Stockwatch: this share price plunge is overdone

Having done well backing this company in the past, analyst Edmond Jackson thinks there’s another buying opportunity for experienced traders happy with a high element of risk.

21st June 2024 12:08

by Edmond Jackson from interactive investor

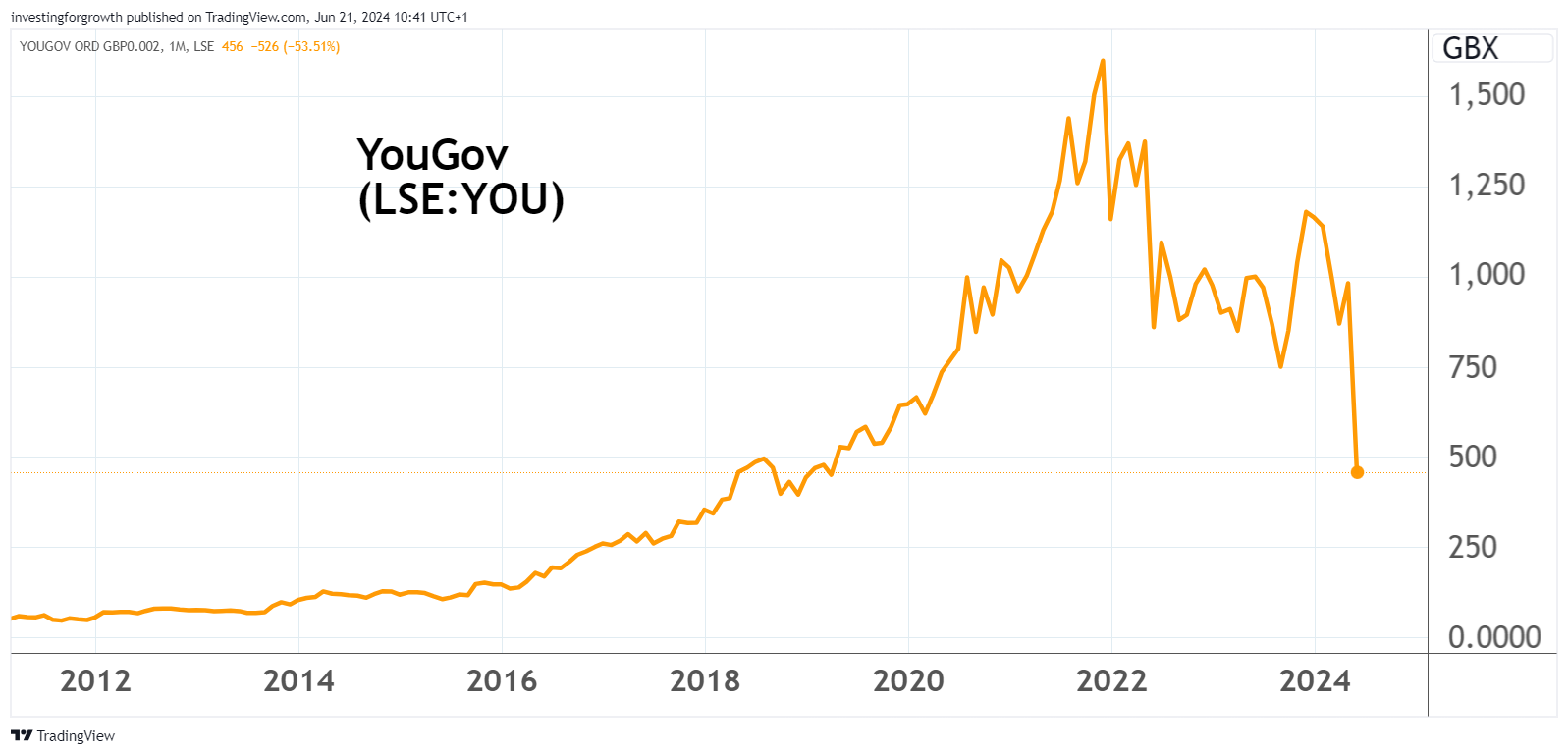

A profit warning from YouGov (LSE:YOU) – nowadays an international data research group rather than just a popular polling company – has hammered its stock to around 450p, even after this year’s decline from 1,150p to 820p:

It marks a retrace to the level in 2018, amid a long bull run from around 70p in 2013. I am not surprised given an overall downturn in the business has come soon after an intangibles-heavy balance sheet was geared up for the circa £270 million acquisition of Consumer Panel Services, a leader in European household purchase data.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Transfer an ISA

This left the 31 January balance sheet with a modest £39 million net current liabilities and goodwill/intangibles constituting 220% of net assets.

