Stockwatch: is the tide turning for this small-cap share?

28th June 2022 12:19

by Edmond Jackson from interactive investor

This UK company has an interesting story to tell and is worth watching, believes companies analyst Edmond Jackson.

Last February, I was sceptical about power products group Volex (LSE:VLX) after its stock had fallen 43% to 280p in three months – despite interim results to 3 October proclaiming “strong trading”, and bankers opting to triple the debt facility in support of organic growth and acquisitions.

There were reassurances on coping with supply chain challenges and passing on inflationary cost increases. The chief financial officer had also bought £5,000 worth of shares at 279p.

I was concerned how acquisitions had blurred the true sense of “underlying” revenue and earnings growth that Volex tends to highlight when reporting results.

Capitalised at around £500 million at the time, this company was not exactly a size where accounts differentiate organic performance from acquisitions. But it was apparent that the purchase of a European power cord-with-plug manufacturer accounted for all the interim profit growth.

I was not wholly surprised that hedge fund GLG had appeared over the 0.5% disclosure level for short positions. Serial examples exist of profit growth easing when acquisitions slow.

I thus concluded: “it is up to Volex to show us the real money”.

After a further 20% drop to 225p, what now?

Trading since last Thursday’s annual results to 3 April 2022 has also been influenced by wider volatility, initially taking the price down, then back up to 240p.

Mind that while the one-year chart conveys a bear trend possibly bottoming out, the all-time chart context reflects mean-reversion after a big spike from mid-2020 – possibly related to excitement over stocks generally, accentuated by Volex’s increasing exposure to electric vehicles.

Reporting in US dollars and assuming projections for 35% earnings growth to 27.8 cents (22.6p) in the April 2023 year, the prospective price/earnings (PE) ratio would be 10.6x – seemingly modest, albeit assuming strong growth – while consensus for a 4.4p dividend implies a sub-2% yield.

With earning cover ranging from 3x to near 7x since dividends were introduced from the 2020 year, there appears scope to improve the payout. But the free cash flow record is all over the place and an acquisitions strategy for growth limits shareholder returns.

Investor perception therefore tends to hinge on capital growth prospects, where a carrot is dangled of “a new stretching plan” for $1.2 billion revenue by April 2027, including at least $200 million revenue from new acquisitions. The current underlying profit margin is targeted as maintained in a 9-10% range.

