Stockwatch: is the rally in this litigation play justified?

This FTSE 100-listed company is embroiled in a legal battle in the US courts, but its shares remain popular. Analyst Edmond Jackson gives his opinion on the stock.

25th October 2024 11:22

by Edmond Jackson from interactive investor

Why are the FTSE100 shares in consumer brands group Reckitt Benckiser Group (LSE:RKT) rallying – despite no obvious triggers in recent updates?

It initially appears an example of “mean-reversion”, where a financial security re-adjusts to a sense of middle ground after a major mood swing. Last March, Reckitt plunged by 15%, or nearly £5.5 billion equivalent, after a US court awarded £46 million of damages following an infant fatality linked to a milk product from Mead Johnson, which is owned by Reckitt. There are more than 400 other cases pending, applying also to Abbott Laboratories using a similar product.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

Reckitt bought Mead Johnson Nutrition, a US manufacturer of baby milk formula, for nearly £14 billion in 2017. Management intends to appeal on grounds that the verdict is “not supported by the science or experts in the medical community”. It can be tricky to make direct comparisons, but this is quite like what GSK (LSE:GSK) has done regarding its Zantac heartburn treatment, which was allegedly linked to cancer, settling cases without admission of blame.

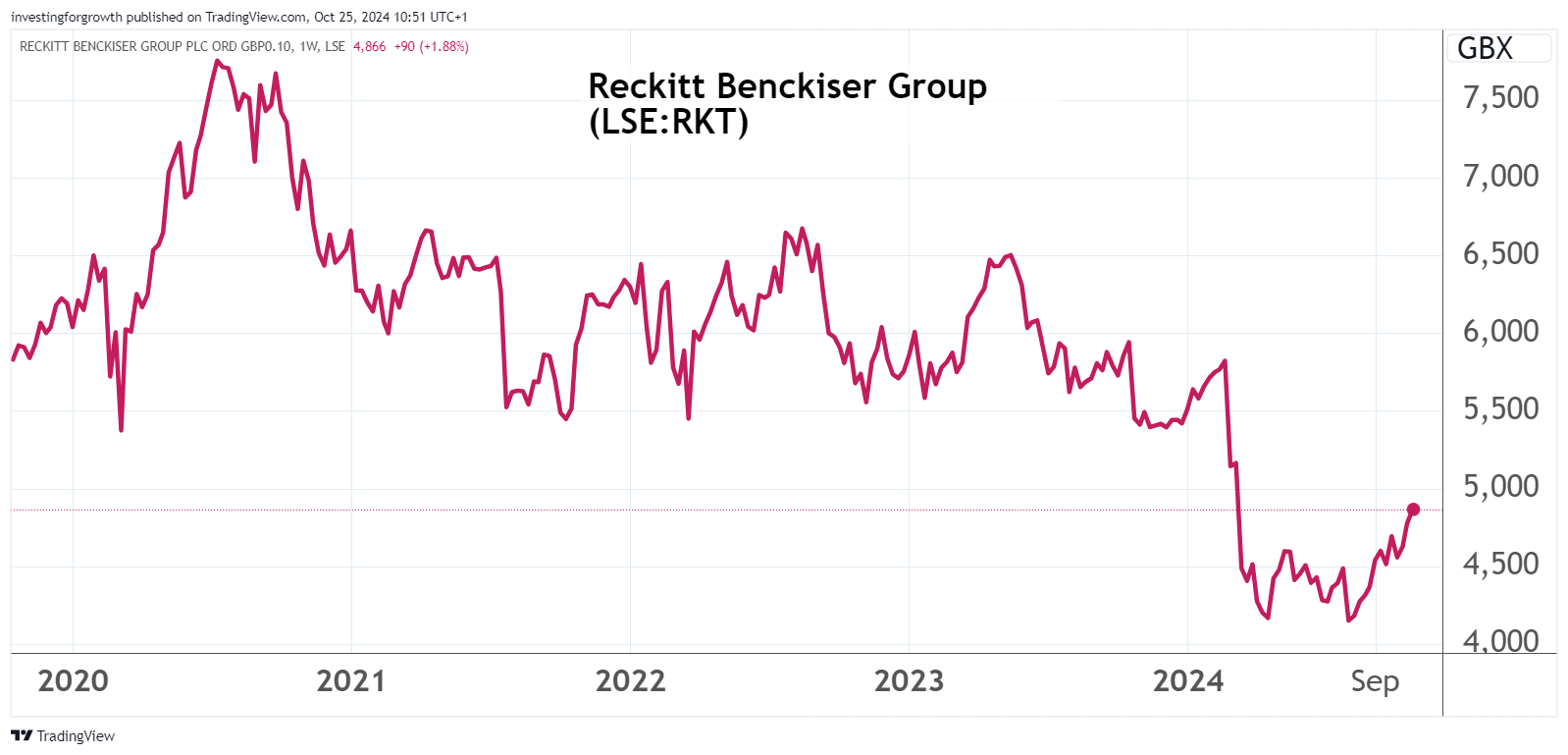

Medium-term charts help set the context

Comparing both “litigation stocks”, we see Reckitt well down on a sideways range of about 5,500p to 6,500p. It’s unclear whether 2020s rally to over 7,500p is fair context or an aberration amid huge monetary stimulus in response to Covid. A classic “double bottom” reversal point manifested last April and early August, although it seems hard for slaves to charts to account for a circa 20% rebound in two months.

Reckitt has, however, de-rated from around 7,100p prior to buying Mead, having achieved a splendid bull run from below 1,000p in the 1990s after Reckitt was merged with the Dutch firm Benckiser.

Source: TradingView. Past performance is not a guide to future performance.

