Stockwatch: a tale of two financial sectors

Analyst Edmond Jackson examines the outperformance of UK banks, while another area of the finance industry has traded sideways despite fat yields. Is it their turn to re-rate?

27th December 2024 10:25

by Edmond Jackson from interactive investor

While my last article noted rare tech stocks had risen 200-300% this year, be aware that UK banks have also been outstanding performers – if the timing was right. It shows how a “value” style of investing – low price/earnings (PE) multiple, high yield and/or discount to net tangible assets – can also enjoy time in the sun.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

It is relevant if US tech stocks are forming a top and this sector gets more volatility globally in 2025. If inflation proves more stubborn than expected and interest rates are slower to fall, this could also weigh on high PE/low-yield “growth” ratings.

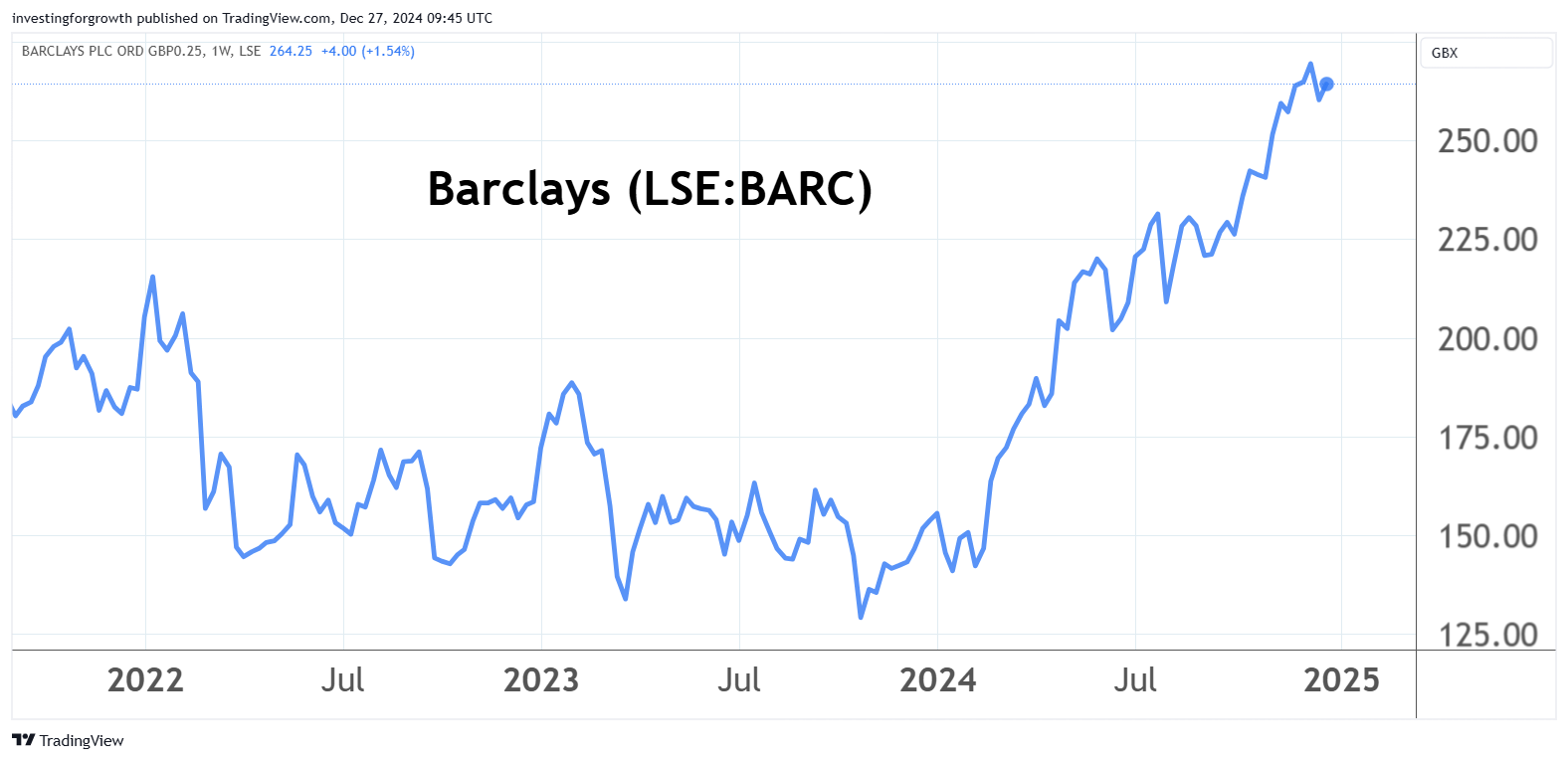

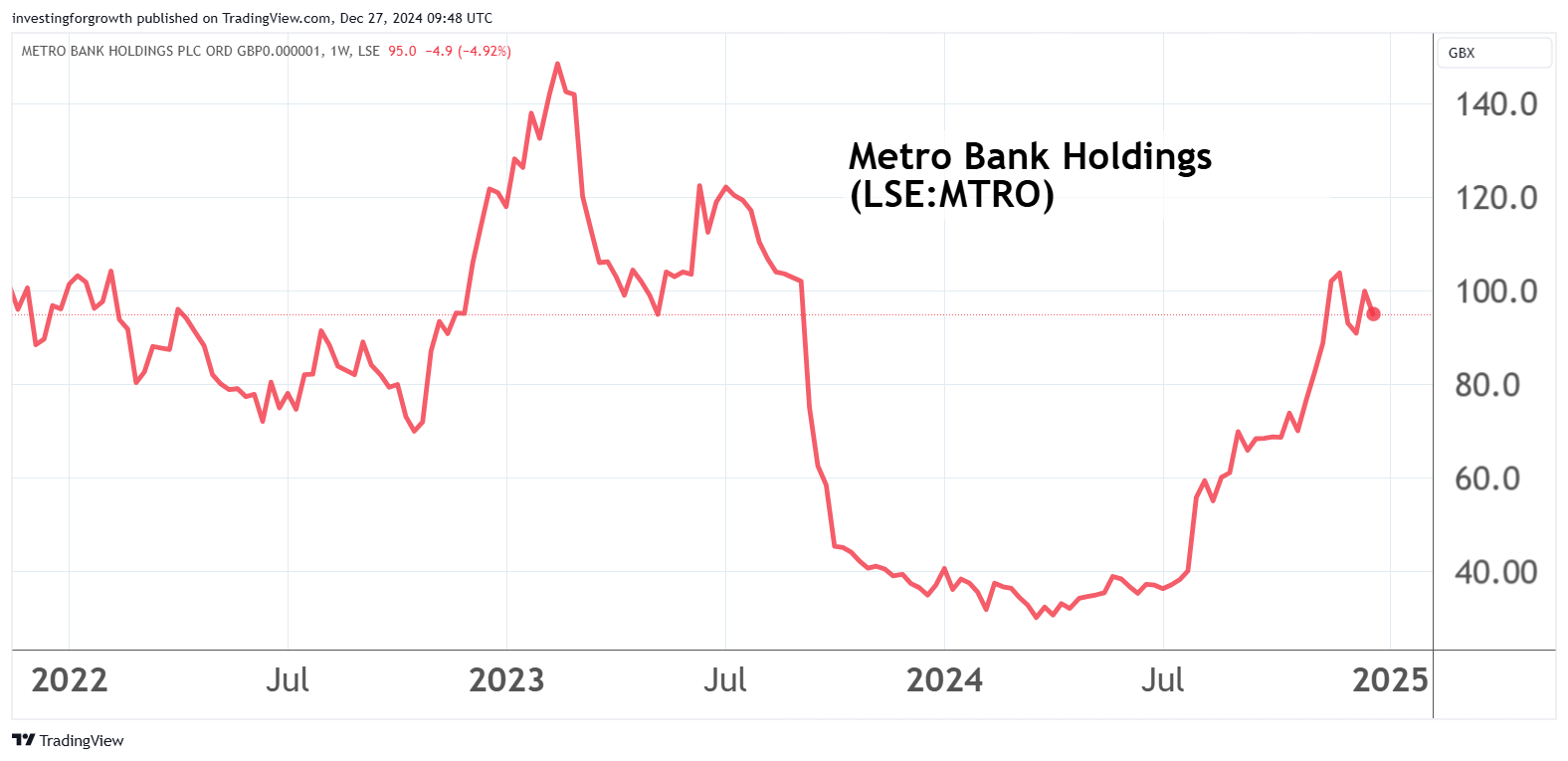

From spring 2024 lows, a trio of unloved UK banks – Barclays (LSE:BARC), NatWest Group (LSE:NWG) and Metro Bank Holdings (LSE:MTRO) – roared higher, with 150% average upside to December, admittedly weighted to the smaller Metro Bank at a huge discount to net tangible assets. Yet Barclays and NatWest are businesses each worth over £35 billion, which has represented a colossal valuation anomaly given large-cap pricing is meant to be relatively efficient.

