Stockwatch: a FTSE 100 share worth owning for near 10% yield

This blue-chip income stock could replicate the recent significant share price outperformance of tobacco giant BAT, believes analyst Edmond Jackson. Here’s why.

6th September 2024 11:39

by Edmond Jackson from interactive investor

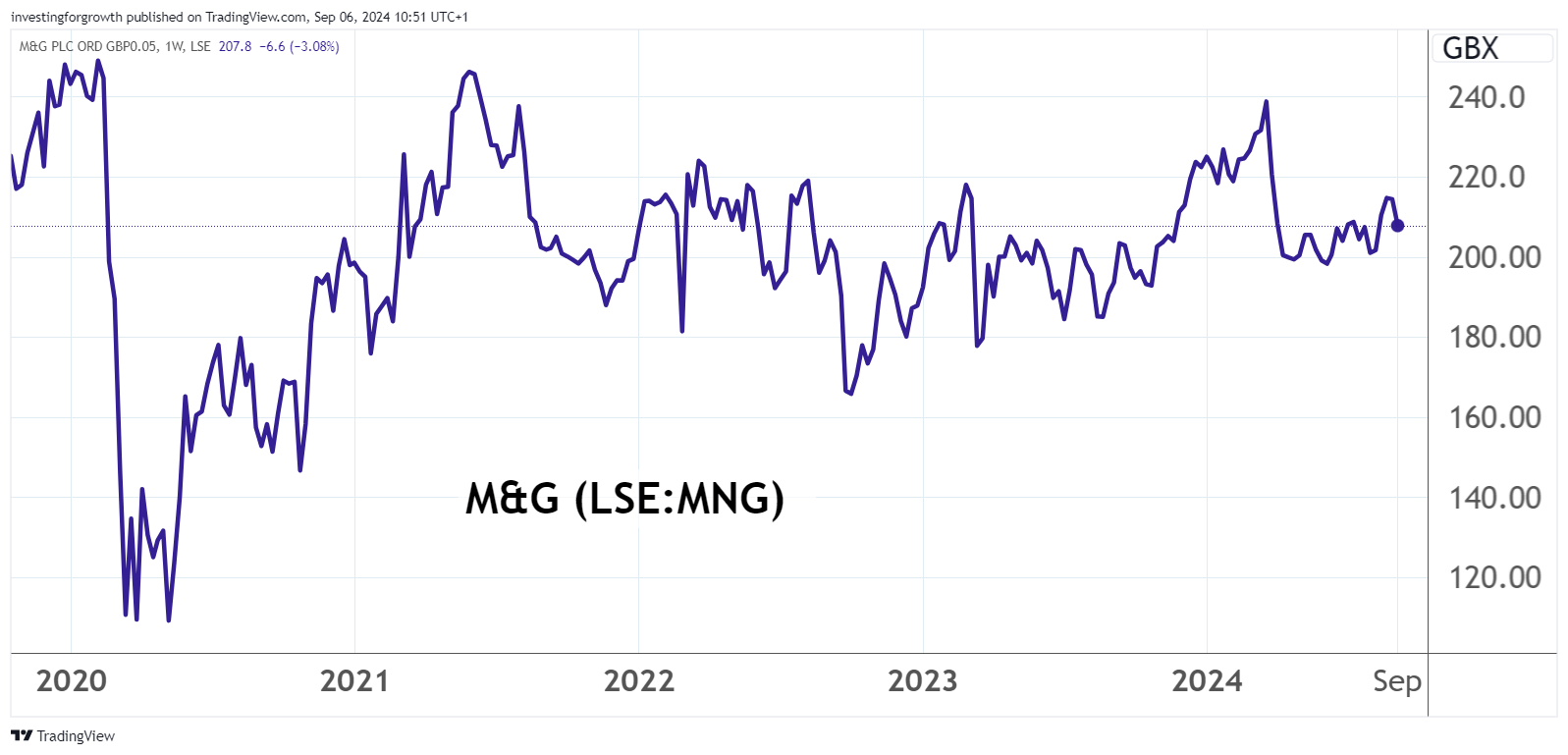

Do first-half 2024 results affirm investment manager M&G Ordinary Shares (LSE:MNG) in recovery-to-growth mode? While the FTSE 100 stock was initially firm at 214p in response, and despite Wednesday’s plunge in US equities, it has eased to 207p, putting it back to where I advanced a “buy” case last April.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

While patience is often required with out-of-favour “value” stocks, this might seem like overall underperformance during a benign period for markets.

