Stocks that made you a fortune last tax year

Huge stock market losses grab the headlines, but there were also massive winners in the past 12 months.

7th April 2020 15:03

by Graeme Evans from interactive investor

Huge stock market losses grab the headlines, but there were also massive winners in the past 12 months.

Even though savers and investors finished the 2019/20 tax year in a sea of red, a select band of stocks provided ample consolation with some stunning gains over the 12 months.

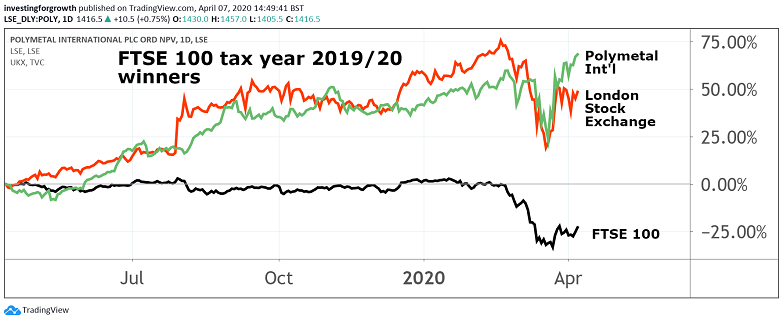

Holding FTSE 100 index pair Polymetal International (LSE:POLY) and London Stock Exchange (LSE:LSE), for example, would have delivered share price returns of 63% and 46% respectively. Russian miner Petropavlovsk (LSE:POG) and CMC Markets (LSE:CMCX) also more than doubled in value in the FTSE All-Share.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

Source: TradingView Past performance is not a guide to future performance

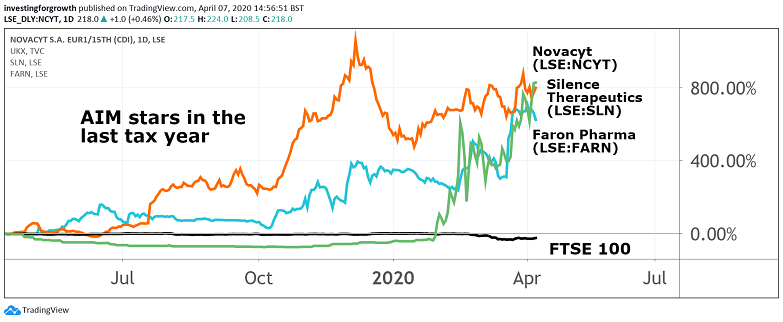

And an impressive 33 stocks achieved the same feat in the junior AIM market, led by rises of 760% for both coronavirus testing firm Novacyt (LSE:NCYT) and Silence Therapeutics (LSE:SLN) in 2019/20.

These gains will have been more than offset for most investors by the severe impact of the Covid-19 pandemic and lockdown on some of the London market's biggest stocks. Popular holdings such as BT Group (LSE:BT.A), Centrica (LSE:CNA), Lloyds Banking Group (LSE:LLOY) and ITV (LSE:ITV) all fell by more than 50% in the year, with the pain compounded in most cases by the prospect of no dividend this year.

Cruise ship firm Carnival (LSE:CCL) was the biggest faller over the year with a decline of 84.5%, while aero engines maker Rolls-Royce (LSE:RR.) was down 73% prior to the significant rebound seen since the start of the new tax year on Monday.

There were also six stocks in the “90% club” in the FTSE All-Share, with Intu Properties (LSE:INTU), Amigo Holdings (LSE:AMGO), Ted Baker (LSE:TED), Tullow Oil (LSE:TLW), N Brown (LSE:BWNG) and Costain Group (LSE:COST) the ones blowing a big hole in portfolios.

Never before will so many investors be taking the opportunity to reduce capital gains tax by carrying forward losses to use against taxable gains in future years. But for many hardy investors, now may look like a good time to put some of this year's £20,000 ISA allowance into immediate action by betting on a recovery in share prices as the pandemic runs its course.

- FTSE 100 stocks jump 25% and three shares confirm corona boom

- The first fund we’ve bought since the crash

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Those early-bird investors will be hoping for a repeat of 2018/19, when the 25 top performing stocks in the FTSE 350 produced gains of 40% or more and were led by Ocado Group (LSE:OCDO) with a rise of 165%.

The winners in 2019/20 were more defensive in nature, with Pennon Group (LSE:PNN) among the best performing stocks in the FTSE 100. The South West Water owner rose 43% following a deal to sell its recycling and waste business Viridor to investment firm KKR. Severn Trent (LSE:SVT), meanwhile, improved 8% and United Utilities (LSE:UU.) added 3%.

AstraZeneca (LSE:AZN) and Hikma Pharmaceuticals (LSE:HIK) also provided a safe haven for 2019/20 tax year investments, as the pair generated returns of 16% and 27% over the period. London Stock Exchange was 46% higher as progress towards its $27 billion transformative deal to buy data and analytics provider Refinitiv helped offset a significant decline in new stock market listings.

Precious metals miner Polymetal International took the crown for the biggest blue-chip riser in the tax year, helped by a surge in gold prices. Petropavlovsk achieved the same feat in the FTSE 250 index, with its rise of 127% only matched by CMC Markets as the spread betting firm benefited from significant market volatility toward the end of the period.

Rival provider Plus500 (LSE:PLUS), which today reported a 487% jump in revenues for its most recent trading quarter, was up 46% over 2019/20. Other All Share risers included Avon Rubber as the maker of respiratory systems continued to see strong demand from the US military.

Its shares rose 87% in the year, just ahead of Galliford Try (LSE:GFRD) after the construction firm bolstered its balance sheet with the disposal of its housebuilding division Linden Homes.

Other notable risers included Pets at Home (LSE:PETS), which jumped 45% after a strong end to the tax year as it benefited from its status as an essential retailer during the coronavirus lockdown.

The AIM market, meanwhile, threw up its usual array of big winners and losers in 2019/20. As well the rise for Novacyt (LSE:NCYT) as its looks to meet global demand for its Covid-19 testing kits, Finland's Faron Pharmaceuticals (LSE:FARN)was up 672% after progress on its joint initiative to prevent Covid-19 and other pneumonia patients from dying of acute respiratory distress syndrome.

Silence Therapeutics (LSE:SLN) also enjoyed a stunning return to form. The original member of the junior market when it started in 1995 has been transformed by a collaboration with US firm Mallinckrodt Pharmaceuticals for the commercialisation of its RNAi Therapeutics technology.

Source: TradingView Past performance is not a guide to future performance

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.