Stockwatch: is this an existential crisis for GSK?

After slumping to a six-week low on litigation news, this UK drug maker’s share price has attracted attention. Here’s what analyst Edmond Jackson thinks of the situation and his successful ‘buy’ tip.

4th June 2024 12:30

by Edmond Jackson from interactive investor

Well, what should we make of yesterday’s near 10% fall in FTSE 100-listed drug major GSK (LSE:GSK) after a Delaware state court allowed jury trials on cancer claims relating to the company’s Zantac heartburn drug?

This came despite very positive drug development news about how Jemperli has shown 100% effectiveness to spare bowel cancer patients the need for surgery and chemotherapy.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

The Zantac matter has rumbled along for nearly five years, with the US Food and Drug Administration (FDA) insisting on withdrawal of Zantac in 2020 – other companies involved include Sanofi SA (EURONEXT:SAN), Pfizer Inc (NYSE:PFE), Boehringer Ingelheim and the GSK spin-off Haleon (LSE:HLN).

The justification was ranitidine, the active ingredient within Zantac, “containing a probable carcinogen”, which gave sufficient hook to the US litigation system to pursue the matter on behalf of people developing cancer. However, the analytical dilemma was that middle-aged to older people are more susceptible to cancer anyway, hence in December 2022 a Florida judge dismissed thousands of such litigation cases on grounds of insufficient evidence.

This has also been GSK’s position, re-iterated in yesterday’s announcement, about how “the scientific consensus is there being no consistent or reliable evidence that ranitidine increases the risk of any cancer”.

Moreover, and only on 24 May, it was announced that a jury in Illinois had found GSK not liable for a plaintiff’s cancer claim. What is there to fear then about the matter going to wider jury trials?

Among five cancers qualifying for Zantac lawsuits, there appears a strongest connection with bladder cancer.

I think the medium-term view of the stock effectively hinges on what we make of jury trials generally: how consistent and reliable are they? Will any be convinced by fresh evidence?

The stock market hates uncertainty, and the fact that a US judge considers the evidence of expert scientific witnesses should be weighed by juries, introduces a scenario where another jury potentially finds in favour of patients. Then where does it lead?

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- Six FTSE 100 giants to pay £10 billion dividends in June

If GSK genuinely has nothing to fear or hide here, why is it investing so much effort trying to prevent plaintiffs’ scientists testifying? It defies the very nature of science where a key endeavour is to submit existing hypotheses to maximum scrutiny.

Some 72,000 of these cancer claims are allegedly related to GSK. In response to yesterday’s news, analysts at stockbrokers banded potential liability figures of $2-3 billion (a median £2 billion) with one citing a 50% chance of $5 billion. A radio broadcast summarising the day’s news, however, quoted £40 billion, and in response one bulletin boarder questioned if GSK would be left viable. I cite this just to show how the story is unfolding.

Around 1,600p currently, GSK is capitalised at £66 billion, or just over twice annual sales.

Potential for recovery buyers of GSK

Keeping one’s nerve, it is interesting because the situation already shows scope for sentiment to get over-alarmist.

Yet there is a genuine dilemma of being able to quantify much of the possible outcomes reliably. The US justice system can generate remarkable extent of damages, and while you can already see a steady stream of announcements with GSK settling cancer claims privately, so remain the details.

Objectively again, any litigation hinges on the target’s ability to pay, so even if awards gain traction, GSK is not going to be terminally affected. But given R&D is a significant need for a drugs group (see capital expenditure taking around 30% of operational cash flow) a millstone of substantial settlements would hit dividends.

