Stockwatch: a high-flying growth stock plunges, is it time to buy?

16th August 2022 11:12

by Edmond Jackson from interactive investor

A sudden profit warning has sent the share price sharply lower. Companies analyst Edmond Jackson weighs up whether investors should attempt to buy low.

Yesterday, the small-cap shares in Treatt (LSE:TET) plunged by more than a third after a sudden profit warning - contrary to a bullish outlook only three months ago, when annual revenue hopes were raised to 15%.

The situation has relevance not only as a potential “buy” for recovery or even a takeover target, but more widely. It deals a blow to the sense that affluent people will keep buying luxury-type discretionary goods. Input costs are rising and for companies doing business abroad, foreign exchange volatility is another hurdle.

It appears profit forecasts signed off only a month or so ago, are no longer relevant.

- Find out about: Trading Account | Share prices today | Top UK shares

Yet the chair and CEO have bought meaningful amounts of shares after the drop, something only a cynic would say is a propping-up exercise.

Dialling into demand for more discerning products

Treatt makes and supplies natural extracts and ingredients for the flavour, fragrance, beverage and consumer products industries.

That puts it in an ideal position to capitalise on people’s tastes widening and becoming more refined; if making it somewhat at the behest of (multinational) manufacturers.

From spring 2020, hopes soared on how a prized growth stock was taking shape. Indeed, the September 2021 annual advance in revenue/profit was material; although 2017 achieved near 44% earnings growth also.

I have followed Treatt periodically since it floated in the late 1980s. Therefore, if its specialist area truly offered growth – and is able to withstand wider pressures – one might reasonably expect by now, revenue at a multiple of £124 million last year.

- Stockwatch: this share is a buy for its recovery prospects

- Insider: small-cap firm gets backing as Afentra boss buys

Double-digit operating margins are respectable enough, advancing from 13% to 16% last year – even if they are now being checked. Likewise, return on capital in the mid-teen percentages, if hardly justifying a price/earnings ratio (P/E) over 20x. Yet serially high capital expenditure has meant a poor record of free cash flow. This is why earnings cover for dividends is kept at over 3x.

