Stockwatch: is stubborn inflation reason to worry?

Global stock markets remain in high spirits, much of it driven by anticipated cuts to interest rates this year. But amid conflicting data, analyst Edmond Jackson remains wary.

28th May 2024 12:09

by Edmond Jackson from interactive investor

Inflation has started to weigh on stocks again. It was counterbalanced at the end of last week by blow-out profit numbers from AI chip maker NVIDIA Corp (NASDAQ:NVDA), which aided US market recovery on Friday, while takeover approaches continue to provide excitement in the UK.

Meanwhile, in Asian markets, this week started strongly in a sense that commercial momentum generated by Nvidia is positive for tech firms there too. AI, cloud computing and 5G are conflating for a positive global semiconductor cycle with various offshoots.

- Invest with ii: Top UK Shares | How to Start Trading Stocks | Open a Trading Account

It looks to me as if highly rated tech stocks are getting riskier because “growth” tends to be inherently more sensitive to interest rate changes than “value”. If, say, a 10-20% chance of a scenario where US rates have to rise actually happens, it would prick bubble valuations. Right now, the market has written off such a prospect.

In the UK, and as I have noted before, widespread stock spikes in April and May can be interpreted as a “break-out” from lethargic valuations – justified by resilient underlying profits and an expectation that interest rates are indeed coming down within six months.

This latest company results reporting season has appeared to deliver more surprises on the upside than any real shocks. Together with anticipation of lower interest rates, it has fostered greed, which is fine if inflation is essentially slain, but what if not?

In the US, there is now a skewed market, where it’s possible to see the Nasdaq technology index rising intraday, while the more traditional Dow Jones index is in steep fall and the broader-based S&P 500 index is going nowhere. Does “lack of depth” to the current rally cap its potential?

How interest rate expectations got ahead of reality

Last Thursday’s service and manufacturing data indicated that the US economy remains stronger than expected, while disclosure of minutes from a recent Federal Reserve policy meeting added to concerns about stubborn inflation.

The minutes said: “Various participants mentioned a willingness to tighten policy further should risks to inflation materialise in a way that such action became appropriate.”

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- Stockwatch: a buy after strongest numbers this results season?

I think a chief dilemma here is that a huge amount of fiscal and monetary stimulus is still in the system after the Covid years. I recently explained how a strong rally in US equities and property from last November led to “wealth effect” spending on travel, eating out and designer goods, as manifested in recently strong performance by the US arm of Watches of Switzerland Group (LSE:WOSG).

Source: TradingView. Past performance is not a guide to future performance.

But it has led to a two-tier economy: the US Treasury secretary expressed concern this last weekend about how “substantial” rises in living costs remain “a problem to a lot of people”. Despite strong wage growth, the cost of housing and everyday goods remains high for many US voters ahead of November’s election.

This plays to sceptics wary about low levels of overall consumer confidence, given consumer spending represents about 70% of US Gross Domestic Product, while delayed effects of high interest rates also mean risks for the second half of this year.

The CEO of McDonald's Corp (NYSE:MCD) has cited “broad-based consumer pressures persisting around the world” and its stock has substantially reversed gains made in the “everything rally” from last autumn, driven by hopes for interest rate cuts.

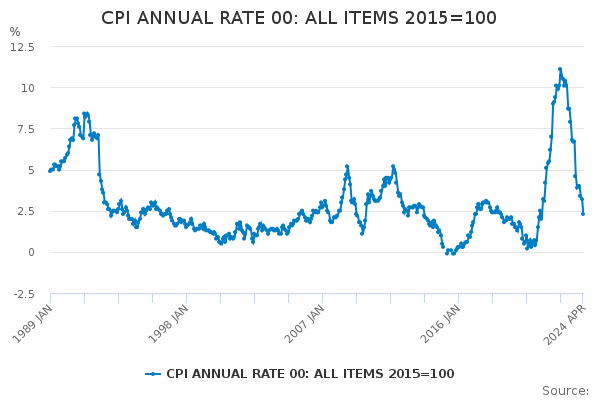

Might UK inflation be similarly stubborn?

