Stockwatch: a rare re-rating prospect for 2025

Shares in this company are near a two-year low, but analyst Edmond Jackson thinks it should thrive in the current economic situation.

10th January 2025 11:42

by Edmond Jackson from interactive investor

Might 2025 be a favourable year for H&T Group (LSE:HAT), the UK’s largest pawnbroker, as fresh consumer pressures beckon with a public debt crisis? Around 350p to buy, shares in this £154 million company are at a two-year low.

It is not a one-way ticket, mind, when the economy gets tough. Pawnbrokers tend to dovetail their operations with jewellery and watch retail, which makes strategic sense, but if discretionary spending falls then lower retail revenues can take the edge off pawnbroking, which itself hinges on demand for loans.

- Invest with ii: Top UK Shares | Share Prices Today | Open a Trading Account

But a latest trading update shows the pawnbroking pledge book up 26% annually, ahead of expectations, to £127 million, even if this does benefit from a February 2024 acquisition whose book rose 9% to £6 million over 10 months. Since the impetus came late in the year it has yet to feed through to profit, and it is assumed there will be lower pledge book growth in the spring due to redemptions, then stronger growth in later months.

Fourth-quarter 2024 retail sales met expectations at slightly improved margins. Jewellery customers have favoured lower price points, which worked well for a range of lower-priced new items; and watch sales showed “solid” growth as the pre-owned watch market stabilised.

Higher national insurance rates are expected to increase employment costs by around £2 million annually, relative to consensus for net profit to grow from around £22 million towards £25 million this year. As yet, it appears the guidance is for the bigger pledge book to help absorb this cost, although it’s hard to see how it can otherwise be mitigated without letting some staff go.

The shares have steadily risen 5% to 350p in response, but with 2024 consensus expectations looking assured the price/earnings (PE) multiple is a very modest 7x, easing to 6.5x in respect of 2025 if targeted earnings per share (EPS) of 54p is realistic.

H&T’s track record on free cash flow is erratic due to recent years’ higher capital expenditure, but with around 19p per share anticipated in respect of 2025, the prospective yield is 5.4% with nearly 3x earnings cover.

