Stockwatch: possible bid target and hedge against IHT

This quality company has grabbed the attention of analyst Edmond Jackson, who believes it’s worth buying for tax benefits and longer-term potential.

15th November 2024 12:10

by Edmond Jackson from interactive investor

The UK Budget on 30 October did not prove as harsh on AIM shares as feared. It followed intense lobbying about how a Labour government abolishing business property relief could kill off an “enterprise” market that has already lost 92 companies this year – hitting a 23-year low for the number of companies listed.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

It appears the chancellor struck a somewhat happy medium to cut business property relief on AIM shares from 100% to 50%, instead of abolishing it. With inheritance tax relief applying after two years of holding, it provides an effective IHT rate of 20%.

This therefore maintains an aspect of utility for AIM shares in estate planning, albeit with the dilemma that investing in AIM shares is largely speculation in higher-risk businesses, as it should be to promote enterprise, hence the aspect of tax breaks. But as many investors nursing losses from AIM will tell you, it can be a minefield.

Yet no listing criteria exist as to how early stage or speculative AIM companies must be. Occasionally, listed companies with a proven long-term record and “investment grade” credentials, step down from a full listing to cut costs. This narrow seam of shares can be worth mining by inheritance tax planners.

Exemplifying relatively low risk on high-risk AIM

One such company is pubs group Young & Co's Brewery Class A (LSE:YNGA) – a bit oddly named, given it divested brewing activities seven years ago to focus on pubs (some with hotel rooms).

At around 935p currently, its market price is at an 18% discount to end-September net tangible assets of 1,144p a share – an aspect of “margin of safety” even though, strictly, business assets are worth what they can earn. In this respect, Young’s does have a long history of earning power, founding in 1831 via the purchase of Ram Brewery in Wandsworth. The 10-year table shows how despite interruption from Covid lockdowns, earnings, cash flow and dividends affirm this is no speculative play.

Young & Co's Brewery - financial summary

Year end 30 Mar

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Turnover (£ million) | 227 | 246 | 269 | 279 | 204 | 312 | 90.6 | 309 | 369 | 389 |

| Operating profit (£m) | 41.5 | 38.4 | 42.7 | 43.5 | 44.6 | 37.9 | -35.1 | 51.7 | 43.4 | 28.6 |

| Operating margin (%) | 18.3 | 15.6 | 15.9 | 15.6 | 14.7 | 12.2 | -38.7 | 16.7 | 11.8 | 7.4 |

| Net profit (£m) | 26.7 | 26.6 | 30.0 | 30.1 | 31.5 | 19.3 | -38.3 | 34.4 | 29.7 | 11.1 |

| Reported earnings/share (p) | 55.1 | 54.7 | 61.5 | 61.6 | 64.3 | 39.3 | -68.2 | 42.6 | 50.7 | 18.9 |

| Normalised earnings/share (p) | 42.7 | 59.0 | 68.6 | 69.3 | 72.5 | 53.6 | -143 | 25.0 | 64.2 | 72.5 |

| Operating cashflow/share (p) | 89.8 | 108 | 115 | 107 | 122 | 120 | -41.0 | 174 | 142 | 125 |

| Capital expenditure/share (p) | 66.9 | 85.6 | 70.7 | 62.2 | 69.2 | 67.1 | 34.0 | 63.1 | 68.7 | 99.3 |

| Free cashflow/share (p) | 22.9 | 22.6 | 43.9 | 44.8 | 53.3 | 53.2 | -75.0 | 111 | 72.9 | 25.5 |

| Dividend per share (p) | 16.5 | 17.5 | 18.5 | 19.6 | 10.0 | 21.4 | 0.0 | 18.8 | 20.5 | 21.8 |

| Covered by earnings (x) | 3.4 | 3.1 | 3.3 | 3.1 | 6.5 | 1.8 | 0.0 | 2.3 | 2.5 | 0.9 |

| Cash (£m) | 0.2 | 13.2 | 6.6 | 7.2 | 8.5 | 1.1 | 4.7 | 34.0 | 10.7 | 16.9 |

| Net debt (£m) | 129 | 130 | 127 | 141 | 164.0 | 280 | 249 | 174 | 165 | 360 |

| Net assets (£m) | 407 | 453 | 493 | 549 | 593 | 591 | 645 | 700 | 724 | 772 |

| Net assets per share (p) | 840 | 930 | 1010 | 1124 | 1212 | 1205 | 1,104 | 1,197 | 1,238 | 1,243 |

Source: historic Company REFS and company accounts.

