A stock in one chart: AB Foods overrated?

29th September 2016 11:10

by Phil Oakley from ii contributor

Former City analyst Phil Oakley believes the fortunes of many companies can be summed up in a single financial chart. This week it's .

Associated British Foods has been a very popular share in recent years. This might be surprising given that its long-standing sugar and agricultural businesses are not very glamorous.

However, investors have been attracted to a portfolio of dependable grocery brands such as Twinings, Ryvita and Ovaltine, with the icing on the cake provided by the fast-growing budget clothing chain, Primark.

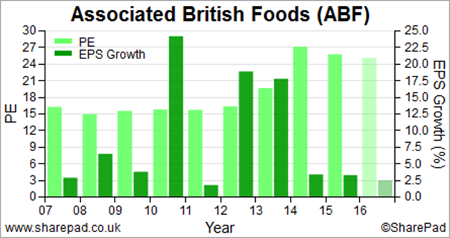

Strong growth in profits (earnings per share [EPS] - dark green bars) in 2012 and 2013 pushed up the valuation of the shares to very high levels (price/earnings [PE] ratio - light green bars). The PE of the shares has remained high since - a sign of confidence in the company's long-term growth prospects.

2014 and 2015 proved difficult, as falling profits in sugar and agriculture offset the growth at Primark. As a result, there was very little EPS growth. This trend is expected to continue in 2016 and possibly 2017, as Primark's growth rate has slowed and the fall in the value of the pound is expected to reduce profit margins.

City analysts are forecasting the company to post another year of sluggish EPS growth of around 2.5% in 2016. Yet the shares still trade on 25 times forecast earnings at a share price of 2,625p. That is high, given the low expected growth rate.

Since December 2015, when the shares were changing hands for around £36, they have been losing some of their lofty valuation. However, if profit growth expectations do not start to pick up soon, there is a risk that ABF's high valuation and, therefore, its share price, might keep on falling.

The ii view:

AB shares have fallen 19% in the past few weeks, but still trade on well over 20 times EPS estimates for 2017. That's not a problem; it's been common for years. Directors bought shares this summer, too, and some analysts predict high single-digit profit growth in 2017.

However, while AB's odd mix of sugar producer, food business and discount fashion retailer can provide diversification, Primark generates almost half of group revenue, and margins will shrink. Potential upside does not currently outweigh downside risk.

Read more from Phil Oakley here. Financial charts are a feature of SharePad, the web-based service from ShareScope. Voted UK's Best Investment Software 2015. For a limited period, you can get a three month subscription to SharePad for just £25.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.