Stockwatch: six wins in 2024 plus possible bid targets in 2025

After a number of his tip stocks were acquired at big premiums over the past year, analyst Edmond Jackson looks at other companies he covers that could be taken over.

31st December 2024 09:51

by Edmond Jackson from interactive investor

In thematic terms, the outstanding issue of 2024 – for companies covered in my Stockwatch column – has been takeovers. It was especially true of AIM where in addition to de-listings, this has contributed to the lowest number of quoted companies in London in 23 years to below 700. Will scarcity value prompt a final rush for worthwhile businesses before this market loses critical mass?

- Invest with ii: Top UK Shares | Share Tips & Ideas | What is a Managed ISA?

More positively, and versus critics who say the UK economy and stock market are a lost cause due to Brexit and low productivity, the fact that I’m noting a mass of takeovers for the first time in a Stockwatch annual review underlines how private buyers are exploiting UK stock market values.

That AIM has dominated takeovers also indicates businesses of substance versus a perception of flaky companies. And premiums have sometimes been substantive, as if mispricing persisted.

Whether such a pace continues hinges on the domestic economy. Will President Trump stay true to his election claims on tariffs, or dial them down? The chief risk for the UK would be export tariffs coming after business/consumer confidence are at a hiatus due to the employer National Insurance hit and other higher costs.

If we did enter recession, that could pause and later re-accelerate takeovers, partly prompted by lower stock prices. It’s just one example of how a tactical approach may work best for stocks in 2025 than “buy and hold”.

A stream of AIM takeovers at 40%+ premium

For Stockwatch companies, takeovers kicked off in March when a private equity group offered £432 million, or 804p a share in cash, for wealth manager Mattioli Wood (running £15 billion of client money). This represented around 15x earnings expectations for its year to May 2025, which management was content enough with. If staying public, they said delivery of growth would have been slower and more uncertain because capital-raising would have been tricky at low share prices.

I drew attention variously over the years, with a “buy” at 455p in July 2014 to “take profits” at 855p in September 2018 and “buy” again at 650p in January 2019.

- AIM share tips review 2024: my stocks beat the AIM market

- Why you should expect more UK takeovers in 2025

The premium was above 70% for Keywords Studios, an international video games service provider, whose shares (at 1,420p) I suggested last March would be ideal for ISA inclusion given upside recovery potential. The offer also underlined how competitive position can be significant in takeovers, as Keywords is market leader. However, the Swedish investment group involved (rather than an operating rival) did not create a regulatory issue.

Showing how slowdown – if it comes in 2025 – can help trigger takeovers, this share had more than halved from a September 2021 high when lockdowns boosted video gaming. The forward price/earnings (PE) had fallen from around 60x to just 13x. Yet management had capitalised on a sector slowdown to position the group boldly for an upturn, making five acquisitions, only to end up being bought for £2.1 billion.

Net tangible assets discount is hint to takeover odds

Last April saw a takeover of Lok’nStore self-storage services at 1,110p after I drew attention at 680p in October 2023 – due to a 30% discount to external valuers’ reckoning of asset value.

Sometimes with property-related shares you must look beyond historic balance sheet values lest these are unrepresentative of what the assets can fetch.

The purchaser was Brussels-based and the largest self-storer in Europe, hardly as if the post-Brexit economy is disappearing down a plughole.

- Watch our video: a FTSE 100 stock to watch in 2025

- Watch our video: my favourite share for 2025

N Brown Group – a digital retail platform for clothing and footwear – was another example. Its shares fell to a whopping 70% discount to net tangible assets of 69p a share, although care is needed with retailers lest high inventory signals dated or overvalued stock due writing down.

I drew attention as a “buy” in June at 20p after turnaround actions – including various new product launches – started to deliver profit improvement. The price/sales ratio (market value versus annual revenue) was just 0.16, implying value would kick in if the turnaround evolved.

