Stockwatch: a large-cap share in value territory

A recent drop in share price has presented investors with an opportunity, believes analyst Edmond Jackson, but you must have faith in the UK consumer.

6th December 2024 10:32

by Edmond Jackson from interactive investor

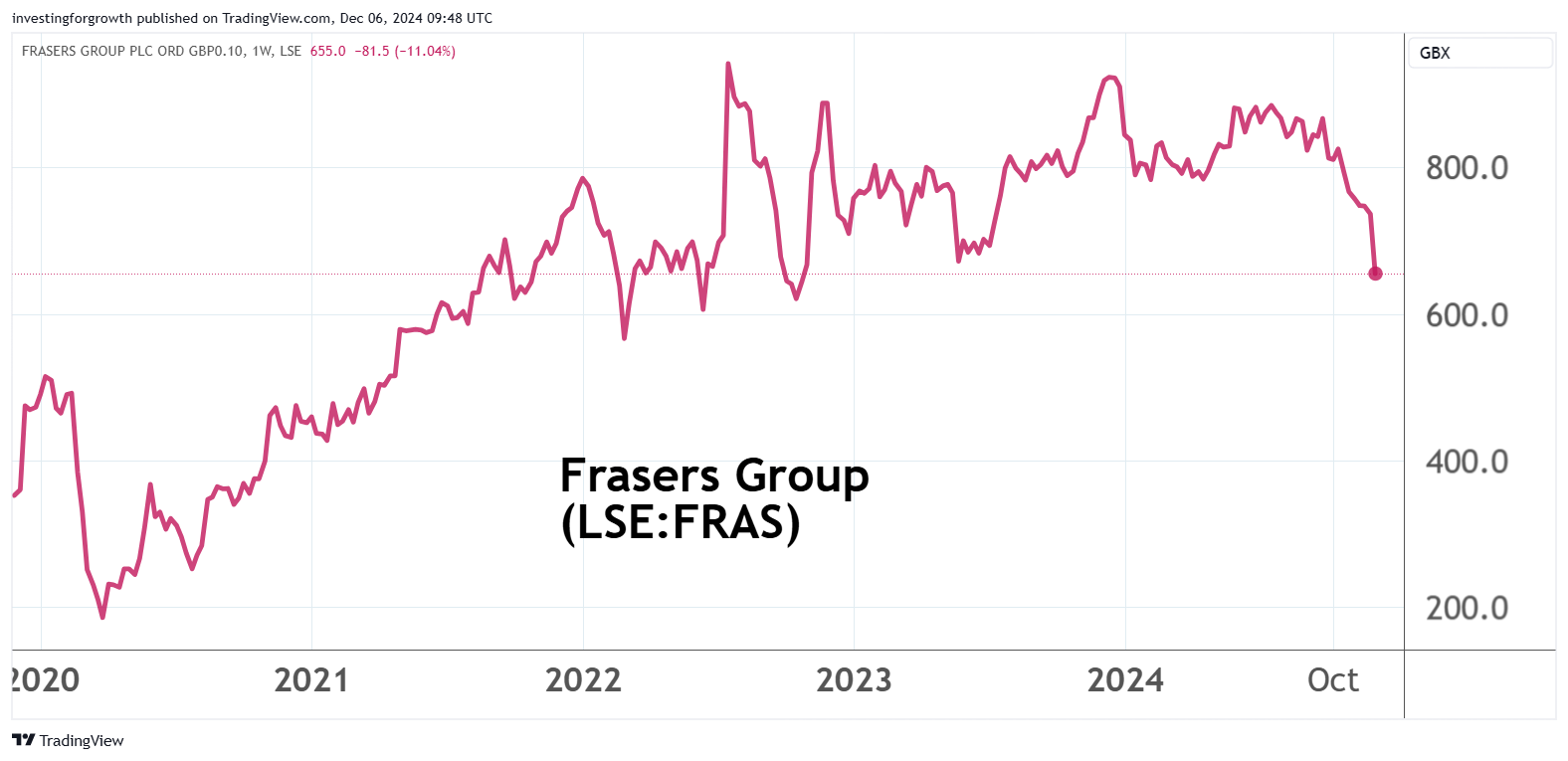

Is a modest profit warning from Frasers Group (LSE:FRAS) an amber light – both for the shares and the UK retail sector alike – or more likely already creating investment value, with Frasers' price having fallen 11% to 653p?