Source: TradingView. Past performance is not a guide to future performance.

The numbers and narrative are rather mixed, the release headlining a 4% slip in pre-tax profit to £375 million but at least it appears in line with expectations. A near £5 billion company with investment and insurance operations has many moving parts, hence it is rather futile to fuss over precise profit.

Crucially for a stock that tends to appeal most to income seekers, end-June cash (or equivalents) of £5.4 billion affirms the dividend policy either to grow or at least maintain the per share payout, likely to cost around £470 million this year. And unlike so many companies engaging in share buybacks, M&G does prioritise genuine returns.

- ii view: income star M&G makes more money than expected

- Lloyds Bank among FTSE 100 stocks paying £14bn in dividends

The case for M&G essentially hinges on pricing for a near 10% yield becoming seen as over-generous for the group’s risk/reward profile. Also, that a capable new CEO from two years ago stands a decent chance of exacting further efficiencies and positioning the group better for growth. Investment management is competitive, yet M&G is well-placed in workplace pensions enjoying keen demand.

M&G -financial summary

Year-end 31 Dec

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Turnover (£ million) | -4,627 | 30,682 | 14,036 | 14,739 | 786 | 5,115 |

| Operating margin (%) | -21.3 | 11.9 | 25.0 | 4.5 | -466 | 16.4 |

| Operating profit (£m) | 985 | 3,657 | 3,516 | 656 | -3,665 | 838 |

| Net profit (£m) | 33.0 | 1,120 | 1,138 | 83.0 | -2,068 | 297 |

| Reported EPS (p) | 31.1 | 40.8 | 44.0 | 3.2 | -83.6 | 12.4 |

| Normalised EPS (p) | 43.8 | 50.1 | 56.5 | 12.6 | -73.1 | 20.4 |

| Return on total capital (%) | 0.5 | 1.6 | 1.5 | 0.3 | -1.9 | 0.4 |

| Operating cashflow/share (p) | 54.1 | 7.9 | 99.6 | 50.8 | -20.4 | 84.1 |

| Capex/share (p) | 9.3 | 15.1 | 31.7 | 29.9 | 23.2 | 20.7 |

| Free cashflow/share (p) | 44.8 | -7.2 | 67.9 | 20.9 | -43.5 | 63.4 |

| Dividend per share (p) | 0.0 | 11.9 | 18.2 | 18.3 | 19.6 | 19.7 |

| Covered by earnings (x) | 0.0 | 3.4 | 2.4 | 0.2 | -4.3 | 0.6 |

| Cash (£m) | 6,373 | 5,848 | 6,518 | 6,908 | 4,298 | 4,998 |

| Net debt (£m) | -1,976 | 2,007 | 2,096 | 2,435 | 3,614 | 3,387 |

| Net assets/share (p) | 344 | 197 | 215 | 278 | 182 | 171 |

Source: company accounts

‘The halfway point of a three-year journey’

Within a group transformation programme under way, cost savings have helped mitigate various effects of adverse asset pricing movements that are chiefly behind the profits slip.

First-half group costs were trimmed 4% - making a total £121 million savings since the programme launched in early 2023. The target is raised to £220 million by 2025, excluding additional benefits from streamlining operations.

