Stockwatch: attractive yields and a possible upturn

There are a number of fundamental drivers that could trigger a longer-lasting improvement at this well-known company. Analyst Edmond Jackson also discusses odds of a takeover.

7th January 2025 11:05

by Edmond Jackson from interactive investor

After I examined GSK (LSE:GSK) as a frustrating roller-coaster share last year, it is pertinent to consider home improvement group Wickes Group (LSE:WIX) – currently a £370 million small-cap share at 152p.

As with a year ago at 157p, it continues to offer a yield above 7% that should be very well covered by free cash flow, even if roughly 1.3x prospective earnings cover looks potentially tight. The share price had risen to 175p by last September then got mauled in a tough fourth quarter.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

A dilemma, as underlined by latest British Retail Consortium figures, is UK sales growth close to flatlining. In the three months to December, total UK retail sales growth was 0.4% as shoppers prioritised spending on food and drink. At least those retailers should be relatively secure, although you cannot buy shares in Aldi and Lidl which continue their record sales run, hence are likely taking market share.

Total UK retail sales edged up just 0.7% but slipped in inflation-adjusted terms. The sector next faces £7 billion of higher costs from tax increases and regulation, where even food inflation looks set to rise to 3% this year. At 277p, Sainsbury (J) (LSE:SBRY) is being priced for a yield of just over 5% with possibly 1.6x earnings cover.

Implicitly, the market regards Wickes as potentially more exposed if discretionary spending is further pressured. Against this there is the well-established argument about how British housing stock is in real need of improvement. With an average energy efficiency rating of D, the UK’s near 27 million homes are among the least efficient in Europe, losing heat up to three times faster. Wickes has also shown some adeptness in marketing; for example, its budget “Lifestyle” fitted kitchens range has done well in the sub-£4,000 spending segment, which is a sweet spot.