On the face of it, our economy’s relative lack of productivity, also (some would say) the self-inflicted wound of Brexit, means the UK simply does not have the same momentum as the US.

For inflation, that is perversely a good thing right now, implying rate cuts could come sooner than the US (albeit at some risk of sterling selling off, leading to import cost inflation). After the International Monetary Fund (IMF) upgraded its UK GDP growth forecast for 2024 from 0.5% to 0.7%, keeping 2025 at 1.5%, it is hardly a “Goldilocks” scenario, yet not high risk either.

- Inflation eases to 2.3%, but hopes of imminent rate cuts dashed

- Stock markets at records and cash at 5%: what will happen next?

There may be false hope, however, in UK consumer price inflation easing from 3.2% last March to 2.3% to April, after gas and electricity prices were lower by 27% like-for-like in April.

Food price inflation has eased from 4% below 3%, but service sector inflation slipped only 0.1% below 6% as businesses passed on higher costs to customers, such as April’s increase in the National Living Wage from £10.42 to £11.44 per hour, hence inflation in hotels and restaurants is up from 5.8% to 6%.

Source: Office for National Statistics.

It means a high “core” inflation rate - core CPIH excludes energy, food, alcohol and tobacco, and rose by 4.4% in the year April, down from 4.7% in March – and is one that the Bank of England watches.

We see this reflected in the interim results to 13 April for mid-cap hospitality group Mitchells & Butlers (LSE:MAB), which achieved better-than-expected performance despite the “cost-of-living crisis” supposedly compromising people’s ability to eat/drink out in pubs, restaurants and bars.

Like-for like sales growth rose a very respectable 7% and operating profit jumped 64% on a margin up from 7.8% to 11.7%. This is despite food and drink prices having risen after Covid lockdowns, and higher labour costs due to the rise in the National Living Wage, plus the challenge to fill jobs after Brexit.

- ii view: bar owner Mitchells & Butlers nears three-year high

- Making the most of your tax breaks in 2024

I think the key reason is because enough customers’ wages are keeping pace with price rises – neatly illustrating the Bank of England’s current dilemma if it is to achieve the central bank’s holy grail of 2% inflation.

Some economists say “3% is the new 2%” and that central banks will capitulate to cut rates because modest endemic inflation will help “inflate away” excess public debt. To me, the only certainty would be division on monetary policy committees.

The UK Office for National Statistics cites wage growth is running at 5.7%, or 1.7% in broad inflation-adjusted terms. Economists had expected it to fall to near 5%, so this is quite a miss. With labour shortages persisting, sticky inflation is cited as extending to water bills, air fares and recreational and cultural services.

Unless core inflation and wage growth are seen tempering, I cannot see the Bank of England starting to cut rates.

Profit margins have been squeezed higher

An interesting below-radar study by the Unite trade union shows pre-tax profit margins were 30% higher on average in 2022 for 17,000 UK firms, versus the 2018-19 average. Post-tax margins were on average 20% higher.

Unite claims major banks and electricity generation companies gouged the most – a 60% increase in profit margins – although Lloyds Banking Group (LSE:LLOY) has approximately recovered a 20% margin after falling to 10% in 2019, then 4% in 2020 (Covid). SSE (LSE:SSE) has similarly rebounded – 25% in its year to March 2024 comparing with 22% in March 2019.

- Insider: heavy buying and selling of these FTSE 100 shares

- Shares for the future: a business I love is in great shape

The claims need more investigation as regards listed companies, but looking at operating margin trends, I concur that shareholders have been partly compensated for inflation by deft actions by companies on costs.

My wariness on inflation could get proven wrong by summer data, but US and UK stock markets alike are very confident in rate cuts ahead, which are yet to be justified in the data. Take care.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.