GSK - financial summary

Year-end 31 Dec

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

| Turnover (£ million) | 27,889 | 30,186 | 30,821 | 33,754 | 34,099 | 34,114 |

| Operating margin (%) | 9.3 | 13.9 | 17.8 | 20.6 | 22.8 | 18.1 |

| Operating profit (£m) | 2,598 | 4,181 | 5,486 | 6,961 | 7,783 | 6,165 |

| Net profit (£m) | 912.0 | 1,532.0 | 3,623 | 4,645 | 5,749 | 4,385 |

| EPS - reported (p) | 23.3 | 66.0 | 88.0 | 116 | 143 | 108 |

| EPS - normalised (p) | 40.9 | 118 | 107 | 169 | 122 | 109 |

| Operating cashflow/share (p) | 165 | 175 | 212 | 200 | 209 | 196 |

| Capital expenditure/share (p) | 59.9 | 55.7 | 45.2 | 53.9 | 55.6 | 72.3 |

| Free cashflow/share (p) | 105 | 119 | 167 | 146 | 153 | 124 |

| Dividends per share (p) | 80.0 | 80.0 | 80.0 | 80.0 | 80.0 | 80.0 |

| Covered by earnings (x) | 0.5 | 1.5 | 1.3 | 2.1 | 1.5 | 1.4 |

| Return on total capital (%) | 6.5 | 14.0 | 15.4 | 12.5 | 13.4 | 11.1 |

| Cash (£m) | 4,986 | 3,911 | 3,958 | 4,786 | 6,370 | 4,335 |

| Net debt (£m) | 13,804 | 13,178 | 22,106 | 25,722 | 20,780 | 19,838 |

| Net assets (£m) | 1,124 | -68.0 | 4,360 | 11,405 | 14,587 | 15,055 |

| Net assets per share (p) | 28.6 | -1.7 | 111 | 288 | 363 | 374 |

Source: historic company REFS and company accounts.

A weak technical profile emerging for the stock

Existing GSK shareholders might psychologically opt to ride this out – witness online postings reflecting denial that this problem amounts to any serious matter, calling it “a gross over-reaction”.

But if the likes of me were now to slap a “buy” stance on GSK – which then proceeded to go pear-shaped – you, or indeed any other new buyer of the shares, might later claim this was negligent. The same applies to any fund manager with fresh money – why potentially blot your career?

- Trading Strategies: economy boosts this popular FTSE 100 share

- Insider: Rolls-Royce and Glencore among four FTSE 100 deals

A “hold” stance is much more defensible given the history of litigation, for example, versus the tobacco industry whose shares did subsequently recover. But overall, it doesn’t then counter-balance net selling by those investors who are fearful.

It could only be of modest effect, but I think this helps explain GSK’s muted rebound from below 1,600p yesterday, and a slip to 1,590p Tuesday morning.

