Stockwatch: three shares to buy after industry warning

Just because one company has problems, doesn’t mean all peers should be tarred with the same brush. Analyst Edmond Jackson explains his thinking on this sector’s best investments.

23rd July 2024 12:23

by Edmond Jackson from interactive investor

Stock markets have kept their poise around record highs at the start of this week, following a surprise cut in Chinese interest rates to spur their economy from post-Covid slumber. It shows how equities generally are prone to take their cue from (changes in) interest rates rather than corporate fundamentals. Yet the second quarter of this year is revealing some genuine bad news, initially in recruitment, then luxury goods and now in leisure & travel and hospitality.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Transfer an ISA

Can we safely brush these examples aside as late-stage effects of high interest rates, which may soon change as cuts appear to be on the way? Or they are manifestations of how the second half of 2024 could become more volatile in risk assets? There is also uncertainty about November’s US presidential election if Democrats can continue to manage their choice of nominee and campaign better.

Leap in UK firms in significant financial distress

A 37% increase in UK companies in financial trouble compares with the second quarter of 2023; otherwise, sequentially it is a 10% rise. AIM-listed insolvency services group Begbies Traynor Group (LSE:BEG) cites a marked acceleration in significant distress for travel and tourism, up 20%, hotels and accommodation up 16%, and bars & restaurants up 12%.

It says: “The growth in financial distress among these sectors reflects the ongoing weakness of consumer confidence in the UK, which is putting a huge amount of pressure on these consumer-facing sectors in the country.”

It is quite some blow to equity bulls who argued that spending on "experiences" would remain largely intact despite selective weakness on goods. People were supposedly prioritising travel and social life in the wake of Covid restrictions; this being a fundamental change in spending patterns.

But yesterday came news that 51% of UK parents say a holiday is beyond their budget, with 32% saying they are worse off this summer than last, according to a poll by the Action for Children charity.

There is also a “stagflation” angle to this, given costs have risen in hospitality and travel. One key reason the Bank of England is holding off interest rate cuts, despite headline consumer price inflation flirting with its 2% target, is stubborn services inflation, especially wages. While some people blame the rise in UK minimum wage, others note wages fundamentally have to rise to draw in British people willing to do the work in a post-Brexit environment.

Ryanair hits a major air pocket, in mid-flight

And there are problems at the industry’s largest and lowest-cost carrier: the Euronext shares in Ryanair fell 17% yesterday after saying it has had to engage more discounting that expected in the second quarter. Its average fare is down 15% and management sees no end to the need for price cuts.

It has apparently only needed consumers to become “a bit more careful with their money” while operating costs have risen, to hit operating profit hard.

The fiscal first quarter to end-June has seen a 10% increase in customers, albeit they’re paying an average fare down 15%. Meanwhile, operating costs are up 11% - hence a 46% slump in after-tax profit.

It conveys stagflation rather than interest rates finally working to stem cost rises.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- DIY Investor Diary: 10 private investors share their top tips

- UK dividends hit record quarterly high, but 2024 outlook cut

Higher staff costs appear chiefly to blame (less so Boeing delivery delays), with fuel price volatility continuing to be managed adeptly. The sense now is of a “race to the bottom” on fare pricing for the rest of this summer, with only prospects for winter pricing offering any respite. Yet investors may have to wait until the early November interim results for guidance.

Ryanair’s warning remains a shocker generally, given this is the kind of business that people should be gravitating to right now if a “soft landing” (excuse the pun) economic scenario is realistic, where consumer spending is broadly maintained albeit with a cost-conscious mentality. After recruitment, luxury goods and now budget travel have warned on financial progress, there is precious little scope for wider upsets.

I think some exception can be made, how airlines are fundamentally exposed to surprise developments. Since budget travel has attracted more operators, competition means low margins are easily squeezed by some unexpected factor.

