamentals. Consensus targets $48 million net profit this year.

Perhaps the crux issue is whether the executive chair is running GMS sufficiently well that its post-flotation downfall is history. The answer is probably yes, if the global economy muddles through, but not if Trump’s tariffs lead to chaos and lower energy demand. I have followed enough cycles for oilfield services shares to know a commodity price slide impacts their performance in all respects.

While corporate governance rules advocate a split at the top – between chief executive and non-executive chair – I think a capable executive chair can be well-suited to a smaller company and this should not be a deterrent.

GMS might not be a key holding for those risk-wary, which helps explain its low PE and assets discount. Annual results in early April seem likely to reinforce the bull case if management can continue to cite firm demand and day rates.

I therefore rate medium-term “buy” for investors who are comfortable with higher risk.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.