Source: TradingView. Past performance is not a guide to future performance.

At 455p this morning, YouGov is capitalised at £527 million, which if downgrading previous forecasts aggressively, implies potentially 1.7 times revenues. Yet the price/earnings (PE) multiple could still be over 20 times and the recently projected 9p a share dividend (if fully paid) would only offer a 2% yield. It is a stark example of how growth stocks become volatile when the story is disrupted.

Short- to medium-term profit projections are made tricky after investment was made this year in anticipation of client demand that has not materialised. If cost-cutting next is adept, then does that limit damage?

- Shares for the future: how I rank one of AIM’s biggest companies

- Sector Screener: don’t chase exciting stocks, buy these instead

It is also a reminder of how “criticism of accounting” can be a red flag – here, for example, capitalisation of intangibles boosting adjusted profit. I would need to examine past accounts in detail but, provisionally, note anyway a good long-term record of profit and cash flow at the reported (not simply adjusted) levels. Since 2018, the operating margin has been in double-digit per cent and free cash flow has near-consistently beat earnings. Only recently has the balance sheet become geared; otherwise, it had net cash of at least £30 million since 2018.

YouGov- financial summary

Year-end 31 Jul

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Turnover (£ million) | 88.2 | 107 | 117 | 136 | 152 | 169 | 221 | 258 |

| Operating margin (%) | 4.9 | 7.1 | 10.1 | 14.7 | 10.0 | 11.2 | 13.6 | 17.2 |

| Operating profit (£m) | 4.3 | 7.6 | 11.8 | 20.0 | 15.2 | 19.0 | 30.0 | 44.4 |

| Net profit (£m) | 3.4 | 4.7 | 8.2 | 14.9 | 10.0 | 11.5 | 17.1 | 34.5 |

| EPS - reported (p) | 3.2 | 4.2 | 7.3 | 13.1 | 8.5 | 10.2 | 15.2 | 30.8 |

| EPS - normalised (p) | 3.8 | 4.5 | 7.8 | 12.1 | 12.1 | 13.7 | 19.1 | 33.5 |

| Operating cashflow/share (p) | 11.0 | 14.9 | 16.1 | 29.7 | 31.3 | 43.4 | 55.2 | 52.8 |

| Capital expenditure/share (p) | 5.7 | 7.1 | 7.3 | 10.7 | 16.6 | 21.1 | 15.6 | 15.5 |

| Free cashflow/share (p) | 5.3 | 7.8 | 8.8 | 19.0 | 14.7 | 22.3 | 39.6 | 37.3 |

| Dividends per share (p) | 1.4 | 2.0 | 3.0 | 4.0 | 5.0 | 6.0 | 7.0 | 8.8 |

| Covered by earnings (x) | 2.3 | 2.1 | 2.4 | 3.3 | 1.7 | 1.7 | 2.2 | 3.5 |

| Return on total capital (%) | 5.4 | 8.9 | 11.1 | 15.4 | 12.1 | 14.8 | 20.0 | 20.8 |

| Cash (£m) | 15.6 | 23.5 | 30.6 | 37.9 | 35.3 | 35.5 | 37.4 | 107 |

| Net debt (£m) | -15.6 | -23.2 | -24.8 | -26.8 | -26.0 | -22.3 | -25.2 | -96.0 |

| Net assets (£m) | 74.1 | 80.5 | 90.9 | 108 | 110 | 113 | 125 | 196 |

| Net assets per share (p) | 71.0 | 76.4 | 86.2 | 102 | 101 | 101 | 112 | 168 |

Source: historic company REFS and company accounts.

Trading update portrays mixed but overall declining revenue

While customised research solutions (around 60% of group revenue) are experiencing higher demand this year, sales of data products (near 30%, the remainder constituting a small contribution from CPS) have remained slow. “We continue to see declines in fast-turnaround research services,” it says. Geographically, Germany, Austria and Switzerland have been particularly weak.