A good example of dilemmas with a “stop loss” approach

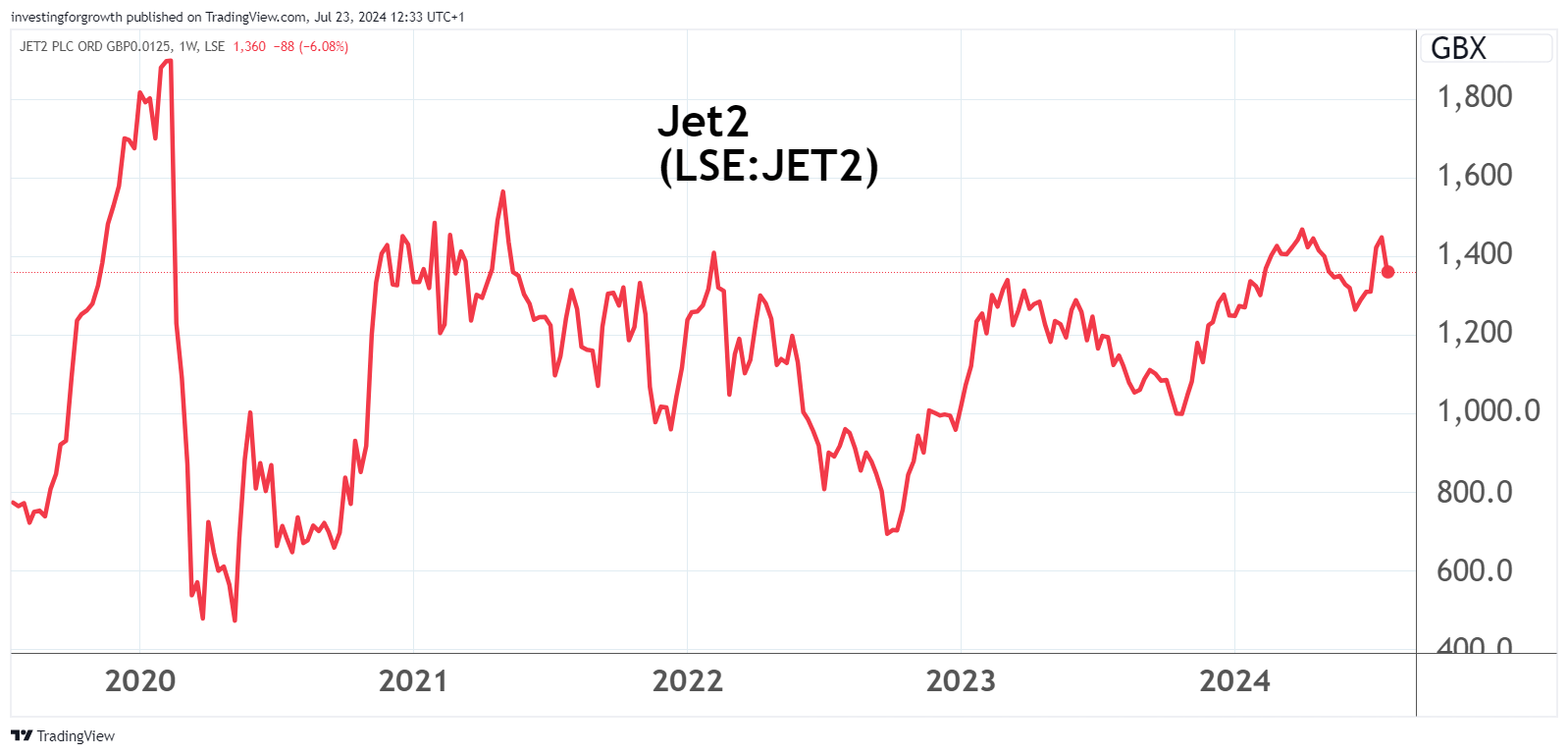

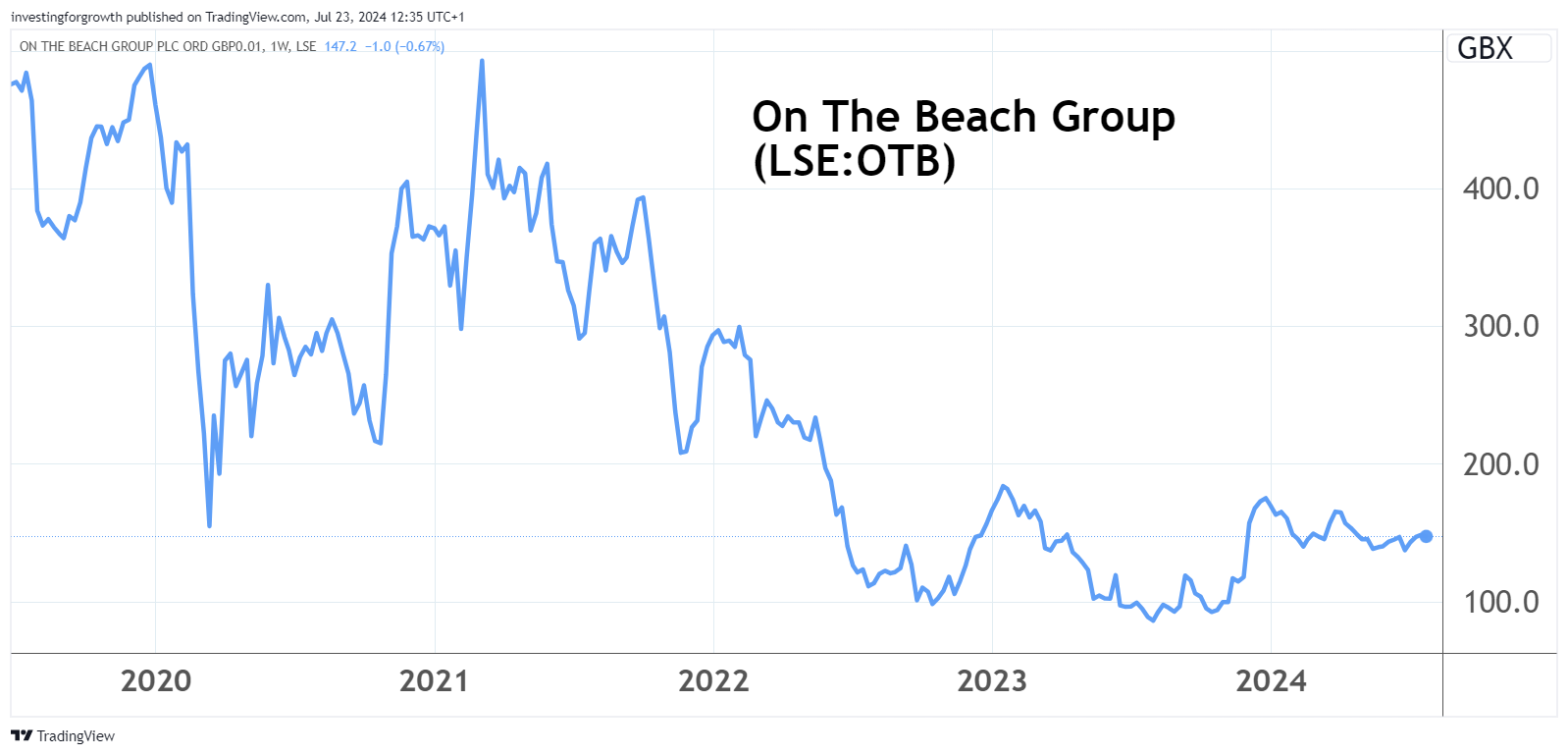

Last September, I reviewed FTSE 100’s easyJet (LSE:EZJ), £3 billion AIM-listed Jet2 Ordinary Shares (LSE:JET2), and small-cap On The Beach Group (LSE:OTB). I suggested a broad inflection point for these travel stocks on forward price/earnings (PE) of around 8 times, albeit easyJet the only one that offers much yield at around 4%.

