Stockwatch: are these the next banks being re-rated?

Despite some near-term uncertainty, a recovery could be under way at this finance sector duo. Analyst Edmond Jackson has also spotted director share buying at one of them.

25th March 2025 11:04

by Edmond Jackson from interactive investor

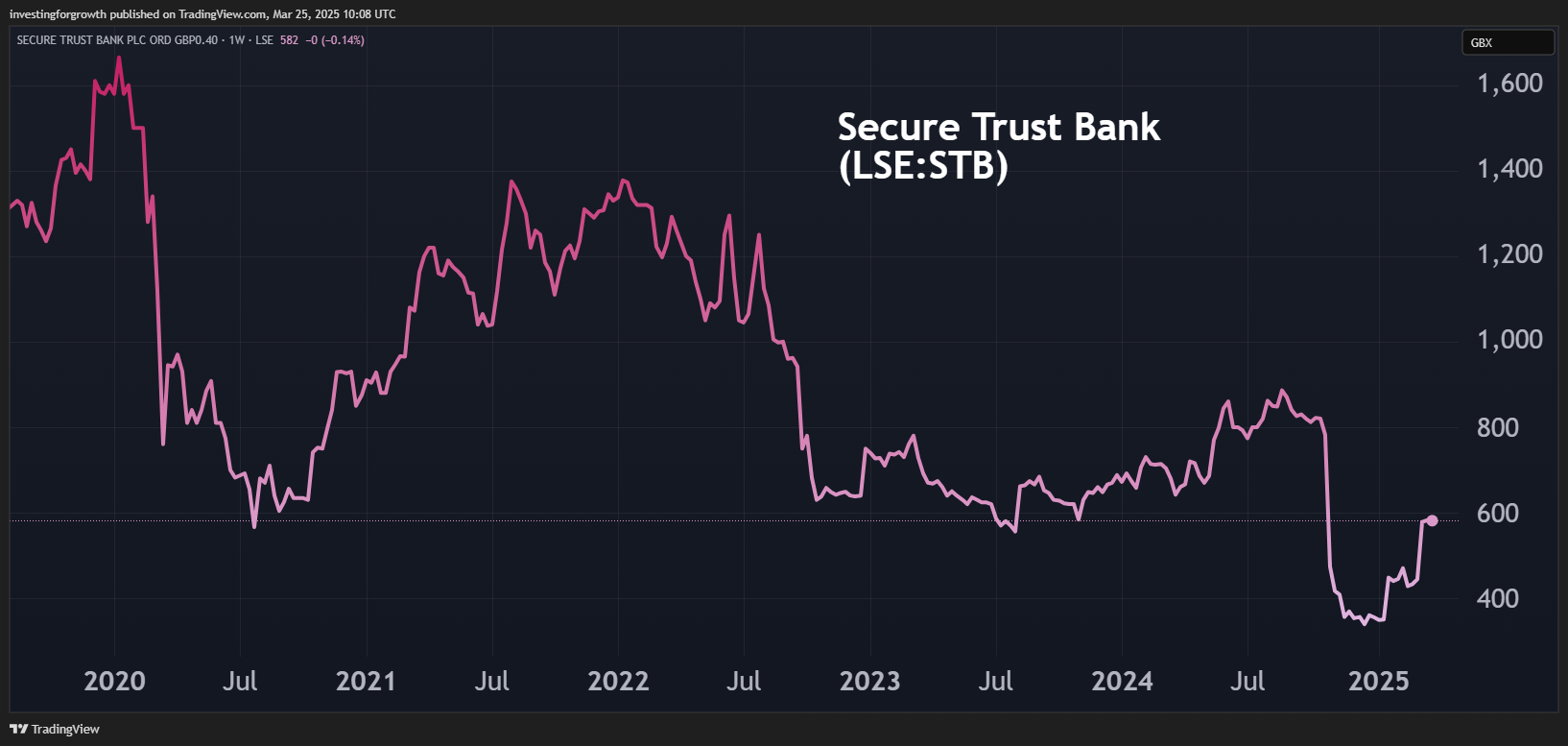

Should you trust rebounding share price charts for Secure Trust Bank (LSE:STB) and Close Brothers Group (LSE:CBG) despite various risks with a Supreme Court ruling next month on compensation for car finance mis-selling?

After plunging over 50% and 60% respectively last year, charts imply both shares have bottomed: Secure Trust at around 350p early this year and currently at 572p, and Close at 185p last November and now 284p. Possibly enough investors scared by the probe have sold, leaving the balance of trading tending to the upside unless the eventual verdict is crippling.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

Source: TradingView. Past performance is not a guide to future performance.

Close did, however, drop around 20% to 275p following interim results to 31 January, which estimated a £164 million provision for claims and costs, relative to a market capitalisation of around £426 million. But Secure Trust appeared sufficiently confident to judge for only £7 million relative to £109 million market cap. Outcomes could be radically different from such estimations, however.

