Stockwatch: Buffett, Trump, China and trading tactics

As investors attempt to make sense of a chaotic few days on global stock markets, analyst Edmond Jackson gives his assessment of some of the key talking points ahead of company earnings season.

8th April 2025 11:27

by Edmond Jackson from interactive investor

President Xi Jinping of China, left, and US President Donald Trump. Credit: DAN KITWOODNICHOLAS KAMM/POOL/AFP/AFP via Getty Images.

Asian stock indices have recovered some poise today – the Nikkei 225 up nearly 6%, the Hang Seng near flat – so is this broadly a time for bargain-hunting after markets have plunged around 10% in just a few days? Technically this looks overdone, hence you would expect some near-term rebound.

A market slide is supposedly heaven for long-term investors – if you have material cash – hence “be greedy when others are fearful”, as Warren Buffett puts it succinctly.

- Learn with ii: How to become an ISA millionaire | ISA Investment Ideas | Top ISA Funds

Interestingly, the Berkshire Hathaway Inc Class A (NYSE:BRK.A) investment holding company where he remains CEO aged 94, has since last year generated around $300 billion (£235 billion) from reducing stakes in Apple Inc (NASDAQ:AAPL) and Bank of America Corp (NYSE:BAC). Such were prescient moves given that Apple is now hard hit by the tariffs confusion and banks are not the best holdings for a recession when credit demand falls and bad debts rise.

Buffett probably just recognised that Berkshire’s Apple stake had become outsized in a portfolio context and was unclear whether its rating was sustainable as Android devices proliferate. But reducing Bank of America intrigued me earlier this year, as if he did not want to be overweight banks ahead of a possible recession.

Source: TradingView. Past performance is not a guide to future performance.

An essential insight I gleaned over the Christmas holiday – from a video interview of Felix Zulauf in Switzerland, another wise old guy aged 75 – was the market under-estimating how serious Trump is about tariffs. Consensus about how they are chiefly a negotiating gun on the table is now being proven drastically wrong.

Zulauf stressed how the scale of tariffs goes much further than the 1930 Smoot-Hawley Act and, if reciprocal actions kick off, then the deflationary hit will be worse than forces that led to the Great Depression. Consider too, how the global economy is far more interlinked than it was nearly a century ago.

This key insight kept me sidelined with cash despite the strong temptation of buying opportunities I noted here, that kicked off from mid-January in UK shares. Plenty of charts have simply retreated to such levels, and even sensitive financial shares such as banks and insurers to levels only of last year. Only the purer and smaller asset managers show continuing downside among financials.

- Bear markets: what, why and how

- Stockwatch: four defensive shares to consider amid market wreckage

- How have US trusts fared since Trump won re-election?

Investors can feel relatively comfortable given that UK valuations became nothing like as exposed as in the US – where recession risks are suddenly high.

Long-term charts imply that buying in the teeth of a panic pays off consistently enough. I think we need to differentiate when the fears are mainly market or economic based, however, and when “teeth” are truly bared.

I was partly wrong-footed in the 1987 crash - getting out of modest holdings ahead of the slump then failing to buy back as the market rebounded. That was substantially a market-oriented panic where programme trading (subsequently better regulated) over-did the selling. Yet economies remained strong and shares more than recovered before the early 1990s recession.

Yet fundamentals-driven crises such as 2008, eurozone debt in late 2010 and Covid in 2020 suggest that while there are indeed trading opportunities after a sudden drop, they can be the proverbial “rally in a bear market”. It may take possibly six months to find a low, especially if recession follows.

Cyclically adjusted PE on US shares still high

The “CAPE” Ratio as devised by Professor Robert Shiller remains at a relatively high level of around 30x versus a median historic value of 16x, with a record high of 44x and low of 5x. It reflects dividing share prices by the average of 10 years’ earnings adjusted for inflation and can be an indicator of returns from equities over a 10 to 20-year horizon. Higher CAPE values imply lower than average, long-term annual average returns.

Yes, the US market remains relatively more exposed than the UK, but tariffs will have some disruptive effects here and we will not be impervious to US recession.

Mean-reversion according to CAPE implies the S&P 500 index starts with a “3” rather than 5,000, and it will be interesting to see if that level holds this afternoon.