Another upshot from N Brown was that the best director trades to note are very substantial purchases rather than modest cluster buying by an entire board. Two members of the Alliance family – the founder’s wife and her son who is a director – each bought a million shares at 20p last July. In October, the son initiated a take-private deal at 40p a share.

Loss of one of AIM’s better-quality gold plays

September heralded a near-£2 billion equivalent, cash and shares offer for Centamin by Anglogold Ashanti (NYSE:AU) – representing a near-40% premium to market price of 131p when I drew attention in April as a “buy”.

While Centamin has been quite a “one-project company” by way of Egypt’s largest gold mine – hence focused political besides operational risk – it attracted private shareholder criticism for being relatively low in Centamin’s historic share chart range.

But it certainly looked well-timed. Gold prices were testing $2,400 an ounce amid central bank buying, and global uncertainties were seemingly increasing. Moreover, Centamin’s key mine was at an operating inflection point after a period of investment, and mining tends to be operationally geared (changes in revenue magnified in profits). After testing $2,800 last November, gold has traded volatile sideways as a second Trump presidency – and its unpredictability – beckons.

- Golden returns in 2024: but is it now too late to profit?

- Are commodities the key to a smoother ride?

Should gold prices remain strong, a consolidation trend among listed miners looks set to continue.

Possible AIM targets for bid or going private

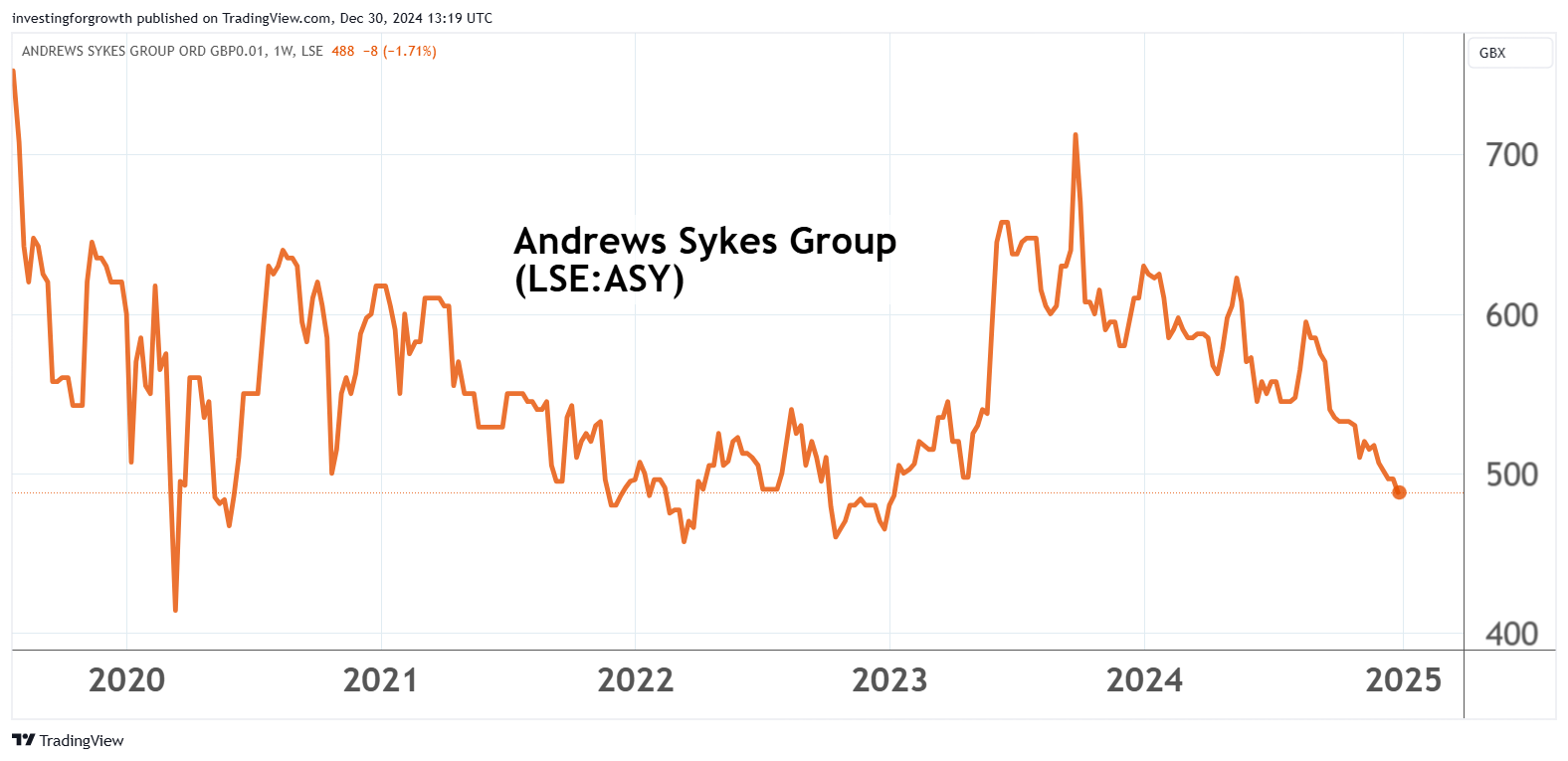

Equipment hirer Andrews Sykes Group (LSE:ASY) strikes me as one such, similar to N Brown in the sense of being family-controlled and at around £200 million market value, a bit questionable whether an AIM listing is cost-effective. It significantly depends on the family’s objective - the founder’s son is non-executive vice-chair. However, this stock is a long-term success story. While down from 625p last November to 500p currently, it has risen from 50p since early 2009.

Source: TradingView. Past performance is not a guide to future performance.

