Stockwatch: is it now 'darkest before dawn' for this sector?

This sector has had a triple whammy of change to cope with, but analyst Edmond Jackson thought it was worth backing. Here’s what he thinks of these two stocks now.

15th October 2024 12:21

by Edmond Jackson from interactive investor

Are ongoing poor results from recruiters – with no sign of improvements – a portent of recession, or is there something industry-specific to explain this? Since this sector is often a tell-tale, the question needs answering from a wider perspective, not simply on the stocks.

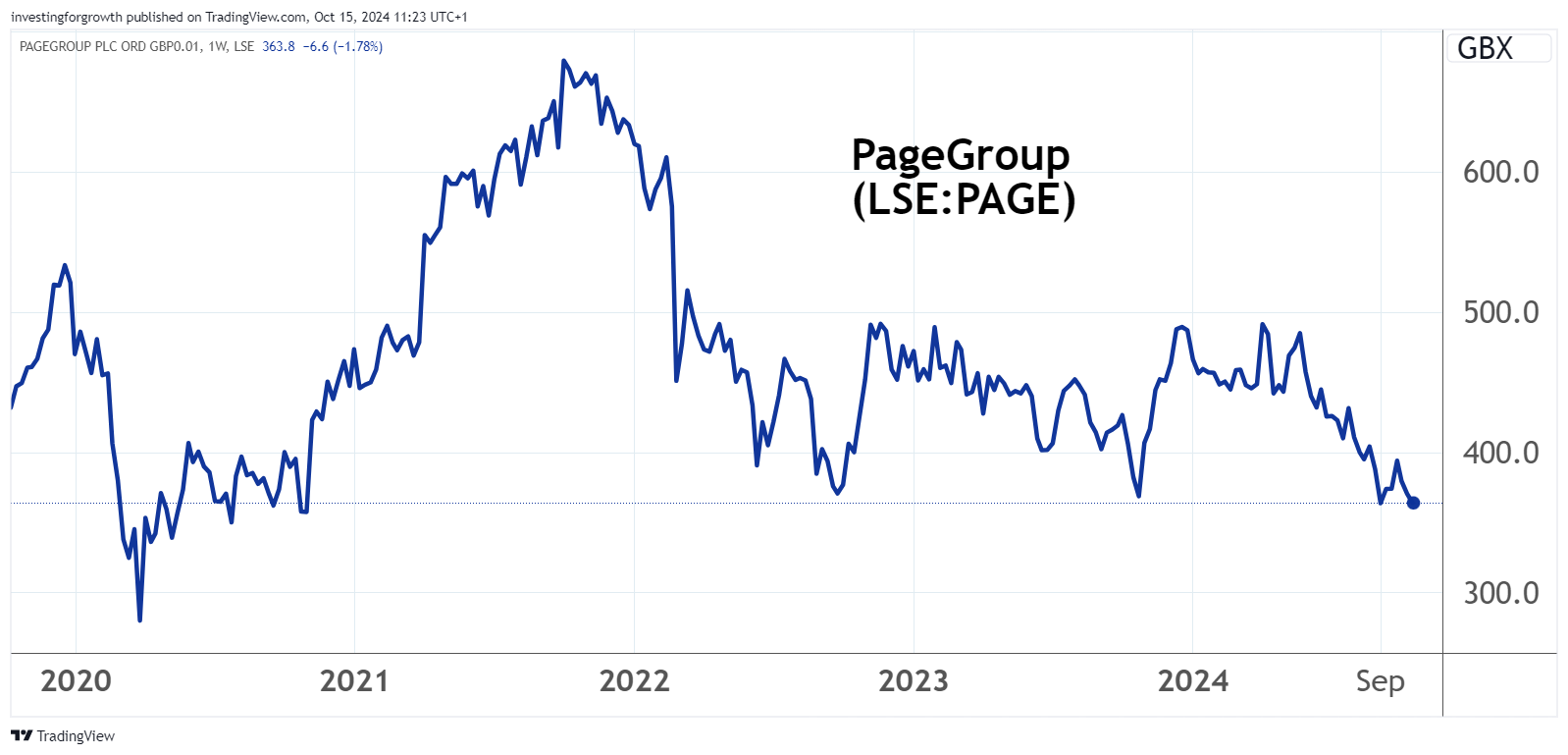

When the likes of Hays (LSE:HAS) and PageGroup (LSE:PAGE) rallied 5% in response to weak updates in July, I noted how they were starting to price in potential benefits of lower interest rates on company hiring. I suggested a case to consider averaging in, given the next reported numbers were expected to be poor anyway.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Transfer an ISA

But September being a key month for recruiting after the summer holidays, these companies are not citing any improvement in the “exit rate” on trading. When Hays results came out last Friday, its stock initially slipped a penny or so to 83p but has so far stabilised at 85p; and yesterday PageGroup closed down 3p at 367p.

Source: TradingView. Past performance is not a guide to future performance.

Source: TradingView. Past performance is not a guide to future performance.