President Trump’s tariffs represent effectively the biggest tax rise on US consumers and industry – by way of higher import costs – in history. That China retaliated last Friday with a 34% US tariff and Trump yesterday threatened a further 50% on China shows things getting out of control rather than cool negotiation, risking business and consumers being stunned into torpor.

Such is the dilemma with Trump’s shock-and-awe tactics, his transactional approach honed over decades versus hard-nosed property developers.

In terms of corporate PE’s (price/earnings), we have no idea yet as to how “E” could manifest from mid-year. Possibly the US economy retains some of its remarkable resilience after serially defying recession fears. But radically higher import prices are poised to strike, along with a confusion of tariff implementation. Trump defines himself by tariffs; America now has to eat what it voted for.

Rationalising Trump administration’s actions

A dilemma from some 80 years of the US dollar having become the global reserve currency is its strength, which nowadays strains the US export sector. The social issues arising are why Trump enjoys support in the US “rust belt” sector of traditional manufacturing.

The so-called Mar-a-Lago Accord is no formal policy but a characterisation of how the Make America Great Again (MAGA) protagonists seek to force major trading partners to accept a weaker dollar. So, there is potentially a landing strip where Trump can exact some extent of concessions from other countries on trade to mitigate that US deficit; and on the budget deficit, encourage “burden-sharing” where holders of short-term US Treasury bonds such as China, are encouraged to convert into long-term bonds in return for appeasement on tariffs.

So far, the dollar has depreciated by around 8% since Trump’s inauguration and, if he could get this to around 20%, then possibly it could be presented as a victory of sorts, to help revive American exporters. An irony is US exports of technology and services – what Americans are good at – are already strong, just that these employees may not be the strongest voters for Trump.

