Stockwatch: a better 2025 for GSK, or best to sell now?

Investors in this drug giant have become used to volatility, but the shares are near the bottom of their 14-year range and offer a decent yield. Analyst Edmond Jackson gives his view.

3rd January 2025 12:17

by Edmond Jackson from interactive investor

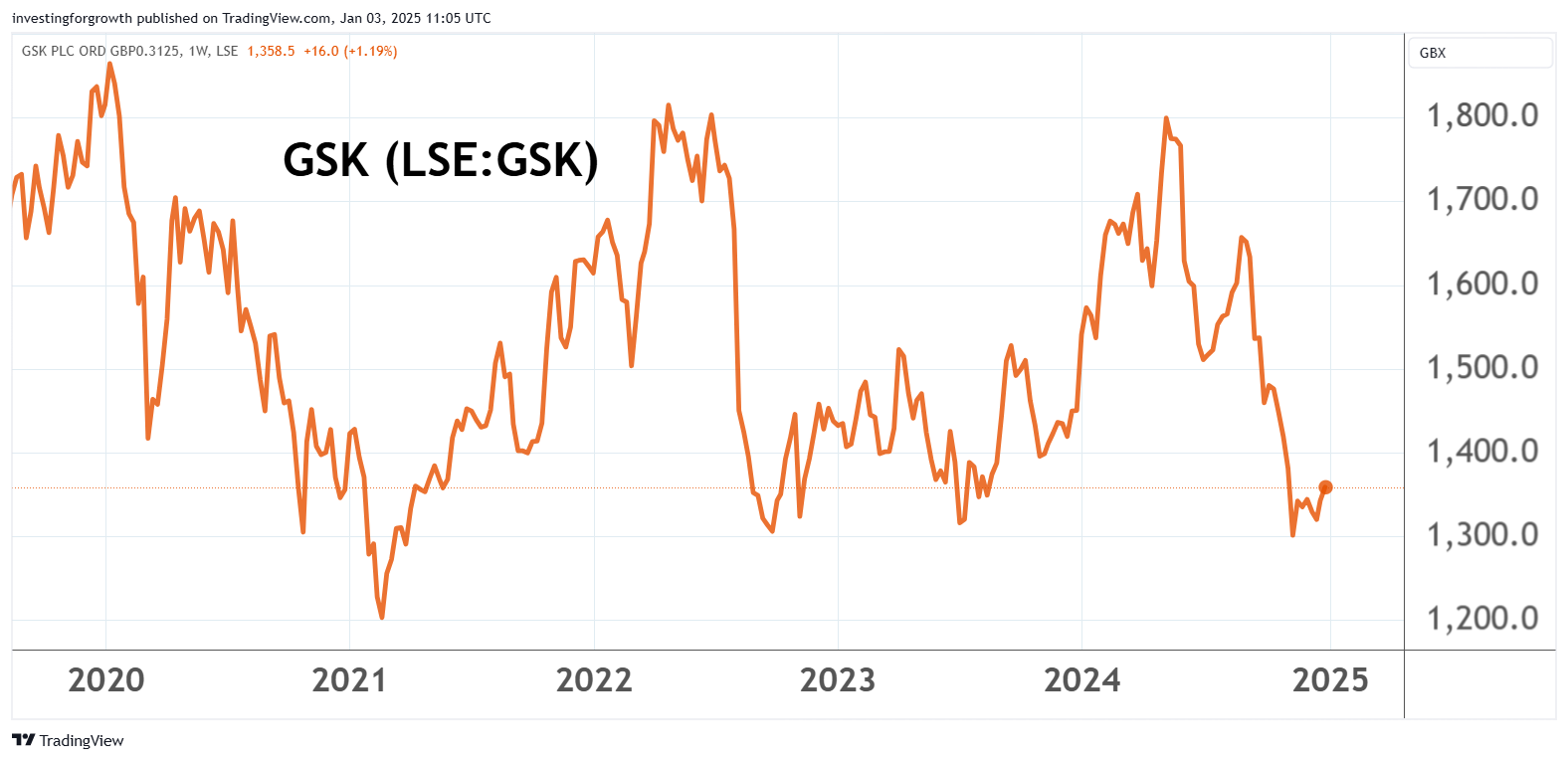

A key frustration from 2024 has been the ongoing roller coaster in FTSE 100-listed drugs group GSK (LSE:GSK).