Weak performances are broad-based globally

Among major economies in a macro context, this week has started with news of how China’s exports slowed sharply in September as global demand weakened – to 2.4 % like-for-like, down from 8.7% in August. This was well down on consensus for a 6% rise, and possibly resulted from EU and European tariffs. More positively, however, fears of a US recession are receding after gross domestic product (GDP) has been reported at a solid 3%.

Trailing data like this can become quite irrelevant, however, should oil installations get seriously attacked in the Middle East – leading to supply disruption and “stagflation” from high prices.#

- ii investment performance review: Q3 2024

- 10 hottest ISA shares, funds and trusts: week ended 11 October 2024

That potential risk aside, the question is whether or not performance profiles are chiefly about the economy. The trend in net fee income (gross profit, the key performance benchmark for these companies) is looking poor. It tallies with a pessimistic view among economists about how the effects of higher interest rates are yet to fully bear down, hence recession remains a fair risk in 2025.

A case of recruiter numbers looking ‘darkest before dawn’?

Hays cites a 14% like-for-like decline in net fee income, the three months to end-September being its fiscal first quarter.

Performance was worst in the UK and Ireland, also Australia and New Zealand, with net fee income down 20%. Asia fell 10% and only the US somewhat bucked the trend, down 2% only. In this respect, recruitment figures do appear a function of the still-buoyant US economy.

The permanent jobs side has fallen 20% like-for-like where hiring is taking longer, as candidates seemingly prefer to keep heads down working where they are. Temporary is down a relatively better 10% given this form of recruiting involves lower risk for employers. The period closed with trading “in line with the period overall”.

At its 22 August annual results, Hays had said it was premature to assess trends for the first quarter. Now they expect near-term market conditions will “remain challenging”.

Some £30 million annual structural savings are targeted by end of the June 2027 year, relative to consensus for £54 million net profit in the June 2025 year - rising to over £91 million in 2026. A near £5 million loss was struck this last fiscal year.

Expectations therefore remain “a turning point is nigh”, hence my concern that there is a hint to downside risk if this isn’t the case.

Normally you would regard the likes of Hays as a “quality cyclical” stock, as shown by only modest volatility of earnings over a decade, until curiously the worst in June 2024:

| Hays - financial summary | ||||||||||||

| year ended 30 Jun | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

| Turnover (£ million) | 3,697 | 3,678 | 3,843 | 4,231 | 5,081 | 5,753 | 6,071 | 5,930 | 5,648 | 6,589 | 7,583 | 6,949 |

| Operating margin (%) | 3.4 | 3.8 | 4.2 | 4.2 | 4.1 | 4.2 | 3.9 | 1.6 | 1.7 | 3.2 | 2.6 | 0.4 |

| Reported earnings/share (p) | 5.1 | 6.0 | 7.3 | 8.4 | 9.5 | 11.3 | 11.0 | 3.1 | 3.6 | 9.1 | 8.5 | -0.3 |

| Normalised earnings/share (p) | 5.1 | 6.2 | 7.4 | 8.4 | 9.5 | 11.3 | 12.2 | 5.7 | 3.4 | 9.3 | 8.5 | 1.4 |

| Cash flow/share (p) | 5.0 | 6.7 | 9.0 | 7.0 | 9.2 | 11.1 | 11.5 | 23.1 | 0.4 | 10.1 | 10.2 | 6.0 |

| Capex/share (p) | 0.8 | 0.8 | 0.9 | 1.1 | 1.5 | 1.8 | 2.2 | 1.7 | 1.1 | 1.4 | 1.8 | 1.5 |

| Free cash flow/share (p) | 4.2 | 5.9 | 8.1 | 5.9 | 7.7 | 9.3 | 9.3 | 21.4 | -0.7 | 8.7 | 8.4 | 4.5 |

| Dividend per share (p) | 2.5 | 2.5 | 2.7 | 2.8 | 3.0 | 3.8 | 4.0 | 0.0 | 1.2 | 2.9 | 3.0 | 3.0 |

| Covered by earnings (x) | 2.1 | 2.5 | 2.8 | 3.0 | 3.3 | 3.0 | 2.8 | 0.0 | 3.0 | 3.2 | 2.8 | -0.1 |

| Source: historic Company REFS and company accounts | ||||||||||||

Falling between two stools on PE and yield considerations

The dilemma presented by “something adversely new” in recruitment patterns is stocks still on relatively high multiples of expected earnings and quite modest dividend yields. The market still assumes a strong medium-term recovery, but what if this does not materialise, at least to the extent that’s expected?

Consensus is for normalised earnings per share of 3.4p, rising to 5.6p, implying a forward price/earnings (PE) multiple of 25x, easing to 15x, implying pretty high confidence. Perhaps the chief variable for Hays is deriving nearly a third of net fee income from Germany which saw an overall 13% fall in the first quarter

Against this – say if there is much slippage relative to expectations – consensus is for the dividend to be held around 3p per share, implying a 3.5% yield albeit only just covered if the earnings forecast is fair.

