Stockwatch: Sound rationale for buying US bank shares

18th January 2019 09:42

by Edmond Jackson from interactive investor

Big American banks could be a contrarian play on the US government shutdown, argues our companies analyst.

Major "universal" and investment banks have kicked off US corporate reporting for the final quarter of 2018 with mixed messages: early this last week, Citigroup (NYSE:C) and JPMorgan Chase (NYSE:JPM) indicated recently firm lending demand - a positive reflection on the US economy - though financial market turbulence dented trading returns.

Cost-cutting rescued earnings per share (EPS) numbers, though obviously you have to question how sustainable this can be if revenue profiles change. Bosses have warned that if the partial US government shutdown drags on, it will harm the US economy, and at least one independent observer has suggested US Q1 2019 GDP growth could turn negative.

Wells Fargo (NYSE:WFC) then struck a more cautious note on trends within its lending, although major reputational damage suffered two years ago may remain a competitive hangover. The US market then advanced more strongly when Bank of America (NYSE:BAC) and Goldman Sachs (NYSE:GS) beat estimates and affirmed a strong US economy. Revenue from merger and acquisitions advice boosted Goldmans investment banking returns compared with the universal banks running into trouble from securities trading.

Health test of US economy and stockmarket

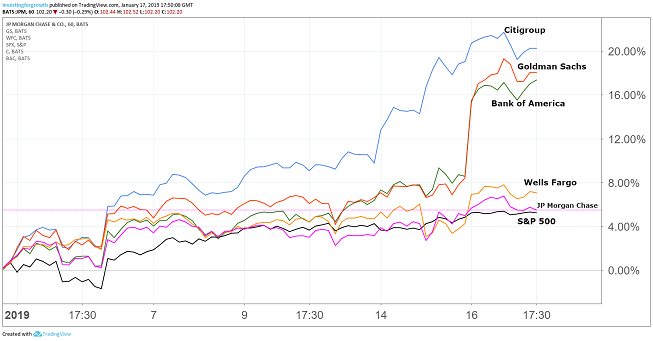

I alight on US financials as a leading indicator of the US economy and which are prone to higher beta, being more responsive than the market yet driving its trend. Thus, shares in Citi and JPM initially dropped 3-4% then stabilised or recovered, while Bank of America and Goldman jumped 4-5%.

Such examples show how tricky it can be to anticipate financial stocks in the near-term, although, as I explain below, they are at least a speculative play on when the US government partial shutdown may end. US financial stocks broadly fell by 30% from their 2018 highs, down around 20% in Q4, so mind an aspect of a rally in relief that results were not a lot worse.

S&P 500 companies are forecast to have grown earnings by 12% in Q4 2018, down from 18% as expected in July, mainly due to the US/China trade war – but which a few observers reckon is over-leverage in the corporate system, meeting higher interest rates.

The S&P 500 index currently trades on 15 times forward earnings, down from 18.6 times a year ago, although this could be interpreted as higher on a cyclically-adjusted view if the economy is slowing. So what clues do the banks offer?

Loan demand remains sound for now

Monetary economists would say loan demand is important within the various M measures of money in circulation that lead economic activity. As America's third-biggest lender, Citigroup said both private and corporate banking had maintained strong performance and reduced loan losses helped EPS up 4.5% ahead of expectations; but its finance director cautioned, the government shutdown, trade dispute with China and moves by central banks to reverse quantitative easing could have hurt lending henceforth.

Source: TradingView (*) Past performance is not a guide to future performance

JPM similarly had a warning by way of an 18% year-on-year rise in money set aside for bad debts, to $1.55 billion, versus analysts' $1.3 billion estimate. It also anticipates writing down commercial loans, and rising losses in retail credit cards albeit after expanding exposure. This is relevant in a broader aspect if a crux for the US if not global economy, is the credit cycle rolling over.

