Stockwatch: can this activist shareholder unlock value?

It’s fallen from grace and had a choppy few years, but a wheeler dealer has seen something he likes at this former high-flyer. Analyst Edmond Jackson gives his view on prospects.

29th October 2024 10:32

by Edmond Jackson from interactive investor

Are the AIM-listed shares in fast-fashion group Boohoo Group (LSE:BOO) finally becoming interesting again? The price has ticked up from 27.4p last Wednesday to test 30p after the maverick retailer Mike Ashley requisitioned an extraordinary general meeting (EGM) to replace the current chief executive.

Ashley owns over 73% of sports retailer Frasers Group (LSE:FRAS), which in June 2023 bought 5% of Boohoo along with 9% of ASOS (LSE:ASC) and 9% of Currys (LSE:CURY). The Currys’ stake was sold down but Boohoo was raised to 26%, ahead of the founder executive chair with nearly 13%. Similarly, Frasers’ ASOS stake has risen to near 24%.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

Mind, this does reflect Ashley’s predilection for wheeling and dealing stocks, he would not be able to indulge without strong control of Frasers. Investing so deeply means he has to get involved if the managements at ASOS and Boohoo do not deliver.

From shooting to fallen star

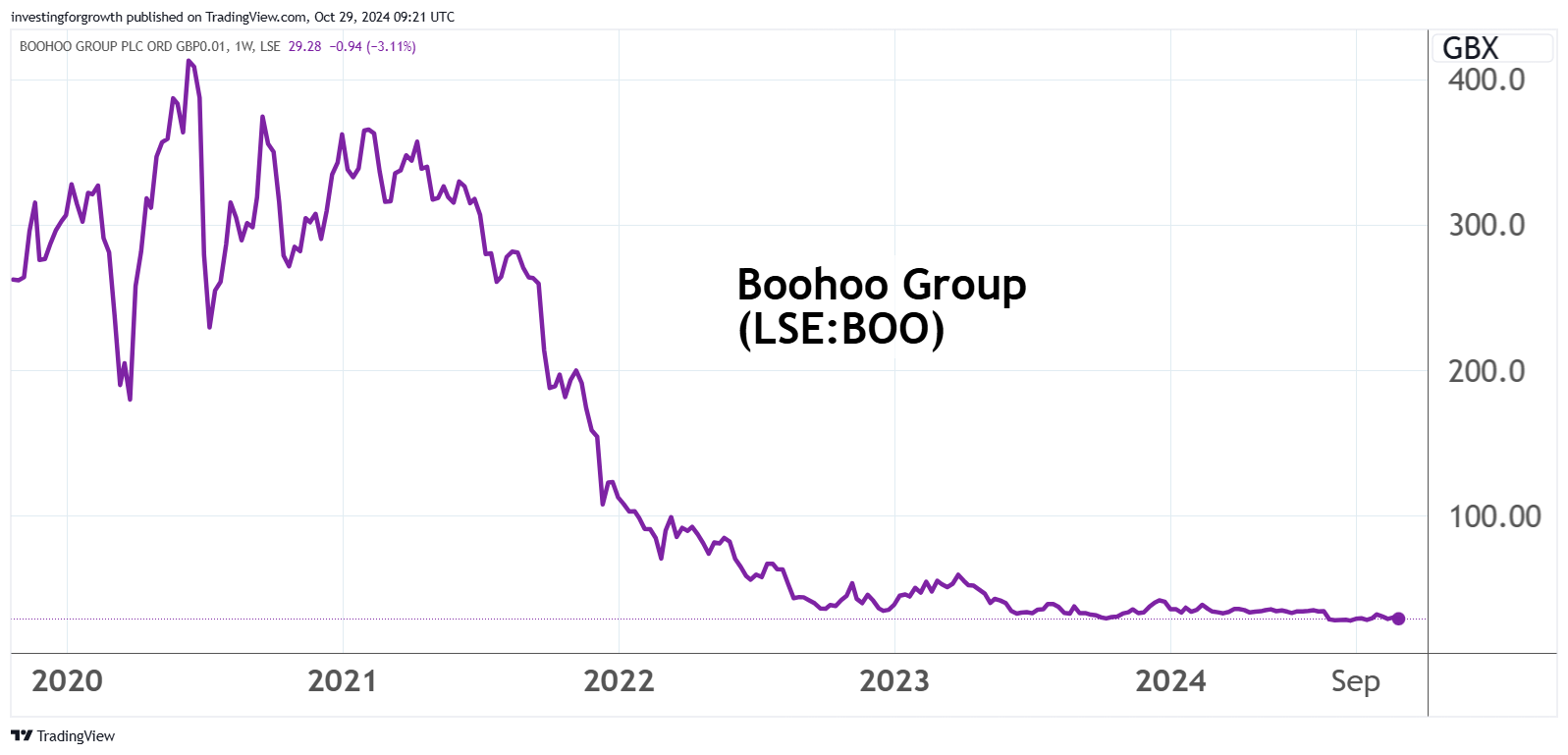

From 2015 to mid-2020, Boohoo had a spectacular run from 24p to over 400p. Variously from 35p in November 2015, I drew attention to it as “the next ASOS”, which had been even more spectacular: soaring from a few pence in the early noughties to over 7,000p by 2028.

Both companies were well-attuned to fashion trends, enjoying strong cash flows, hence balance sheets. Boohoo’s price/earnings (PE) multiple soared to around 35x but ASOS was over 70x. Things became over-extended, with Boohoo leap-frogging ASOS to a trailing PE above 100x – setting up an inevitable mean-reversion.

Source: TradingView. Past performance is not a guide to future performance.

The trigger has been Chinese competition from the likes of Shein and Temu, largely responsible for decimating both companies’ earning power.

My skeptical stance was premature though: even at 187p in April 2016 I began to question if Boohoo’s marketing skills could defy margin pressures: “Anyone prioritising capital protection should strongly consider locking in capital gains.” This was, however, a fair call in terms of the business’s altering dynamics, and in some respects shows how Ashley’s intervention has come late.

It recalls one of Warren Buffett’s classic adages: “When a manager with a reputation for excellence tackles a business with poor fundamental economics, it is the reputation of the business that remains intact.”

- AIM stocks worth £40bn make it to FTSE 100 and FTSE 250

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

