Stockopedia: how to find the most promising growth stocks in the market

This growth strategy looks for earnings and price strength, but at the right time.

14th April 2021 16:38

by Ben Hobson from Stockopedia

This growth strategy looks for earnings and price strength, but at the right time.

This time last year we were in the throes of uncertainty and a market crash that was faster and sharper than anything most of us can remember. Shares have been in recovery mode ever since, and some have not only bounced back but are now obliterating their previous high prices.

Buying growth stocks - across the market-cap range - is a strategy that has paid off well over the past decade. But in all the recent chaos, earnings growth and price momentum now feel much more vulnerable than they have done in recent years.

But one growth strategy that is proving to be effective is one that looks for solid earnings and price strength but takes more of a trader’s approach to timing - and that’s William O’Neil’s CAN SLIM model.

O’Neil is a legend among investors all over the world for his successful system of buying fast-growing shares. Accelerating earnings growth and price momentum are crucial components, as well as a strict discipline of selling on signs of weakness.

Finding market winners

O’Neil’s 1994 book How to Make Money in Stocks is an investment classic that followed years of research into the background of some of the best-performing shares of all time. Its appeal lies in the excitement of finding companies that are seeing their profits rise just as the market is starting to notice.

The popularity of his approach meant that O’Neil, a stockbroker by trade, could build a mini empire for his ‘CAN SLIM’ strategy.

- Stockopedia: 10 value investing shares proven by the ‘magic formula’

- Stockopedia: eight growth shares at potentially cheap prices

CAN SLIM represents the seven factors that O’Neil looks for in a stock. His strategy blends conventional ‘growth’ measures such as current and annual earnings growth and new product innovation with ‘technical’ indicators like the supply and demand for shares, whether it’s the leader in its specific sector, whether it has institutional support allied with overall bullish market strength.

Importantly, O’Neil doesn’t pay too much attention to valuation ratios such as the price-to-earnings (PE) ratio when it comes to analysing shares. His research found that it was actually stocks that looked very expensive based on these measures that went on to be some of the greatest winners.

Given the risks of buying expensive stocks, O’Neil insists on setting strict 8% stop-losses on entry points, which limits the financial damage that can be done if the price falls.

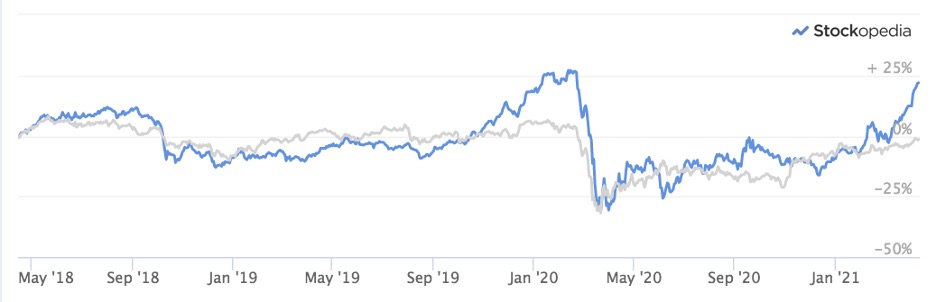

A pre-costs strategy based loosely on CAN SLIM rules tracked by Stockopedia has performed well against the FTSE All-Share over the past three years - but the performance has been on a tear in in recent months.

Past performance is not a guide to future performance.

The essence of this strategy looks for fast and accelerating earnings growth in profitable companies with prices that are trending higher and close to new highs. Here are some names that currently pass these rules...

| Name | Mkt Cap (£m) | EPS Growth % Q on Q | EPS Gwth % Forecast 1y | Return on Equity % | Relative Price Strength 1y |

|---|---|---|---|---|---|

| SDI Group (LSE:SDI) | 189.2 | 55.4 | 104.3 | 15.8 | 156.7 |

| Ferrexpo (LSE:FXPO) | 2,160 | 54 | 32.5 | 44.7 | 145 |

| Sylvania Platinum (LSE:SLP) | 324.4 | 69.8 | 115.9 | 33.6 | 142 |

| Alumasc (LSE:ALU) | 72.3 | 2,555 | 139.8 | 18.6 | 135.8 |

| Volex (LSE:VLX) | 547.4 | 67.8 | 79.5 | 16.2 | 129.7 |

| Kainos (LSE:KNOS) | 2,063 | 111.6 | 142.3 | 43.1 | 100.1 |

| Games Workshop (LSE:GAW) | 3,445 | 203.7 | 60.5 | 67.7 | 76.8 |

Some of these names have become very highly regarded by growth investors in recent years - and they are still showing very strong trends. Companies like the buy-and-build scientific tech company SDI, building products firm Alumasc, wiring specialist Volex and niche gaming retailer Games Workshop have all performed very well - and still pass these growth strategy rules.

- Discover how to be a better investor

- Your chance to win £1,000: take part in the Great British Retirement Survey

Approaches like O’Neil’s CAN SLIM model are similar in nature to the strategies of other successful investors, like Sam Wienstein and Mark Minervini. They all focus on earnings growth in shares that the market is beginning to buy into. These firms need to be profitable but the valuation of their shares isn’t a major factor. What’s more important is a disciplined approach to selling them if they don’t perform as expected.

In bullish conditions, O’Neil’s approach has a track record of working well and that’s been illustrated in recent months in the UK. The approach needs careful handling but it can be a useful pointer to stocks that are growing fast and starting to capture the imagination of the market.

interactive investor readers can get a free 14-day trial of Stockopedia here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.