Stockwatch: a share with scope to double and more

Worth just a fraction of what they were valued at three years ago, analyst Edmond Jackson believes a recent jump in share price could be the start of a lucrative recovery.

24th January 2025 12:12

by Edmond Jackson from interactive investor

Following my recent article on Sanderson Design Group Ordinary Shares (LSE:SDG), another share on the market fringe is showing how its price has festered to a big discount from underlying asset value. It’s as if the market of late last year let slip a host of small-caps, and now we are seeing some of them snap back higher, simply in response to trading broadly “in line”.

- Invest with ii: Top UK Shares | Free Regular Investing | Open an investment Account

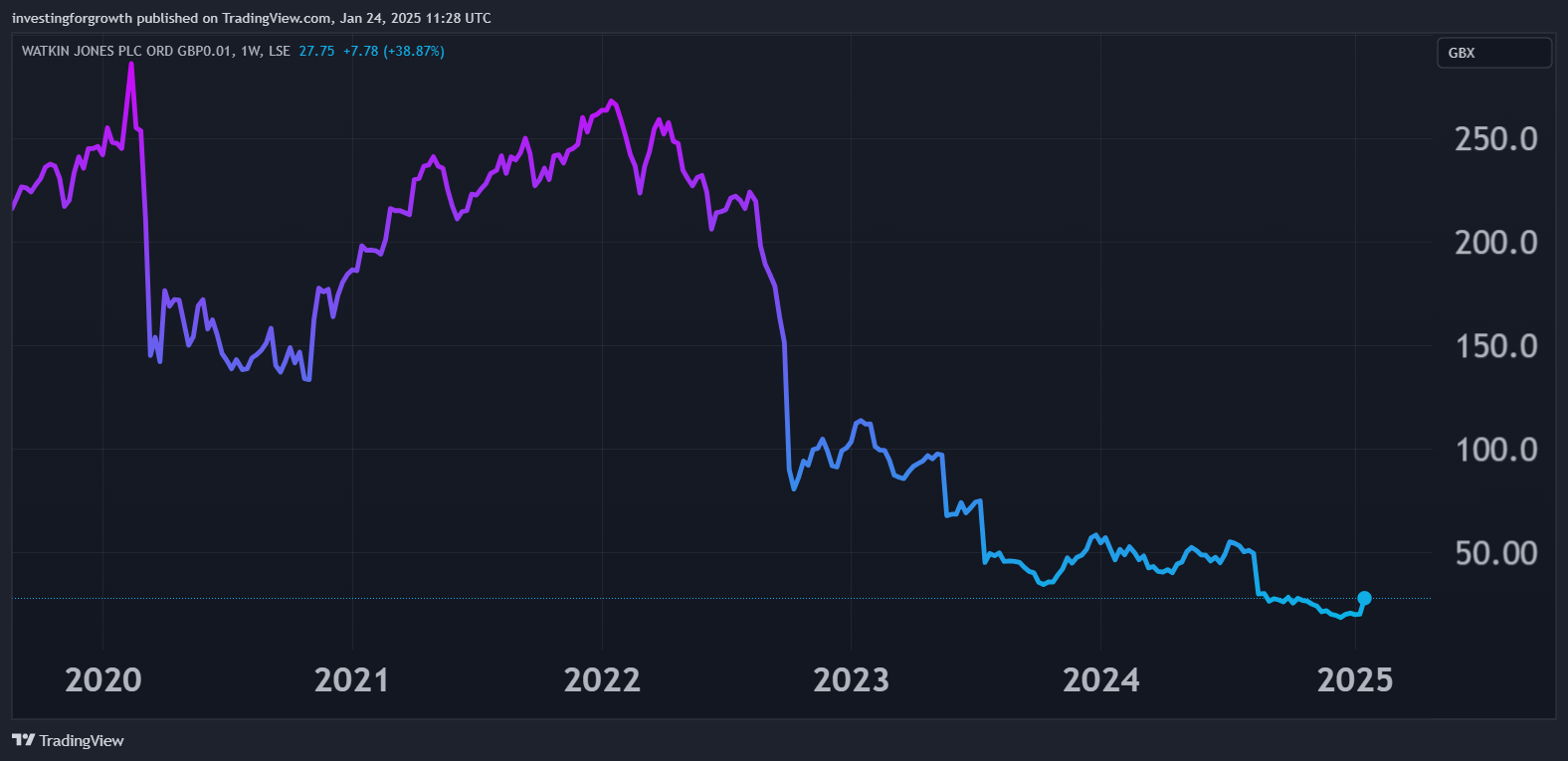

Yesterday, Watkin Jones (LSE:WJG), a developer/trader of housing to rent and also student accommodation, saw its shares jump nearly 30% to around 25p, and is up another 4% this morning to around 26p. However, it still trades at a 45% discount to last September’s net tangible asset value. It follows a comprehensive slump in the shares since 2022, hence it is tempting to ask what further scope there is for upward mean-reversion. Is the sense of a “margin of safety” – a key differentiator of investment value – valid?

