Stockwatch: a springboard for this FTSE 100 share to rally

There was a negative reaction to recent results from this high-profile company, and analyst Edmond Jackson is surprised. He believes there’s reason to buy the shares here at a historic support level.

8th November 2024 13:07

by Edmond Jackson from interactive investor

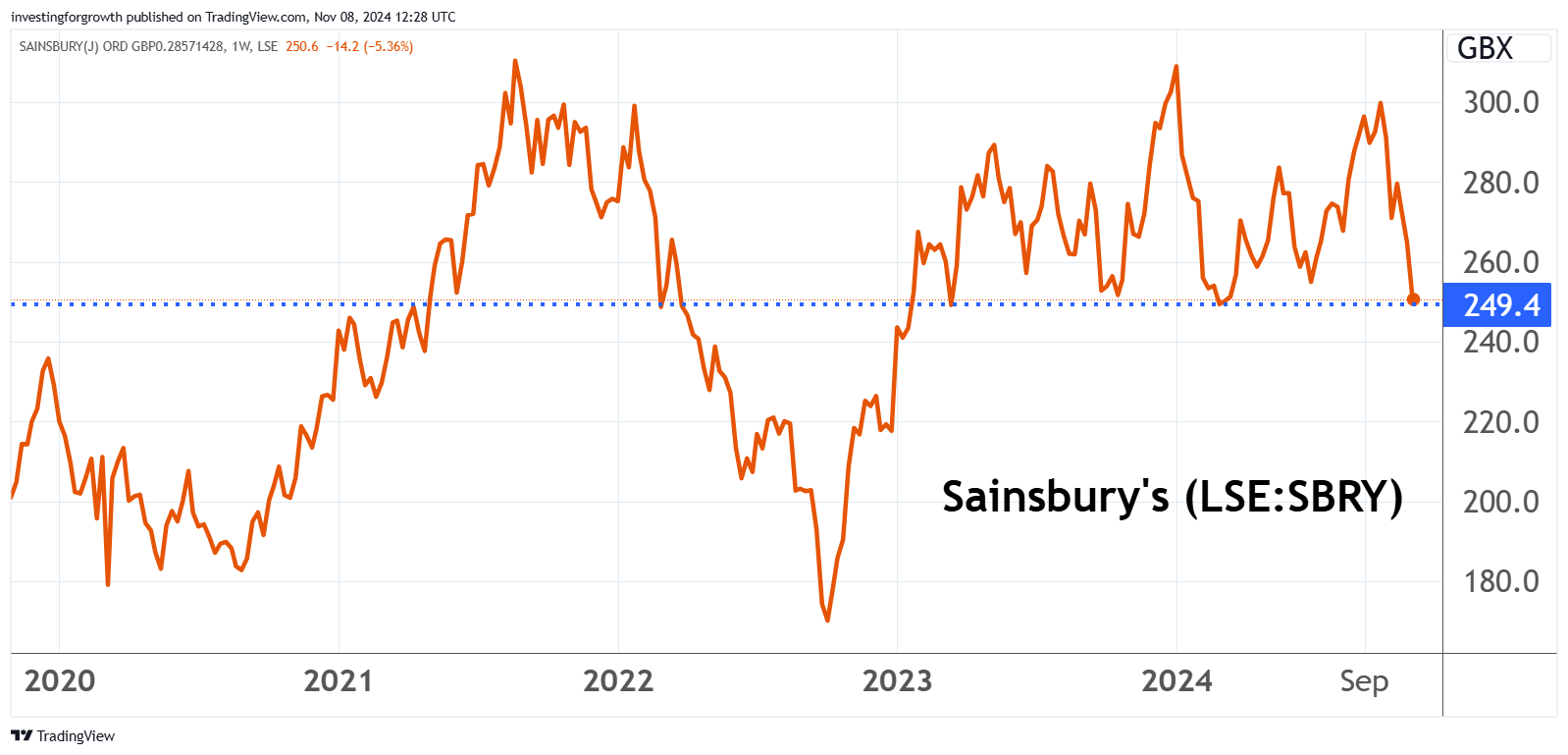

For reasons I shall explain, I was a bit surprised to see Sainsbury (J) (LSE:SBRY) falling yesterday in response to interim results – initially down around 2% then closing 4% easier at 257p. This morning, the price has fallen again to 248p, where support has kicked in a number of times over the past few years.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Transfer an ISA

The prospective dividend yield is currently around 5.5% and September’s net tangible assets constitute 97% of market value, which intrinsically implies downside protection despite market price being in a firm downtrend from 300p since end-September.