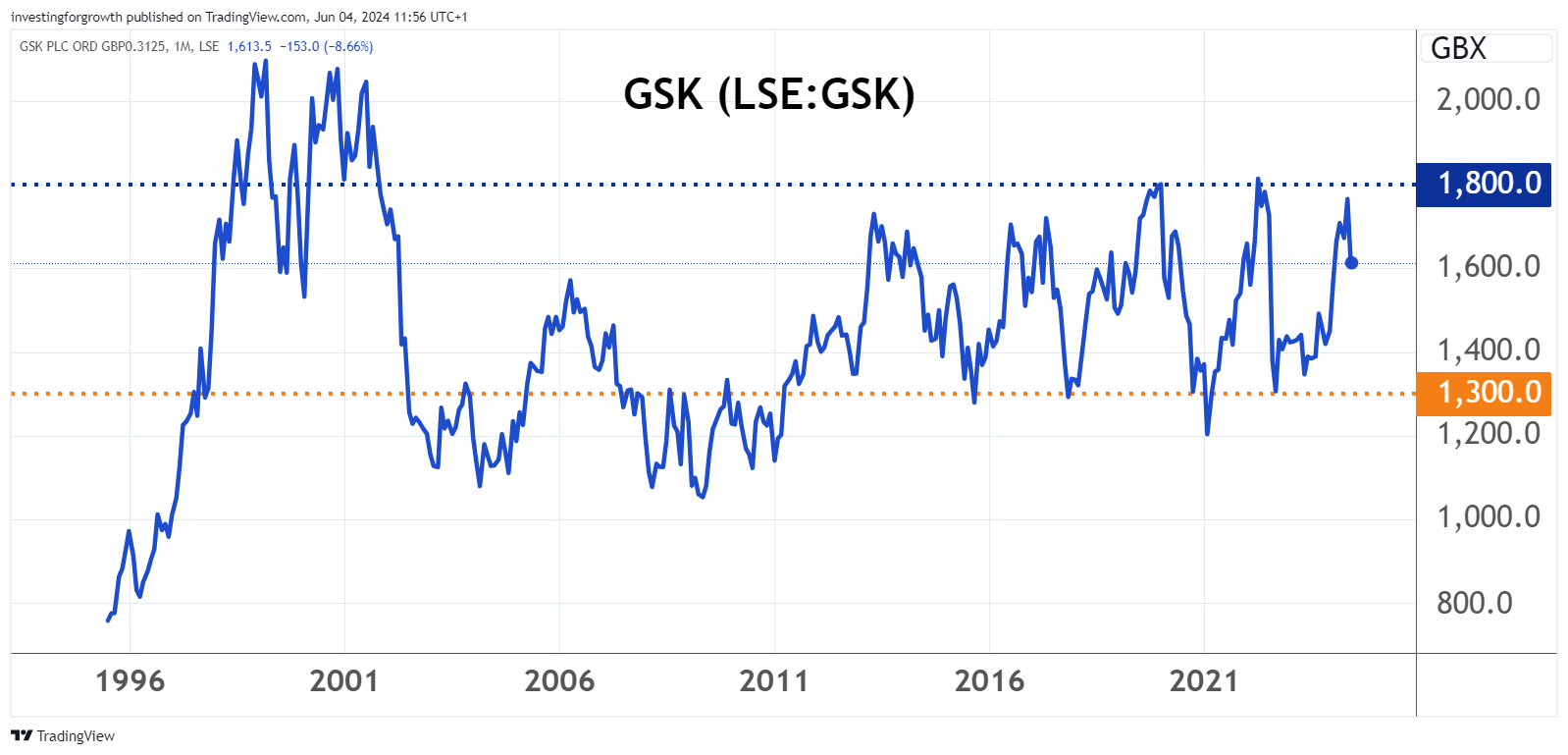

Five-year chart context still looks nothing special

The drop can be interpreted as mean-reversion to an upward trend-line from July 2023 that is also quite consistent with volatility through 2021-22.

Source: TradingView. Past performance is not a guide to future performance.

Its significance, however, is checking what was shaping up as a potential break-out from the circa 1,800p high achieved in 2020 and 2022. Confidence has recently been growing, helped by regular successful drug announcements, and how GSK is in a “delivery” phase on investment made over the last few years under a new CEO since 2017.

January 2024 ‘buy’ case still up 10% before dividends

This Zantac development is unfortunate after GSK had risen 25% to comfortably over 1,800p in May after I made a “buy” case at 1,450p in January.

GSK had risen 12% from a modest double bottom at around 1,300p in July 2023, benefits of investment were materialising, and the board was targeting paying out 40-60% of earnings averaged across investment cycles. The 12-month forward price/earnings (PE) multiple was 9.3x and the dividend yield 4.2% with 2.6x earnings cover (assuming forecasts).

The discount to AstraZeneca (LSE:AZN),which traded then on around 16x forward earnings and similar yield considerations, was partly explained by GSK needing to overcome a reputation for relatively less vigour, which, yes, it was doing.

- Shares for the future: a business I love is in great shape

- How to invest ahead of the general election

- Stockwatch: is stubborn inflation reason to worry?

There was also the historic legacy of Zantac uncertainties, management appeared to be coping with by way of settling specific cases without acceptance of liability. This Delaware initial ruling does, however, disrupt that perception, potentially opening the floodgates.

What current stance to take on the stock is thus largely a function of risk appetite. With consensus for net profit of £6.4 billion this year and £7.2 billion in 2025, earnings per share around 160p and 177p respectively imply a PE multiple of 10, reducing to single figures. The prospective yield is just shy of 4%.

If the likelihood of successful mass-scale Zantac litigation is minimal, then the stock once again has double-digit per cent, medium-term upside.

But it is not reasonable to predict where this litigation is heading. Indeed, it is hard to know if downside risks are priced in.

Various stances can thus be rationalised

You could therefore say that if capital protection is the first objective when investing, the proper stance – also in respect of my January “buy” idea” – is now to “sell”. That does at least cut it cleanly, but I think that’s harsh given a worse-case scenario remains a long shot.

As things stand, it is possible to conjure both “sell” and “buy” stances according to one’s risk appetite, so perhaps you will excuse my compromising with “hold” as the only way to balance differences. I recognise potential negligence with “buy”, yet could end up looking daft by downgrading to “sell”.

With fresh money, I would see how the jury story evolves and if a weak technical situation prevails.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.