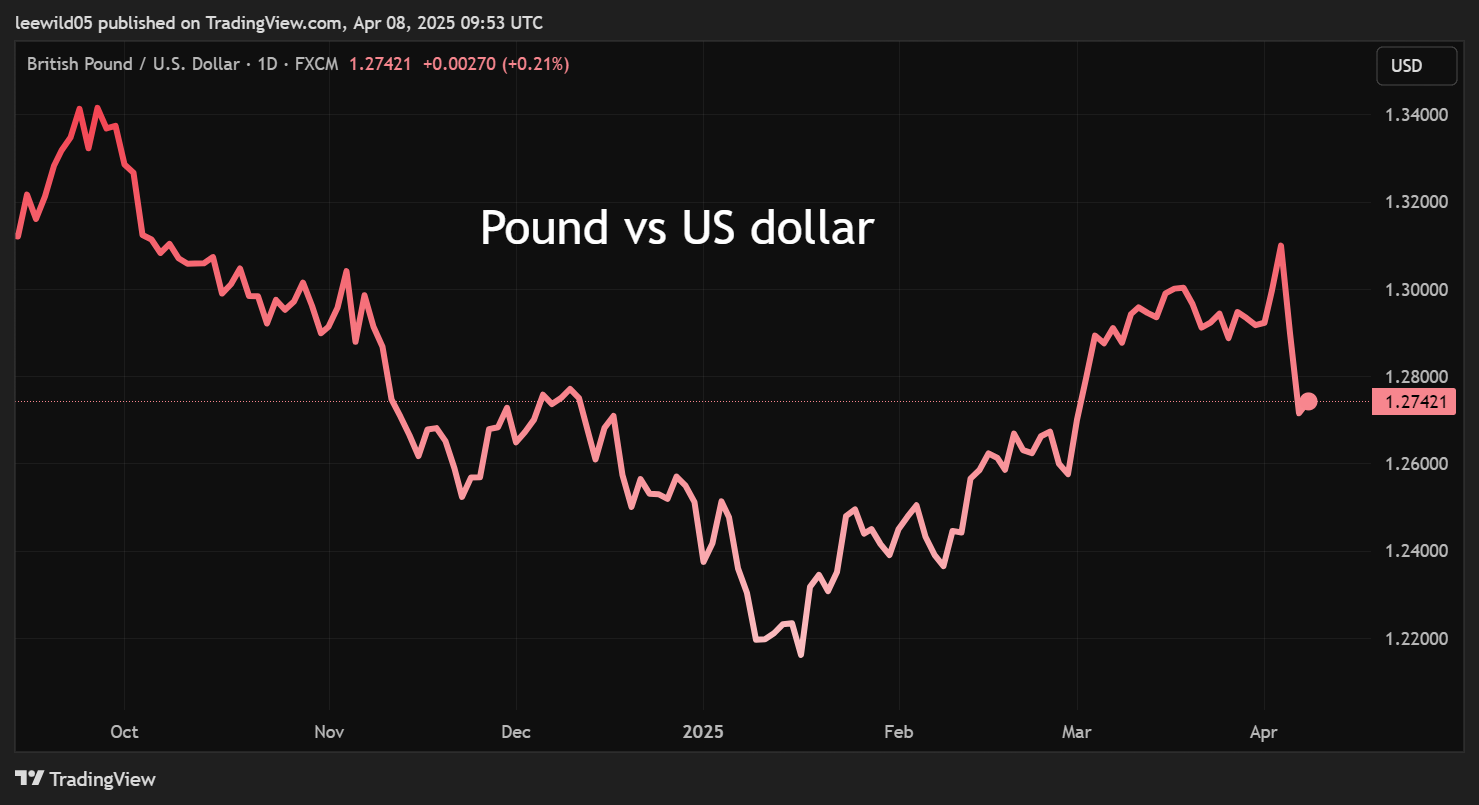

Source: TradingView. Past performance is not a guide to future performance.

A further irony is the MAGA zealots’ resolve to de-throne the dollar as a reserve currency being illogical without a replacement. The euro is a currency without a government and Chinese capital markets are not open. Are they thinking crazily of bitcoin?

That markets have been caught by surprise with Trump’s tariffs’ vigour shows their lack of understanding about how he probably wants to get this dirty work done soon, such that by the time of the mid-term US elections in November 2026 he can tease with tax cuts.

Of encouragement to share buyers today is Trump’s latest quip about how “There can be permanent tariffs and there can also be negotiations, because there are things we need beyond tariffs.” This revives the smoking gun theory about how he is ready to walk back tariffs once satisfied with exacting concessions.

There might be some adjustments and free trade deals with “friendly” countries such as the UK, Australia and New Zealand, plus easing tariffs on Canada and Mexico to limit North American trade flows.

But it is all a huge gamble where chaos and confusion mean a net loss to US prosperity. There is no point the likes of Apple “re-shoring” production to America given that this would be at least a five-year project by which time Trump will be gone – and probably tariffs too, like Smoot-Hawley which was reduced from 1934.

It is a recipe for plenty of near-term volatility, and it’s unsurprising to see UK indices up over 1% in early trading today.

But unless Trump soon engages a walk-back of tariffs, then I expect US recession indicators to manifest by mid-year.

Outcome of US/China trade conflict will be critical

While a measure of European retaliatory tariffs is inevitable, the key dynamic is versus China where the Communist Party looks in no mood to be pushed around, saying today that it will “fight to the end” if the US continues to escalate the trade war.

China looks in the stronger position with a command-type economy where the government can run monetary policy as desired to stave off recession risks. Trump, meanwhile, has to huff and puff versus Jerome Powell as chair of the Federal Reserve, who is unlikely to reduce interest rates thereby anchoring US inflation higher.

- Insider: big director deals at Glencore, Diageo and Vistry

- Shares for the future: here’s how I rank this simple AIM stock

So, it’s unclear how Trump manages this given that China is provoking a narcissistic personality type. Hopefully, reason prevails and he realises China is still America’s principal creditor without whom problems would be even worse.

Alert traders are in clover

Yesterday saw a remarkable turnaround in Volex (LSE:VLX), which initially dropped over 10% to the low 190p area despite a strong trading update, then recovered and currently tests 230p.

Ramsdens Holdings (LSE:RFX) is up 12% today as it upgrades profit for its year to 30 September, and a pawnbroker-come-holiday foreign exchange provider like this is arguably a good “hold” at 230p for challenged times; likewise, H&T Group (LSE:HAT) up 3% to 364p.

Rolls-Royce Holdings (LSE:RR.) up 5% to 667p shows how coveted blue-chips are often first to respond after a big drop; likewise BAE Systems (LSE:BA.) up 4% at 1,560p. The dilemma with such big-cap trading, however, is needing to time contrarian buying to perfection, given their near-term volatility is a proxy for the market which you need to be ahead of.

In general, I think longer-term investors can bide their time to let the macro chaos manifest in company reporting.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.