Is a pragmatic verdict the most likely outcome?

Despite the Supreme Court rejecting an intervention by the UK Treasury – arguing that PPI-scale compensation would make car loans harder and more expensive to get – investors overall seem to have decided this latest financial services fiasco will reach a realistic conclusion. They hope the outcome will see respectful compensation that any guilty parties are able to pay, rather than crippling the businesses. That would still leave scope to compromise shareholder value going forward, and it is a speculative question just how much is already priced in.

- Five AIM income stocks for your ISA in 2025

- Insider: a FTSE 100 stock backed to rebound after sell-off

- Important last-minute checklist for tax year end 2025

I note that current market values around 0.3x net tangible asset value – even after modest recoveries – have lent support in the banking sector, for example at Barclays (LSE:BARC) and Metro Bank Holdings (LSE:MTRO) a year ago. These banks were not “litigation plays” of sorts but each had their own varied reasons for loss of credibility. Admittedly, they still trade on low asset ratios of around 0.6x versus NatWest Group (LSE:NWG) on 1.3x, although NatWest has rallied 145% in the past 18 months.

So, if the verdict is pragmatic versus this kind of asset’s discount, and the banking environment is reasonably supportive then, yes, both shares can offer further upside.

Outlook for lending in a challenged UK economy is key

Secure Trust’s 2024 results on 13 March showed near 9% net lending growth primarily driven by a 13% improvement on the consumer side, while property (described as “business”) rose 4% and commercial saw a small fall in a subdued market.

The outlook statement did not add much insight beyond reiterating a £4 billion target versus £3.6 billion achieved in 2024, with a net interest margin (difference between what is earned from loans versus paid to depositors) of 5.4%, which was targeted at over 5.5%.

Close’s loan book eased 3% to £9.8 billion over the six months to 31 January, its adjusted operating profit down 15% to £75 million and adjusted earnings per share by 29% to 30.9p. So, its share drop was not all about the motor finance outcome. Management proclaims: “strength and resilience of our business model...we are a trusted partner to UK smaller and medium-sized enterprises...more relevant than ever, and aligned with the UK government’s growth agenda”.

- eyeQ: Close Brothers gets interesting after 20% slump

- ISA ideas: short-term plays and long-term holds

- Watch our video: mining stocks, Trump, tariffs, China and critical metals

Recent falls in UK business confidence need to improve lest they temper demand for credit. A worst-case scenario would be recession leading to a jump in bad loans, where Secure Trust already cites a 43% rise to £62 million for 2024. This was significantly due to a pause in collections relating to vehicle finance leading operational issues, but defaulted loans rose too.

Last October’s court judgment hampered recovery of these defaults and, more positively, management says its quality of new lending has improved, hence arrears reduced from 12% to 10%.

To a large extent such banks – serving smaller enterprises and consumers – are at the behest of the UK economy, though savings accounts can benefit from people shoring up their finances amid uncertainty. Secure Trust is largely deposit-funded, hence it is respectable how these grew 10% to £3.2 billion last year, helped by new accounts and ISAs.

Profits require firm lending, however, at a decent margin from what is paid out to savers. Secure Trust had a stable net interest margin of around 5.4% last year, while Close’s recently slipped from 7.5% to 7.3%.

Uncertainty to prevail at least through April

The motor finance outcome is a two-stage process: a final decision by the Supreme Court on technical aspects of liability by mid-May, then the Financial Conduct Authority (FCA) will consult on an industry-wide compensation scheme if the court rules in motor customers’ favour.

One scenario might be akin to the pension fund liabilities at BT Group (LSE:BT.A) or Reach (LSE:RCH) – jokingly referred to as “pension fund with company attached” where big liabilities have taxed returns to shareholders over years. Yet both companies stabilised, and attractive dividends – even periods of capital growth – have been possible even after pension trustees had negotiated their dues.

Secure Trust Bank - financial summary

Year-end 31 Dec

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Turnover (£ million) | 153 | 166 | 167 | 150 | 170 | 185 | 204 |