As a short- to medium-term call, this worked well: easyJet rose 30% from 447p by last April, and Jet2 by 37% from 1,115p, while excitement over winter bookings meant On The Beach soared 54% from 116p by December.

These three companies are distinguishable from Ryanair in the sense that they offer package holidays which should smooth financial volatility relative to Ryanair. However, they remain a play on discretionary consumer spending.

- eyeQ: is slump at easyJet and IAG a buying opportunity?

- 10 hottest ISA shares, funds and trusts: week ended 19 July 2024

Assuming this summer marks the toughest period before interest rates fall, and Labour does not stiff the middle class with subtle tax rises come September, I retain these “buy” stances and suggest a trailing stop-loss approach.

Despite its relatively material dividend yield, easyJet has borne the most brunt, back down to around 430p which remains low in five-year context:

Source: TradingView. Past performance is not a guide to future performance.

Jet2 has demonstrated better relative strength since April, showing how diversification is wise if contemplating this sector:

Source: TradingView. Past performance is not a guide to future performance.

As with last September, I continue to favour On The Beach overall given its smaller size – near £240 million currently – implies better scope to leverage gains. Obviously, this assumes a fair tailwind. Its stock also remains low in a five-year context, yet its underlying financial record shows decent recovery since Covid and consensus expects earnings per share to double for this current year to September then 15% growth to September 2025.

| On The Beach Group - financial summary | |||||||

| year end 30 Sep | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| Turnover (£ million) | 83.6 | 104 | 148 | 71.2 | 30.5 | 145 | 170 |

| Operating margin (%) | 25.3 | 25.2 | 13.0 | -64.5 | -117 | 1.8 | 6.1 |

| Operating profit (£m) | 21.1 | 26.2 | 19.2 | -45.9 | -35.8 | 2.6 | 10.3 |

| Net profit (£m) | 18.0 | 21.5 | 15.7 | -38.8 | -30.2 | 1.6 | 10.1 |

| EPS - reported (p) | 13.8 | 16.5 | 11.9 | -27.7 | -19.0 | 1.0 | 6.3 |

| EPS - normalised (p) | 15.6 | 16.8 | 17.5 | -8.2 | -14.9 | 2.2 | 7.1 |

| Return on total capital (%) | 20.5 | 20.3 | 14.2 | -28.9 | -23.5 | 1.6 | 6.0 |

| Operating cashflow/share (p) | 15.4 | 20.1 | 17.3 | -53.5 | 0.8 | 13.1 | 13.1 |

| Capital expenditure/share (p) | 2.4 | 4.6 | 6.4 | 3.7 | 3.2 | 7.4 | 7.2 |

| Free cashflow/share (p) | 13.0 | 15.5 | 10.9 | 57.2 | -2.4 | 5.7 | 5.9 |

| Dividend/share (p) | 2.8 | 3.3 | 3.3 | 0.0 | 0.0 | 0.0 | 0.0 |

| Cash (£m) | 33.0 | 47.3 | 54.8 | 36.5 | 56.0 | 64.5 | 75.8 |

| Net debt (£m) | -33.0 | -42.8 | -54.8 | -32.3 | -53.1 | -60.6 | -71.3 |

| Net assets (£m) | 96.6 | 118 | 129 | 152 | 150 | 157 | 168 |

| Net assets per share (p) | 74.0 | 89.7 | 98.7 | 96.8 | 90.6 | 94.3 | 101 |

| Source: historic Company REFS and company accounts | |||||||

Such forecasts ought to involve less risk for On The Beach at 142p rather than these other travel stocks, given Ryanair has said passenger volumes are up 10% and OTB’s May interim results cited bookings up 15%, with higher prices paid in the six months to end-March.

Source: TradingView. Past performance is not a guide to future performance.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.