Still time to back two of America's best bankers

Of all the finance companies on Wall Street and beyond, overseas investing expert Rodney Hobson thinks these ones are the stocks worth buying. He also gives his opinion on three others.

24th January 2024 08:42

by Rodney Hobson from interactive investor

Investors hoping that American banks would give a clear signal at the start of 2024 were doomed to disappointment. What a mixed picture emerged! Here was a real conundrum for those who like to debate whether the pot is half full or half empty. The short-term situation is distorted by heavy contributions that viable banks have had to make to a federal fund propping up struggling regional banks.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

interactive investor’s Keith Bowman has already analysed the mixed picture at JPMorgan Chase & Co (NYSE:JPM) where revenue was up but net income down, and at Citigroup Inc (NYSE:C) where restructuring charges have dented profits.

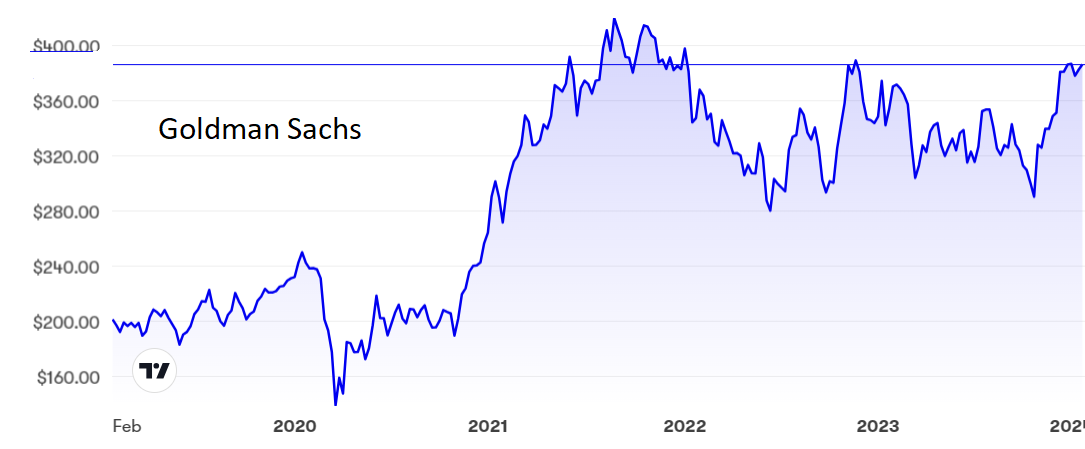

The Goldman Sachs Group Inc (NYSE:GS) managed to beat expectations in the fourth quarter of 2023 as its asset and wealth management side stormed back. Revenue rose 6.8% in the quarter to $11.32 billion and net earnings, helped by heavy cost cutting including the loss of 3,200 jobs during the year, jumped 51% to just over $2 billion.

This marked a strong end to an underwhelming year in which net profits fell 24% to $8.5 billion, the lowest for four years. Goldman has made a mess of its push into consumer banking, leading to reports of low staff morale.

Goldman shares have been on the rise since bottoming out at $290 three months ago, but the improvement looks to have run out of steam with the latest figures providing insufficient impetus. At the current $380 the price/earnings (PE) ratio is pretty average at 16.7 while the yield is 2.7%, acceptable but not particularly tempting.

Source: interactive investor. Past performance is not a guide to future performance.