In a five-year context, however, this merely continues a sideways-volatile trend since early 2023, with the price currently at that low – and possibly “buy” – point, after the 2020 to 2022 rollercoaster when supermarkets benefited from pub and restaurant closures during lockdowns:

Source: TradingView. Past performance is not a guide to future performance.

What has changed however, for taking one’s cue from the chart, is the Budget-hiking employer national insurance (NI) contributions to 15% of wages from the next tax year. The market is trying to price this in, notwithstanding guidance in yesterday’s interim results (to 14 September) for strong profit growth this financial year to end-February 2025.

Groceries are performing well, I believe because Sainsbury’s stores – at least the larger ones – offer the best all-round choice for variety, quality and keen pricing. Marketing-wise, they have cracked it, to become the UK leader in terms of overall offering. A stronger performance is also expected from Argos in the second half.

- ii view: Argos a drag on Sainsbury's despite grocery growth

- Stockwatch: a tax warning for UK and US investors

One estimate, however, suggests the NI changes will cost Sainsbury’s £140 million next financial year; that’s in context of a recent consensus for net profit to re-rate from £137 million to £501 million in respect of February 2025 and £568 million in 2026. That would imply a downgrade heading towards 30% unless further actions are taken on costs – but perchance this is happening by way of a three-year £1 billion cost savings programme out to the 2026-27 financial year. Possibly some fine-tuning along the way will at least mitigate the extra NI cost.

