Stockopedia: eight growth shares at potentially cheap prices

This strategy can be an ideal way of finding strong returns at relatively cheap prices.

17th March 2021 14:30

by Ben Hobson from Stockopedia

This strategy can be an ideal way of finding strong returns at relatively cheap prices.

Investing in fast-growing companies has been especially profitable in recent years. With investors feeling bullish and looking for stocks with the ability to re-rate quickly, dynamic small- and mid-cap firms have found themselves in favour. Naturally, the valuations of some of these stocks have been rapidly increasing as well.

These circumstances have made it much harder to find growth companies trading at reasonable prices. Stockopedia’s tracking of strategies that look for strong signs of earnings growth in shares with price/earnings multiples that won’t send investors reeling, have turned up very little so far this year.

Part of the reason is that valuations among popular growth stocks have spiralled - so they no longer pass muster as classic ‘growth at a reasonable price’, or GARP, shares.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

But another reason is that most GARP strategies look for shares with a solid recent record of beating the market. In essence that means they hunt down shares that are trading ahead of the market on a six to 12-month period. Given that markets cratered pretty much a year ago - which impacted badly on growth shares - it’s no wonder that GARP strategies have been on the ropes ever since. But things are starting to change.

Every day that now passes is putting more distance between now and the market collapse that we saw 12 months ago. Relative price strength measures are improving all the time. In short, there’s a case to think that GARP strategies will continue to get better traction from here.

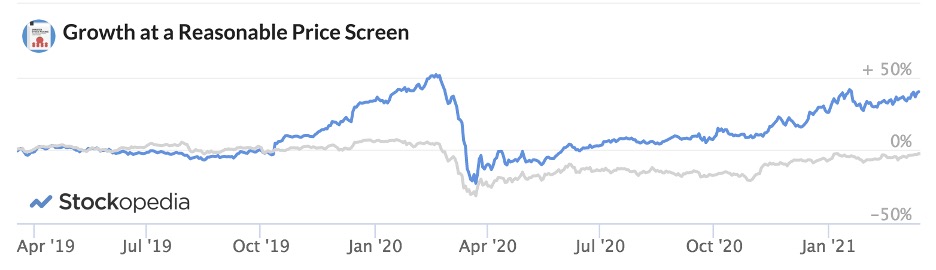

This chart of a GARP strategy shows just how well it was performing in the 18 months prior to Covid-19 hitting the UK - and just how badly it was affected when it did. It also shows a solid recovery since - and the good news is that more companies are starting to pass the rules of this screen.

- Stockopedia: how to find companies with the strongest ‘moats’

- Stockopedia: 10 stocks that brokers are backing to grow fast

- Stockopedia: 10 value stocks the market might be warming to

GARP strategies come in various flavours, but typically you’d been looking at rules like these:

- Double-digit compound earnings-per-share growth rate over three and five years

- Below average price-to-earnings (PE) ratio (and it must be below 20x)

- Double-digit return on capital employed that is growing year-on-year

- Net margins that are growing year-on-year

- Positive relative price strength against the market over the past year

Here are some of the stocks currently passing those rules. There are some trends here. For example, mining stocks such as Sylvania Platinum (LSE:SLP), Rio Tinto (LSE:RIO) and Polymetal (LSE:POLY) are a nod to the resurgence of parts of the mining sector, but again they have below-average valuations because of their naturally cyclical nature.

Name | Mkt Cap (£m) | EPS 5y CAGR (%) | P/E Ratio | Relative Price Strength 1y | Sector |

339.4 | 98.1 | 7.47 | +154.5 | Basic Materials | |

381.4 | 18.3 | 11.2 | +96.6 | Healthcare | |

246.7 | 23.1 | 15.8 | +31.9 | Industrials | |

90,820 | 36.1 | 11.1 | +27.0 | Basic Materials | |

570.4 | 45.4 | 16.9 | +26.1 | Industrials | |

7,670 | 13.8 | 16.0 | +12.2 | Industrials | |

3,157 | 13.3 | 8.90 | +6.65 | Financials | |

7,122 | 33.7 | 9.40 | +2.36 | Basic Materials |

Overall, this strategy has proved to be quite a good barometer of emerging trends and sentiment because it detects cheaply priced growth that’s finding favour in the market. Right now, some of the stocks currently passing these GARP rules have a cyclical flavour, such as strong exposure to financial trading (market volatility) and mining. But, more generally, this strategy can be the starting point to finding hidden gems.

In bullish conditions, growth stocks can produce stunning returns against the rest of the market - but they can falter when uncertainty sets in - which is exactly what we saw a year ago. For investors looking for growth, a GARP strategy can be an ideal way of finding potentially strong returns at relatively cheap prices. But in volatile markets, it's a strategy that needs careful watching.

interactive investor readers can get a free 14-day trial of Stockopedia here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.