Stockwatch: John Wood – start of recovery or dead cat bounce?

After a share price plunge last week, analyst Edmond Jackson decides whether an ongoing accounting review is priced in, or if investors are underestimating possible outcomes.

12th November 2024 10:48

by Edmond Jackson from interactive investor

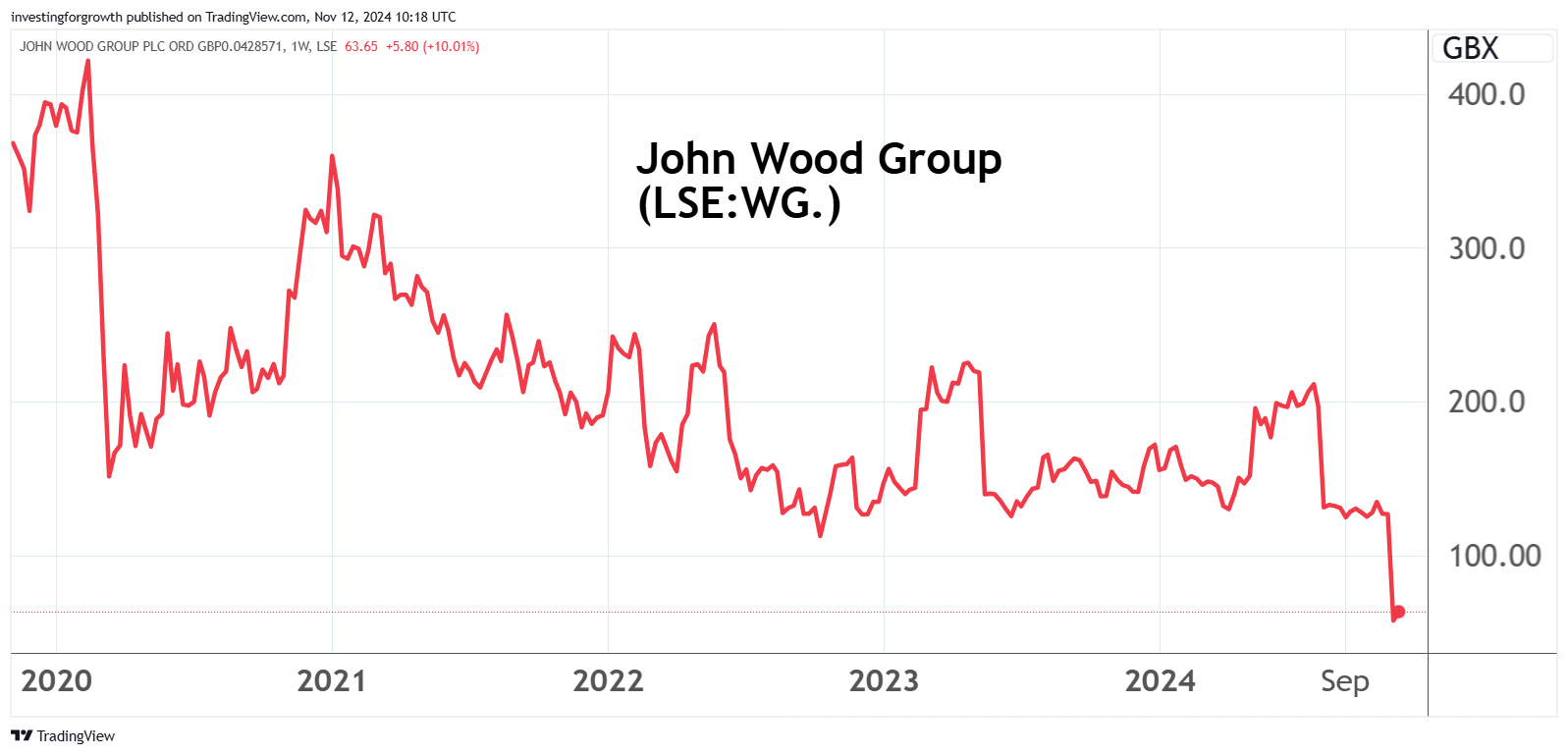

Mid-cap engineering contractor John Wood Group (LSE:WG.) is on a roller coaster. Last week, the share price plunged over 60% to just below 50p amid fears an accounting review could re-state performance versus nearly $1.3 billion (£1 billion) net debt as of end-June.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

It is a startling debacle already given that a proven new chief executive from 2022 had, until this year, cited an improving trend; the sale of Wood’s “built environment” consulting side raised $1.5 billion supposedly to clear debt; vigorous share buying by directors including the CEO; and two serious takeover approaches at 230p and 240p a share.