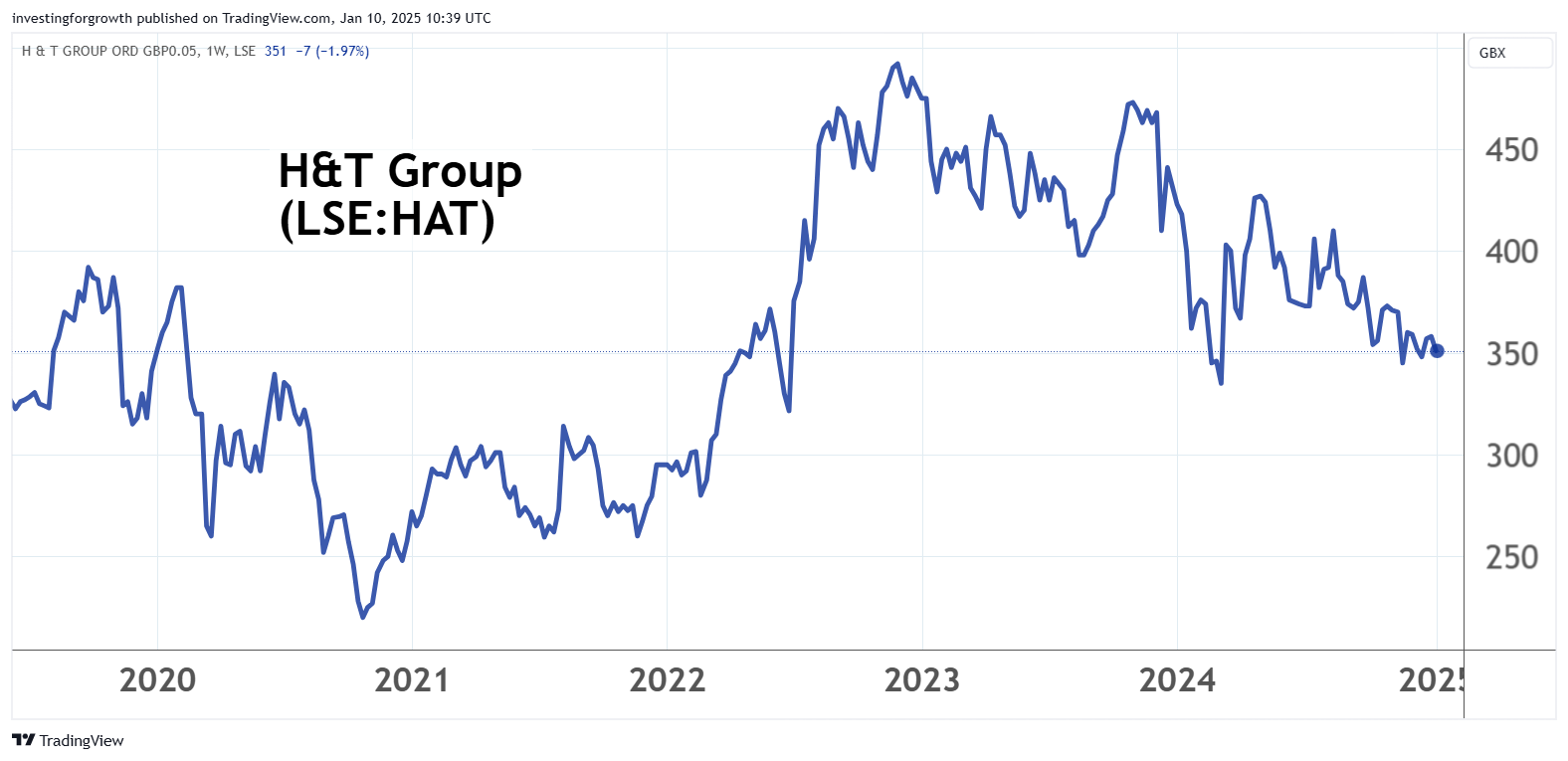

De-rating of last two years looks to be mean-reversion

After a very strong performance in 2022, the shares have been in overall downtrend which admittedly has yet to define support:

Source: TradingView. Past performance is not a guide to future performance.

Yet the mid-2024 balance sheet had £181 million of net assets, of which 20% constituted goodwill/intangibles, hence with net tangible assets of 330p per share there is firm support on fundamentals.

I think upside really depends on H&T delivering a reasonably consistent narrative where historically there has sometimes been “a tale of two sides” – H&T hopefully can continue to mitigate in tough times by astute marketing of relatively low-priced items. Firm gold prices should also help, and this is an indirect means of exposure.

Variable and cyclical aspects to the business overall mean its shares have never sustained a growth type rating, and considering it has been on and off the stock market over some 40 years (to my recollection) shareholders have seen a volatile chart – if in an overall uptrend.

This however does set H&T up as a buyout candidate, also considering weak sterling (for an overseas buyer) as a UK debt crisis looms, and modest £49 million net debt before £20 million of leases.

The business is long-established – an essential service industry – having founded as Harvey & Thompson in 1897 and when previously listed, been acquired by Cash America Inc in 1992. It’s unclear whether another US investor would repeat this, but the timing looks good both for the business and in currency terms. Shares are also at a medium-term low to tempt holders.

There was also a management buyout in 2004 and H&T returned to the stock market via an AIM listing in 2006 at 172p. The shares rallied in volatile fashion to over 380p by mid-2011 then slumped to 130p by mid-2013 – at least helping set up another bull run that tested 500p by late 2022.

A tricky share to call vs the underlying story

Disclosure: I have been attracted serially by H&T’s UK market leadership, the enticing prospect of pawnbroking in tough times, plus a modest rating in its shares.

At end-2018 I rated the shares a “buy” at 260p when all the operations were showing progress and a well-managed pawnbroker seemed an appropriate core business for a difficult consumer environment. The strategic goal had broadened to becoming the premium provider of alternative credit in the UK, striking a balance to serve people excluded by mainstream finance without getting caught by regulators intent on protecting those vulnerable from higher interest rates.

This was good timing in terms of a rally near 400p by September 2019 but at 340p that August I retained a “buy” stance only to see the shares fall to 210p by November 2020 – impacted by Covid, however.

- Stockwatch: attractive yields and a possible upturn

- 10 hottest ISA shares, funds and trusts: week ended 3 January 2025

I also took a “buy” stance in July 2022 at 333p, vindicated by a 47% rally to 490p that November which then reversed to two years of downtrend.