With the mercurial founder Mike Ashley - nowadays off the board of directors yet still a sounding board for his son-in-law CEO - one argument is that this helps Frasers’ marketing and execution to be cutting-edge, which is what’s needed in a tough retail environment. There is precedent in the wake of the 2008 crisis, when the group was named Sports Direct, and from 2010 its shares went on a tear.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

They also later plunged from around 750p to near 300p from late 2015 into 2016, significantly due to Ashley’s antics. Frasers has sustained Ashley’s predilection for listed share dealing that recently ran into public spats with luxury brand Mulberry Group (LSE:MUL), where Frasers owns 37%, and Boohoo Group (LSE:BOO), where it owns 25.5% and Ashley tried to become CEO. At what point does such a strategy involve distractions from the main business in hand? Who is really in control?

Perhaps a sense of déjà vu with this group helps explain why its shares at 653p are down over a quarter since July, if hard yet to assume a downtrend after nearly quadrupling from below 200p in March 2020:

Source: TradingView. Past performance is not a guide to future performance.

Frasers does, however, exhibit clear outperformance versus JD Sports Fashion (LSE:JD.), for example, which has halved since early September:

Source: TradingView. Past performance is not a guide to future performance.

I drew attention to Frasers as a “buy” at 700p in June 2022, while also citing concern at the appointment of the 31-year-old CEO. The price soared to over 940p that July but has since been a volatile-sideways affair, and dropped from around 900p to 800p last July to October. The Budget sent it down to around 750p but yesterday it opened at around 640p in reaction to latest interims, and is currently 662p.

A near-term market technical concern is that this puts Frasers in line for demotion from the FTSE 100. However, it might be worth considering a buy to exploit index fund selling.

- Frasers swimming against the tide amid FTSE 100 relegation

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Despite the CEO having been with the group since 2015, heading its property and retail operations, he was a fresh face in a publicly listed group and is Ashley’s son-in-law. The essential concern would be that he is less able to stand up to Ashley, the 73% shareholder, and tell him the listed company share dealing is seen as distracting from main issues.

I still liked the appeal of value-based sports kit and the last two years has evidenced that, but what of prospects now given the group also contains “premium lifestyle” items subject to discretionary spending? Such items saw a 14.1% revenue fall in the six months to 27 October, within an 8.3% group decline, although management does cite “planned decline of low-margin businesses”.

Does the ‘elevation strategy’ amount to something distinctive?

The aim is to leverage performance, although it’s unclear whether it may involve taking on too much versus challenges (and antics) at home, especially with regard to international expansion.

It is exemplified by “stronger relationships with the biggest global brands including new partners FENDI, Ferragmo and Prada Beauty”, which in such respect ties the group more to “luxury” and how that segment fares. There is also selective expansion including partnerships in the Netherlands, Australia/New Zealand and Africa.

Fair enough, but how distinctive is this from what many listed companies aim for with a “buy and build” strategy?

If something special, then it needs consuming attention rather than the distraction of domestic contests such as with Boohoo lately. There is a point at which listed groups try to do too much, tilting more towards risk than reward. Frasers must be careful not to become perceived so.

Frasers Group - financial summary

Year-end 28 April

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Turnover (£ million) | 2,904 | 3,245 | 3,360 | 3,702 | 3,957 | 3,507 | 4,691 | 5,557 | 5,538 |

| Operating margin (%) | 7.7 | 4.6 | 6.0 | 4.3 | 4.9 | -2.1 | 6.4 | 9.9 | 9.9 |

| Operating profit (£m) | 223 | 148 | 201 | 161 | 192 | -73.3 | 301 | 535 | 521 |

| Net profit (£m) | 277 | 230 | 20.1 | 112 | 93.8 | -83.0 | 250 | 488 | 387 |

| EPS - reported (p) | 45.5 | 38.3 | 3.8 | 21.5 | 18.5 | -18.2 | 47.5 | 100 | 90 |

| EPS - normalised (p) | 51.9 | 31.4 | 2.4 | 25.6 | 27.9 | 18.2 | 78.4 | 101 | 88 |

| Operating cashflow/share (p) | 10.8 | 42.9 | 61.4 | 52.5 | 74.3 | 103 | 108 | 118 | 156 |

| Capital expenditure/share (p) | 33.9 | 68.9 | 39.2 | 30.6 | 63.8 | 43.9 | 68.5 | 102 | 60.9 |

| Free cashflow/share (p) | -23.1 | -26.0 | 22.2 | 21.9 | 10.5 | 59.1 | 39.5 | 15.7 | 94.6 |