Mixed if respectable numbers in challenged times

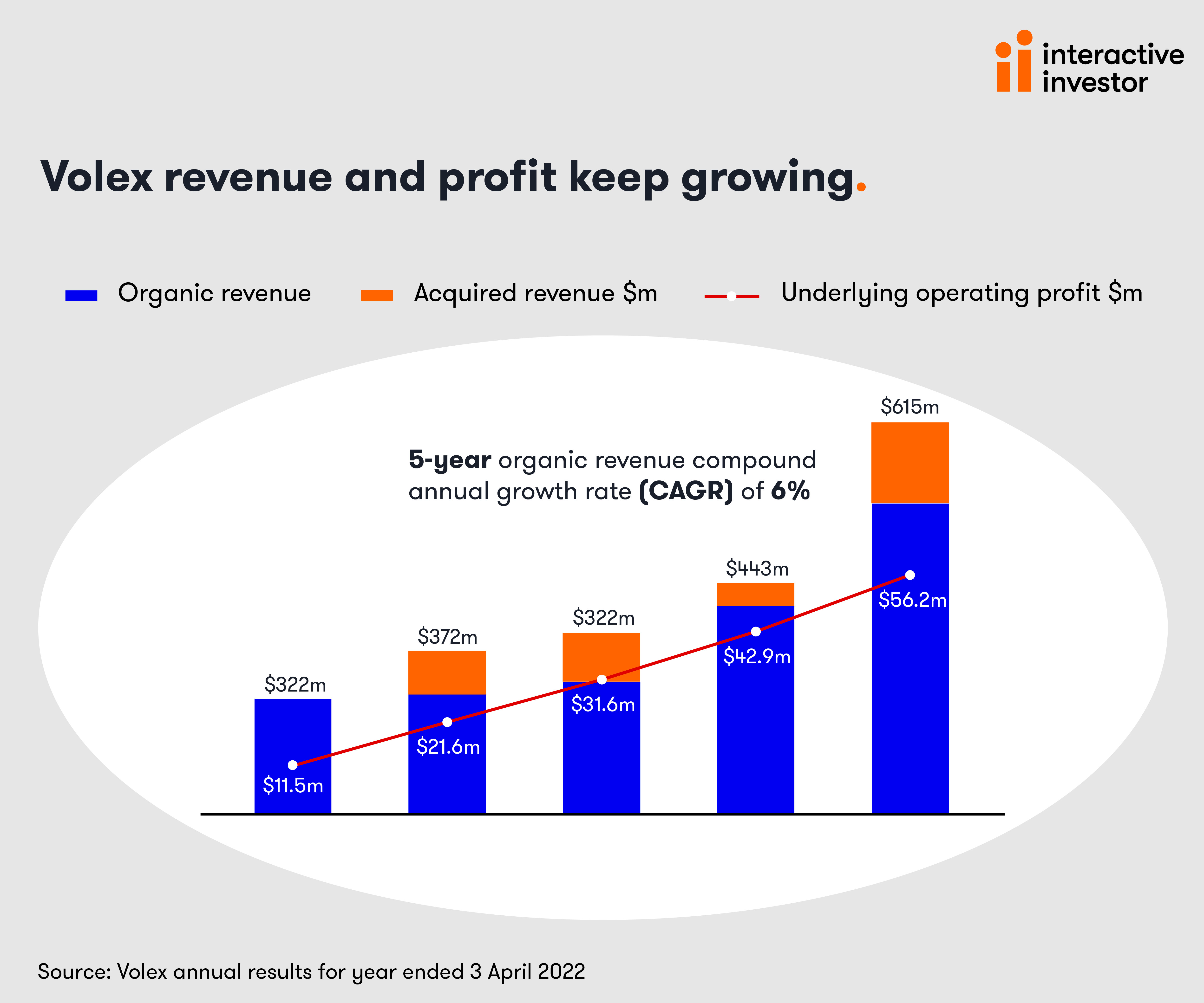

Highlights proclaim revenue up nearly 39% to $615 million “through strong organic growth and acquisitions”.

Four acquisitions were completed this year at a total $47 million cost, which for context is around 10% of Volex’s market value.

