Stockwatch: a tax warning for UK and US investors

Still analysing the recent UK Budget, attention now turns to the US presidential election. Analyst Edmond Jackson shares his thoughts on outcomes and a surprise lurking for investors.

5th November 2024 09:36

by Edmond Jackson from interactive investor

The UK stock market is now over the uncertainties presented by Labour’s first Budget, and US stocks could rally this week if Trump wins and the Federal Reserve cuts interest rates on Thursday. Are we back to the races?

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

While the UK Budget was partly billed for growth and the US economy has continued to surprise on the upside – as if neither presidential candidate can disrupt this – I would be aware of medium-term risks with tax rises happening in both economies. In the US, it is more a legal technicality like the “debt ceiling” that could yet be averted by Congress; however, its risk does not seem to be on investors’ wavelength at all, hence a surprise element lurking.

Can multiplier effect from UK public investment outweigh tax rises?

This to me is the crux question for many domestic stocks. Chancellor Rachel Reeves is enabling a £13 billion increase in capital investment, raising total government departmental spending to £131 billion for 2025 to 2026. Public investment is to be boosted by over £100 billion over the next five years across roads, rail, schools and hospitals, while allegedly “keeping debt on a downward path”. We shall see in due course what the bond market makes of that.

According to the “multiplier effect” theory, a greater increase in economic output than such money spent will follow as effects spread out. It is a basic premise of left-wing economics that the economy flourishes when the state spends more; whereas a right-wing perspective frets that the history of the state allocating resources effectively is inferior to the market. Time will tell.

- Budget 2024: what it means for your money

- Budget 2024: AIM shares no longer IHT exempt, and ISA allowance frozen

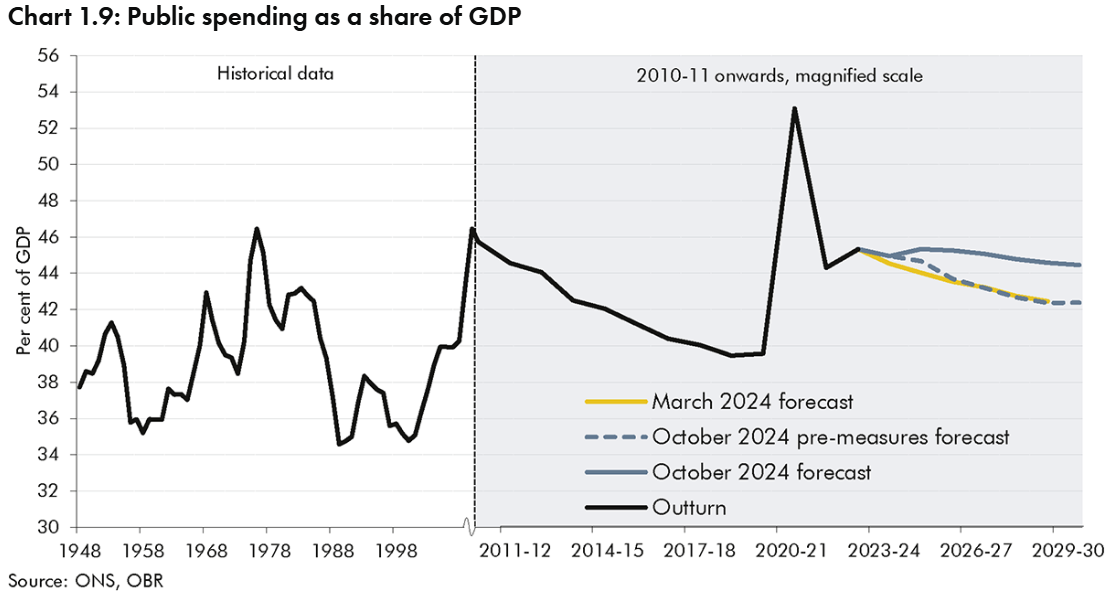

The UK state is reaching record involvement in the economy: the Office for Budget Responsibility (OBR) projects public spending to reach 45% of gross domestic product (GDP) during this government’s term, and taxation to 38% of GDP. Disconcertingly for equities, the OBR further projects downgrades to UK growth – as if it is not tepid already – as a result of the state crowding out the private sector.

Looking back to the 1990s, the UK private sector was about twice the size of the state, whereas under Labour, the two will end up about the same, but with the private sector having to fund the state unless borrowing and personal taxes rise.

Potential modest stagflation effect from NI rise

Versus some possible multiplier effect weighs the £25 billion burden on employers by way of national insurance (NI) contributions from 13.8% to 15.0% of wages paid. As with cost inflation during Covid, there will be an attempt to pass this on to customers by way of higher prices, especially in the hospitality sector, which employs many lower-paid staff where the minimum wage is rising 6.7% to £12.21 per hour for those aged over 21.

This is likely to have an effect on retail price inflation and is liable to temper scope for the Bank of England to continue reducing interest rates in 2025, with RPI having fallen from 3.5% year-on-year in August to 2.7% in September.