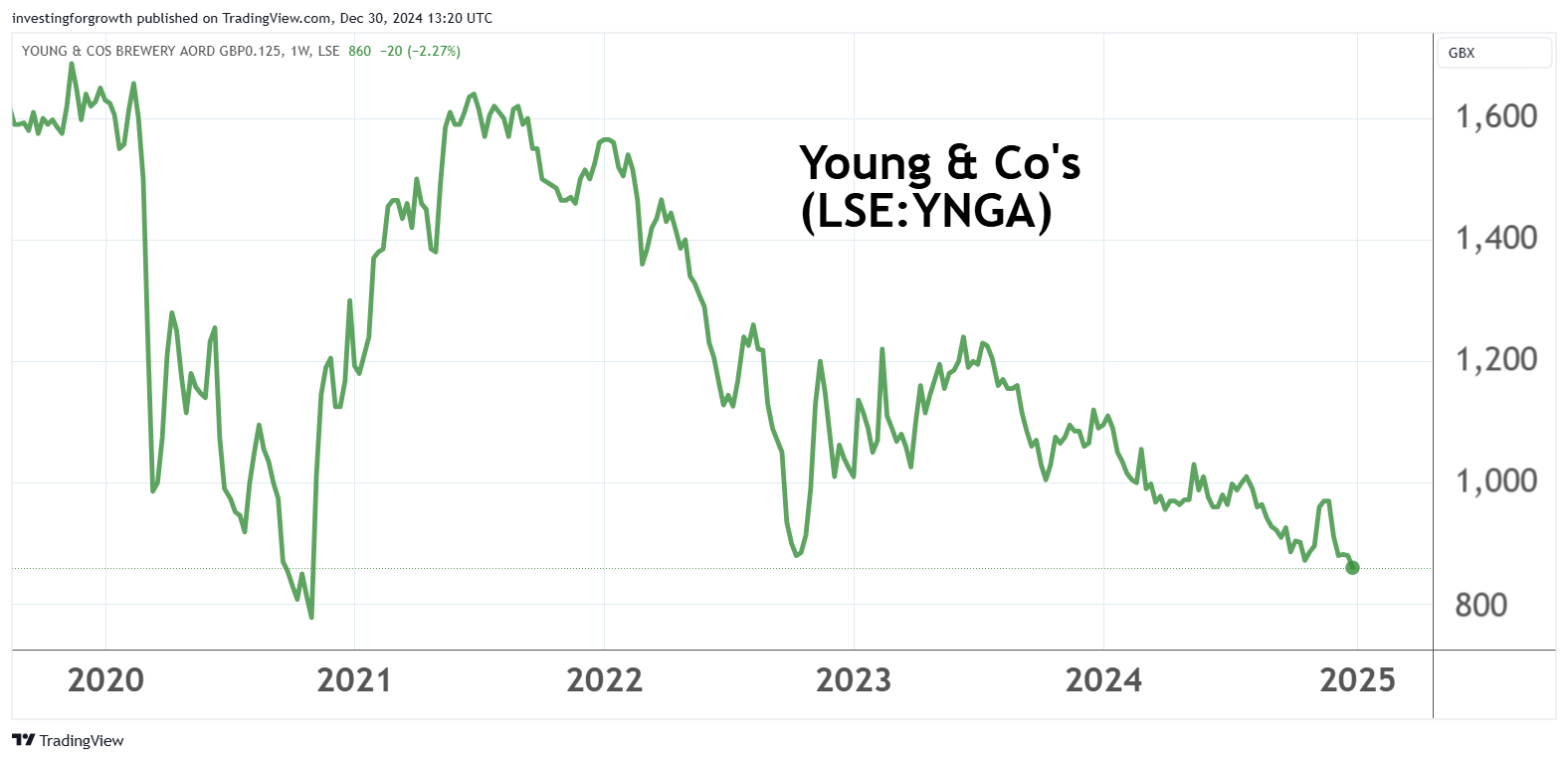

Young & Co's Brewery Class A (LSE:YNGA) is down from highs around 625p to 500p, representing a 23% discount to net tangible assets for this southern England-oriented pubs group. This takes the stock back to mid-2013 levels, on a forward PE around 14x albeit lacking near-term earnings growth prospects.

In the post-2008 recession, however, it proved a strong performer in all respects as those relatively affluent maintained social spending. With free cash flow per share generally ahead of earnings per share and net gearing of 44%, it is a possible buyout candidate if the appeal of AIM is reducing.

Source: TradingView. Past performance is not a guide to future performance.

Ongoing prospects in fully listed shares

Direct Line Insurance Group (LSE:DLG) has been the only fully listed takeover situation in my universe this year, where the offer from Aviva (LSE:AV.) looks to have a chance of succeeding. I would expect the Competition & Markets Authority (CMA) to examine this but ultimately wave it through, given a resulting 20% market share is still quite small in a wider industry context and there is scope for synergies to reduce premiums for consumers.

I made a “buy” case for Direct Line at 158p in February 2023, suggesting 230p as a fair target if rated similarly to Admiral Group (LSE:ADM). A year later, Belgian insurer Ageas made a possible offer in shares and cash equivalent of 233p a share. With the shares at 204p I maintained a “buy” case despite doubting Ageas would bid up to 250p a share. Yet after it backed off, Aviva has affirmed underlying value. The deal is currently worth 267p in a mix of cash, Aviva shares and a 5p dividend.

- Stockwatch: a cheap way to secure Aviva’s 8% yield?

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

It will be interesting to see if there is renewed takeover interest at retailer Currys (LSE:CURY) as its turnaround gains traction and also at contractor John Wood Group (LSE:WG.) after an audit review saw its shares plumb fresh depths.

A Christmas trading update at Burberry Group (LSE:BRBY) will clarify what extent of turnaround is yet to come under a new CEO, where the brand possibly has integration value into another luxury goods group.

If markets and the economy lurch lower as 2025 gets under way, however, potential bidders may keep their powder dry.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.