A stock in one chart: Low multiple, 6% yield

12th May 2016 11:49

by Phil Oakley from ii contributor

Former City analyst Phil Oakley believes the fortunes of many companies can be summed up in a single financial chart. In the last of this 10-week series, it's .

If someone told you about a company that makes high returns on the money it invests, generates lots of free cash flow and has been paying a rising dividend there's a good chance that you want to find out a bit more about it. You are then told that you can buy the shares for just over eight times forecast earnings with a prospective dividend yield of 6%.

What's not to like about it? Surely this is the type of company that most investors would like to have in their portfolios?

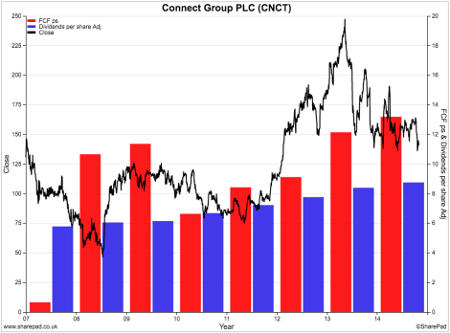

The company I've been describing is Connect Group, a distributor of newspapers, magazines, books and parcels. If you look at the chart above you can see that for the last five years the company has been generating an increasing amount of free cash flow per share (the first/red bars) which is usually seen as an indicator of a good and improving business.

This rising amount of free cash flow has enabled it to comfortably pay a rising dividend to shareholders (the second/blue bars) and still have some money left over (the red bars have been bigger than the blue bars). Yet it seems that the stockmarket doesn't really like Connect Group shares.

During the last year the share price has gone nowhere and has also been quite volatile. Virtually all the returns earned by shareholders have come from dividends. So what is it that people are so worried about?

One possibility is that the company will struggle to grow its profits in the future. Its main business of delivering newspapers and magazines is shrinking as people buy less of them. Profits are being propped up by cutting costs, but ultimately there are only so many costs you can cut.

Attempts to find new sources of growth have been mixed. Delivering books to bookshops and libraries hasn't been too successful, but the company has been growing its click and collect business by securing contracts with the likes of and . It has also splashed out a lot of cash to buy Tufnells Parcels in order to grow.

If Connect can start producing strong profits growth then the shares look like they could be a bargain. However, its businesses have low profit margins and face lots of competition and success is far from guaranteed. It looks as if the latter scenario is what the current share price is implying.

ii view:

Delivering newspapers is hard work, ask any kid. Making big money from it is even harder, ask the £400 million Connect Group. However, the Swindon-based firm spun out of in 2006 is coping well. Yes, its core business is in decline, but it's not falling off a cliff. Other initiatives have been successful, and Connect can keep stripping out costs for years to come. It will never trade on growth multiples - expect mid-single-digit earnings improvements at best - but 8 times looks cheap and the attractive dividend safe for now.

Read more from Phil Oakley here. Financial charts are a feature of SharePad, the web-based service from ShareScope. Voted UK's Best Investment Software 2015.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.