- Watch our video: a FTSE 100 stock to watch in 2025

- Watch our video: my favourite share for 2025

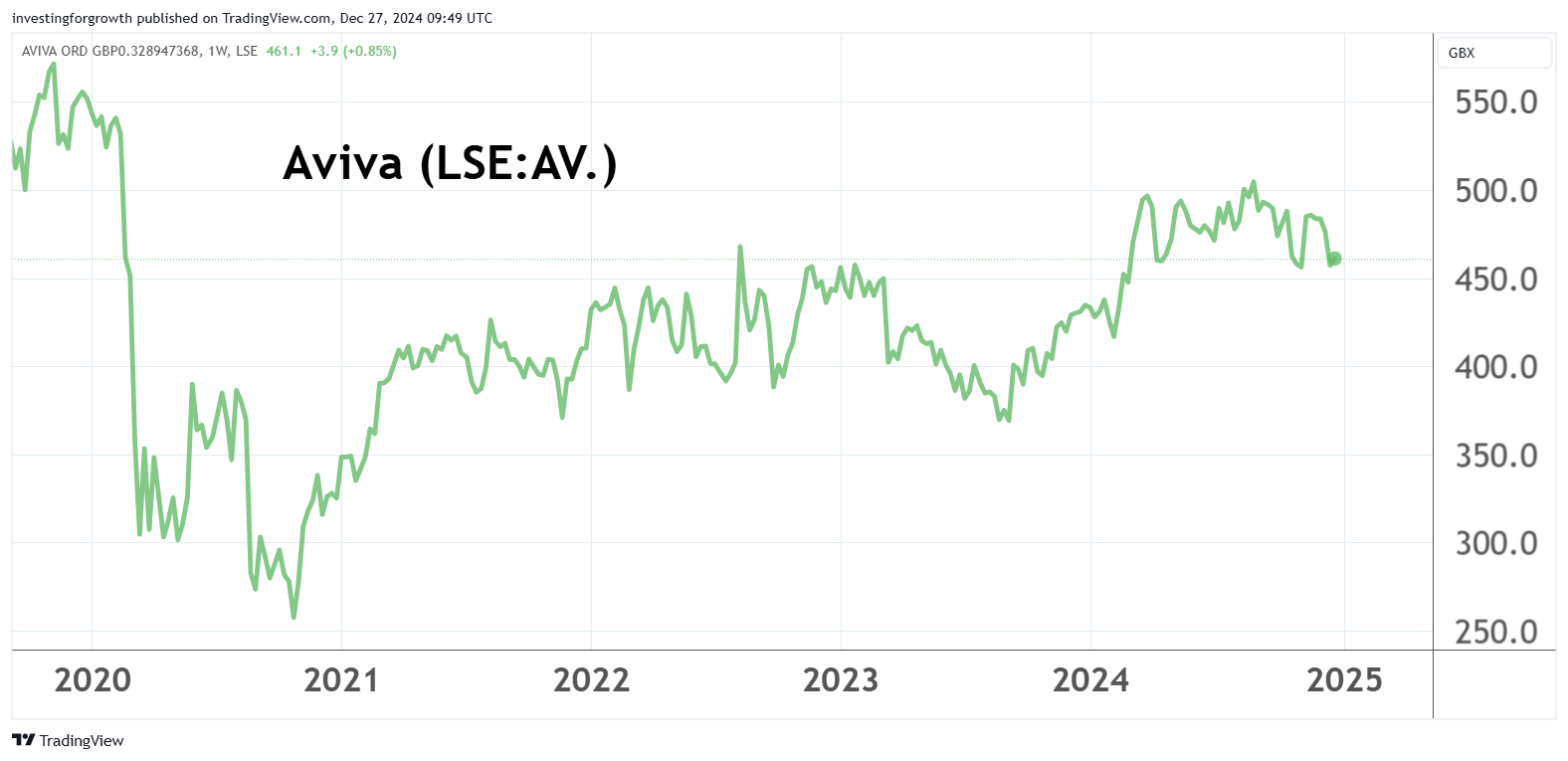

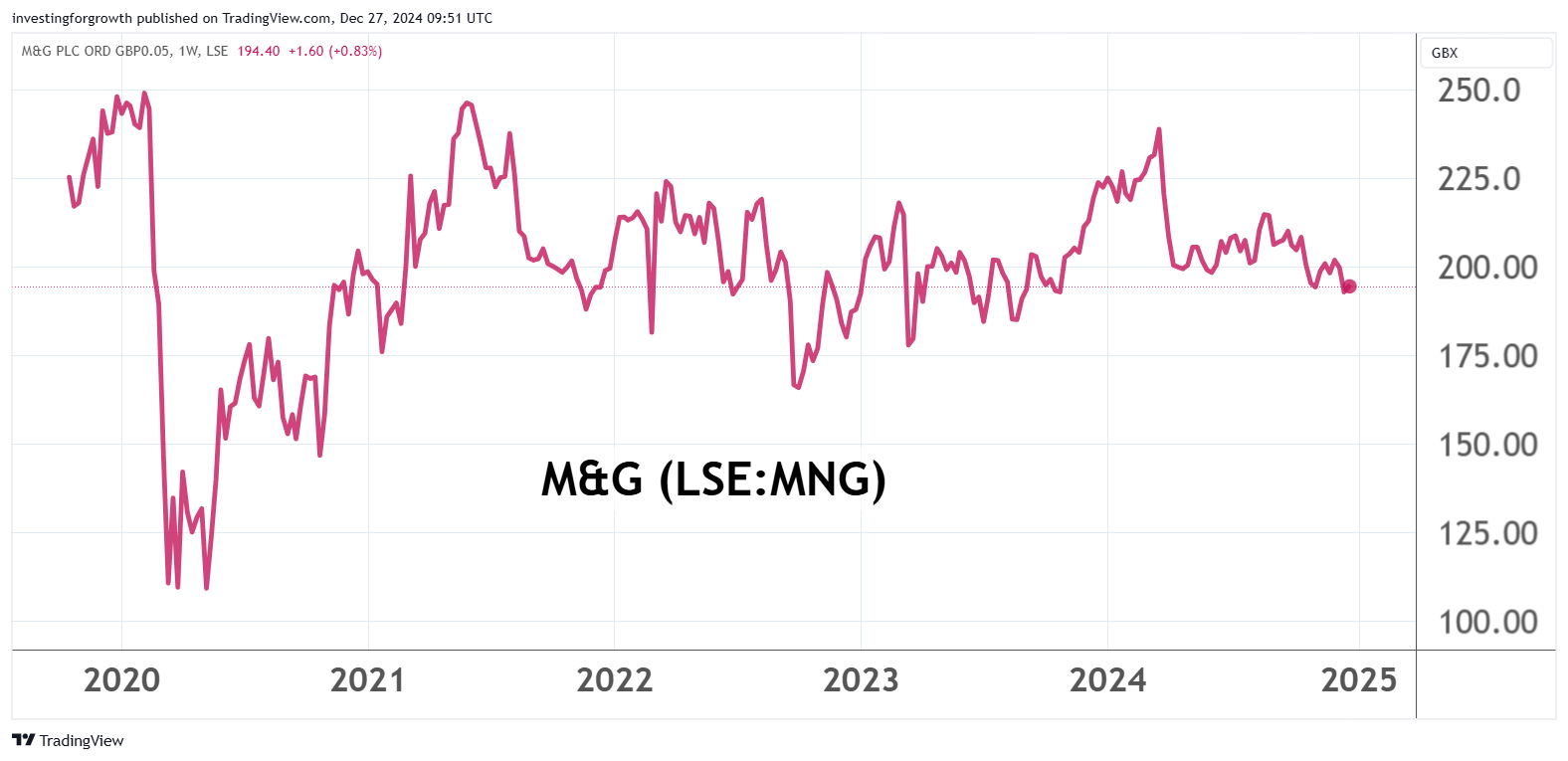

Moreover, it begs the question about whether insurance and asset management-type shares, which have lagged banks due to weak industry conditions and investor outflows, might similarly be at or near a contrarian “buy”.

2024 has thus seen “a tale of two financial sectors” that’s worth examining in more detail.

UK banks: from outstanding to fair valuations now?

It has certainly been hard to identify a turning point - bank shares traded well down after the 2008 crisis as investors licked scars. Furthermore, their business models were compromised by very low interest rates under persistent monetary stimulus measures. The net interest margin, or difference between interest received on loans and what is paid to depositors, can be axiomatic. Yet higher interest rates from later 2021 did not provide any turning point in the shares until early 2024 when Barclays’ operating results were lacklustre, but NatWest displayed underlying momentum.

When I examined both banks last April in response to annual results, Barclays at 200p was already 45% up from its low, but I noted a 4.5% prospective yield as enough to imply further upside. The rise extended to 270p despite last October’s Budget disrupting most shares in big employers, especially retail.