- ii view: DIY retailer Kingfisher awaits housing recovery

- 10 hottest ISA shares, funds and trusts: week ended 3 January 2025

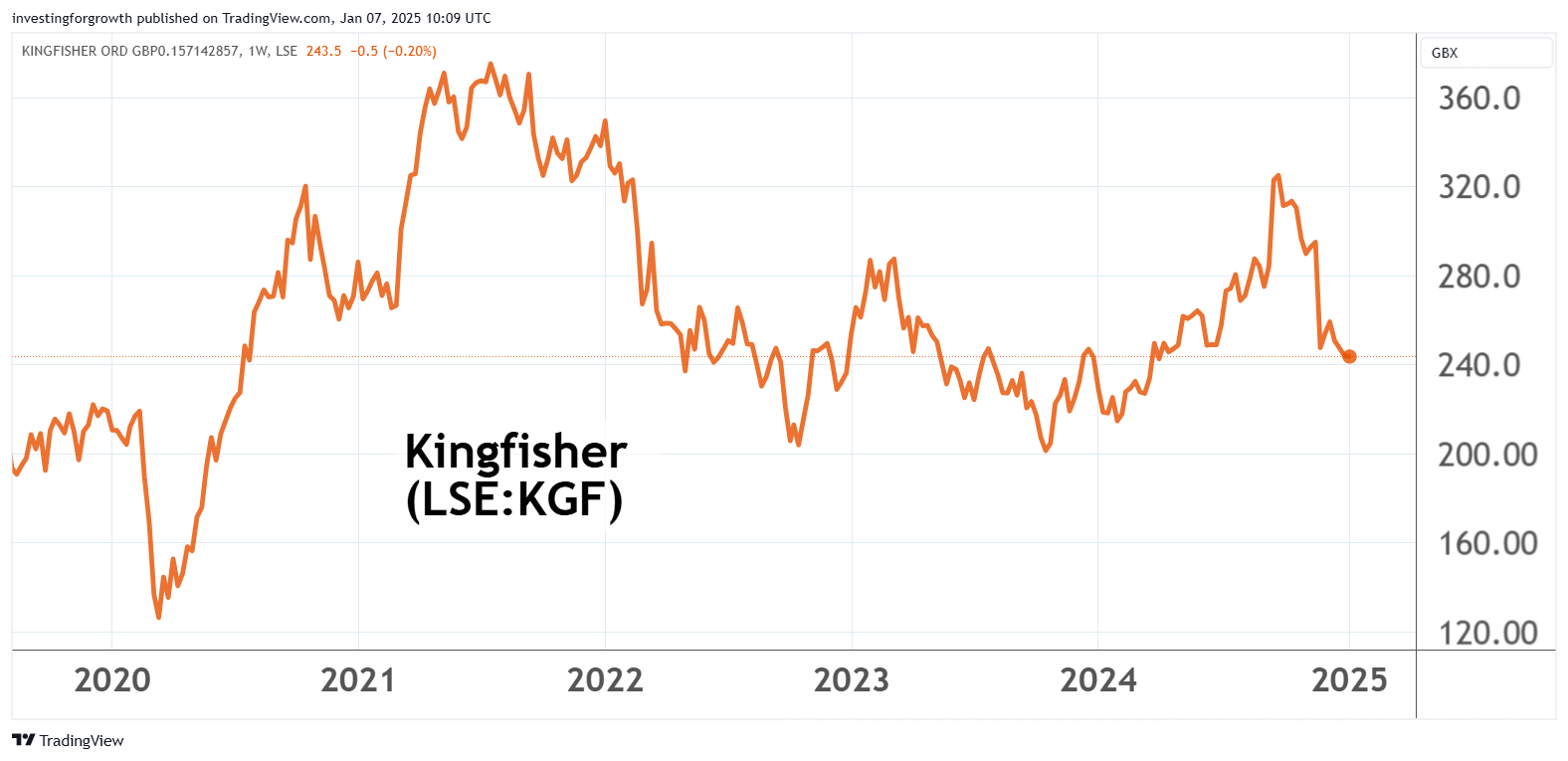

I find Wickes sometimes useful; it is just I am not too regular a shopper given Toolstation and Screwfix – owned by Kingfisher (LSE:KGF) – are nearer to hand. At 245p, the market is pricing Kingfisher for a 5% yield with around 1.7x earnings cover, its shares having just had a bad fourth quarter, down 25%. While broadly exposed to home improvement, it is a more complex £4.4 billion group with European interests, although it’s unclear whether there’s as much at risk currently as the UK.

Source: TradingView. Past performance is not a guide to future performance.

I may have an aspect of bias given I originally made a “buy” case for Wickes at 135p in March 2023 – similarly on a yield near 7% back then, and forward price/earnings (PE) multiple around 11x. Its rating has thus slightly contracted given higher uncertainties today, yet after 2023 put in a chart “double bottom” the trend would seem upwards, if volatile. Possibly some mean-reversion upwards is under way after an initial slump following Wickes’ 2021 divestment from Travis Perkins (LSE:TPK) in April 2021. The question is whether UK consumer prospects will allow it broadly to continue:

Source: TradingView. Past performance is not a guide to future performance.

A consolidating sector but revenue struggles to match inflation

In support of steady long-term growth, the UK home improvement market is estimated to be worth around £27 billion having grown around 2.5% annually in the last decade. Retailers should also now benefit from the failures of Wilko, CTD Tiles and Carpetright. Home ownership remains a national pre-occupation and when interest rates do manage to ease versus inflation, this should benefit the housing market. Refurbishment can happen whether in preparation for a home sale or after purchase. Under astute management and with a fundamentally cash generative set-up, Wickes therefore qualifies as a relatively dependable income share.

The group’s 2024 narrative shows its capital growth profile as dicier. First-half revenue slipped 3.4% to £800 million and adjusted operating profit by 16% as that margin slipped from 5.1% to 4.4% amid various cost inflation. It was a tale of two sides as retail representing 79% of sales rose 1% - albeit a slip relative to inflation – and the design/installation side – “do it for me” – fell 17% despite a near 19% rise in kitchen sales.

The interim income statement needed quite some unpacking. Reported operating profit was up 9% to £35 million as administrative expenses fell from £90 million to £80 million, albeit down 16% to £35 million also on an adjusted basis. Fundamentally, it was a decline due to various higher costs including wages; however, unrealised gains and losses on foreign exchange derivatives (linked to importing) were represented from net finance costs into cost of sales. I still would have liked further explanation of the 11% cut in admin costs which looked admirable, but I wonder how much further it can go?