Ironically, the long-term financial summary shows very good progress as H&T recovered strongly from the 2020 hit; hence my thinking the odds more likely favour upside, possibly another buyout:

H&T Group - financial summary

Year ended 31 Dec

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Turnover (£ million) | 87.7 | 89.2 | 94.2 | 125 | 143 | 160 | 129 | 122 | 174 | 221 |

| Operating margin (%) | 7.1 | 8.4 | 10.6 | 10.0 | 11.4 | 14.0 | 13.1 | 7.5 | 11.8 | 13.4 |

| Operating profit (£m) | 6.2 | 7.5 | 10.2 | 12.5 | 16.2 | 22.5 | 16.9 | 9.1 | 20.6 | 29.5 |

| Net profit (£m) | 4.3 | 5.4 | 7.6 | 9.5 | 11.0 | 16.7 | 12.6 | 6.0 | 14.9 | 21.1 |

| Reported earnings/share (p) | 11.8 | 14.9 | 20.9 | 25.9 | 29.6 | 43.8 | 32.1 | 15.4 | 37.1 | 48.5 |

| Normalised earnings/share (p) | 17.5 | 14.9 | 21.4 | 25.9 | 85.4 | 89.3 | 46.4 | 31.0 | 59.6 | 85.3 |

| Operating cashflow/share (p) | 39.8 | 31.0 | 3.6 | -9.5 | 19.4 | 67.8 | 141 | -7.8 | -33.0 | -7.8 |

| Capex/share (p) | 3.1 | 3.3 | 5.3 | 4.8 | 9.1 | 23.4 | 15.8 | 24.2 | 35.0 | 34.3 |

| Free cashflow/share (p) | 36.7 | 27.7 | -1.7 | -14.3 | 10.3 | 44.4 | 126 | -32.0 | -68.0 | -42.1 |

| Dividend per share (p) | 4.8 | 7.6 | 9.2 | 10.5 | 11.0 | 4.7 | 8.5 | 12.0 | 15.0 | 17.0 |

| Covered by earnings (x) | 2.5 | 2.0 | 2.3 | 2.5 | 2.7 | 9.3 | 3.8 | 1.3 | 2.5 | 2.9 |

| Return on total capital (%) | 8.9 | 10.1 | 10.6 | 13.2 | 11.0 | 5.8 | 10.4 | 12.3 | ||

| Cash (£m) | 9.6 | 8.7 | 11.4 | 12.0 | 34.5 | 17.6 | 12.2 | 11.4 | ||

| Net debt (£m) | 9.4 | 2.0 | 5.1 | 13.1 | 37.4 | 38.6 | -13.8 | 1.4 | 22.8 | 53.6 |

| Net asset value/share (p) | 247 | 255 | 267 | 266 | 276 | 309 | 338 | 343 | 374 | 411 |

Source: historic company REFS and published accounts.

The only negative upshot of which is negative operating cash flow per share since 2021, but which turned positive to £5.4 million in the first half of 2024 versus £2.5 million negative in the first half of 2023 and £3.4 million negative in 2023.

In terms of business split, the last interim results showed 68% of gross profit deriving from pawnbroking and a modest 12.5% from retail (albeit 24% of revenue hence lower-margin. Gold purchasing was 8% of gross profit albeit eased from 10% like-for-like).

Gross profit from retail was relatively higher in 2021; however, jewellery demand was supported by loose monetary policy benefiting demand for collectibles.

Lack of recent director buying

While I make the case there is implicitly an inflection point here between stronger prospects for pawnbroking – the group’s majority earner – and its weakened share price, which the directors have yet to exploit. I am unsure exactly when H&T goes into its restricted period on dealings but would think there is a current window after this update.

They did, however, believe in value when the shares were falling in 2023: £107,000 of shares bought that March at 428p by one director; another £32,000 worth at 431p and a third £67,000 at 444p that June, amid other smaller purchases. In June 2024, £39,000 was bought at 387p.

So, you take your view about whether a current lack of enthusiasm reflects genuine uncertainty for UK retail overall, plus demand for credit – on which pawnbroking is ultimately based.

However, now would be another occasion logically to offer shareholders an exit, both at a good premium to market but also enabling an acquirer to exact longer-term value. I see this as speculative alongside H&T’s fundamentals looking attractive.

Despite my “buy” cases lacking (with hindsight) a timely “sell” some months later, I therefore find it timely to re-iterate my positive stance.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.