Source: TradingView. Past performance is not a guide to future performance.

Yes, the macro context has turned more uncertain this year, casting a shadow over energy demand, hence required infrastructure, which is also a medium-term and financially lumpy commitment. But Wood’s crisis appears also to say something about scope for different views on accounting for projects, namely their performance and financial status.

A third-quarter update cites “mixed” rather than problematic trading for the Aberdeen-headquartered group: strong year-on-year growth on the operations side plus margin growth in consulting, albeit the projects side hit by delayed awards in chemicals and ongoing weakness in minerals and life sciences. This is not untypical for a contracting group with over £4.5 billion equivalent revenues; rarely do they fire on all cylinders.

The US comprised 24% of 2023 revenues, the UK 13%, Canada 6%, Australia 5% and Saudi Arabia 4%. Wood is moving on from a fossil-fuel industry orientation, with, for example, an offshore clean power project in Germany and engineering work for a green hydrogen project in Spain.

Review to focus on reported positions of ongoing contracts

Angst was triggered by the update citing an independent review by auditors to “focus on reported positions on contracts in projects (side of the group), accounting, governance and controls, including whether any prior year restatement may be required”.

Since the parameters of this review are yet to be set, you wonder if conclusions will even be published by end-2024 and what effect in the meantime that could have on the order book.

First-half 2024 results cited $140 million of exceptional items relating to lump-sum turnkey and large-scale engineering, procurement and construction contracts. This is where a contractor assumes responsibility to finish a project in return for a lump-sum payment, which assumes also the financial risk of obtaining it.

- Stockwatch: a springboard for this FTSE 100 share to rally

- Little to excite in Vodafone's half-year results

Wood terminated future contracts of this type in 2022 but it says, “we continue to have a significant balance sheet position and claims exposure across some legacy contracts. The closure of these businesses has reduced our leverage to negotiate commercial close-outs and the staff involved have now all been exited from the business, making claims recovery or defence of litigation considerably more challenging.”

I suspect an overhang remains from the 2017 ill-fated acquisition of Amec Wheeler Foster for £2.2 billion, which brought many problems including bribery allegations.

The $140 million exceptional charge included $53 million provisions against $1.6 billion end-June balance sheet receivables (customers due to pay), although it’s unclear how much can get converted to cash. It is significant given there were $1.7 billion trade payables, also hence $42 million net current liabilities prevailing. The ratio with current assets does not need to worsen.

While some reports have cited Wood’s CEO “announcing” this review, the request appears to have come from the auditors in the course of their “ongoing work”.

Is group genuinely on the cusp of profitability?

Management has entertained a narrative of a $6.2 billion order book last August, heralding “significant” free cash flow in 2025. Yet three months later it has eased to £5.4 billion and, despite disposal proceeds, net debt is expected at similar levels to end-2023 at just below $700 million.

The adverse order dynamics are said to reflect phasing of large awards in the operations business, ongoing weakness in projects across minerals and life sciences, and delays in awards across chemicals.

A new chief financial officer took office last April having previously been chief financial officer at Rolls-Royce Holdings (LSE:RR.) – a financial success story if ever you wanted one. So, it is interesting how he made a career decision to join Wood – hardly as if it appeared to him as a business on the ropes. Moreover, and especially, what have been his changes from initiating his own review?

Wood’s first-half net loss of £983 million related chiefly to the CFO cutting $815 million from the carrying value of goodwill, then this further $140 million from exiting large-scale contracts. Whether or not the auditors are justified in seeking a fresh review, let us not lose sight of how this was one capable new CFO’s judgement. He did not resign at the sight of what he discovered this last spring/summer.

Moreover, he would have been involved – if not be principal in offering guidance – for “high single-digit growth in EBITDA” this financial year. Of course, earnings before interest, tax, depreciation and amortisation, are not profit. There was indeed a normalised interim operating profit of $67 million before an $815 million goodwill impairment and $151 exceptional items. Yet $53 million net finance charges and a $22 million tax charge meant Wood was only entertaining break-even.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Shares for the future: this profit machine must grow faster

At a time like this in its history, and with around a quarter of revenue going to the US, Wood needs Trump’s promised trade tariffs like a hole in the head. This is the factor I fear most for Wood, other than accounting issues. Logically, it does not accord why auditors should necessarily take a far worse view than an ex-Rolls-Royce CFO.

To be fair, I am not aware if Wood’s US operations may be able to mitigate tariffs, and Trump’s threat of 20% tariffs on all US imports could have been electoral bluster. Yet this is a UK-domiciled group, and I do not doubt Trump will impose an extent of tariffs.