- Wild’s Winter Portfolios 2024: riskier portfolio outperforms Wall Street

- Insider: boss deals in Raspberry Pi shares

- Watch our video: the megatrend I'm following in 2025

The third quarter then showed both sides improving – in the sense of retail up 4.2% like-for-like while design/installation mitigated its decline to 13.3%. Group revenue edged up 2.1% or 0.4% like-for-like, but was roughly flat when considering inflation. Mind, third-quarter trading did benefit from outdoor projects delayed by a wet spring and early summer, with such pent-up demand expected to subside in the fourth quarter.

Management was still “comfortable” with 2024 profit expectations, where consensus has looked for around £31 million after tax and expects this to rise to £36 million in 2025. Hence a chief issue for sentiment is whether a later-January trading update can affirm growth hopes this year. It seems early to do so anyway, given the uncertainty about whether tax rises affect employment in the months ahead, and also whether further tax rises become necessary as the Institute for Fiscal Studies (IFS) estimates.

Downside to the shares therefore looks limited – barring a recession – due to a relatively superior yield, yet capital prospects are murkier to divine in the near term. Wickes appears to be growing market share, but will 2025 enable this to boost profit?

Wickes Group - financial summary

Years to 1 Jan then 31 Dec

| 2019 | 2020 | 2021 | 2022 | 2022 | 2023 | |

| Yr to 31 Dec | ||||||

| Turnover (£ million) | 1,200 | 1,292 | 1,347 | 1,535 | 1,559 | 1,554 |

| Operating margin (%) | 4.7 | 4.4 | 4.5 | 6.3 | 4.3 | 4.1 |

| Operating profit (£m) | 56.6 | 56.2 | 61.0 | 96.7 | 67.1 | 62.9 |

| Net profit (£m) | 14.9 | 12.9 | 26.3 | 58.8 | 31.9 | 29.8 |

| Reported EPS (p) | 5.9 | 5.1 | 10.4 | 23.3 | 12.5 | 11.7 |

| Normalised EPS (p) | 11.0 | 14.1 | 17.8 | 34.6 | 29.2 | 15.5 |

| Earnings per share growth (%) | 28.5 | 26.1 | 94.8 | -15.6 | -47.0 | |

| Return on total capital (%) | 5.2 | 5.3 | 7.2 | 11.8 | 8.6 | 8.3 |

| Operating cashflow/share (p) | 70.1 | 43.0 | 83.8 | 40.2 | 49.4 | 70.2 |

| Capex/share (p) | 17.4 | 9.6 | 8.0 | 10.5 | 15.9 | 15.0 |

| Free cashflow/share (p) | 52.7 | 33.4 | 75.8 | 29.7 | 33.5 | 55.3 |

| Dividend/share (p) | 0.0 | 0.0 | 10.9 | 10.9 | 10.9 | 10.9 |

| Cash (£m) | 16.2 | 25.4 | 6.5 | 123 | 99.5 | 97.5 |

| Net debt (£m) | 879 | 830 | 784 | 619 | 592 | 578 |

| Net assets (£m) | 264 | 279 | 130 | 161 | 164 | 163 |

Source: flotation prospectus and company accounts.

Might this be time for a US acquirer to act?

Wickes seems to have drifted from investors’ radars but is a sound cash-generative operation for a buyout. The above table shows free cash flow per share trending often substantially in excess of earnings, which is useful for debt service besides underwriting payouts.

Not surprisingly, this is another company engaging in buybacks - from mid-March to mid-September - at around 3.2% of the issued share capital, was repurchased for cancellation. Annual results in March should include an update on whether this continues.

The mid-2024 balance sheet actually had no financial debt but there were £615 million longer-term leases and £86 million short-term leases, versus £152 million cash which was down 20% on mid-2023. Effectively, that is quite some gearing on net assets of £154 million despite constituting only 17% goodwill/intangibles.

Net finance costs took just over a third of interim operating profit, and it seems any buyout analyst would want to see more proof that UK interest rates are coming down given inflation may tick up again. Consensus is still currently for a 0.25% ease in February then two more rate cuts in August and November, which would aid Wickes’ profitability.

A key question seems to revolve around whether strength in the US dollar versus sterling, since September, is maintained and thus aids further US takeovers. This is probably so, given the UK’s fiscal and growth challenges.

So, while I do not flag Wickes as a bid target, there seems an off-chance which part-compensates for lack of near-term growth appeal, behind lack of interest in the shares. It would be logical to act relatively soon while a premium offer looks attractive, before Wickes can benefit from any upturn.

I therefore retain a “buy” stance.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.