A year ago, at 1,450p, I asked whether it could finally break out of a 20-year trading range, having also made a “buy” case at 1,440p in January 2023 using the rationale that despite rather erratic performance under the current CEO since 2017, the benefits of focused investment were starting to materialise. Management had guided for up to 10% sales growth in 2023 and earnings growth of 15%.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

The shares achieved 1,530p in 2023 but essentially traded sideways, such that a year ago, GSK continued to look a sound inexpensive investment - operating margins in the order of 20% and free cash flow trending strongly despite capital expenditure for drug development. Return on capital employed looked also to be trending through 20%.

GSK’s share price did rally 25% to over 1,800p in the first half of 2024, but had plunged towards 1,300p by mid-November. A recovery to 1,380p in early December failed, such that GSK ended 2024 down 7% at 1,346p. Yet in January so far, at 1,360p, it is making a second attempt that might conceivably define a “double bottom” reversal, hence GSK is interesting to re-examine.

Source: TradingView. Past performance is not a guide to future performance.

A share slump despite removing Zantac litigation thorn

Also perturbing is how this occurred against a fundamentals context of news last October of a settlement with law firms representing 93% (some 80,000 people) regarding alleged cancer liability for the Zantac heartburn drug. This was without GSK accepting liability, hence stood a fair chance of snuffing out the residual cases. The £1.8 billion involved represents just 3% of GSK’s current market value, and management said the cost would be funded through existing resources with no change to its growth agenda or R&D investment plans.

This essentially was very good news as it dealt with a sore around the shares, where once removed they could supposedly rally. But from around 1,500p the price continued to drop, and some observers have questioned if this implies shortcomings in GSK’s drugs portfolio – as if it is not making sufficient progress to replace an historic reliance on respiratory drugs, and also with several key patents near to expiry.

- Dozen FTSE 100 stocks promise dividends in January

- Ian Cowie: why this is the biggest theme in my forever fund

The third-quarter results invited such criticism due to sharp revenue falls in several vaccines, which management attributed to changes in regulatory guidance and somewhat ironically “prioritisation of Covid vaccines in the US”.