Another element of uncertainty therefore - but potentially on the upside - is how the numbers from CPS fill in the story. At the early February interims, this “transformational” acquisition “has since seen a positive response from both employees and clients.” Various synergies were cited in terms of expanding the client offering, also new markets and internationally, and at that point CPS was said to be “trading ahead of expectations.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- Election manifestos 2024: the impact on your personal finances

Management was however also “confident of achieving market expectations for the full year” (to 31 July) and even cited “a significant acceleration” in group sales momentum during the second quarter after a slow first period. Now the story has shifted to “lower sales bookings than anticipated” in the second half from February.

While CPS is “continuing to perform well, in line with expectations” there is an apparent timing matter around how “aligning CPS’s revenue recognition policies with YouGov’s means some contribution will shift slightly into the July 2025 year.”

Revenue is thus guided at £324-327 million versus recent consensus for £341 million, and adjusted operating profit at £41-44 million versus £67 million consensus. Mind, this is before adjustments and any exceptionals, and also a higher interest cost now.

After £30.3 million adjusted operating profit was achieved in the first half, it therefore implies only around £12 million in the second. Whether such a performance continues post-July seems to depend on how capably costs can now be reined back. Yet management also cites in the update: “prioritising investment in key growth areas such as upgrading our data products, continuing to build AI capabilities and enhancing our sales organisation...”

Since they only just got investment wrong, anticipating growth, it is not much assurance.

£213m debt was assumed to make CPS purchase

Last July, £51 million gross was raised via a placing at 920p, a then near 4% discount to market price albeit those new shareholders are now seriously under water, and those existing not helping their average.

This was followed by a £237 million equivalent loan facility, the 31 January balance sheet showing debt going from zero with £41 million cash, to £174 million long-term debt and £39 million short-term, mitigated by £53 million cash.

Mind, the increase in group cash probably came via the acquisition, given the interim cash flow statement showed like-for-like net cash generated from operations falling from £29 million to £13 million.

- Insider: directors raise stake in UK oil company with 15% yield

- Stockwatch: this 9% dividend yield may not be available for long

Interim finance costs rose from £0.3 million to £1.2 million, outweighed by £2.1 million finance income. Yet the CPS acquisition was only completed in early January, so even if there was an element of payments staggering, we can expect a more serious net interest charge. It is another reason making short to medium-term forecasts tricky.

With CPS set to contribute materially going into the July 2025 year, forecasts had been for net profit of £39 million, rising to over £55 million and earnings per share towards 50p. Writing that down to nearer 30p derives a PE multiple of 15x which feels about right given the uncertainties – around the off-chance of another equity-raise becoming necessary, for example.

A current tussle of greed and fear

Such a savage de-rating of shares in a well-established global business would seem likely to attract takeover speculation – as another candidate among harshly treated London equities.

US financiers could perhaps buy and oversee operations privately for a few years – possibly integrate with another business and re-float in the US on a much higher rating. At the very least, the proverbial “opportunistic” approach ensues, whether or not it substantiates.

Going back in my notes, I have favoured YouGov in timely fashion, and likewise became wary of its valuation – though it dropped off my radar and, when re-appearing earlier this year, I was not happy the stock was falling versus plenty of others that were up.

In April 2019 I set out a “buy” case at 450p and tilted to “buy” again at 577p that July but cautioned “the PE multiples YouGov enjoys today can’t last forever” hence “for experienced traders only”. There was a long bull run over 1,550p by late 2021, then what could be viewed as mean-reversion to around 800p and a volatile-sideways range topped just over 1,100p.

If management has a grip and the business environment does not get tougher, then this plunge looks overdone. Mind a current market technical dilemma about how a majority of holders are “growth” type investors whose typical response is to cut any losses and move on to better criteria. Meanwhile, YouGov is yet to demonstrably appeal to the “value” camp which sees no real yield and possibility of a second warning.

The logical approach to me is tag the stock as speculative and high-risk, albeit similarly as five years ago, one for experienced traders who now should at least consider and watch for an entry, potentially averaging a position. Buy.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.