This time span is useful to show how various cost rises affecting hospitality – such as energy, wages, food and drink – have compromised a 15-18% reported operating margin, starting before Covid.

Yet the latest interim results profess a sector-leading margin of 15.2% despite a 10% hike in the national living wage as well as utility/running costs. It would have been good to see a breakdown of operating cost dynamics affecting the income statement, given the one for cash flow shows £21.7 million invested across the existing Young’s estate.

It can be a moot point - the extent to which refurbishment and the like is within the scope of normal operating costs, for such an operation to stay competitive, or be regarded as “exceptional”. In fairness, only £3.0 million adjusting items are shown before £35.1 million of reported operating profit. A £1.7 million charge for maintaining two head office structures appears to have been treated as a regular cost.

Higher operating costs as a Labour government raises employee national insurance (NI) contributions, plus ongoing increases in the minimum wage, are a priority to figure right now – and are affecting many retail-facing shares.

Young’s CEO notes an extra £11 million of costs from next April to include rising utility costs, but hopes not to have to pass much of this on to customers. Purchasing synergies from the acquisition of City Pub Group - such as beer - will start in the second half.

Separate from the interim announcement, a Young’s spokesperson clarified no extra costs would be passed on above the usual 2% to 3% yearly price rises. Apparently, greater uses of technology to maximise sales, also better deployment of staff during busy periods, will be off-setting.

This £162 million takeover of another listed company, which kicked off a year ago and completed in March, added 50 pubs, taking Young’s estate to 278 – of which 55 include rooms, with a total room count of 1,051. The resulting revenue mix is 63% drink-based, 29% food and 7% accommodation.

Keener prices for beer purchasing should therefore help, and accommodation is not such a high element – should cost-of-living issues weigh on taking weekend breaks next year. Labour promised not to tax working people more, but we will be paying higher prices generally as NI and other cost hikes get passed on.

How resilient is Young’s clientele?

What seems tricky to fathom regarding Young’s customer base, hence revenue dependability, is the extent they may be affected by latest economic pressures. This stock enjoyed a fabulous bull run from around 400p during the late-2008 financial crisis, to over 1,880p by May 2019 - due to affluent Southerners (Young’s orientation is London and towards the South West) continuing to enjoy drinking and eating out through a recession.

Lately, however, we have seen professionals’ recruitment groups caution on their net fee income outlooks as employees cautiously keep their heads down in existing jobs. This more conservative attitude has applied, especially in London. It could help explain Young’s modest like-for-like interim revenue growth of 4.4%, which only just beats inflation - assuming it continues in the second half.

This is an important dynamic, but the CEO’s wariness not to pass on costs higher than usual, implies he is wary not to take Young’s clientele for granted.

- Wetherspoons begins recovery from Budget hangover

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Fickle British weather, and also the number of big sporting events, also remain significant to pub revenue. The results statement cites “challenging early spring and summer weather” followed by an excellent EURO 24 football tournament last June/July.

But, as with Wetherspoon (J D) (LSE:JDW), which has a loyal clientele happy with its cheap food and drink, so Young’s pubs enjoy patronage for quality time out. I therefore find it interesting to note a possible chart low for Young’s.