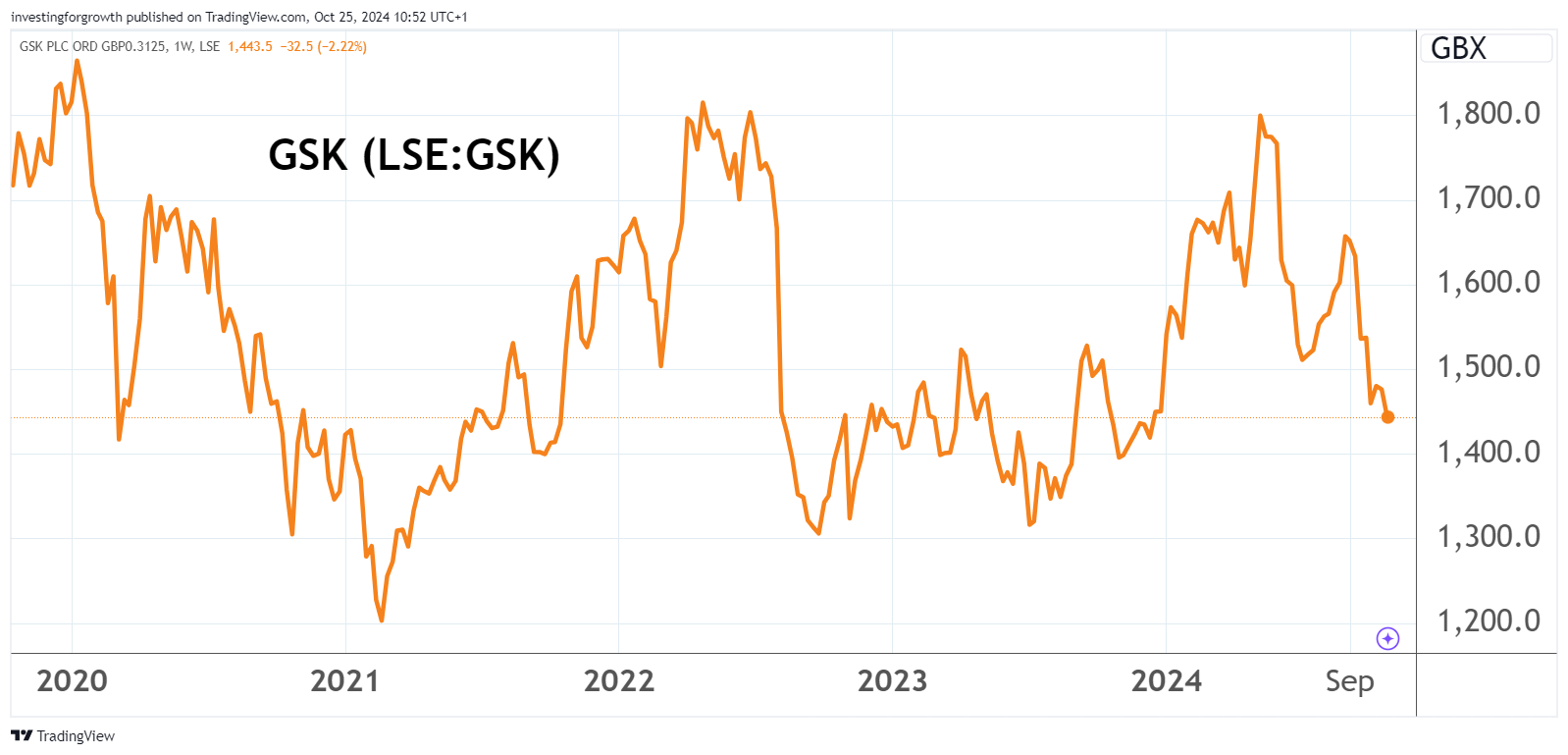

GSK, meanwhile, has not been performing well this year - essentially a big swing up and down - despite this looking par for its course, again in a five-year context:

Source: TradingView. Past performance is not a guide to future performance.

I can’t draw too close a comparison between a consumer and pharma stock, nevertheless it is interesting given that GSK is significantly more advanced in its contest over Zantac. Only this last month it achieved a settlement up to £1.7 billion equivalent to resolve some 80,000 US lawsuits. Yet there was just a blip from around 1,450p to 1,500p, which has retraced despite positive news on other drugs.

Reckitt looks fairly valued on fundamentals

At around 4,850p currently, the stock trades on 14.5x 12-month forward earnings, although its expected earnings growth rate is only mid-single digit per cent.

This puts the price/earnings-to-growth (PEG) ratio at about 2.5x where ideally you are looking for sub 1.0 - possibly up to 1.5 in exceptional cases but 2.0 would start to look pricey. Admittedly, such a ratio is simplistic, and some will argue that the stock merits a premium for brands such as Cillit Bang, Nurofen, Durex and Finish. There is also an argument that you do not engage double-counting, the brands’ values are reflected in their earning power.

- GSK update eases investors’ fears as focus turns to vaccines

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

The upside caveat would be if brands were selectively sold, say, to multinationals which can justify paying high prices due to synergies exacted. This gets speculative, however.

In fairness, Reckitt’s prospective yield of around 4.3% is material despite the full earnings valuation; this kind of relatively defensive consumer stock likely often to feature in institutional investor portfolios. Despite the six-year financial summary table showing a static 175p per share dividend to 2021, last year free cash flow per share beat both measure of earnings and consensus looks for low to mid-single digit dividend growth.

Some uncertainty is introduced, however, if material compensation payments are required.

Reckitt Benckiser - financial summary

Year-end Dec

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Turnover (£ million) | 12,597 | 12,846 | 13,993 | 13,234 | 14,453 | 14,607 |

