Stock market rally doesn’t convince professional investors

16th August 2022 12:04

by Sam Benstead from interactive investor

Bank of America’s latest fund manager survey still points to extreme pessimism and defensive portfolios.

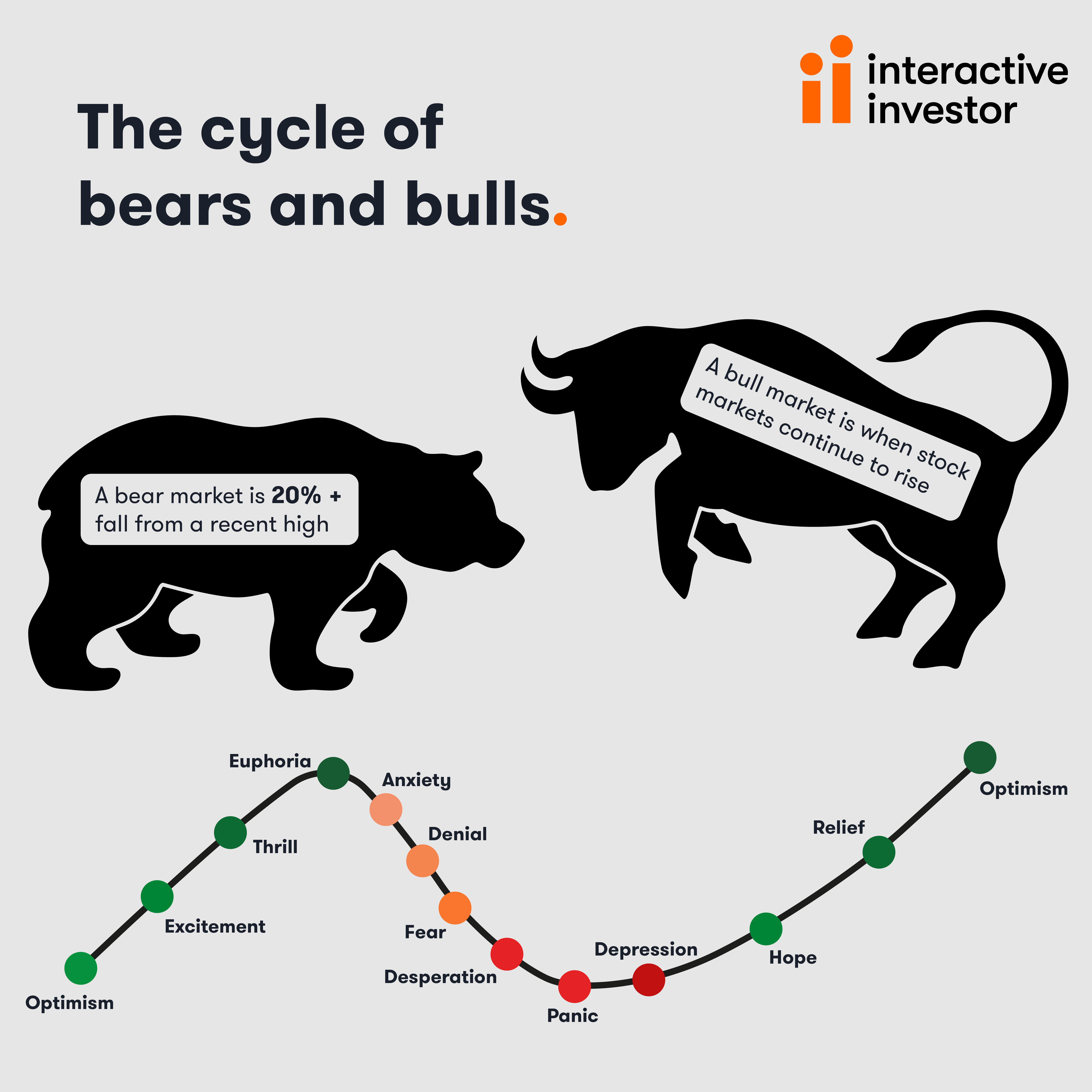

Sentiment among professional investors remains bearish, despite a strong bounce-back in share prices over the past two months.

Bank of America’s monthly global fund manager survey of investors with more than $800 billion (£665 billion) under management found that investors were still extremely pessimistic about markets, but no longer “apocalyptically” bearish on grounds that inflation may have peaked and interest rate rises could end soon.

Nevertheless, its much-watched “Bull & Bear” indicator remained at zero, its maximum reading for bearishness.

This is despite a more than 20% rise for America’s tech-heavy Nasdaq index and a 17% rise for the S&P 500 index since mid-June, as measured in dollar terms. The FTSE All-Share index has rallied about 7% over that period.

Stocks are rallying due to signs that inflation is easing, particularly in America. Its July consumer price index figure was 8.5% year-over-year, which was less than economists expected and below the 9.1% figure for June. Meanwhile, commodity prices continue to fall on fears that recessions around the world will reduce demand for raw materials.

- Reasons why the bear market is far from over

- Why these defensive investments will continue to deliver

Bank of America said that investors cut their net underweight in stocks while moving back into tech and consumer discretionary names, and out of consumer staples and utilities. Nearly 90% of investors expect lower inflation in the next 12 months, it found.

This move reflected confidence that “growth” stocks, which are dearly valued versus their current profits, would outperform cheaper “value” stocks over the next 12 months, the first time that investors have taken that view since August 2020.

The survey also revealed that cash levels remain elevated, at 5.7% compared with 6.1% in July, with the most-crowded trade being long the US dollar.

Despite the slight increase in optimism, the pros are still positioned for high inflation and low growth, which is known as stagflation. This is expressed in overweight positions in cash, defensive stocks and commodities.

- Terry Smith’s buying spree: should investors be concerned?

- Bond Watch: is this a sign the US has finally seen peak inflation?

Bank of America’s house view is that the bear market is not over yet, calling itself a “patient bear”, as it expects company profits to fall.

July's survey showed that fund managers were capitulating, with global growth and profits expectations at all-time lows, cash levels their highest since 9/11, and equity allocation at the lowest level since Lehman Brothers collapsed in 2008.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.