Source: TradingView. Past performance is not a guide to future performance.

I believe the key explanation for this slump, and future prospects, is interest rates. The share price slump broadly tracks rising interest rates in response to inflation post-Covid. It is not because WJG is geared: last September’s balance sheet had a modest £14 million of debt (down 52%) and nearly £8 million of leases, in context of £122 million net assets. It is interest rates that affect demand for institutional investors to buy and manage these assets for income.

- 14 stocks expected to move sharply after posting results

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

We see this in the way annual revenue is 12% lower at £362 million; however, operating profit turned around from a £200,000 loss to £10.6 million profit, helped by sales made during the period. Yet this was before £7 million of remedial costs for building safety (such as cladding) treated as exceptional. While fair for a developer/trader to treat lumpy disposals as part of its normal operations, shareholders do ultimately bear the costs of remedial work.

This followed through into earnings per share (EPS) of 3.5p at the adjusted level, hence a trailing price/earnings (PE) ratio of barely 7x. However, in the current investment climate, a cautious near-term outlook means no upgrade as yet to consensus for EPS to slip below 1p, hence a PE more like 35x. There is no dividend, although the summary table shows 7p and 8p a share in more prosperous years.

Watkin Jones Group - financial summary

year end 30 Sep

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Turnover (£ million) | 244 | 267 | 302 | 363 | 375 | 354 | 430 | 407 | 413 | 362 |

| Operating margin (%) | 13.3 | 4.2 | 14.4 | 14.9 | 14.1 | 8.8 | 13.3 | 6.0 | -9.5 | 1.0 |

| Operating profit (£m) | 32.5 | 11.3 | 43.6 | 54.0 | 53.0 | 31.2 | 57.3 | 24.3 | -38.0 | 3.6 |

| Net profit (£m) | 22.2 | 4.2 | 35.8 | 44.2 | 38.8 | 21.1 | 41.9 | 13.4 | -32.5 | 1.9 |

| EPS - reported (p) | 10.4 | 2.0 | 14.0 | 17.3 | 15.2 | 8.2 | 16.3 | 5.2 | -12.7 | 0.7 |

| EPS - normalised (p) | 11.4 | 8.8 | 13.7 | 15.9 | 16.0 | 14.9 | 16.4 | 7.9 | -1.6 | 2.7 |

| Return on equity (%) | 19.6 | 4.7 | 31.3 | 33.2 | 25.8 | 12.8 | 23.8 | 7.4 | -21.2 | 1.4 |

| Return on total capital (%) | 25.5 | 10.7 | 28.6 | 17.8 | 16.0 | 9.2 | 17.8 | 8.9 | -16.6 | 1.0 |

| Operating cashflow/share (p) | 11.1 | 5.9 | 7.5 | 21.3 | 9.4 | 14.9 | 24.0 | -10.4 | -12.3 | 11.8 |

| Capital expenditure/share (p) | 0.02 | 0.06 | 0.1 | 0.1 | 0.1 | 0.1 | 0.3 | 0.3 | 0.2 | 3.1 |

| Free cashflow/share (p) | 11.1 | 5.9 | 7.4 | 21.2 | 9.3 | 14.8 | 23.9 | -10.7 | -12.5 | 8.7 |

| Dividend/share (p) | 0.0 | 4.0 | 6.6 | 7.6 | 8.4 | 7.4 | 8.2 | 7.4 | 1.4 | 0.0 |

| Cash (£m) | 60.1 | 48.2 | 66.2 | 107 | 116 | 135 | 136 | 111 | 72.6 | 97.0 |

| Net debt (£m) | -40.0 | -33.2 | -41.9 | 63.1 | 60.2 | 39.2 | 4.8 | -33.6 | 1.2 | 83.4 |

| Net assets (£m) | 113 | 103 | 126 | 140 | 161 | 168 | 185 | 177 | 130 | 133 |

| Net assets per share (p) | 44.3 | 40.2 | 49.5 | 54.9 | 63.0 | 65.5 | 72.1 | 69.0 | 50.7 | 51.7 |

Source: historic company REFS and company accounts.

