Stockwatch: a near 9% yield and capital prospects

This high-yielding share has caught the eye of analyst Edmond Jackson, who thinks rarity in its chosen sector makes it one to tuck away.

19th November 2024 11:04

by Edmond Jackson from interactive investor

Polar Capital Holdings is worth noting as a rare UK-based investment manager achieving net inflows of client funds. The industry theme has been chronic outflows, hence many stocks de-priced to offer high dividend yields as compensation for perceived risk.

At 535p currently, Polar Capital Holdings (LSE:POLR) offers an 8.7% yield. However, an annual dividend maintained at 46p a share could be a fairly full payout of earnings, and the trend in free cash flow has been volatile over years.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

Such a payout would cost £46.7 million at the current shares issued, versus a market capitalisation below £550 million. Earnings per share (EPS) look to stand a decent chance of progress from around 42p in the financial year to end-March 2024. Latest interim results show cash-at-bank falling from £99 million to £68 million (it’s not clear if a minimum is required for an investment manager running nearly £24 billion of client assets).

Yet the interim cash flow statement shows a jump in net cash from operations from £3 million to £15 million, and management was confident enough to have spent £31 million on asset purchases during the first half.

This enticing yield of near 9% therefore does have risks; chiefly, a major market event disrupting sentiment such that investment manager fees fall (both from lower asset values and clients selling funds out of fear). Otherwise, Polar has not been affected by key individuals leaving, and employment websites rate it an attractive place to work.

As ever with high yields, the question is whether the stock market is reasonable or jaundiced with its pricing. In initial response to yesterday’s interim results the price rose from 510p briefly to over 550p, then came a moderate re-tracing. Be aware, investment manager equities are a “beta play” meaning they can be more sensitive than market index moves, even intra-day.

What of Polar’s long-term record and prospects?