Remarkably, the consensus forecast on Wood (so far as I can detect) has even edged up from $44 million net profit this year to $52 million, then $101 million in 2025 – implying sterling equivalent earnings per share of 4.7p rising to 10.7p.

I would not bank on that. Morgan Stanley has this week cut its price target from 185p to 85p, but I think the key question for medium-term profitability is what extent of US trade tariffs will come to pass.

If speculative buyers of Wood shares are reckoning on a better-than-feared audit review, they should look further ahead.

John Wood Group - financial summary

Year end 31 Dec

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Turnover - $ million | 5,001 | 4,121 | 5,394 | 10,014 | 9,890 | 7,564 | 5,238 | 5,442 | 5,901 |

| Operating margin - % | 3.2 | 2.2 | 0.5 | 1.7 | 3.1 | -0.4 | -1.2 | -10.4 | 0.4 |

| Operating profit - $m | 159 | 89.4 | 27.9 | 165 | 303 | -32.9 | -62.1 | -568 | 26.4 |

| Net profit - $m | 79.0 | 27.8 | -32.4 | -8.9 | 72.0 | -229 | -139 | -356 | -111 |

| Return on capital - % | 5.0 | 3.0 | 0.3 | 2.1 | 4.1 | 0.5 | -0.9 | -10.8 | 0.5 |

| Reported EPS - cents | 17.3 | 7.3 | -7.4 | -1.3 | 10.5 | -34.1 | -32.2 | -104 | -19.4 |

| Normalised EPS - c | 67.5 | 51.3 | 38.7 | 28.7 | 22.2 | -0.3 | -11.2 | -1.4 | -8.5 |

| Operating cash flow/share - c | 123 | 49.5 | 34.2 | 80.9 | 96.4 | 45.1 | -8.8 | -53.0 | 7.1 |

| Capital expenditure/share - c | 21.8 | 22.7 | 18.0 | 13.8 | 21.3 | 13.1 | 17.0 | 20.1 | 21.2 |

| Free cash flow/share - c | 101 | 26.8 | 16.2 | 67.1 | 75.0 | 31.9 | -25.8 | -73.1 | -14.1 |

| Ordinary dividend/share - c | 30.3 | 10.8 | 34.0 | 34.5 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Covered by earnings - x | 0.6 | 0.7 | 0.0 | 0.0 | 2.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Cash - $m | 851 | 580 | 1,257 | 1,353 | 1,857 | 585 | 491 | 522 | 385 |

| Net debt - $m | 320 | 349 | 1,641 | 1,559 | 2,052 | 1,568 | 1,855 | 751 | 1,144 |

| Net assets/share - c | 633 | 576 | 732 | 674 | 645 | 606 | 590 | 539 | 526 |

Source: historic company REFS and company accounts

Moderate director share buying

Non-execs certainly never sensed this audit probe coming. At the end of August, one bought nearly £20,000 worth at 132p, and in early September the chair’s wife picked up £49,000 worth at 133p.

Together with the past trend of director buying, it begs the question whether contracting can be such a mercurial business its equity is best left to insiders who think they know.

- Insider: director buying hits £750k at struggling FTSE 350 pair

- AIM shares and the Budget: winners and losers

Two years ago, directors buying over £300,000 worth of shares was partly why I rated Wood a “buy” at 115p that October – also the CEO citing a strong order book and the sale of the “built environment” consulting side raising £1.5 billion. Shockingly, Wood’s 2023 annual results proceeded to show net debt excluding leases actually jumping 77% to $694 million, or by 49% to $1,094 including leases.

The CEO continued to buy determinedly – another £200,000 worth at 133p – citing double-digit growth in the order pipeline and positive pricing trends, factors which appeared also to attract both a private equity then an industry suitor.

Likely to remain volatile into 2025

There looks a fair chance that risks linked to the accounting review are (more than) priced in. However, there is no margin of safety given $2.6 billion of net assets is covered 132% by goodwill and intangibles.

If the CFO was to buy significant shares, that would be a trigger. As yet, none of the directors has bought after this plunge.

It may renew takeover interest, however, once the review is published. Enough shareholders may be willing to remove a blot from their portfolios; even a recent buyer, Franklin Mutual, halved its stake to 2.5% in response to the update at around the share price lows.

The stance is thus now – to me – a fudge of “hold” where reasons exist still to anticipate upside, yet the situation has become too risky to rate an investment-grade “buy”.

Speculators appear to predominate in early dealings today with the price edging up 1p to 63p.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.