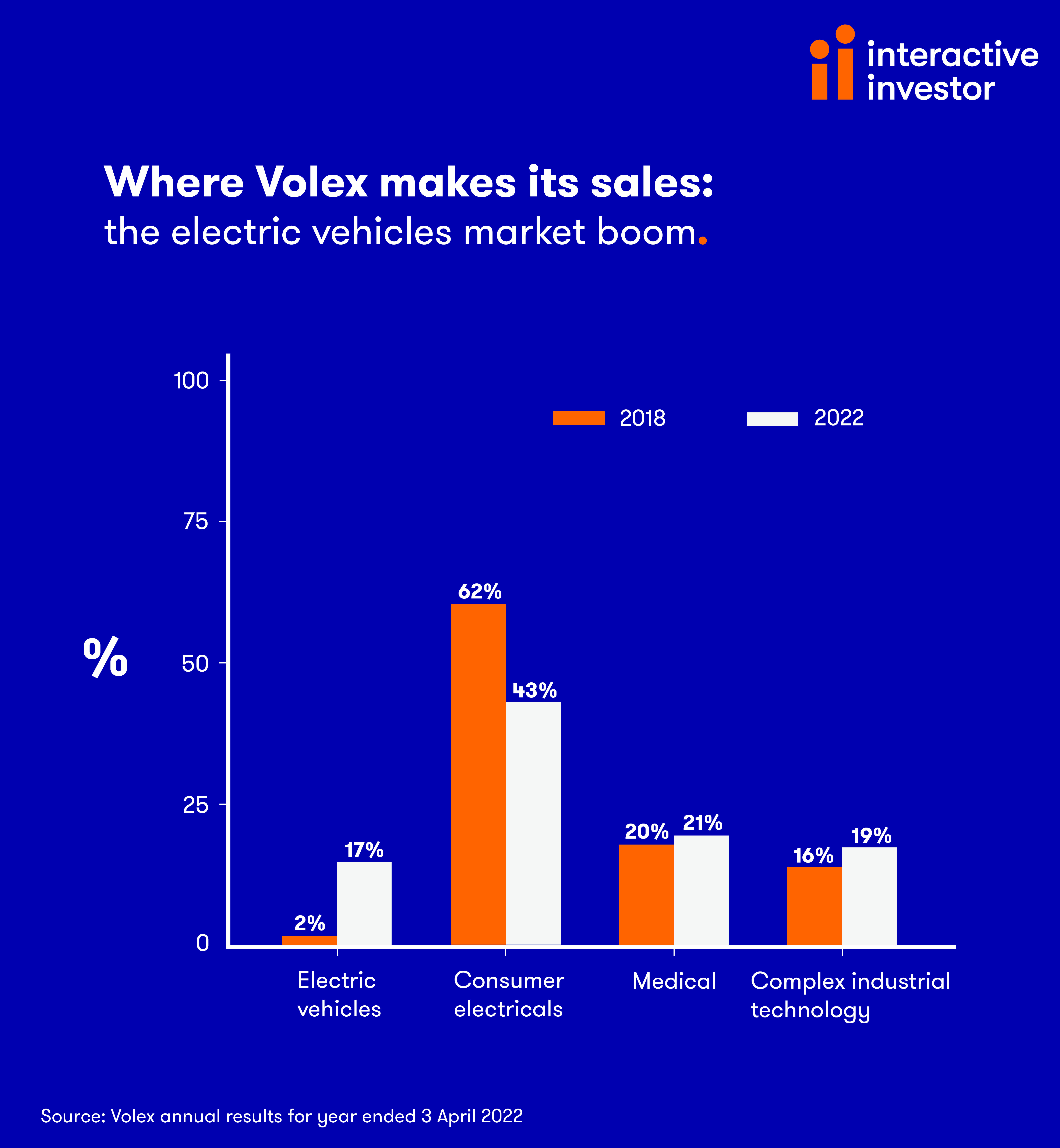

The trading performance review cites 19% organic revenue growth overall, with 96% growth to over $104 million in grid cords for electric vehicle charging. With a market-leading position, this is indeed an attractive area, although competition will increase.

Organic growth of 14% is cited in consumer electrical, up 60% overall to $262 million, with robust demand for such products over the year, but going forward this looks potentially affected by lower discretionary spending. Mitigating this risk is ongoing progression to higher-speed data cables.

Medical equipment saw 13% organic growth to $128 million, and a global backlog in healthcare procedures created by Covid is expected to sustain demand. That’s fair enough, although I have witnessed such equipment manufacturers push the defensive growth narrative in healthcare yet still meet challenges.

Complex industrial technology is cited down 2% organically but up 6% overall to $120 million. Order books are said to be strong, but I sense this area would be affected by a general slowdown – if that happens.

The stand-out for growth prospects in a stagflation scenario therefore appears to be supplying the electric vehicles industry, with consumer and industrial prone to cyclicality and a question mark over healthcare, which may not escape the effects of a recession either.

Ongoing acquisitions therefore appear vital to tilt Volex’s financial profile towards growth, where a recession could actually favour a buyer when negotiating price.

Deferred tax utilisation has skewed earnings comparison

Underlying diluted earnings per share (EPS) is down 16% to 25.2 cents because $12.9 million deferred tax credits boosted April 2021 earnings. Otherwise, underlying diluted EPS rose just over 6%.

In a relatively benign economic context and “10% of market cap” worth of acquisitions made, 6% growth is unexciting, but the full effect of those deals is probably why consensus looks for 35% earnings growth in the current year.

That only 4% is pencilled in for April 2024 underlines the significance of takeovers.

When you cannot be sure of organic versus acquisitive contributions to profit, and EPS is anyway advancing only at mid-single-digit rates, the “growth” story here is essentially in the narrative of increasingly complex technology requiring critical connections.