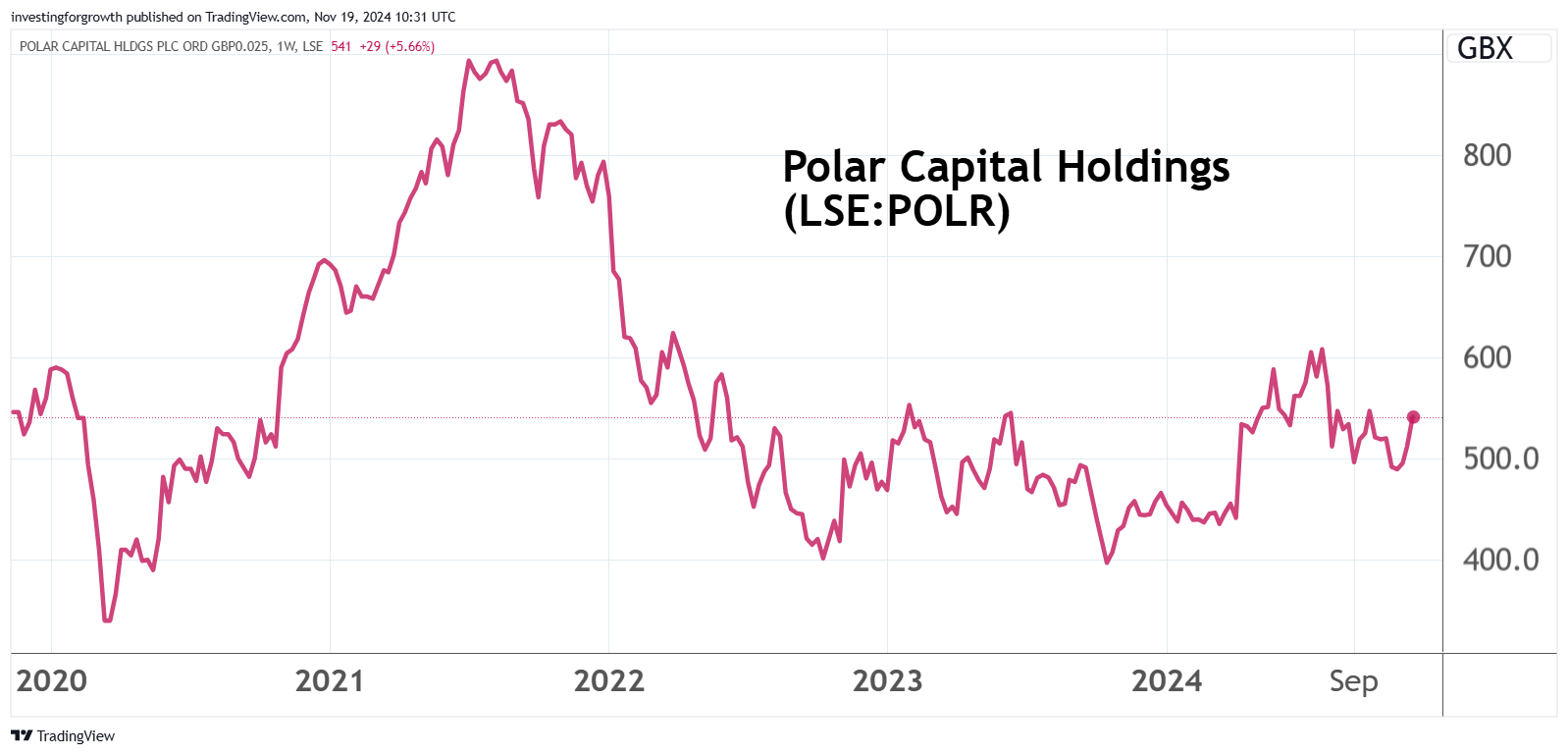

The five-year chart shows a sideways see-saw that only becomes modest appreciation if you go back to the 2012 listing at 190p.

Source: TradingView. Past performance is not a guide to future performance.

Moreover, 42% of assets under management (AUM) relate to technology, whereas a benchmark such as the US Nasdaq index is up over seven-fold from 2,400 to 18,700 since 2012. Obviously, it is Polar’s clients who own AUM, the manager chiefly derives fees as revenue, yet this is an early hint the managers are taking a performance element in their pay.

The stock tweaked up also because the first half saw £472 million inflows or 2% of assets under management; positive market movements extending this to a 4% gain; then into the second half AUM rose a further 5% to £23.9 billion as of 8 November. Mind how that cutely included a knee-jerk up in US equities after the US presidential election result.

Yet Polar is enjoying success with emerging markets and Asia as part of a “growth with diversification” strategy. Its star performer lately has been the Emerging Market and Asia Stars fund range, which received £929 million net inflows (otherwise mind, there would have been net client outflows). It said: “The significant net inflows were almost entirely a consequence of gaining market share from peer emerging market equity managers.” Last July, Polar was Emerging Markets Manager of the Year at the European Pension Awards 2024, and in September, an international small companies fund was launched.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Why concentration risk is a problem for many investors

Technology stocks still predominate at 42% of AUM; healthcare 17% and global insurance 11%; the remaining 30% being diversified. The interims have no review of the tech fund performance, although looking up the Polar Capital Technology Ord (LSE:PCT) its assets are 30% weighted in four leading US companies – NVIDIA Corp (NASDAQ:NVDA), Microsoft Corp (NASDAQ:MSFT), Meta Platforms Inc Class A (NASDAQ:META) and Apple Inc (NASDAQ:AAPL). While this reflects stock-picking success it does pin Polar to risk/reward prospects with this narrow segment of US tech leaders.

Overall performance for funds representing three-quarters of Polar’s total AUM, are very good: 90% of their AUM is in the top two quartiles over one year to 30 September 2024; 77% in the top two quartiles over three years’ 97% over five years, and 99% since inception. Past performance may not guide to the future and fund managers are to an extent hostage to market swings, but such a record is comforting.