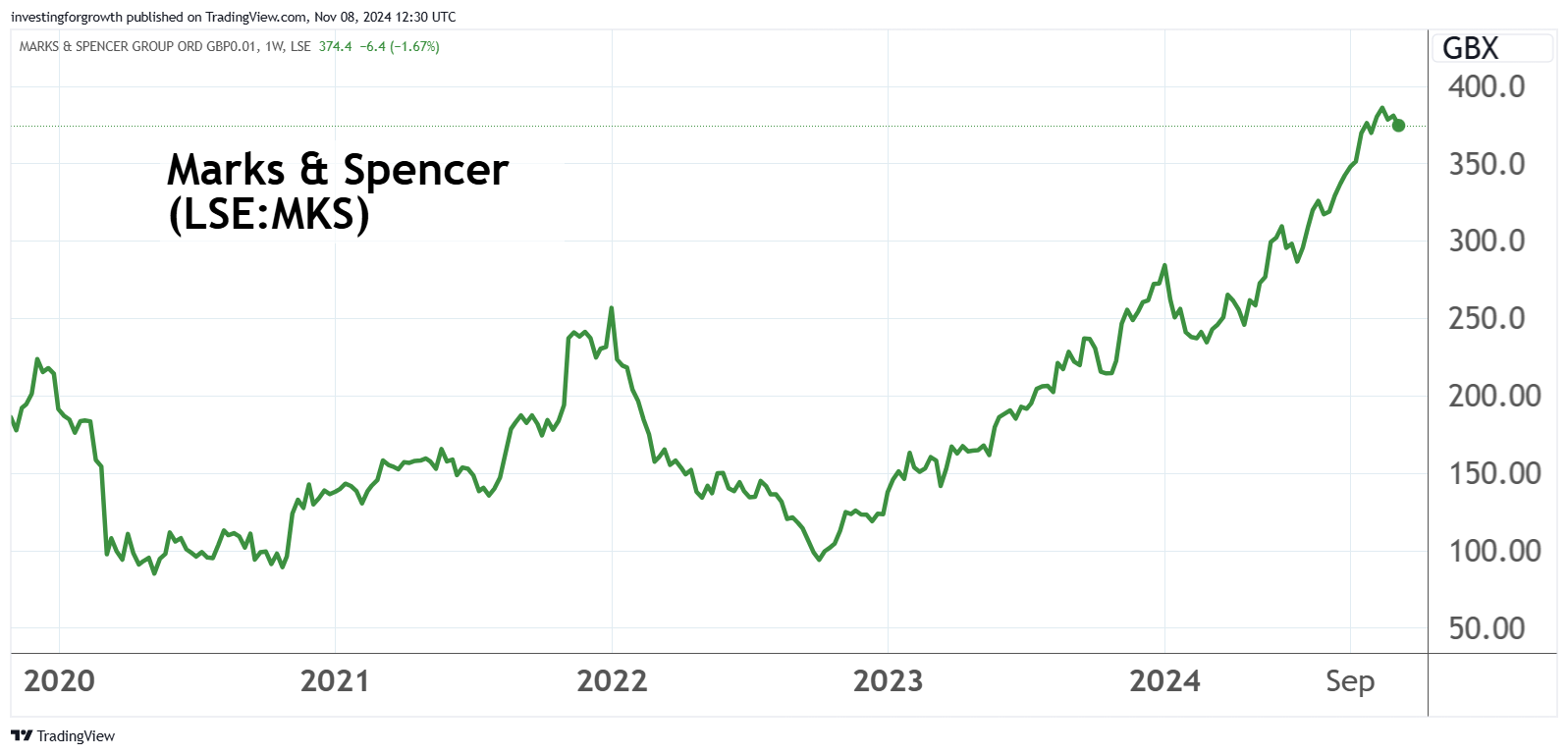

M&S shares barely affected by Budget change

Marks & Spencer Group (LSE:MKS) shares have barely flinched. Indeed, they hit a seven-year high close to 400p – currently 390p – in response to strong interim results last Wednesday.

Its financial dynamics are currently stronger than Sainsbury’s, however the dividend yield is only around 1.7% and net tangible assets constitute 35% of market value.

- Latest profit boost extends M&S share price rally

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

M&S’s forward price/earnings (PE) multiple is only slightly higher at 13.5x versus 11x for Sainsbury’s, although it constitutes a “turnaround to growth” situation with normalised earnings per share (EPS) growth over 20% expected in its current financial year to 31 March 2015, possibly below 10% next year as the NI burden weighs.

Consensus for Sainsbury’s has been a fall in EPS of over 20% this year, and possibly the rebound is limited to around 10% to February 2026.

Such a perspective risks short-termism, but fair credit to M&S, that it is achieving stronger performance by comparison. Versus Sainsbury’s, and in terms of share trend, it is a classic example of whether to back a momentum play versus a sideways-volatile trend starting to look looking attractive for yield:

Source: TradingView. Past performance is not a guide to future performance.

Also, M&S is relevant for showing the timescale over which shares may “mean-revert” to trade more appropriately relative to asset value, reflecting management’s overall success (or otherwise) with the business. I first made a “buy” case for M&S at 88p in May 2020 based on a 30% discount to net assets, with the clothing side struggling to progress from a reliance on essentials and formal wear. The net asset value (NAV) discount still offered a margin of safety and, in time, management has turned around the clothing business. But it’s been four years for a low against NAV to become an overt momentum share.

- ii view: John Wood shock triggers share price crash

- How IHT on pensions could impact your retirement choices

If you include £811 million of intangible assets - to some extent fair, given Sainsbury’s has a good reputation - then NAV per share is around 280p per share. I would tend to regard this as limiting downside risk rather than any margin of safety as applied to M&S, implying upside as and when the business story improves. Sainsbury’s is already at or near “as good as it gets”, retailers need to keep making improvements just to stand still in a changing world; whereas M&S four years ago offered a chance for turnaround of clothing to re-rate value.

A contingent liability for employee pay

Sainsbury’s is not alone among retailers for being subject to current and ex-employee claims for equal pay, according to several Acts of Law. Just scroll down to note 16 in the interim accounts. There are around 17,000 such claims from some 11,900 claimants alleging their work within the stores was of equal value to those working in Sainsbury’s distribution centres, hence are seeking differential back pay.

The group believes further claims will be served but, given the outcome of two further litigation stages “over several more years”, the uncertainty of outcome means nothing is as yet provided for in the accounts.

You take your view therefore about whether this rules out affected retail shares, or from a yield perspective is actually useful because the market will price for a yield high enough to attract investors, notwithstanding the risk.