These helped operating profit within the asset management side rise by 9% like-for-like to £129 million. End-June assets under management were £346.1 billion, £2.6 billion higher than at the start of the year, due to strength in markets offsetting £2.4 billion net client outflows in UK institutional asset management. This still improved on a £3.8 billion net outflow in the first half of 2023. The international institutional side enjoyed net inflows, although valuation changes meant those assets fell from £2.4 billion to £1.9 billion.

The quite similar “wealth” side slipped 9% to £83 million due to a reduction in asset returns also amortisation accounting involved.

This amortisation issue is cited also to explain a 7% decline in operating profit to £263 million on M&G’s main life insurance side. It symbolises quite unpredictable aspects with this kind of business.

Similarly, within the insurance side, the income statement shows “other investment return” swinging from a £125 million loss to £3,097 million profit. The benefit was knocked out however by net insurance finance expenses soaring from £692 million to £4,246 million.

- Share Sleuth: how I decided to make this double trade

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- Insider: blue-chip directors eye more progress

Central costs of £100 million have eased 2% but still appear substantial at 21% of operating profit. What can the new-ish CEO achieve here, or will this represent an opportunity for an acquirer to strip out?

Despite some big swings within M&G’s income statement, reported pre-tax profit has come out relatively similarly at £209 million, even though it is up from £128 million. Yet a sharply higher £265 million tax charge meant a £56 million net loss.

Grappling with it all may help explain the market’s “meh” reaction despite no real negatives and the improvement programme on track. I hesitate to accept the “transformation” label, but it will be interesting to see what better efficiency is achieved next from combining life insurance and wealth management operations. Plus, a further 18 months to go with improving the group overall.

Pinch of salt is required over growth forecasts

If I have a concern it is the volatility of asset returns numbers within these interim results, during a seemingly benign period for markets.

What if the US economy does weaken and finally undermine its historically high stock market? Asset management stocks inevitably react to market trends and can be seen as a geared play.

But assuming consensus for around £520 million net profit this year, rising to over £600 million in 2025, this would still be around half what was achieved in 2019 and 2020 – thus possibly reflecting scope for capable management to improve.

With management at least affirming full-year 2024 forecasts, M&G trades on 9.4x earnings – which would reduce to 8.4x assuming 13% per share growth to over 25p next year. It’s unclear whether efficiency improvements can dominate over client flows, in and out of funds, and also values of the financial securities held, which I doubt.

- The 20 most-popular dividend shares among UK fund managers

- BP share price drop attracts bargain hunters

Yet while the interim dividend has only edged up from 6.5p to 6.6p, and consensus looks for low single-digit dividend growth to 20.0p in respect of this year and 20.6p next – I regard this as relatively much more secure than the potentially volatile earnings outlook. Management retains a target for £2.5 billion operating cash flow this year.

So unless financial market values fall in months ahead, a 9.8% prospective yield should now be providing a prop.