Wells Fargo struck a more cautious note as the fourth-largest US lender, its loan book easing 1% like its Q4 profit, although total revenue fell 5% to $20.98 billion which was 3.5% below consensus. Wells' revenue strains likely continue to reflect historic sales abuses such as overcharging and staff opening fake accounts to meet targets; however, there does appear some cyclical pressure in mortgage lending, previously the bank's chief source of profit.

Showing how competitive advantage may make a difference, Bank of America, the second-biggest US bank, out-stripped both revenue and profit estimates with Q4 revenue up 11.3% and EPS 11% ahead of consensus, boosted by rising interest rates and lower taxes.

Its chief executive sees "a healthy business climate driving a solid economy" and this helped push up US stocks on the day, but mind like-for-likes will get tougher without the tax change, while the Federal Reserve has signalled flexibility on monetary policy.

Trading revenues highlight Achilles heel

Whether US universal banks or UK insurance companies, financial asset volatility means stock ratings get a beating or boost according to market trend. I’m surprised the US banks blame Q4 volatility for a slump in revenues which ought to be meat for trading activity.

Citigroup's overall $112 billion Q4 revenue missed expectations by $0.5 billion and was 2% lower on 2017; blamed on bond trading revenues down 21% like-for-like amid December's difficult markets.

JPM's total revenue fell 4% to $26.1 billion, missing expectations by 2.7%, where total banking revenue rose 1% to $3.28 billion but fixed income trading revenue plunged 35% to $1.86 billion and equity markets trading by 17% to $1.32 billion. There was also a $150 million write-down on private equity holdings.

• Nvidia stock: Grounds for optimism this earnings season

• How to trade FAANG stocks this earnings season

• International stocks prove happy hunting ground for UK investors

• Facebook: What the stock price chart reveals

As with UK insurance company and investment management stocks – Aviva (LSE:AV.) and Legal & General (LSE:LGEN) - a significant aspect to consider is not just their sales' prospects but underlying volatility in assets' base. On a comparative basis with US banks, UK insurers offer much higher dividend yields hence better risk/reward profiles, despite their stocks being likely to trend with markets' direction.

This may help explain e.g. why US investor David Herro's Oakmark fund has lately bought into UK financials.

US government shutdown could wipe out GDP growth

While it's easy to see British parliamentary deadlock as the laughing stock of the world, the one within US government since 22 December will - unless the two sides compromise – start to exact a serious toll.

The Trump administration has doubled its damage estimate from a 0.1% reduction in growth every fortnight to 0.1% every week, due to greater losses from private contractors out of work, beyond 800,000 federal workers not receiving pay, and further government spending halted.

This is more aggressive than Wall Street consensus which anticipates a circa 0.5% negative effect on Q1 2019 US GDP growth, although Pantheon Macroeconomics contends a shutdown persisting through the quarter would result in an outright decline in Q1 GDP. It's unclear whether statistics will appear with government data collectors sidelined.

It would seem both sides will need to compromise, Trump in terms of what he regards as acceptable by way of a Mexican wall, and the extent of money the congressional Democrats will commit to it.

US bank stocks are exposed to changes in expectations for US Q1 GDP, hence liable to fall again if the shutdown drags on - then rebound on its eventual resolution. Other things being equal, they are a contrarian trading opportunity to consider the longer this dispute extends.

Risk/reward looks unfavourable, but could improve

An upshot of this study is highlighting the comparative attractions of UK insurers on low PE's and high dividend yields, notwithstanding challenges within that industry. Short-term, US banks may be dictated by the shutdown, and medium-term whether greater bad debts emerge as higher interest rates hit the expansion of consumer/corporate borrowing.

More positively, if overall Q4 corporate reporting continues as well as it has started – most CEO's declaring good progress and a sound outlook this week – then US financials are more likely to rise.

Moving averages on the US stockmarket imply January's rebound is now at a key resistance point, thus could trend higher if breached, especially if China trade talks produce results and the shutdown resolves. For alert, event-driven traders: Speculative buy.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.