Stocks mixed on ‘buy houses, not holidays’ message

Relaxing lockdown restrictions has sent some sectors soaring, but others have plunged again.

13th May 2020 13:01

by Graeme Evans from interactive investor

Relaxing lockdown restrictions has sent some sectors soaring, but others have plunged again.

A focus on holidays, house moves and luxury cars got a mixed response from investors today amid warnings over the post-lockdown dangers of restarting economies too quickly.

Last night's message from America’s leading infectious-disease specialist Dr Anthony Fauci triggered a sharp sell-off on Wall Street, with the S&P 500 closing almost 2% lower and causing the FTSE 100 index to start down 1% this morning. The mood of London investors was not helped by official figures showing the UK economy shrank by a record 5.8% in March.

Fauci's warning to US states that they could damage the economy further if they lifted restrictions on business activity before there is a 14-day decline in Covid-19 cases, has parallels in the UK, where efforts to restart a number of industries have gathered pace.

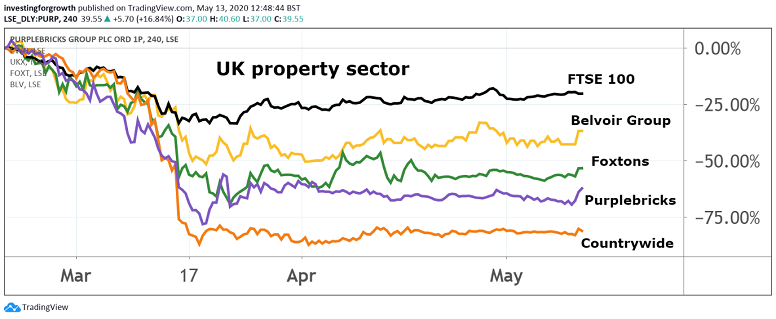

This includes England's housing market, which was today unfrozen to allow estate agents, conveyancers and removals firms to carry out their work at a social distance. Stock market beneficiaries included online agency Purplebricks (LSE:PURP), which jumped as much as 29% to over 43p, but remains sharply down on its pre-Covid price of around 100p, and uncomfortably close to its record low of 23p seen in mid-March.

Source: TradingView. Past performance is not a guide to future performance.

Property services group Countrywide (LSE:CWD), which operates 850 branches and has operations across estate agency, surveying and conveyancing, jumped 17% to 68.5p. FTSE 100 listed online portal Rightmove, whose shares have fared better than the others since March, was 1% lower at 513p after surrendering initial gains this morning.

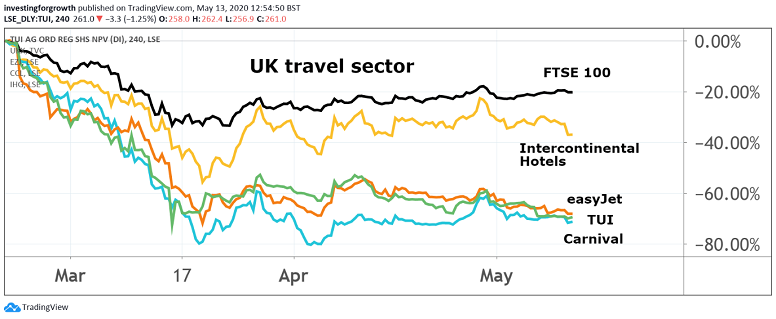

There was no respite for travel company TUI (LSE:TUI), whose shares fell another 6% to a record low of 246p, despite insisting in half-year results that “our customers will still want to holiday”. Analysts at UBS believe that fair value for the stock is 110p.

The Anglo-German holidays operator said today:

“Online enquiries to our website indicate to us that customers are still actively researching holidays and destinations; customers want to travel as soon as tourism can take off responsibly and safely.”

Yesterday, however, UK health secretary Matt Hancock ruled out “lavish, international holidays”, while quarantine rules mean returning Britons will soon have to isolate for 14 days.

Source: TradingView. Past performance is not a guide to future performance.

TUI has responded to the crisis by permanently reducing overheads by 30%, with an impact on potentially 8,000 roles that will either not be recruited or reduced. It has sufficient funds to cover the coming months, with cash and available facilities of €2.1 billion (£1.85 billion).

The company said:

“The tourism industry has weathered a number of macroeconomic shocks throughout the most recent decades, however the Covid-19 pandemic is unquestionably the greatest crisis the industry and TUI has ever faced.”

Today's underlying loss of €813 million was down €512 million, due to travel disruption in March and Covid-19 related costs, most notably ineffective oil price hedges.

It had earlier enjoyed an “exceptional” start to its summer 2020 programme, with January the best ever bookings month in the company’s history.

TUI said: “We consider ourselves very well positioned to benefit from a recovery post the Covid-19 crisis. Our vertically integrated model enables a fully coordinated restart of the value chain.”

- UK GDP suffers biggest fall on record

- Is now a good time to pick up Purplebricks shares?

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Investors also had little appetite for Aston Martin Lagonda (LSE:AML) shares after the luxury car brand recorded first-quarter losses of £119 million following a 60% slide in revenues. The company fuelled speculation that it may need further support from shareholders after saying that it “continues to review all future funding and refinancing options to increase liquidity”.

Shares fell another 14% to 32.5p, compared with 1,900p just over 18 months ago at its IPO. Net debt spiralled to £956.1 million, but this was before Formula One motor racing financier Lawrence Stroll took a 25% stake in the company as part of a £536 million capital raising.

The new executive chairman said his immediate priority was to rebalance supply and demand by reducing dealer inventories. The company's St Athan facility in South Wales also reopened last week, which should mean the company is on track for deliveries of its new DBX sport utility vehicle this summer.

An Aston Martin F1 team will launch next year, which Stroll hopes will give the brand a significant global marketing platform.

He added:

“Having been in the business for a few weeks now I am even more enthusiastic and confident in the multi-year plan that we have set out to bring new and exciting products to market to drive demand and build the Aston Martin brand.”

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.