A key dilemma here seems that unless government does something to properly tax Chinese imports in line with VAT, Boohoo and ASOS face a major headwind.

Chinese have capitalised on new social media

Since TikTok – also founded in China eight years ago – became the world’s most popular social media platform, marketers exploiting it have done very well.

Independent research suggests 73% of under-25s are aware of the Shein brand with 34% making purchases, significantly due to its TikTok campaigns.

Shein and Temu have timed their disruption of the UK market well, given cost-of-living pressures on young people’s disposable income. Domestic operators’ costs have also risen partly due to greater mail order returns. Some consumers say the Chinese merchandise is so cheap anyway, why even bother returning it?

Boohoo’s business update reflected strains

An update on 18 Octoberwas headlined “£222 million debt refinancing”, which appears symptomatic; my recollection from the past being sales success generating cash that took care of development needs.

Instead, and point two: “review of options to unlock and maximise shareholder value” which rather conveys a business having lost its way rather than being in any purple patch.

In 2021, Boohoo acquired the Debenhams brand and website (but not its stores) in a liquidation sale, hence Debenhams becoming a key feature of the narrative.

Management proclaims it “fast-growing and profitable, with a capital-light and highly cash-generative model...” Possibly this is one aspect of the business appealing to Ashley given Debenhams’ long-standing reputation as a turnaround. But can it “do a Marks & Spencer”?

- Shares for the future: a top 3 stock with pristine finances

- Trading Strategies: a catalyst for this blue-chip’s outperformance

The update waxes positively also on the “young fashion brands” including PrettyLittleThing beside the Boohoo brands, serving over 14 million customers with gross merchandise value over £1 billion annually, plus more than 48 million social media followers. The Karen Millen brand has been “transformed” into a global premium one with significant growth potential.

Yet the first-half-year to 31 August shows a 7% fall in gross merchandise value with management expecting higher in the second half – if unclear whether this would be genuine growth or a mitigation of decline.

Adjusted EBITDA is also expected to improve from this latest period’s drop from £31 million to £21 million, down on £620 million interim revenue. Mind, EBITDA is not profit.

The last published consensus on Boohoo was for a £37 million net loss in the current year to February 2025, easing to about £24 million in 2026. That might not be the worst of it given one broker downgraded to a £42 million loss after this update. At least the bank debt is refinanced.

