Stockwatch: the best way to play a new bull market in gold?

This FTSE 250 company is the choice pick among London-listed gold shares, according to analyst Edmond Jackson. The shares have had a fantastic year so far, but he believes there’s more to come.

12th April 2024 12:12

by Edmond Jackson from interactive investor

Gold prices have spiked to an all-time high, testing $2,400 an ounce amid fears that Iran will attack Israel sufficiently to provoke a direct response from Israel that next definitively kicks off war between these antagonists – also drawing in the US.

A measured response by Iran to Israel’s strike on its Damascus embassy may yet prevail given Iran is only too aware of the consequences. But it all raises tension that is helping stoke demand for gold as a store of value.

- Invest with ii: Open a Stocks & Shares ISA | Top ISA Funds | ISA Offers & Cashback

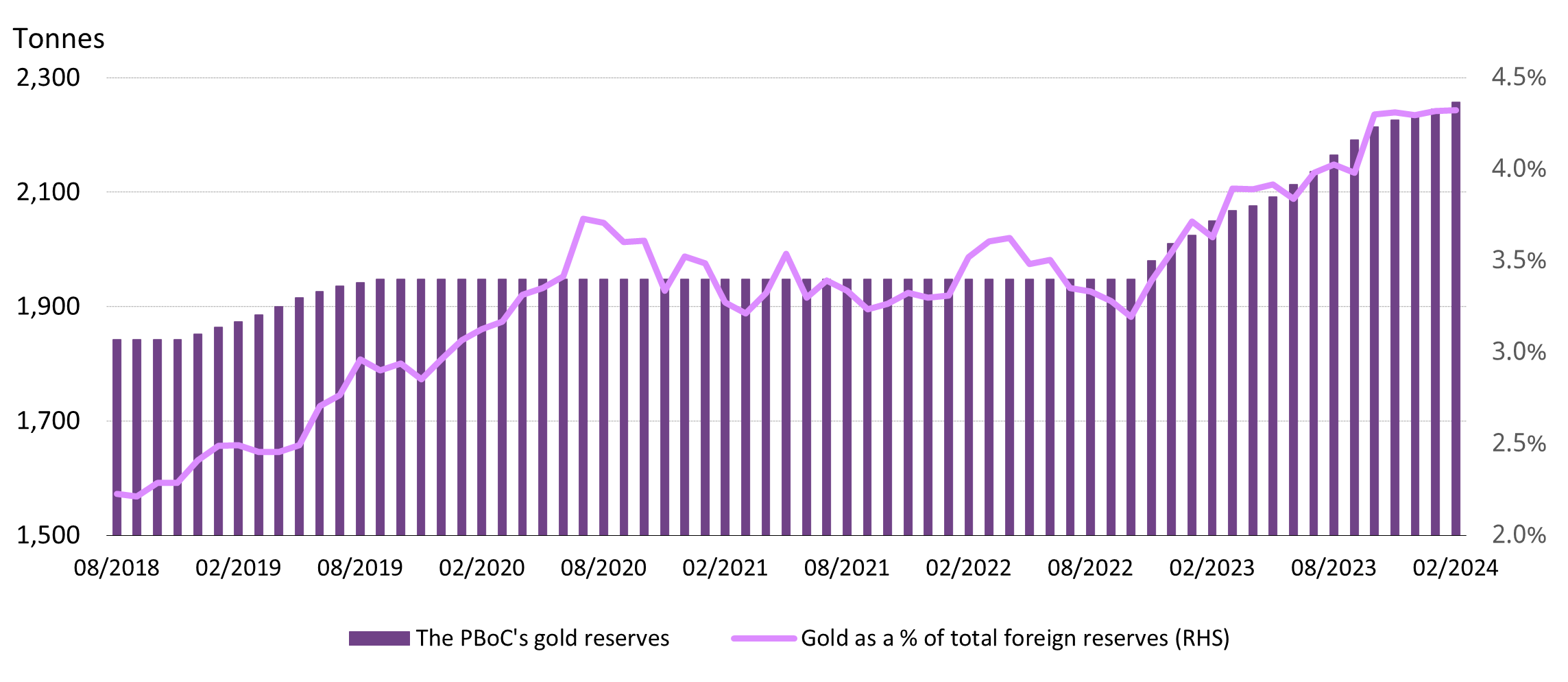

Half a dozen central banks have been key buyers: China, India, Turkey, Jordan, Kazakhstan and the Czech Republic. Probably China has taken note how Russia was frozen out of the Western banking system, losing around $300 billion (£240 billion) of wealth after war in Ukraine began. At end-February 2024, China’s central bank owned gold representing 4.3% of its foreign exchange reserves, up from 3.4% in November 2022. Gold supply obviously being limited, this has helped squeeze up prices.