| Operating margin (%) | 24.2 | -15.2 | 15.4 | -6.1 | 22.3 | 17.3 |

| Operating profit (£m) | 3,047 | -1,954 | 2,159 | -807 | 3,228 | 2,531 |

| Net profit (£m) | 2,161 | -3,683 | 1,187 | -32 | 2,330 | 1,643 |

| EPS - reported (p) | 305 | -393 | 159 | -8.8 | 326 | 227 |

| EPS - normalised (p) | 346 | 353 | 309 | 504 | 356 | 302 |

| Operating cashflow/share (p) | 356 | 199 | 493 | 238 | 334 | 367 |

| Capital expenditure/share (p) | 61.6 | 62.5 | 68.1 | 63.0 | 61.7 | 62.5 |

| Free cashflow/share (p) | 294 | 137 | 425 | 175 | 272 | 304 |

| Dividends per share (p) | 171 | 175 | 175 | 175 | 183 | 193 |

| Covered by earnings (x) | 1.8 | -2.3 | 0.9 | -0.1 | 1.8 | 1.2 |

| Return on total capital (%) | 10.1 | -8.4 | 8.9 | -4.3 | 15.8 | 13.5 |

| Cash (£m) | 1,483 | 1,532 | 1,510 | 1,195 | 881 | 1,158 |

| Net debt (£m) | 10,736 | 10,663 | 9,047 | 8,368 | 8,003 | 7,379 |

| Net assets (£m) | 14,724 | 9,363 | 9,115 | 7,399 | 9,443 | 8,448 |

| Net assets per share (p) | 2,081 | 1,319 | 1,279 | 1,036 | 1,319 | 1,183 |

Source: company accounts.

Again, if we compare GSK briefly, at around 1,450p it offers a similar 4.3% yield albeit with better expected earnings cover towards 2.7x and strong free cash flow, despite drugs involving greater R&D needs than established consumer brands.

GSK trades also on a much lower forward price/earnings (PE) ratio below 9x and its PEG ratio of 0.9 is appealing.

Strategic justification for Reckitt’s premium?

We certainly have to look beyond recently reported numbers. First-half 2024 results showed only 0.8% adjusted revenue growth, and even if a US tornado disrupted the nutrition side which fell 9%, growth was moderate up 4.5% in hygiene products and tepid in health, just 1.3% ahead albeit that barely discounts inflation. Adjusted operating profit slipped 5% due to margin, and earnings per share (EPS) fell nearly 7%, but free cash flow rose over 8%.

Last Wednesday’s third-quarter results maintained a similar trajectory: only 0.4% net revenue growth with nutrition continuing to offset modest 1.4% like-for-like growth from hygiene and 3.2% from health.

There are various teasers going forward: a “new operating model, organisational structure and refreshed global executive committee”, although it’s not clear what extent this is normal updating as business conditions change – possibly overdue. A current £1 billion share buyback programme continues relative to Reckitt’s near £34 billion market value, perhaps this being marginally effective in the stock’s rally.