Boohoo - financial summary

Year end 28 Feb

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Turnover (£ million) | 195 | 295 | 580 | 857 | 1,235 | 1,745 | 1,983 | 1,769 | 1,461 |

| Operating margin (%) | 7.7 | 10.3 | 7.4 | 6.9 | 7.4 | 7.1 | 0.5 | -4.7 | -10.1 |

| Operating profit (£m) | 15.0 | 30.3 | 42.7 | 58.7 | 90.9 | 124 | 9.4 | -82.2 | -147 |

| Net profit (£m) | 12.4 | 24.5 | 31.7 | 43.6 | 63.7 | 90.7 | -4.0 | -75.6 | -138 |

| Reported EPS (p) | 1.1 | 2.2 | 2.7 | 3.7 | 5.4 | 7.2 | -0.3 | -6.1 | -11.5 |

| Normalised EPS (p) | 1.1 | 2.1 | 2.7 | 4.2 | 5.3 | 7.6 | 0.7 | -1.8 | -1.5 |

| Earnings per share growth (%) | 33.5 | 86.8 | 32.0 | 53.3 | 26.7 | 44.0 | -90.3 | ||

| Return on total capital (%) | 20.3 | 26.4 | 19.2 | 21.1 | 25.9 | 25.3 | 1.8 | -9.3 | -19.8 |

| Operating cashflow/share (p) | 1.5 | 2.6 | 5.9 | 8.7 | 9.7 | 13.0 | 0.8 | 11.1 | 0.2 |

| Capex/share (p) | 1.2 | 2.7 | 4.0 | 4.0 | 3.8 | 9.8 | 21.2 | 7.4 | 5.4 |

| Free cashflow/share (p) | 0.3 | -0.1 | 1.9 | 4.7 | 5.9 | 3.2 | -20.4 | 3.7 | -5.2 |

| Cash (£m) | 58.3 | 70.3 | 143 | 198 | 245 | 276 | 101 | 331 | 230 |

| Net debt (£m) | -58.3 | -58.4 | -133 | -191 | -225 | -258 | 50.6 | 133 | 217 |

| Net assets/share (p) | 6.5 | 8.6 | 17.7 | 21.6 | 26.6 | 37.4 | 36.6 | 31.5 | 22.0 |

Source: historic company REFS and company accounts.

Ashley’s patience has clearly snapped

Frasers requested Ashley be appointed CEO at a meeting after the 18 October update – and applying a 48-hour deadline. It marked a change given that Boohoo’s announcement had cited Frasers ruling out Ashley for the role on 9 October after consistently indicating its one nominee would perform a non-executive role.

Impulsive action is characteristic of Ashley, with varied success: from the long-standing example of Sports Direct becoming the UK’s leading sports retailer, to the more questionable acquisition of House of Fraser (hence the group’s re-naming) also his buccaneering share dealing. But arguably, Boohoo has needed a jolt to better assert its development plan after lacklustre results.

Ashley’s timing is smart given the update included the present CEO stepping down “with an orderly transition to a successor”. This was effectively an admission that the task is too tough for him. It will also take time to select the right person.

- 10 hottest ISA shares, funds and trusts: week ended 25 October 2024

- Insider: Barclays chiefs among sellers at three thriving firms

Furthermore, Boohoo is in its closed period ahead of November interim results, hence is compromised to say much about operations and strategy that would be meaningful without the accounts’ context.

A classic proxy fight

In the history of such contests, there have been occasional winning outcomes. Going back to the 1990s, I recall the Anglo-French businessman Jacques Murray wresting control of hire group Andrews Sykes Group (LSE:ASY) whose shares rose from a low base to a 500-600p range in recent years. Coming back to Buffett’s point, however, the group’s underlying businesses of heating, air conditioning and mobile pumps was sound.

Boohoo’s share register shows few significant institutional holders to approach and get on side to win a vote. Schroders appears to own nearly 12%, Camelot Partners 6% and Baillie Gifford 4%. Otherwise, private client brokers, including interactive investor, near 4%.

The founding Kamani family interests may, at a guess, control only about 20% nowadays given that two key members hold nearly 17%.

The uptick in Boohoo’s stock price is recognition of a catalyst in the wings but, given this business’s predicament, it seems highly speculative to get involved just yet. A dilemma is Ashley’s dislike of the media, so I would not expect a detailed published strategic review if he becomes CEO. My sense is of him being more of a “judge-me-by-my-results” operator.

My wariness could be overdone but for now I can rate no better than “hold”.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.