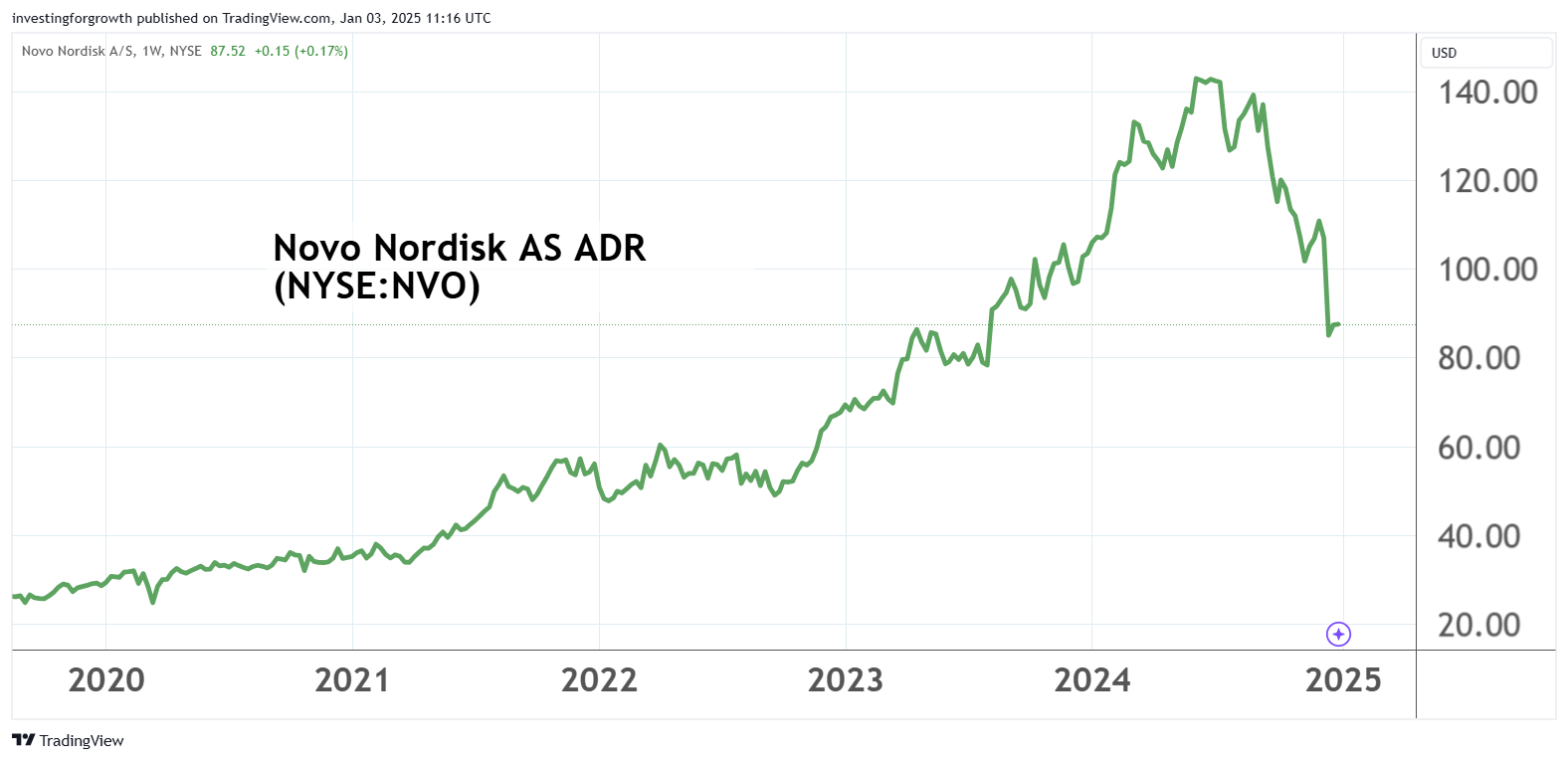

Novo Nordisk more volatile than GSK

GSK’s 28% fall from a high was beaten however by Novo Nordisk AS ADR (NYSE:NVO), which currently has no cancer-related litigation issues, yet its 2024 chart shows a similar trend – up 37% in the first half, then a 40% slump in the second to close 2024 down 27%.

This Danish drug maker is actually the largest company in Europe. Over 20 years to its 2024 high of $155, it multiplied 60x and at $87 is still up over 30x.

Source: TradingView. Past performance is not a guide to future performance.

Part of Novo’s drop may reflect simple mean-reversion in the sense even now it trades on 30x trailing earnings and 22x consensus for 2025, versus a 12-month forward price/earnings (PE) ratio of over 8x for GSK. In recent days it has fallen more than the US market and there does seem anxiety over the next earnings report and its guidance.

Yet it may be the parallel in both shares’ performance reflects fears in the second half – especially after Trump got re-elected – that the US drugs market is being disrupted. Rebates paid by manufacturers to the Medicaid insurance scheme are creeping back and Trump’s populist stance makes it likely he protects his many lower-income supporters. Yes, such a scenario does involve a jolt for highly rated shares, but GSK derives just over half its revenues from the US.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Watch our video: a FTSE 100 stock to watch in 2025

- The UK stock market outlook for 2025

It could be, however, that this headwind is now broadly priced in and that Trump’s bark will yet again prove worse than his bite, especially given that he also likes to be measured by the stock market, which means corporate profits.

GSK’s third-quarter 2024 results re-affirmed guidance

Q3 results mean that consensus expects a 10.5% normalised earnings per share (EPS) advance to 155p, representing a PE multiple of 8.7x which eases to 8.2x, assuming consensus for EPS of 165p this year. The implied earnings growth rare would, however, be shy of 7%, and GSK seemingly needs to do more to convince on growth credentials, hence market pricing is liable to ensure yield sufficient to compensate for perceived holding risks.

Dividend growth projected around 4.0% in 2024 and 6.5% this year is anticipated, covered 2.6x by earnings both years. A dividend of around 64p in respect of 2025 implies a material 4.7% yield. The table below also shows free cash flow per share often significantly ahead of EPS, hence higher cover in terms of what counts.