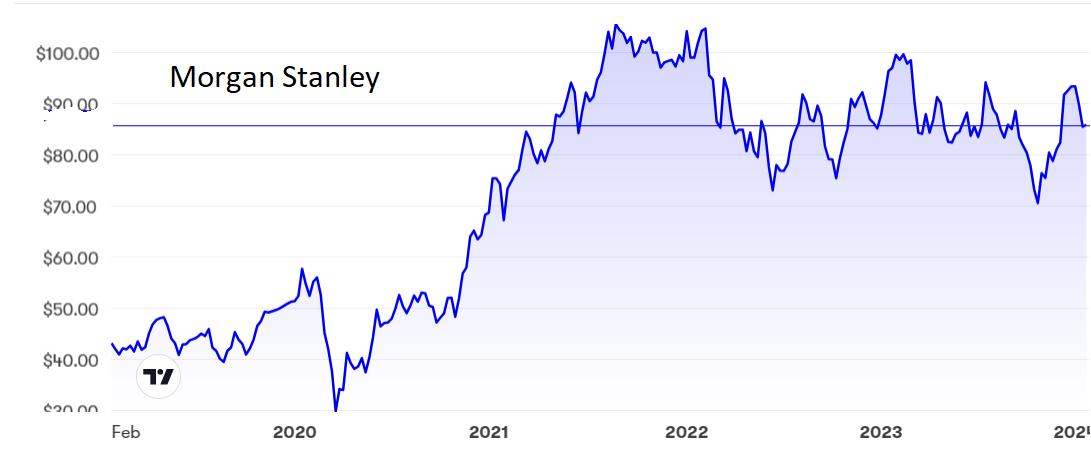

For Morgan Stanley (NYSE:MS), net revenue edged up 1.6% in the final three months, a slight improvement on the full-year rise of 0.9%, but net income was down 32% to $1.54 billion, dragging the annual figure down to minus 17%. MS took a $535 million total one-off hit from a legal dispute plus higher contributions to the Federal rescue fund, but a longer-term impact will be felt from a 6% rise in wages and bonuses.

- Find out who's reporting when this US Earnings Season

- The Analyst: Dzmitry Lipski’s investment insights

- Can Wall Street’s record run continue?

The bank reported “a mixed market backdrop and a number of headwinds”, realistic but hardly a great confidence builder.

The shares bounced up from $70 in late October to a recent peak of $93 but have understandably slipped back more than those of Goldman Sachs and now stand just below $87. Here, the PE is similar to Goldman at 16.5 but the yield is more attractive at 3.8%.

Source: interactive investor. Past performance is not a guide to future performance.

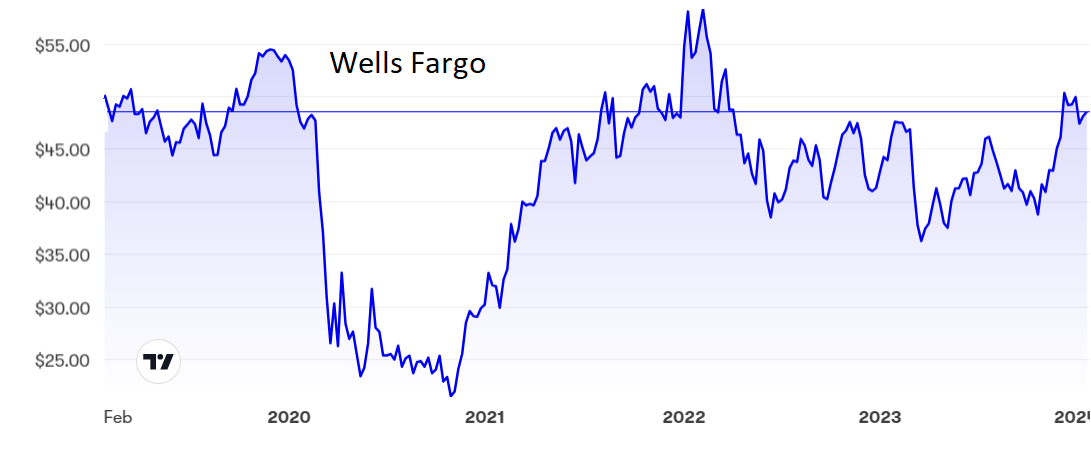

More downbeat still was Wells Fargo & Co (NYSE:WFC), which saw a fall in net interest income in the fourth quarter and warned shareholders of a further fall of as much as 9% in the current year.

This is particularly disappointing as the bank had seemed to be getting back on track after putting adverse legacy issues behind it. Net interest normally improves at times of rising interest rates because banks are able to widen the spread between borrowing and lending costs.

- Stocks are expensive: that doesn’t mean you should stay away

- 28 investment trusts yielding 5% or more: the key things to consider

Total revenue did manage a modest 2.2% rise to $20.5 billion in the final quarter and, rather more encouragingly, net profit improved 9.2% to $3.35 billion. Furthermore, Wells Fargo expects to reduce costs by over 5% this year.

Wells Fargo shares peaked just above $50 in December, later than its rivals, and despite a dip to $46 after the results came out, they have picked up to $49, where the PE is lower than rivals at 10 and the yield is middling at 2.7%.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: I go with the majority of analysts in rating Citigroupa hold, though with less enthusiasm than some. There are better prospects elsewhere, such as Wells Fargo, where the positives outweigh the negatives and it is not too late to buy. Morgan Stanley’s yield also earns a buy rating. Although there is no overwhelming case for buying Goldman Sachs until the picture becomes clearer, existing shareholders should hold on. The same applies to JPMorgan Chase.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.