| Return on total capital (%) | 12.3 | 8.5 | 9.2 | 6.3 | 6.4 | -2.6 | 9.7 | 16.7 | 15.6 |

| Cash (£m) | 234 | 205 | 360 | 448 | 534 | 457 | 337 | 333 | 359 |

| Net debt (£m) | 99.7 | 182 | 397 | 379 | 990 | 972 | 1,112 | 1,097 | 1,094 |

| Net assets (£m) | 1,386 | 1,223 | 1,194 | 1,247 | 1,267 | 1,193 | 1,287 | 1,668 | 1,873 |

| Net assets per share (p) | 232 | 218 | 222 | 232 | 224 | 230 | 263 | 346 | 415 |

Source: historic company REFS and company accounts.

Will consumer confidence settle or worsen?

This appears the key question for predominantly UK-facing retail shares.

Within the revenue elements, all of Frasers’ retail drivers – sports, premium and international – have recently showed revenue decline. Only the smaller property side grew - by 21% to £38 million. Financial services fell over 20% near £48 million, as if customers were warier towards credit.

I think we can look past some near-term issues that have caused Frasers’ other operating costs to jumped 47% to near £32 million, hence a 3% slip in group trading profit. These involved foreign exchange differences – last year’s tailwind becoming a headwind – and modest impairment charges. Otherwise, the gross margin was stable.

Higher investment and interest costs hit reported pre-tax profit by a third to £207 million, yet movements in variables on the cash flow statement meant that interim net cash from operations actually edged up 3% to £379 million.

- How will Rolls-Royce and BAE fare in 2025?

- Nine UK stocks make this European top stock picks for 2025

More significantly, the company said: “both ahead and after the recent Budget, consumer confidence has weakened and recent trading conditions been tougher”.

Adjusted pre-tax profit for the year to end-April is thus guided down from a £575 million to £625 million range to between £550 million and £600 million. Referencing the median point, the downgrade is only 4%, but specifying a range allows 9% variability scope.

The recent Budget is expected to raise costs by at least £50 million from the next financial year, although this only looks to be around 3% of annual operating costs and Frasers says, “we are working hard to mitigate these in order to maintain our profitable growth ambitions”.

In due respect, £75 million savings were achieved in this interim period alone, for example through warehousing efficiencies, although it’s not clear how close to the bone this leaves scope for further cuts without needing to raise consumer prices.

Genuinely strong and well-managed balance sheet

This to some extent mitigates the risk of the mercurial Ashley influence.

Last October it had £1,381 million property-related assets, equivalent to 306p a share and, excluding £56 million intangibles, the net asset position was £2,102 million or 467p a share – constituting 72% of the current share price.

Inventories eased 16% to £1,342 million due to warehousing efficiencies, representing nearly 25% annual revenue compared with around 20% for JD Sports Fashion. Stock is therefore also a pillar of net assets, but it’s hard to say what it would all fetch, say, in a liquidation.

- The recovery outlook for Diageo shares in 2025

- Share Sleuth: tweaks to two shares I’ve held for over a decade

But overall it is strong asset-backing. Despite a relatively modest £324 million, cash, the ratio of current assets to current liabilities is also amply satisfactory at 2.3 times. Furthermore, trade payables/receivables are in good balance than payables being used for free credit.

Mind, long-term debt has risen a third to £1,155 million alongside £609 million leases, hence interim finance costs rose from £49 million to £68 million. Cash positions can vary, yet the end-October comparisons saw a 21% rise in cash and even so, interim finance income fell from £28 million to £9 million. Nearly half of this involved a derivatives’ fair value adjustment yet bank interest still nearly halved.

Anyway, it has left net gearing at 40% excluding leases, which appears satisfactory enough in terms of risk profile. Mind, interest rates may not ease as significantly as hoped for, if UK inflation persists over 2%.

Complexities with adjustments make projections tricky

Consensus has looked for around £420 million net profit in the current year to end-April, rising to £440 million in 2026. Given £159 million interim net profit on a reported basis, it depends what adjustments you want to recognise, but even £350 million annual profit on 450 million shares issued would derive earnings per share of 78p, hence a 2025 price/earnings barely over eight times.

There is no dividend – the 73% holder has no need for one – but relative also to Frasers’ asset-backing I think this puts the shares in value territory overall.

If you think UK consumer sentiment will continue to weaken then avoid, but on the basis that it settles: buy.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.