Less risky than tobacco stocks

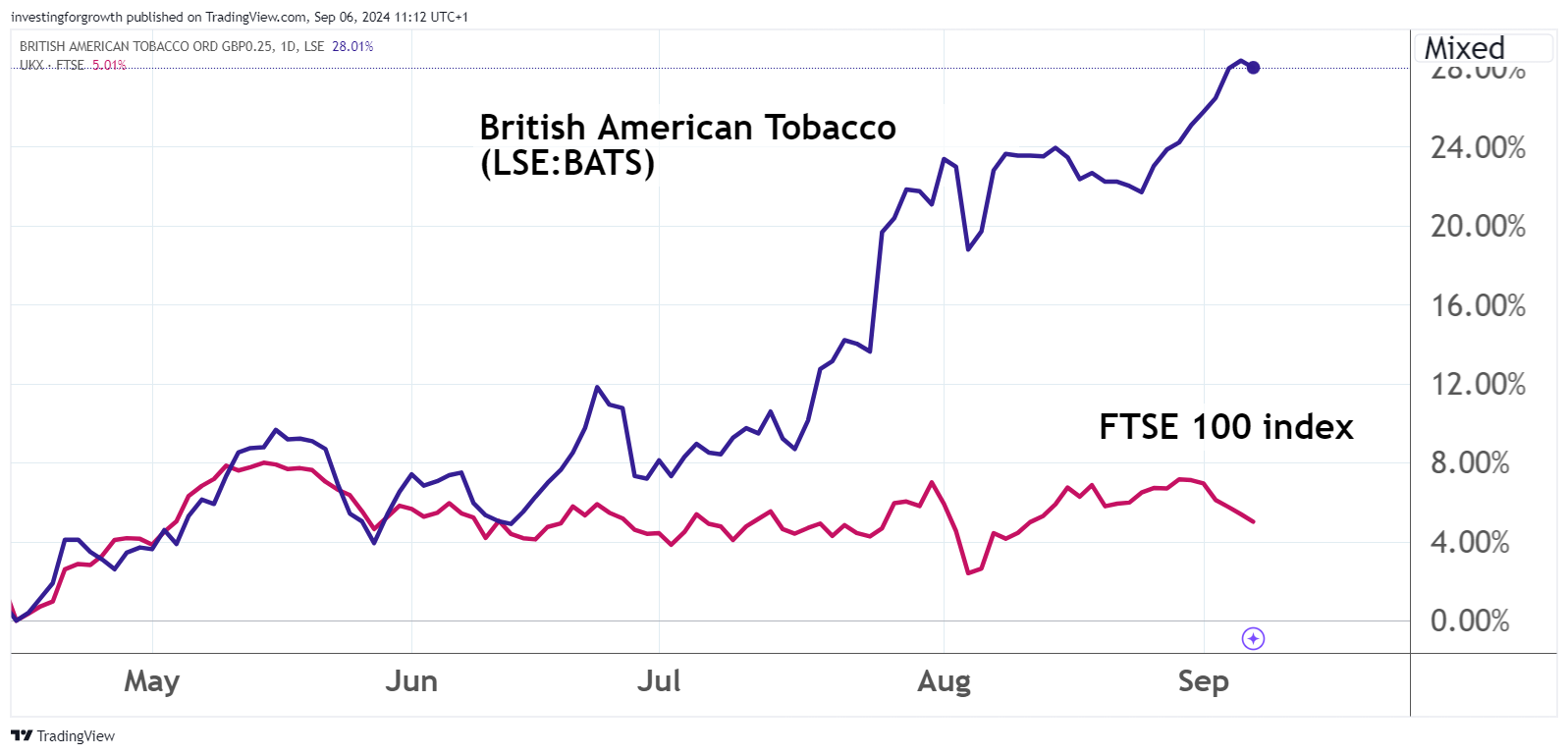

It is an interesting comparison, where for example British American Tobacco (LSE:BATS) at around 2,900p trades on a near 8.5% prospective yield – admittedly with relatively better earnings cover of 1.5x than M&G, and also strong cash flow.

Yet smoking product companies face declining tobacco revenues and the challenge to stay innovative in fast-moving “vapes” which governments are tending to regulate against. Despite asset management-related stocks being to an extent hostage to markets, they would appear to have lower long-term risks than smoking-related.

BAT was shunned down to 2,270p by last April, but has since risen nearly 30% - showing how sentiment can still turn in out-of-favour stocks appealing chiefly for income. At some point, traders may decide the yield is too high and you get a new rising price trend.

Source: TradingView. Past performance is not a guide to future performance.

To be picky over M&G, it is difficult to bring something radically new to life insurance and investment products in a highly competitive market. A new CEO can instigate better efficiency, and the asset managers do their best to sustain or preferably build on 62% of M&G mutual funds ranked in the upper two performance quartiles over three years. In institutional asset management, over 70% of funds have outperformed their benchmarks on a three and five-year basis.

BAT’s offering a 10.5% yield at its April low, does however show the market as mean-reverting when yields are perceived as too generous for risk, and if this smoking stock can rally then, barring a market slide, M&G similarly has upside potential besides a fat yield. I therefore retain for M&G: Buy.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.