Source: TradingView. Past performance is not a guide to future performance.

Modest corrections in banks during the past few weeks likely reflect concern that a loss of business and consumer confidence implies demand for credit will ease – and that a recession could lead to rise in bad debts.

Pricing continues to look fair enough. At around 260p, Barclays trades on a 6x forward PE and 3.5% yield, with over 4x earnings cover (based on forecasts) and NatWest near 400p on a 7x PE yielding 5.2% but with 2.6x cover. Barclays trades at just 0.6x tangible book value whereas NatWest has risen to 1.1x.

Bank shares are significantly a proxy for the economic outlook, so it will depend how that pans out, with NatWest more exposed to UK lending.

Source: TradingView. Past performance is not a guide to future performance.

Such was the turn in sentiment towards banks, it finally lifted small-cap Metro Bank out of the 30p region from the end of last July, up to 107p and currently 101p. That “deep value” stocks can perform well despite an initial re-rate is shown by my arguing a “buy” case last August at 53p straight after a 40% jump in response to interim results. A margin of safety could be perceived in a 57% discount to net tangible assets near 140p a share.

Source: TradingView. Past performance is not a guide to future performance.

A £2.4 billion mortgage portfolio sale to NatWest last July was heralded as an opportunity to increase higher-yield commercial lending and specialist mortgages. This seems a bit of a double-edged sword in the sense it must not imply anything “sub-prime” if the UK economy is deteriorating. Higher returns imply higher risk.

Metro shares rallied in November despite no fresh corporate news, similar to various other UK small-caps, as if investors’ risk appetite was suddenly whetted. Mind, such sentiment changes can easily reverse according to trading updates, but unless the UK faces recession, Metro’s share price at 0.7x tangible book value looks supported despite no dividend.

While overall “hold” stances may be justified on such yardsticks, given an increasingly gloomy outlook for the UK in 2025, it could be wise not to be overexposed to banks oriented to the UK, and to ensure some of 2024 gains are locked in.

Are insurers/asset managers due similar ‘reversion to mean’ values?

They can be quite a geared play on financial market performance and generally offer high yields – as if coiled springs awaiting a turn in sentiment as happened to banks. The current dilemma seems linked to moribund European economies and uncertainty around how disruptive President Trump will prove.

- Stockwatch: a cheap way to secure Aviva’s 8% yield?

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

I have maintained “buy” stance on Aviva (LSE:AV.) since 342p in March 2020, which I re-iterated last June at 470p given a 9% prospective yield with possibly 1.3x earnings cover. The stock is overall up around 7% in 2024, but recent sideways volatility shows the market looking for fresh impetus, which the board hopes will be delivered with the acquisition of Direct Line Insurance Group (LSE:DLG).

Source: TradingView. Past performance is not a guide to future performance.

I followed this with Legal & General Group (LSE:LGEN) as a “buy” at 227p, similarly offering a 9% yield, which at 224p has risen to 9.75% albeit barely covered, according to recent consensus. This is more an asset management share and life insurer, hence significantly more affected by investment flows and valuation changes in assets held. I thought a Labour government would allow a broadly supportive context for workplace pensions. But as the jump to 240p and back this month shows, the market remains in two minds, hence L&G’s appeal chiefly for income.

Source: TradingView. Past performance is not a guide to future performance.

M&G Ordinary Shares (LSE:MNG) has been a similar beast: last April and September I rated “buy” both times at 207p – on an averaging-in basis, it still has yet to turn green versus a current price of 193p. This is despite a prospective yield edging towards 11% and consensus for 16% earnings growth in respect of 2024 and 8% growth for 2025. That puts the forward PE at 8x easing to 7.5x.

Source: TradingView. Past performance is not a guide to future performance.

These bigger asset managers are at least broadly trading sideways compared with falls in those smaller peers such as Liontrust Asset Management (LSE:LIO), offering a 15% yield if sustained, and Premier Miton Group (LSE:PMI) on 10%. Both stocks have seen support this month but, given greater operational gearing in the smaller companies, I am inclined to wait and see how new year markets fare.

The experience with banks in 2024 shows how modest to lowly rated shares can surprise on the upside without any specific triggers. Heightened uncertainty right now is arguably reason to be accumulating, hence I retain “buy” stances on the three FTSE 100 companies. I want to see how the economy trends in early 2025 and, in particular, what happens with Trump tariffs before weighting to small-caps.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.