Polar Capital Holdings - financial summary

Year-end 31 Mar

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Turnover (£ million) | 179 | 153 | 210 | 226 | 185 | 198 |

| Operating margin (%) | 35.9 | 33.3 | 36.2 | 27.5 | 24.4 | 27.7 |

| Operating profit (£m) | 64.1 | 50.9 | 75.9 | 62.1 | 45.2 | 54.7 |

| Net profit (£m) | 52.4 | 40.2 | 62.7 | 48.9 | 35.6 | 40.8 |

| EPS - reported (p) | 53.6 | 41.3 | 64.0 | 48.7 | 36.1 | 41.8 |

| EPS - normalised (p) | 53.6 | 41.3 | 64.0 | 55.7 | 40.1 | 41.8 |

| Operating cashflow/share (p) | 76.4 | 43.3 | 78.8 | 74.3 | 45.7 | 42.7 |

| Capital expenditure/share (p) | 25.3 | 24.9 | 46.3 | 70.5 | 64.1 | 44.4 |

| Free cashflow/share (p) | 51.2 | 18.4 | 32.5 | 3.8 | -18.4 | -1.5 |

| Dividends per share (p) | 33.0 | 33.0 | 40.0 | 46.0 | 46.0 | 46.0 |

| Covered by earnings (x) | 1.6 | 1.3 | 1.6 | 1.1 | 0.8 | 0.9 |

| Return on total capital (%) | 57.4 | 41.7 | 46.3 | 38.9 | 29.6 | 38.1 |

| Cash (£m) | 147 | 149 | 194 | 202 | 195 | 165 |

| Net debt (£m) | -144 | -148 | -190 | -198 | -186 | -159 |

| Net assets (£m) | 110 | 116 | 151 | 156 | 143 | 136 |

| Net assets per share (p) | 116 | 120 | 153 | 156 | 142 | 134 |

Source: company accounts.

Operational gearing compromised by jump in staff costs

Net inflows plus asset appreciation helped interim revenue rise 16% to over £100 million, and a £3.2 million turnaround in “other income” (from modest loss to profit) helped boost net income 19% to £90.5 million despite a 24% hike in commissions near £13 million. This shows how asset managers’ financial dynamics can swiftly change.

Yet in terms of operational gearing – where profit is magnified and a chief reason to own investment manager equity – we see a 22% jump in operating costs to over £67 million. Note four of the results clarifies: amortisation up from £0.6 million near £6.0 million (you could adjust for), yet staff costs are up 18% near £47 million, as if the group income advance is being significantly creamed off.

- Sector Screener: is BP’s share price slump overdone?

- Insider: chiefs spend millions on these FTSE 100 shares

It would lend more confidence if performance bonuses within this 18% cost-hike be quantified in results reporting. Fair enough perhaps if the managers are outperforming rivals, less so if due chiefly to market movements.

It means operating profit is shown up 27% on a “core” basis which excludes performance fees, albeit pre-tax profit rises only by 9%. Similarly, adjusted diluted earnings per share soar 42%, largely because aspects of staff remuneration besides exceptional items are excluded. Otherwise, reported earnings per share edges up a modest 7%.

Polar is operationally distinguished

All considered, this team is performing very well, in a context where asset manager shares are depressed due to client net outflows. Polar has bucked that trend as shown also by the year to March 2024.

Frustrating though it is, I regard this remuneration matter as compromising rather than spoiling the investment case.

More critical is what the future holds for US technology stocks. If you regard the likes of Apple and Nvidia as being in any kind of bubble, then avoid Polar, which applies to its technology trust also. Nvidia’s latest numbers are due Wednesday 20 November and will be widely influential.

Polar looks good value assuming a 46p annual dividend is maintained, although doing so by way of 14p at the interim stage still leaves scope not to at its final results, if markets go awry.

Mind, there have yet to be any insider purchases post-interims. You would think these managers should be alert first of all to their own company’s value. The last market trade was July when Polar’s chief investment officer sold £60,000 worth at 602p. Yet that might have reflected a specific need, and managers here do get shares as part of remuneration.

I therefore rate Polar a “buy” - assuming one has no significant holdings already in asset managers, which include insurers such as Aviva (LSE:AV.) and Legal & General Group (LSE:LGEN). In company-specific terms, the risk/reward profile favours upside from 535p. Among macro risks, mind that if President Trump did not learn from his first term’s chaos, this sector will remain volatile.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.