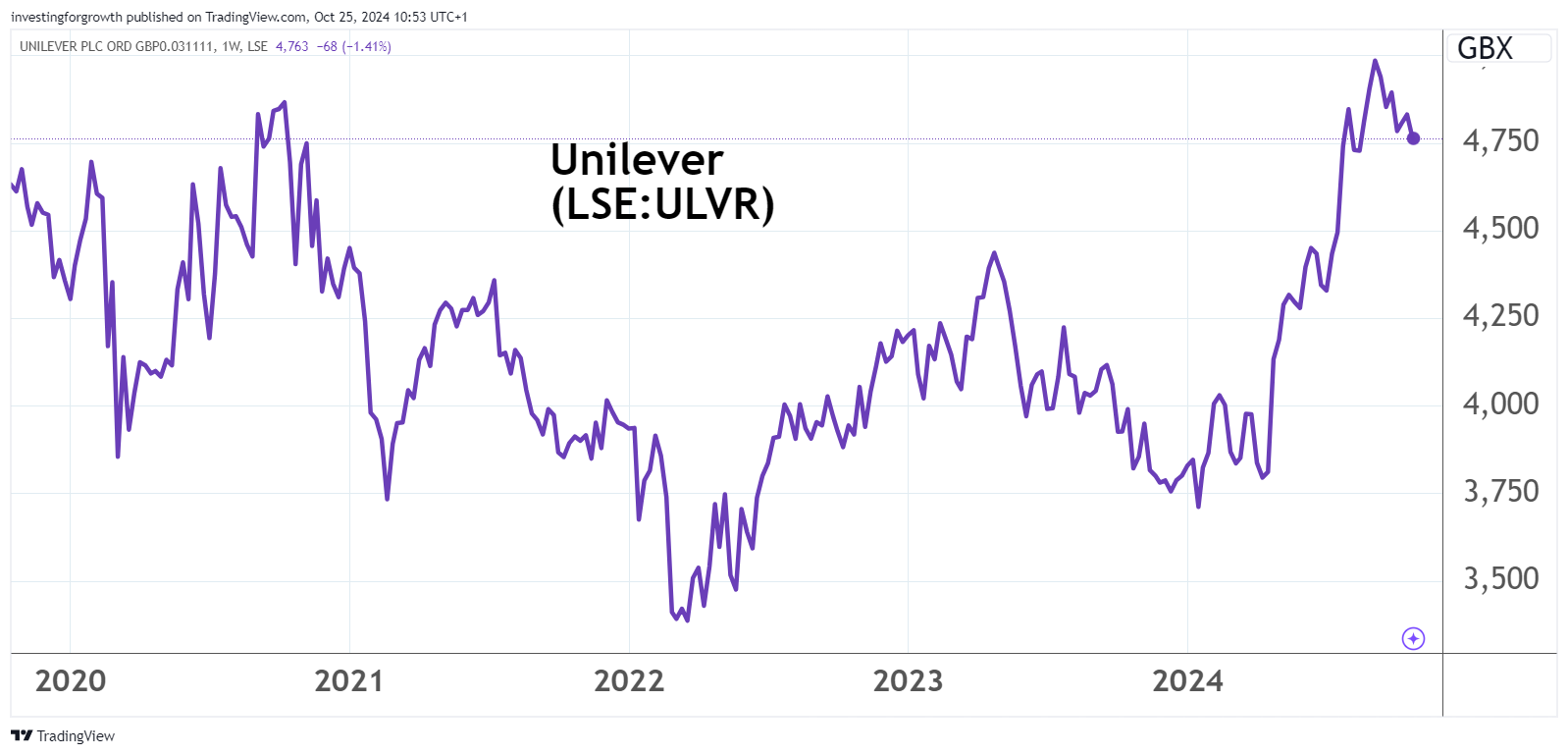

Perhaps some speculation is involved as to disposal of the Mead subsidiary, if hard to accept given its liability risks. This would, however, be part of a general restructuring to focus on Reckitt’s stronger brands, much as Unilever (LSE:ULVR) has been doing thereby generating a re-rate of over 20% during 2024.

Source: TradingView. Past performance is not a guide to future performance.

Last March, Unilever announced plans to separate its ice cream business, proclaiming this one action means “a simpler, more focused company operating four business groups”, and launched a major productivity programme. At around 4,800p, the forward PE tests 19x and the yield is around 3.3%, hence it’s pricier than Reckitt but without potentially big damage liabilities.

- ii view: great advert for Unilever's ice cream unit

- Reckitt Benckiser recovery gathers steam after grim 2024

What I find unsatisfying about these consumer behemoths is there are no blockbuster new products in the offing; marketing coups that are the meat of growth stock ratings. The actions are essentially tinkering about, updating and taking prudent financial measures which, yes, achieve an element of a re-rate, but what extent of long-term growth prospects? These are multi-billion-pound groups, and they need kickers.

A macro element to Reckitt/Unilever re-ratings?

Possibly, investors have sought “defensive” consumer stocks in times of heightened global uncertainty. A macro narrative of falling inflation, hence interest rates, seems to be giving way to concern that ongoing US economic strength may limit the Federal Reserve’s ability to cut rates as expected. Global political risk seems to have increased, especially the Middle East, US election and aftermath.

A defensive concept is likely to be tested by the course of this baby milk litigation, where speculation as to damages could be anywhere up to £8 billion or so, albeit Barclays analysts reckon on £2 billion as a worst-case scenario. Frankly, it seems like the blindfolded challenge to pin a tail on the donkey. Summer’s outcome of the Autonomy executives’ trial underlines how the US legal system can surprise, positively even.

It's unclear whether further write-downs will be required of the Mead Johnson subsidiary, say in relation to a disposal - £5 billion were made three years after acquisition by a new CEO, but what extent of an asset will it prove?

A “sell” stance might be harsh. The crux seems to be if the litigation outcome compromises Reckitt’s returns policy by way of dividends and buybacks. Those exposed to capital gains tax might like to consider trimming ahead of next Wednesday’s Budget. I do not see major attraction as a fresh investment, hence Hold.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.