Still 'considerable' upside for Domino's Pizza shares?

10th October 2017 13:54

by David Brenchley from interactive investor

We've already seen what happens when hedge funds call their high-conviction short positions correctly – they make lots of money, as they did with earlier this year.

is another heavily shorted stock – around 15% of its shares are out on loan. But those pessimistic investors will have to be more patient this time around, after a strong share price performance from the takeaway pizza franchise.

It looked to be going well for the hedgies, as the company saw a third of its valuation wiped out in the six months since March's final results. But that tide looks to have firmly reversed.

Up to Monday's close, Domino's shares had risen 10% since the 20 September announcement of a £15 million share buyback to add to the already purchased £20 million of shares in the first half.

And, after a reassuring third-quarter update Tuesday, the stock surged a further 15% to a seven-month high of 347p. Still, it remains 12% below March's 394p.

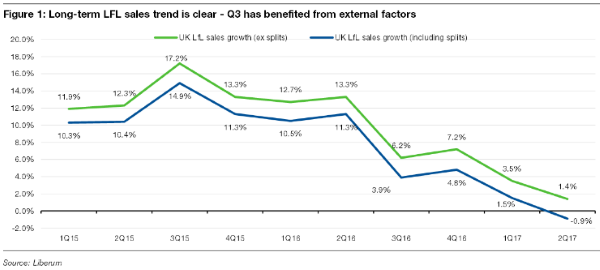

The key takeaway was strong core UK trading. Like-for-like sales grew by 8.1%. That's a 200 basis-point improvement from the same period last year, and broker Credit Suisse tells us it's materially above its estimate of 2%.

That said, Liberum reckons the "real number" is 6% when you include the negative impact of area splits – where Domino's awards more than one franchise in any one area.

Elsewhere, it saw better UK/Republic of Ireland organic sales growth of 12.1% and strong international organic sales growth of 25%. Store openings in the full-year are still on course to come in at 90, with 58 opened year-to-date.

Chief executive David Wild says he is pleased with the "improved trend" in the UK, where "consumers are uncertain and they continue to focus on value". "Forecasts for full-year underlying profit before tax remain at least in line with market expectations" of around £90 million, Wild added.

While the size of short positions may suggest caution on the outlook for Domino's, brokers are split on prospects. Liberum points out that "this is just one quarter and we would urge that a cautious stance should be maintained".

Risks abound, says analyst Wayne Brown. He first points out Domino's Q3 benefited from lower-than-average temperatures and higher-than-average rainfall in the UK, meaning consumers were more likely to stay in rather than eat out.

"We remain concerned that pressures are continuing to rise on franchisees where new stores are being opened in areas with fewer address counts, their margins remain under pressure and it is only a matter of time, in our view, that their appetite to open new stores will decline," he adds. This will lead to meaningful earnings pressure for Domino's as a group.

While both Liberum and Investec have 'sell' recommendations on the stock and target prices of 250p and 242p respectively, others are bullish. Numis has a target of 397p, which implies upside of 14%. "Domino's remains a key pick as a high return on capital employed, cash generative business in a structural, growing segment," explains analyst Richard Stuber.

Peel Hunt wants £4, but for different reasons. It notes that despite shares surging 15% in two weeks, the stock on loan position has only reduced from 15% to 14%. "Thus," says Douglas Jack, "if LFL sales start to accelerate and the buy-back has to compete with short covering on the equivalent of 15% of the equity base, then the upward squeeze on the share price could be considerable."

That may be the case, but a 2018 forward earnings multiple of around 22 times is not cheap, especially if sales fall in an increasingly competitive market (see second chart above).

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.