China’s gold reserves

Source: People’s Bank of China, World Gold Council.

Other central banks followed suit, and now there is a price surge as individuals in Asia jump on the buying bandwagon.

The US election may be helping also as it draws attention to US federal debt running out of control – “up another $1 trillion every 100 days” according to reports – putting the Federal Reserve between a rock and a hard place on interest rates. If it keeps them high, a debt management crisis gets more likely, if rates are cut then the 2% inflation target is kissed goodbye. And that is before the established chaos of Trump back in the White House.

The gold price had trended broadly sideways last year to $1,820 before the 7 October Hamas attack on Israel saw a jump over $2,120 by early December. The price has really taken off from just over $2,000 in late February though.

Source: TradingView. Past performance is not a guide to future performance.

Why gold mining shares are best means to play gold

I say “play” because all this gets highly speculative. Mining shares are geared to gold prices, effectively a play on crowd sentiment. Benjamin Graham – the “father of value investing” - and his “margin of safety” as the defining principle of investment, are out the window.

You are also exposed to operational gearing of a mining operation, which means revenue changes are typically amplified at the profits level. This explains why gold is up around 16% since late February yet mid-cap gold miner Centamin (LSE:CEY) has soared well over 40% from 90p.

Mind how Centamin’s long-term chart is a roller coaster, as momentum traders back it both ways. After the 2008 crisis ,this share soared from 30p to over 170p by end-2010 but gave it all back by mid-2013. It was then back up to 175p by March 2017, next sliding below 90p before an all-time high of 210p was struck in August 2020.

Source: TradingView. Past performance is not a guide to future performance.

The share has in recent days qualified for a 52-week high momentum screen, which could, in addition to gold price momentum, attract technical traders.

I think Centamin is possibly the best pick among London-listed gold miners. However, you do need to be aware this is substantially a “one-project company” and in Egypt, which brings political risk.

There is also a 50:50 profit sharing with the government; a nuisance perhaps but which at least has meant the “Sukari” project became accessible for Western investors. This is Egypt’s largest and first modern gold mine, indeed one of the world’s largest. It has produced 5.7 million ounces of gold since start up in 2009 and has a projected mine life to 2034.

Yet it has not been without classic angst of holding mining shares.

Back in 2012, a third of Centamin’s market value was wiped out and its shares suspended, after an Egyptian court declared its right to mine at Sukari was invalid. Such courts had challenged a number of contracts agreed during the rule of Hosni Mubarak, who was ousted in 2011. The matter did not, however, proceed to a judgment.

Some kind of nationalist backlash is not unusual where Western mining companies go into developing countries. Frequently, however, powers-that-be check such insurgency because they know Western expertise and capital is required to make it happen. Unless, that is, a political revolution ensues.

The shares also fell in August 2013 when violence escalated in the area where Sukari is located. While not specifically against Centamin, it took the share price down around 80% since before the court resistance kicked off.

Risk of instability remains in Egypt, and/or potential for the government to press for higher than a 50% profit share.

Management proclaims Centamin at inflection point

This can be a favourite PR tactic by listed companies given it grabs attention and instils fear of missing out. But here it looks justified. The 2023 annual report reads: “With the investment in resetting our operations now pivoting to investment in growth, we believe we are at an inflection point that will soon see us rewarded for the multi-year investment programme, with stronger free cash flow enabling us to deliver that growth while maintaining our track record of dividend payments.”