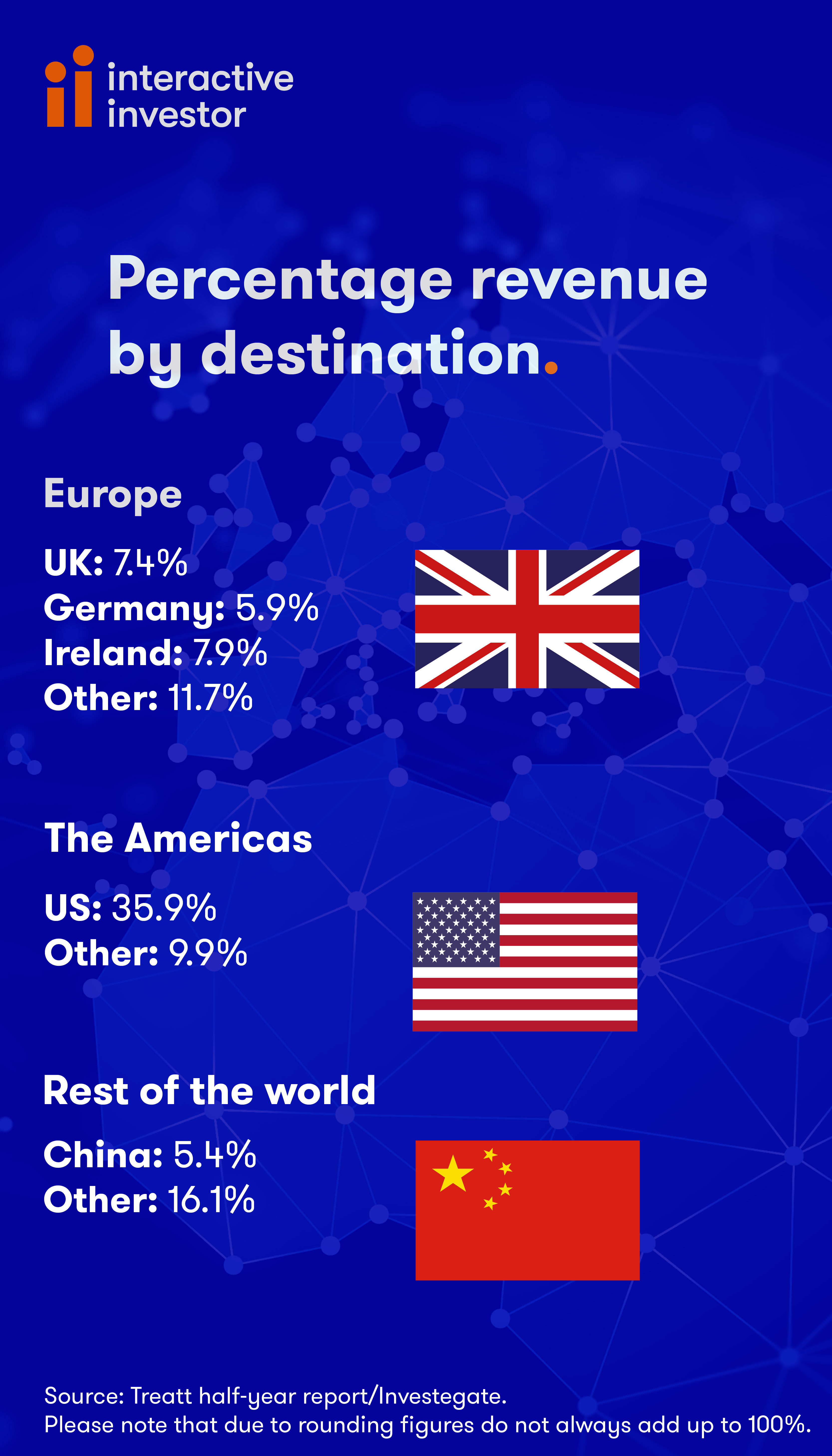

For a company remaining small (in a listed context), Treatt is highly diversified geographically. The UK comprises only 7% of group revenue, and at 36% the US is by far the most significant, otherwise territories are quite evenly balanced.

Potentially, this is a bonus for exporting if sterling continues to weaken given that the UK economy is expected to fare relatively worse over the next two years. It will also boost revenue translation back into sterling. But the update shows how things can work out different in reality.

Why US dollar earnings have been compromised

Despite using foreign exchange contracts to manage risk, either they were not up to the task or however things worked out in practice, the firm notes: “The rapid devaluation of the sterling against the US dollar during the period has had a significant impact on margins.”

Yes, that is an issue, but I am surprised management can only cite it as a negative given US dollar strength will empower US buyers of its products. Perhaps “volatility” is the key issue here.

It underlines how we need to consider exactly what US revenues at a company mean for profit.

The latest advice is to structure an investment portfolio for greater US earnings, given the likely ongoing strength of the dollar versus sterling. But it is not proving so straightforward, even when hedging is apparently used.

Growth expectations temporarily reduce for high-margin tea

A strong performance had been anticipated from this category, driven by iced and hard tea consumption in the US.

Instead, falling consumer confidence in recent months has hit demand, with lower year-on-year tea sales – which the update says, has materially reduced margins (as if operational gearing is involved, not just currency).

So much for affluent consumers continuing to spend on their favourite items. But aside from tea, the firm points out: “We are seeing strong growth in all other Treatt categories…there continues to be sustained growth in demand for our natural and authentic extracts and bespoke solutions for a wide range of beverages.”

- Share Sleuth: with three firms to choose from, here’s the one I bought

- AIM shares: how the 2021 IPOs have fared so far

Lower year-on-year sales are said partly due to an exceptional 2021 performance and a two-year growth rate over 60% highlights a significant opportunity.

But will demand for this tea recover or be left impaired by stagflation in years ahead? If the economic situation worsens, are other Treatt items so immune?

For now, management notes that its overall group order book remains up 25% year-on-year, as guided at the May interims.

Input cost inflation is further compromising margin

On input cost inflation, management points out that while in a number of cases, the business has been able to pass this on to its customers, some longer-term contracts have not yet allowed this to be achieved across the full portfolio.

It affirms a conservative gut feel, higher costs will catch up even with those firms that spent the first half of 2022 declaring that they were successfully passing on higher costs.