Hays said: “Given we have limited forward visibility, unless we see a material recovery in end markets, we continue to expect that pre-exceptional operating profit in the first half of (fiscal year) 2025 will be lower than the second half of (fiscal) 2024.”

My concern is therefore raised, that there is not much downside protection here if the narrative remains tough.

What’s changed, even for well-branded recruiters?

Stock ratings remain seemingly high because their network effect constitutes something of a “moat” where quality candidates get attracted to the big names which likewise become more useful to employers.

But currently depressed fees beg the question whether shocks of Covid – leading to working from home – then wage inflation and now the uncertainty how AI will change jobs, has meant a triple whammy of change to cope with.

In the macro dimension there is the US election, war in the Middle East and no end in sight for Ukraine, plus a stringent first Labour budget due in the UK.

It has all contributed to a behavioural hiatus and, in the UK, Labour’s emphasis on workers’ rights may make it still harder for firms to fire people for poor performance.

PageGroup effectively re-iterates Hays

Net fee income fell 13.5% like-for-like and at constant currency, although the exit rate on the three months to end-September was down 16% on 2023 – slightly worse than Hays.

For PageGroup, the Americas were also decidedly worse, the US down 11% and Latin America by 7%.

China was the outstanding drop, down 25% in context of near 17% for Asia-Pacific as a whole – with marked variations.

The UK did not fare too badly, down 13.5%, albeit with divergent performance between Michael Page down 10% and Page Personnel by 19%.

- ii view: tough times for recruiter PageGroup

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Conversion of interviews to accepted offers remains the most significant area of challenge, with permanent recruitment affected more than temporary.

Yet at this stage, the board still expects 2024 operating profit “broadly” in line with consensus for £58 million.

Consensus anticipates a 55% fall in 2024 net profit to £37 million then a recovery to £62 million – still below 2023 performance.

| PageGroup - financial summary | |||||||||

| Year end 31 Dec | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| Turnover (£ million) | 1,065 | 1,196 | 1,372 | 1,550 | 1,654 | 1,305 | 1,644 | 1,990 | 2,010 |

| Operating margin (%) | 8.5 | 8.4 | 8.6 | 9.2 | 8.9 | 1.3 | 10.3 | 9.9 | 5.9 |

| Net profit (£m) | 66.2 | 72.1 | 83.1 | 104 | 103 | -5.7 | 118 | 139 | 77.1 |

| Reported earnings/share (p) | 21.1 | 23.1 | 26.4 | 32.4 | 32.2 | -1.8 | 37.0 | 43.5 | 24.3 |

| Normalised earnings/share (p) | 21.3 | 23.1 | 26.4 | 32.4 | 32.2 | -1.7 | 37.0 | 44.5 | 26.7 |

| Return on capital (%) | 39.5 | 39.3 | 40.8 | 42.1 | 33.5 | 4.3 | 38.7 | 43.2 | 29.5 |

| Operating cash flow/share (p) | 26.3 | 28.4 | 27.4 | 28.3 | 48.9 | 42.9 | 46.7 | 57.9 | 48.3 |

| Capex/share (p) | 4.8 | 8.1 | 6.7 | 8.0 | 8.2 | 7.1 | 8.9 | 9.9 | 9.9 |

| Free cash flow/share (p) | 21.5 | 20.3 | 20.8 | 20.3 | 40.7 | 35.8 | 37.8 | 48.0 | 38.4 |

| Ordinary dividend per share (p) | 11.5 | 12.0 | 12.5 | 13.1 | 13.7 | 0.0 | 15.0 | 15.7 | 16.4 |

| Special dividend per share (p) | 16.0 | 6.4 | 12.7 | 12.7 | 12.7 | 0.0 | 26.7 | 26.7 | 15.9 |

| Covered by earnings (x) | 0.8 | 1.3 | 1.0 | 1.3 | 1.2 | 0.0 | 0.9 | 1.0 | 0.8 |

| Cash (£m) | 95.0 | 92.8 | 95.6 | 97.7 | 97.8 | 166 | 154 | 131 | 90.1 |

| Net assets per share (p) | 68.0 | 75.6 | 82.6 | 97.0 | 98.7 | 96.1 | 103 | 107 | 93.3 |

| Source: historic Company REFS and company accounts | |||||||||

On such basis, and with the stock a penny firmer at 368p this morning, the 2024 PE is 31x easing to 19x in respect of 2025 hopes.

PageGroup is targeted for better dividend growth than Hays: an 8.5% rise near 18p per share this year, then a 10% rise near 20p in 2025, you might say offers a yield over 5% which is significant as a prop – if such extent of pay-outs happen.

Stepping back from “buy” stances

While I think it an over-reaction to twist to “sell”, my suggestion to consider averaging in from last July has seen Hays down nearly 10% from 94p and PageGroup down over 13% from 424p. I consider a “stop loss” should apply to further buying given this malaise in the sector seems as likely to persist as improve. Hopefully for holders I am turning cautious at stock price lows. Hold.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.