You would hope so, given the 10-year table shows good financial substance albeit some decline in the trend since 2020. In due respect, apart from 2015, operating margins have been above 20%, and near 40% in two years since 2014:

Centamin - financial summary

year end 31 Dec

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Turnover - $ million | 473 | 508 | 687 | 676 | 603 | 652 | 829 | 733 | 788 | 891 |

| Operating margin - % | 17.3 | 11.5 | 38.8 | 30.7 | 25.3 | 26.5 | 38.0 | 21.0 | 21.7 | 21.9 |

| Operating profit - $m | 81.6 | 58.4 | 267 | 207 | 153 | 173 | 315 | 154 | 171 | 195 |

| Net profit - $m | 81.6 | 51.6 | 266 | 96.4 | 74.8 | 87.5 | 156 | 102 | 72.5 | 92.3 |

| Reported EPS - cents | 7.1 | 4.4 | 18.5 | 8.3 | 6.4 | 7.5 | 13.5 | 8.7 | 6.2 | 7.8 |

| Nomalised EPC - cents | 12.9 | 8.5 | 20.6 | 11.9 | 10.7 | 10.0 | 13.5 | 10.7 | 6.2 | 8.1 |

| Operating cash flow/share - cents | 9.7 | 16.0 | 31.6 | 29.1 | 19.2 | 21.5 | 39.1 | 26.7 | 25.0 | 30.0 |

| Capital expenditure/share - cents | 7.7 | 6.1 | 9.2 | 7.1 | 7.6 | 8.1 | 12.0 | 20.7 | 23.6 | 17.2 |

| Free cash flow/share - cents | 2.0 | 9.9 | 22.4 | 22.0 | 11.6 | 13.4 | 27.1 | 6.0 | 1.4 | 12.8 |

| Dividend/share - cents | 2.9 | 2.9 | 15.5 | 12.5 | 5.5 | 4.0 | 15.0 | 9.0 | 5.0 | 4.0 |

| Earnings cover - x | 2.5 | 1.5 | 1.2 | 0.7 | 1 | 1.9 | 0.9 | 1.0 | 1.2 | 2.0 |

| Cash - $m | 126 | 200 | 400 | 360 | 283 | 285 | 291 | 208 | 102 | 93.3 |

| Net debt - $m | -126 | -200 | -400 | -360 | -283 | -285 | -291 | -208 | -102 | -93.3 |

| Net assets/share - cents | 116 | 118 | 125 | 117 | 111 | 112 | 112 | 115 | 114 | 118 |

Source: historic company REFS and company accounts

The 2023 results convey an improvement, helped by a 9% rise in realised gold prices – in context of a 4% rise in gold sold and 4% decline in cash costs. This translated into revenue up 13% and both net profit and earnings per share (EPS) up 27%. Adjusted free cash flow was transformed from near $18 million absorbed to $49 million generated.

With 2024 gold production guided at 470,000 to 500,000 ounces, consensus is for earnings per share to double to 16.5 US cents – based on $192 million net profit, up from $92.3 million.

As befits the industry, capital expenditure has been high in some years. Returns on capital employed have moderated into mid-teen percentages but are still good, and at end-2023 Centamin had no debt – instead, $93 million cash.

Despite a sharp rise in the shares to over 130p, the sterling forward price/earnings (PE) ratio looks around 10 times and the prospective yield around 2.5%, rising to over 5%. Projections are sketchy given the volatile gold price, but the aspect of political risk has helped keep the valuation modest.

Centamin does have a wide exploration portfolio in Egypt and the Ivory Coast, but Sukari is key.

Vigorous two-way trading lately

I notice a lot of shares being sold into the rise. For example, this morning nearly twice as many sold (for what trading indicators are worth) but Centamin adds 3p to 131p.

Warren Buffett says he does not like to get involved in “revolving-door” shares where owners are constantly entering and exiting. But like many of his aphorisms, regarding gold this one is contradictory.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- Wild’s Winter Portfolios 2023-24: up 25% with one month to go

After making his stance on gold abundantly clear over years – that it does not square with value-based investing – in the second quarter of 2020 Berkshire Hathaway Inc Class B (NYSE:BRK.B) spent $560 million on shares in Barrick Gold Corp (NYSE:GOLD) – exiting only two quarters later, but still exploiting a surge in the gold price during Covid.

It seemed a good example of how value-based investors sometimes drop their guard when they identify a potential boom/bust pattern evolving.

I feel similarly towards Centamin: it looks pretty much the choice pick among London-listed gold shares, and even if Iran backs off striking Israel in the short term, global angst is supportive for gold. China has by no means finished buying.

You have to decide timing but broadly: Buy.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.