The problem is central banks tackling inflation belatedly, meanwhile wage rises and labour shortages (linked for example to demographics and EU workers returned home) are ingraining price rises.

- FTSE 100 backed to go higher, despite UK uncertainty

- Shares for the future: our own Warren Buffett names 23 shares in his ‘buy’ zone

Treatt says its challenges to profitability are “predominantly short term”, although I believe they could persist – or vary – over the next year or two.

Bosses buy this steep drop in the stock chart

The chair has picked up nearly £50,000 worth at 555p and the CEO nearly £20,000 worth at 559p; although despite this being announced late yesterday morning the price drifted to 525p before closing at 535p.

With a further easing near 520p this morning, it marks an overall 60% fall from near £13 at the end of last December, when Treatt traded on around 50x earnings expected back then.

While it is not back to the 500p level from which it re-rated from spring 2020, the business has advanced by way of investment, etc. Now, however, there is no scope for governments and central banks to boost demand with stimulus measures.

A macro view is that such volatility was linked to ultra-low interest rates and excess speculation during Covid lockdowns – that guaranteed a mean-reversion.

Treatt - financial summary

Year-end 30 Sep

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

| Turnover (£ million) | 88.0 | 101 | 112 | 113 | 109 | 124 |

| Operating margin (%) | 10.2 | 12.4 | 11.4 | 11.3 | 12.9 | 16.1 |

| Operating profit (£m) | 9.0 | 12.5 | 12.8 | 12.7 | 14.0 | 20.0 |

| Net profit (£m) | 6.2 | 9.6 | 12.2 | 8.8 | 9.8 | 15.1 |

| EPS - reported (p) | 11.7 | 15.9 | 15.9 | 16.5 | 18.1 | 24.9 |

| EPS - normalised (p) | 12.7 | 18.2 | 19.0 | 18.4 | 20.5 | 25.5 |

| Operating cashflow/share (p) | 16.7 | 3.5 | 1.0 | 30.6 | 22.5 | 14.1 |

| Capital expenditure/share (p) | 1.5 | 9.7 | 11.3 | 17.6 | 41.5 | 23.6 |

| Free cashflow/share (p) | 15.2 | -6.2 | -10.3 | 13.0 | -19.0 | -9.5 |

| Dividends per share (p) | 4.4 | 4.8 | 5.1 | 5.5 | 6.0 | 7.5 |

| Covered by earnings (x) | 2.7 | 3.3 | 3.1 | 3.0 | 3.0 | 3.3 |

| Return on total capital (%) | 16.6 | 20.7 | 14.5 | 12.6 | 13.0 | 16.9 |

| Cash (£m) | 6.6 | 4.8 | 32.3 | 37.2 | 7.7 | 7.3 |

| Net debt (£m) | 2.3 | 10.2 | -10.1 | -16.0 | -0.4 | 9.1 |

| Net assets (£m) | 37.2 | 46.5 | 81.6 | 87.1 | 91 | 106 |

| Net assets per share (p) | 70.6 | 87.9 | 137 | 145 | 151 | 176 |

Source: historic company REFS and company accounts

Remains on a high multiple of likely near-term earnings

September 2022 annual profit is guided at just over £15 million, a significant drop £24 million as projected by Edison Investment Research barely five weeks ago. This is notable because paid-for research – especially its numbers - is normally signed off by the CFO, as if there was a rapid change of awareness.

I would pencil in earning per share (EPS) around 20pm, which implies a 27x P/E – plenty high enough considering Treatt’s guidance has left at least one analyst, if not investors, exposed.

With hindsight, a 39% drop in interim profit was a harbinger of tougher times, despite revenue up 9% to a record £66 million. Yet management was fully confident in a second half-year profit weighting, and momentum building. That results release is now shown as needing more respect of wider economic conditions.

I suspect the 2022 total dividend will be held around 8p a share, with the prospective yield being 1.5%.

Net assets of £115 million imply 192p a share with only 2.5% constituting intangibles.

It may be late to sell, given Treatt’s US exposure may encourage takeover speculation, but equally, if economic conditions worsen on a one to two-year view, it is premature to buy. Hold.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.