The Institute for Fiscal Studies (IFS) makes plain: “Increases in taxes and borrowing are not costless, and the spending plans after 2025 to 2026 are unlikely to survive contact with reality.”

As for consumer demand and confidence, while the minimum wage rise is positive for spending, the rise in the bus fare cap from £2 to £3 hence may take some of this away. Further up the pay scale, little is changing so far, albeit related to Labour’s election promise it would not raise taxes on “working people”. Yes, the inheritance tax take is rising but seems of minimal consequence to consumer sentiment.

Possibly, the pre-Budget fear factor will now ebb; but there is no feel-good factor about this Labour administration right now, or anything in the Budget to help smaller private businesses. The chancellor has delivered a classic “public works” programme, and we are left hoping its effects can overcome those of higher taxes and public debt.

US has momentum but mind risks of Trump, debt and taxes

Probably it will take until Wednesday morning at least to learn the election outcome, but whoever wins the US economy seems likely to manifest relatively superior economic growth, helped by deficit spending.

In the first six months of 2024, the US economy grew at an annualised rate of 3% versus none of the world’s next six largest economies growing over 1%. While employment was boosted by unauthorised immigration, the bulk of growth came from productivity improvements. Output per hour rose around 2% or more in the third quarter after 2.7% in the previous four quarters, comfortably above the 1.5% average annual rate from 2007 to 2019. A UK chancellor would surely kill for this.

- Harris or Trump: funds to play the US election result

- US election: what a Trump or Harris win means for share prices

Such momentum is hard to disrupt unless Trump takes early vigorous action on tariffs, possibly also ordering deportation of illegal immigrants. Quite whether his threats were election bluster is unclear, but Trump has vowed to impose a 60% tariff on Chinese goods and at least a 10% levy on all other imports – potentially heralding a far worse re-run of his 2018 to 2019 trade war with China, when it retaliated with agricultural tariffs and switched buying to Brazil and Argentina.

While the US stock market and dollar seem likely to welcome a Trump victory, the big medium-term risk is therefore raising US import duties back to 1930s levels - hiking inflation and disrupting supply chains.

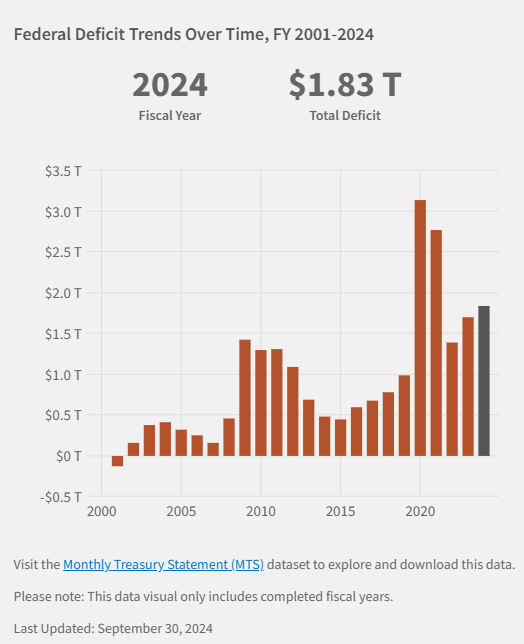

From his career as a real estate developer, Trump has no qualms about overseeing high debts. Whether that is ultimately a good or bad thing, given the US Congressional Budget Office (CBO) estimates a 2025 budget deficit near $2 trillion - of which over half would represent net interest. US public debt would be over $30 trillion, or 99% of GDP. By 2034, the debt is estimated to exceed $50 trillion or 122% of GDP, at which point $1.7 trillion a year would be spent on interest.

Source: The US Department of the Treasury

Furthermore, a tax technicality implies material rises in 2026 unless Congress decides to extend the 2017 Tax Cuts and Jobs Act, which reduced tax rates for taxpayers across all income levels. If it expires as scheduled, over 62% of tax filers will be hit, which would be significant given consumer spending represents around 70% of the US economy.

Not only will income taxes be affected, but various exemptions such as mortgage interest and child tax credits too.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Is it time to come out of cash? And what to buy now

A twist is also involved: CBO projections assume the US government will indeed be benefiting from substantially higher taxes from 2026, otherwise more debt will be required. Congress could simply “kick the can down the road” like it has done to serially raise the US debt ceiling, albeit this would raise long-term financial risk – thus probably hurting the dollar and Treasury bonds.

Comparing current risks to the UK economy over the employer national insurance hike, the US situation seems potentially more dramatic – hence disruptive to financial assets, given stock ratings are at historically high levels.

Buckle down and try to find the best companies?

Perennially, you can find macro reasons to be cautious on equities, then looking back a few years hence, big winners. I would still be aware and watching how these tax and public debt issues will affect perception of investing in the UK and US in years ahead. They dial directly into security values.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.