Interim results affirm strength for dividend income

Underlying group operating profit is up 4.7% on sales up 3.1%, reflecting improved cost control and operational gearing.

Management thus proclaims a strong start to its “next level” strategy set out last February: leveraging profit from food volume growth ahead of the market. Customer satisfaction and employee engagement rates are rising, and more customers are choosing Sainsbury’s for their main shop, driving the biggest market share gains in the industry. Basket size growth is significantly ahead of competitors.

The high cost nowadays of “treat” dining out appears to be supporting Sainsbury’s premium Taste the Difference products which now appear in one in three baskets.

- Shares round-up: brakes on at Rolls-Royce, Auto Trader in reverse

- Share Sleuth: performance over 15 years, and a share sale

Altogether it has meant six consecutive quarters of volume growth; though obviously, any business needs to achieve such simply to stand still if there is any inflation in the wider economy. Ongoing food price inflation will also have contributed to revenue growth.

Groceries thus rose 5.0%, with group revenue checked by general merchandise and clothing easing 1.5%, and Argos down 5.0% also fuel sales down 4.4%.

Financial services did very well up 38%, albeit from a small base, to £18 million. Restructuring this division was chiefly responsible for a £176 million non-underlying items cost, responsible for a 51% drop in statutory after-tax profit to £76 million.

Retail free cash flow was £425 million and is on track to deliver at least £500 million in the current financial year, equating to at least 21p per share. The table shows this being in a low median position of the 17.0p to 79.1p a share range of the last five years.

J Sainsbury - financial summary

Year to end-Feb

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Turnover (£ million) | 29,007 | 28,993 | 29,048 | 29,895 | 31,491 | 32,721 |

| Operating margin (%) | 2.0 | 2.3 | 0.6 | 3.9 | 1.9 | 1.8 |

| Operating profit (£m) | 592 | 679 | 165 | 1,161 | 609 | 571 |

| Net profit (£m) | 186 | 152 | -201 | 677 | 207 | 137 |

| EPS - reported (p) | 7.5 | 5.8 | -9.4 | 28.8 | 8.8 | 5.7 |

| EPS - normalised (p) | 28.9 | 21.2 | 18.3 | 22.6 | 42.5 | 27.5 |

| Operating cashflow/share (p) | 42.3 | 55.5 | 106 | 42.9 | 92.9 | 82.1 |

| Capital expenditure/share (p) | 23.9 | 25.9 | 26.9 | 29.5 | 31.4 | 65.1 |

| Free cashflow/share (p) | 18.4 | 29.7 | 79.1 | 13.4 | 61.5 | 17.0 |

| Dividends per share (p) | 11.0 | 3.3 | 10.6 | 13.1 | 13.1 | 13.1 |

| Covered by earnings (x) | 0.7 | 1.8 | -0.9 | 2.2 | 0.7 | 0.4 |

| Return on total capital (%) | 3.7 | 4.3 | 1.2 | 6.8 | 4.2 | 4.2 |

| Cash (£m) | 1,332 | 1,076 | 1,665 | 1,021 | 1,813 | 2,004 |

| Net debt (£m) | 6,434 | 5,994 | 5,273 | 6,361 | 5,332 | 4,545 |

| Net assets (£m) | 7,782 | 7,791 | 6,701 | 8,423 | 7,253 | 6,868 |

| Net assets per share (p) | 353 | 351 | 300 | 361 | 308 | 290 |

Source: company accounts.

Even so, the interim cash flow statement cites net cash generated from operations down 47% to £592 million. This did however amply cover around £400 million investment and £217 million in dividends, although cash reserves - £1.6 billion as of 14 September - were applied for share buybacks.

The table shows Sainsbury’s capital expenditure needs can be significant and variable, affecting free cash flow – the chief factor for dividends. Balance sheet cash should buttress payouts, however, against such variability and possibly also the long-term pay liabilities.

Respecting Sainsbury’s marketing position, financial performance and strengths, I therefore believe it is entering a “buy” range intrinsically. Not as attractive (with hindsight) as Marks & Spencer was at around 100p, but where income funds are likely to start feeding on the shares.

The chart says wait, and management affirming what NI liability could also weigh. But the yield and asset backing should start to lend support.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.