GSK - financial summary

Year-end 31 Dec

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Turnover (£ million) | 27,889 | 30,186 | 30,821 | 33,754 | 24,354 | 24,696 | 29,324 | 30,328 |

| Operating margin (%) | 9.3 | 13.9 | 17.8 | 20.6 | 24.6 | 17.5 | 21.9 | 22.2 |

| Operating profit (£m) | 2,598 | 4,181 | 5,486 | 6,961 | 5,979 | 4,321 | 6,433 | 6,746 |

| Net profit (£m) | 912.0 | 1,532.0 | 3,623 | 4,645 | 5,749 | 4,385 | 14,956 | 4,928 |

| EPS - reported (p) | 23.3 | 66.0 | 88.0 | 116 | 111 | 69.2 | 104 | 120 |

| EPS - normalised (p) | 40.9 | 118 | 107 | 169 | 78.9 | 68.1 | 114 | 140 |

| Operating cashflow/share (p) | 165 | 175 | 212 | 200 | 209 | 196 | 181 | 165 |

| Capital expenditure/share (p) | 59.9 | 55.7 | 45.2 | 53.9 | 55.6 | 72.3 | 55.3 | 57.0 |

| Free cashflow/share (p) | 105 | 119 | 167 | 146 | 154 | 124 | 126 | 108 |

| Dividends per share (p) | 80.0 | 100 | 100 | 100 | 100 | 100 | 61.3 | 58.0 |

| Covered by earnings (x) | 0.5 | 0.7 | 0.9 | 1.2 | 1.1 | 0.7 | 1.7 | 2.1 |

| Return on total capital (%) | 6.5 | 14.0 | 15.4 | 12.5 | 10.3 | 7.8 | 17.2 | 17.8 |

| Cash (£m) | 4,986 | 3,911 | 3,958 | 4,786 | 6,370 | 4,335 | 7,877 | 4,992 |

| Net debt (£m) | 13,804 | 13,178 | 22,106 | 25,722 | 20,780 | 19,838 | 13,110 | 13,026 |

| Net assets (£m) | 1,124 | -68.0 | 4,360 | 11,405 | 14,587 | 15,055 | 10,598 | 13,347 |

| Net assets per share (p) | 28.6 | -1.7 | 111 | 288 | 363 | 374 | 263 | 329 |

Source: historic company REFS and company accounts

While the 9 October announcement on Zantac liability settlement did not specify dividend maintenance, in the 30 October third-quarter results statement this was iterated at 60p a share in respect of 2024. Free cash flow in the third quarter alone was £1.3 billion.

The interim balance sheet had shown cash stable at just shy of £3 billion, although total debt was close to £17 billion relative to £13.8 billion net assets – including £22.4 billion goodwill/intangibles.

So, yes, GSK looks as if it can navigate the £1.8 billion Zantac settlement without cutting capex or the dividend. However, the balance sheet looks debt-heavy if interest rates stay higher for longer amid stubborn inflation. A £150 million net interest cost in the first half clipped only 9% off operating profit, but if cash runs down then net interest will rise.

All considered, I’m inclined to rely on a 60p a share dividend or better, implying a 4.4% yield – which is significantly why GSK is attracting support now. The table also shows a strong track record of payouts.

Can GSK reinvigorate drugs portfolio?

As if alert to the challenge, the third-quarter results headlines included specialty medicines sales up 19%, HIV up 12% and oncology (cancer) up 94%. While GSK’s historic trend of spending around 20% of revenue on R&D has slightly lagged similar companies, recent such progress was said to “strengthen growth prospects in all key therapeutic areas”.

The portfolio does need more balancing from respiratory towards cancer and infectious disease treatments; for example, AstraZeneca (LSE:AZN) has 32 final-stage cancer treatment trials versus seven for GSK, partly explaining Astra’s PE of 14x expected earnings.

An HIV/AIDS treatment marketed as Tivicay is set to lose its 10-year patents filed between 2013 and 2023, which account for nearly 20% of group revenue, hence a substitution challenge lies ahead.

Uncertainty is involved and it’s unclear whether even a 10,000-word research paper by a pharma specialist would judge it correctly.

Yet today heralds news about a rhinosinusitis treatment approval in China – potentially a 30 million patient market.

Were the shares near the top of their historic range, it could be a deterrent, but around their low and with yield support, I am inclined to think GSK’s innovation is given the benefit of the doubt.

Modest insider buying just lately

On 20 December, the wife of the non-executive chair bought nearly £20,000 worth of shares at 1,315p and a non-executive director bought £7,200 at 1,319p. It is small-scale but consistent with a sense of averaging in around this price level.

It is a broad-brush judgement, and I concede to being no drugs specialist. However, I am inclined to retain a “buy” stance. GSK may be that kind of patient “value” play where a multi-year view is required. It will be interesting to see if a generalist perspective - on essentials – finally works sustainably.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.