| Operating margin (%) | 22.7 | 23.3 | 12.0 | 37.4 | 22.9 | 19.5 | 14.3 |

| Operating profit (£m) | 34.7 | 38.7 | 20.1 | 55.9 | 39.0 | 36.1 | 29.2 |

| Net profit (£m) | 28.3 | 31.1 | 16.2 | 45.6 | 33.7 | 24.3 | 19.7 |

| Reported earnings/share (p) | 151 | 166 | 87.0 | 244 | 153 | 137 | 101 |

| Normalised earnings/share (p) | 151 | 166 | 87.0 | 244 | 153 | 162 | 136 |

| Operating cashflow/share (p) | -443 | -1,098 | 514 | -517 | 170 | -236 | 575 |

| Capital expenditure/share (p) | 13.3 | 35.3 | 10.2 | 7.0 | 14.0 | 14.0 | 5.2 |

| Free cashflow/share (p) | -456 | -1,133 | 503 | -524 | 156 | -250 | 570 |

| Dividend/share (p) | 83.0 | 20.0 | 44.0 | 61.1 | 45.1 | 32.2 | 33.8 |

| Covered by earnings (x) | 1.8 | 8.3 | 2.0 | 4.0 | 3.4 | 4.3 | 3.0 |

| Return on total capital (%) | 1.4 | 1.4 | 0.8 | 1.9 | 1.1 | 1.0 | 0.7 |

| Return on equity (%) | 12.7 | 12.7 | 6.2 | 16 | 9.4 | 7.9 | 5.6 |

| Cash (£m) | 215 | 154 | 245 | 286 | 421 | 405 | 469 |

| Net Debt (£m) | -164 | -99.1 | -190 | -232 | -367 | -310 | -374 |

| Net assets per share (p) | 1,283 | 1,375 | 1,452 | 1,622 | 1,749 | 1,811 | 1,890 |

Source: historic company REFS and company accounts.

Secure Trust’s results’ statement cited only 4% of its vehicle finance commission payments involved in contentious “discretionary” arrangements. Its sales structure on motor finance – 80% through brokers, 20% dealers – means only 20% of their commission payments relate to those liable.

Investors also appeared to interpret a 5% rise in the 2024 dividend to 33.8p a share as a sign of confidence in the court outcome. But I think the board would have set payout policy irrespectively, and earnings cover is three times anyway. If events do compromise future payouts, it would be a case of force majeure.

Close’s board appears more cautious. Having suspended dividends, they await clarity on the motor finance review and subsequently its financial impact.

Both banks ensure a similar caveat: how management has modelled and probability-weighted various scenarios and compensation due, which range very significantly either way.

Close Brothers Group - finncial summary

Year end 31 July

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Turnover (£ million) | 889 | 950 | 1,038 | 1,025 | 1,028 | 1,048 |

| Operating profit (£m) | 265 | 141 | 265 | 233 | 112 | 142 |

| Net profit (£m) | 202 | 110 | 202 | 165 | 81.1 | 100 |

| Operating margin (%) | 29.8 | 14.8 | 25.5 | 22.7 | 10.9 | 13.5 |

| Reported earnings/share (p) | 133 | 72.5 | 134 | 110 | 54.2 | 66.9 |

| Normalised earnings/share (p) | 133 | 75.5 | 135 | 110 | 54.2 | 68.4 |

| Operational cashflow/share (p) | 13.5 | 284 | 78.7 | 106 | 683 | -255 |

| Capital expenditure/share (p) | 31.1 | 32.8 | 37.5 | 38.9 | 41.4 | 29.7 |

| Free cashflow/share (p) | -17.6 | 251.0 | 41.2 | 66.7 | 641 | -284 |

| Dividend per share (p) | 66.0 | 40.0 | 60.0 | 66.0 | 67.5 | 0.0 |

| Covered by earnings (x) | 2.0 | 1.8 | 2.2 | 1.7 | 0.8 | 0.0 |

| Return on total capital (%) | 2.5 | 1.3 | 2.2 | 1.8 | 0.8 | 1.0 |

| Cash (£m) | 1,106 | 1,376 | 1,331 | 1,255 | 1,937 | 1,584 |

| Net debt (£m) | 1,509 | 1,233 | 1,270 | 1,615 | 907 | 772 |

| Net assets (£m) | 1,407 | 1,451 | 1,570 | 1,658 | 1,645 | 1,843 |

| Net assets per share (p) | 930 | 959 | 1,041 | 1,102 | 1,093 | 1,224 |

Source: company accounts.

Close does offer diversity by way of its Winterflood market-making and business services operations, the former recently in modest operating losses, while services grew income 22% to £9.6 million on assets under management up 27% to £17.5 billion.

10-month trend of director buying at Secure Trust

From last May, four directors bought around £435,000 of Secure Trust shares, although this was at over 800p before the motor finance commissions probe was launched, and you take your view on whether lending prospects have also changed. Two trades were struck last November at around £20,000 and £25,000, at prices of 486p and 381p respectively.

Notably on the 13 March (results day), the finance director’s partner, and a senior manager’s partner, each bought around £20,000 of shares at 513p and 543p respectively. Then on 24 March, a senior manager bought into the rally, splashing out nearly £60,000 at 619p.

At Close, there was modest buying last September around 420p by three directors but nothing since the investigation or interim results. The only trading has been modest selling after options exercising, which looked likely related to capital gains tax.

Overall, I think both shares broadly rate a “buy” – on an averaging-in basis. You face the uncertainties of the motor finance outcome and UK macro, where possibly these bank shares remain volatile henceforth. But unless the Supreme Court truly has a mind of its own, I suspect the authorities have learned from the PPI fiasco, that is not to sling an albatross around banks’ necks.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.