I sense a vague parallel going back to Bridon, a steel wire rope manufacturer that used to be listed but whose stock would fall in downturns, with the upshot it became acquired, first by FKI in 1997, which was then swallowed by Melrose Industries (LSE:MRO) in 2008. Nowadays, it is part of a Belgian group. Bridon used to insist that its technology was a differentiator – current jargon would say it made its products “mission critical”. Nevertheless, it still succumbed to business cycles.

Volex is more widely spread and, yes, elements of this group may prove relatively resilient.

But genuine “growth” status is deferred, and the yield is insufficient to interest classic “value” hunters.

Rise in inventories and net debt

The 3 April balance sheet had inventories up 55% to $119 million, or as a percentage of revenue from 17.4% to 19.4%. A sceptic might view that as reflecting softening of demand, but it appears a prudent measure against the risk of stock shortages disrupting customer supply.

This potentially helps explain net debt soaring from $27 million to over $95 million for gearing of 46%, although, so far, a $5.2 million interest charge was covered 11x by operating profit.

Taxation variability was the chief reason net cash from operations fell 52% to $18.5 million, also working capital movements.

Volex - financial summary

Year-end 3 April

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

| Turnover ($ million) | 368 | 320 | 322 | 372 | 391 | 443 | 615 |

| Operating margin (%) | 0.9 | -2.1 | 2.7 | 3.5 | 4.4 | 6.9 | 6.7 |

| Operating profit ($ million) | 3.4 | -6.6 | 8.8 | 13.0 | 17.1 | 30.7 | 41.0 |

| Net profit ($ million) | -2.3 | -7.1 | 3.9 | 9.2 | 14.7 | 38.9 | 30.4 |

| EPS - reported (cents) | -2.6 | -7.9 | 6.0 | 6.7 | 9.5 | 25.5 | 18.1 |

| EPS - normalisted (cents) | 1.7 | 10.0 | 8.4 | 10.1 | 11.6 | 27.4 | 20.5 |

| Cash flow per share (cents) | 2.0 | 17.9 | 5.3 | -4.9 | 33.3 | 25.4 | 11.0 |

| Capex per share (cents) | 7.4 | 2.9 | 2.7 | 2.4 | 3.2 | 5.1 | 9.0 |

| Free cash flow/share (cents) | -5.4 | 15.0 | 2.7 | -7.3 | 30.1 | 20.3 | 2.0 |

| Dividends per share (pence) | 0.0 | 0.0 | 0.0 | 0.0 | 3.0 | 3.3 | 3.6 |

| Covered by earnings (x) | 0.0 | 0.0 | 0.0 | 0.0 | 3.1 | 6.8 | 4.6 |

| Return on capital (%) | 3.9 | -9.5 | 12.9 | 10.5 | 11.6 | 12.0 | 12.3 |

| Cash ($ million) | 30.7 | 29.6 | 24.8 | 20.9 | 32.3 | 36.6 | 29.1 |

| Net debt ($ million) | 3.3 | -11.3 | -10.0 | -20.6 | -21.2 | 27.3 | 95.3 |

| Net assets ($ million) | 51.4 | 46.3 | 48.1 | 116 | 131 | 184 | 201 |

| Net assets per share (cents) | 56.9 | 52.1 | 54.1 | 79.6 | 86.2 | 118 | 127 |

Source: historic company REFS and company accounts

‘The year has started strongly with high levels of demand and orders’

Management says the positive start to its new financial year is especially the case for more complex products with longer lead times, which may potentially show Volex as less-affected by stagflation, as a base-case economic scenario.

With the US contributing 44% of revenue, much depends on the success, or otherwise, of the Federal Reserve taming inflation – or triggering a recession – with radically different monetary policy.

At least Volex appears over an inflationary hump for copper prices, which have plunged to a 16-month low. Not that it appears a big user of energy, but all companies will have to contend with higher prices, and the full effects are yet to manifest themselves on margins.

Remains interesting to keep in the frame

Volex could yet prove relatively resilient, hence its stock may rise from a current equilibrium. For what GLG’s short may indicate - 0.9% of the issued share capital as of 7 April – it remains to be seen.

So long as stagflation does not fester into recession, Volex should be able to cope, delivering growth-of-a-sort, enhanced by acquisitions.

I would not be in a hurry to open a new position, especially if the odds tilt towards recession. Hold.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.