But should an asset developer/trader really be benchmarked on lumpy near-term profits this way? If interest rates are more likely to fall in years ahead then are net assets the more suitable benchmark? Scope for differences of view is shown in the way volume yesterday jumped to 12.4 million shares traded compared with less than 1 million on Wednesday.

In the near term, management expects demand to link to reductions in gilt and interest rates, but it sees a strong medium-term outlook due to fundamental shortages “driving investor sentiment and allocations”. Obviously, UK housing is in short supply and the new government has proclaimed looser planning restrictions as a key objective, although that did not prevent housebuilder shares also slumping late last year.

Remedial work involves provision of £48 million

A positive at least, is the net overall provision decreasing by £6.7 million as safety works on three buildings completed. However, within this there was an additional £7.0 million provision covering further properties and change in scope on properties already provided for.

On the face of it, Watkin Jones is covered by adjusted year-end net cash of £83.4 million, although a recent lesson from housebuilder Vistry Group (LSE:VTY) was of net debt on an average monthly basis being sharply higher than year-end, So, without WJG citing average monthly cash, I would beware builders’ ability to dress the financial year-end. With £10.6 million required for remedial works in the September 2025 year, WJG should be well-covered, although the absence of a dividend underlines some uncertainty.

- Rolls-Royce and Aviva shares tipped to surge again

- Sector Screener: why prospects for housebuilders will improve

Note 4 to the accounts is effectively a caution: “The investigation of works required at many of the buildings is at an early stage and is possible these estimates change over time or if government legislation and regulation further evolves.” I would mind but not dwell on that, as it’s the kind of disclosure lawyers would insist on. You should read it through, at least it concludes by citing an average cost of £0.9 million per additional building, which rather caps this liability.

A £65 million market capitalisation relative to year-end cash of £97 million on the balance sheet, suggests fears would be unjustified. Yet there is no dividend on grounds of “prioritising the maintenance of financial flexibility”.

I am inclined to give management the benefit of the doubt given now – being the latter stage of raised interest rates – looks suitable timing on price for the “new acquisitions” they cite, and also planning consents to capitalise on a market recovery.

For example, there was a new development partnership transaction last December for 295 homes in St Helens, and a letter of intent on two further schemes. While there does not appear to have been further significant disposals in recent months – ideally, you want to see them at a good profit – at least net tangible assets of 47p buttress the shares.

A minor niggle is balance sheet trade payables at 2.8x trade receivables, as if WJG is thriving on customer credit, although at least trade payables are down 15% to £86 million.

Property shares involve major changes in sentiment

Over the past 40 years I have seen various property-related shares follow boom-bust type patterns: trading at big premiums to net asset value when a particular concept is in vogue, be it offices or shops or “shopping villages”, latterly student accommodation.

For example, Helical (LSE:HLCL) used to be a high-flyer in central London offices especially – on a big PE and premium to net asset value (NAV) – yet nowadays at 174p it languishes at 0.5x tangible net asset value, capitalised at £217 million.

- Stockwatch: have housebuilding shares put in a low?

- 19 UK stocks on list of conviction ‘buy’ ideas for 2025

“Bust” is inappropriate as these fringe companies can still recover, it’s just that their business models are currently compromised. While WJG cites a fundamental shortage of student accommodation, such town-centre developments have seemed to me quite a bandwagon, and the group obviously has diversified such that low-cost “buy-to-rent” developments are now its majority revenue earner. Build cost inflation is cited as reducing over the last financial year.

For medium-term strategy, however, WJG’s positioning looks overall attractive. Low-cost housing should be in demand; likewise overseas students supporting British universities with high fees will want decent-quality accommodation.

Caution regarding September 2025 annual results

“A low number of transactions in 2024 will affect our September 2025 annual results” due to delaying revenue from buildings WJG had expected to forward-sell.

Showing how macro matters remain influential, it said: “The group’s performance will be significantly influenced by the evolution in forward fund liquidity over the coming months...while possible to deliver year-on-year progress in 2025, this will require market conditions to improve at a faster pace...”

Possibly they will, at least by way of an interest rate cut in February, given a record 50% jump in UK businesses in critical financial distress in the fourth quarter of 2024, according to insolvency specialist Begbies Traynor Group (LSE:BEG).

It would be encouraging to see WJG directors buy material shares to back their words on medium-term potential. Lacking such, possibly the share price drifts again. I was premature with a “buy” stance at 70p mid-2023, but if interest rates move in WJG’s favour it could at least double from 26p; hence I keep this rating.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.