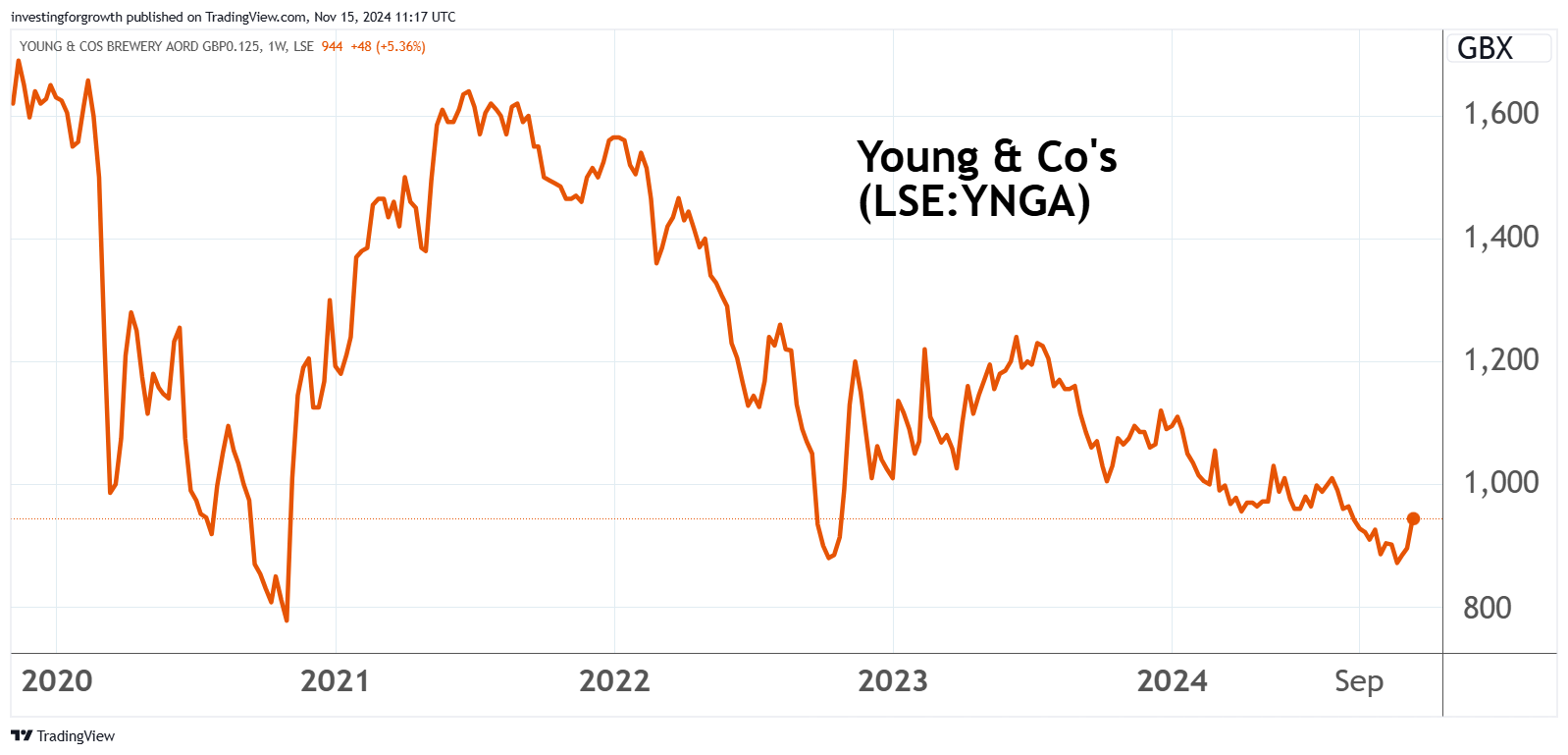

Up 10% off a four-year low, pre-Budget

Young’s fell to 844p on the day before the Budget, taking it back to near the 800p Covid low. Its recovery to 935p beats Wetherspoon, up 3%, which at around 620p trades at nearly twice tangible book value.

Source: TradingView. Past performance is not a guide to future performance.

Admittedly, and assuming consensus forecasts are pacing change, Wetherspoon nowadays trades on a more modest price/earnings (PE) multiple of around 12x compared with Young’s on 14x – although both ratings are at a premium to median expected earnings growth.

Neither enjoy much prospective yield support, if Young’s slightly better at 2.5% with nearly 3x earnings cover versus Wetherspoon at 1.6% covered more like 5x.

While this may not scream “buy” in an overall stock market context, I think the interim results and rebound from chart low do mark out Young’s as a priority “buy” for inheritance tax planners, after the Budget has been merciful. The tax screw seems unlikely to be turned further on AIM shares, given the chancellor has taken on board city lobbying.

- What the Budget means for inheritance tax planning

- Is it time to come out of cash? And what to buy now

- Stockwatch: John Wood – start of recovery or dead cat bounce?

Acquisitions seem the chief means to capital growth given UK pubs are probably around “capacity” at best, after years of expansion. It’s unclear whether management will be able to source another deal such as City Pub, or has to do its best with piecemeal acquisitions/upgrades?

Potential longer-term takeover target

The average investor may see Young’s and other pub stocks falling between two stools, neither especially attractive for growth nor income. But the same could have been said for Greene King before it was taken over by a Hong Kong-based conglomerate five years ago. If an acquirer paid a modest premium to Young’s near £800 million net asset value, it would not be anything like the £4.6 billion stretch for the enterprise value of Greene King, including its debts. Young has a modest circa £250 million net debt.

So without letting the tax tail wag the investing dog, I see reasons to consider tucking away some Young’s equity. Buy.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.