Spending Review poll results

Tax hikes remain on the cards, and investors value ISA allowance most, according to our survey.

25th November 2020 16:35

by Myron Jobson from interactive investor

Tax hikes remain on the cards, and investors value ISA allowance most, according to our survey.

The much-mooted rise in tax to address the burgeoning Government debt failed to materialise in the Chancellor of the Exchequer’s Spending Review - but remains firmly on the cards says interactive investor.

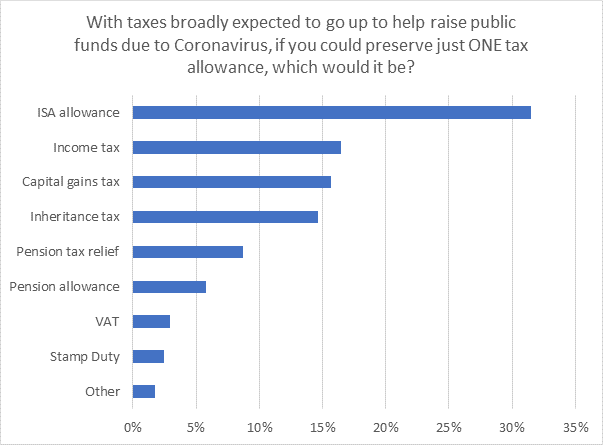

A snap poll among interactive investor website visitors ahead of the Spending Review, attracting 1,582 responses between 08:30 yesterday (24 November) and 11:30 today (25 November), found that just under a third (31%) said if they could preserve just one tax allowance, it would be the ISA allowance, ahead of income and capital gains taxes in joint second place (16%) and inheritance tax (15%) in third.

Only 9% said they would prioritise the all-important pension tax relief from efforts to help raise public funds, 6% the pension tax allowance, 3% VAT, 2% Stamp Duty, while another 2% of respondents cited other forms of taxation.

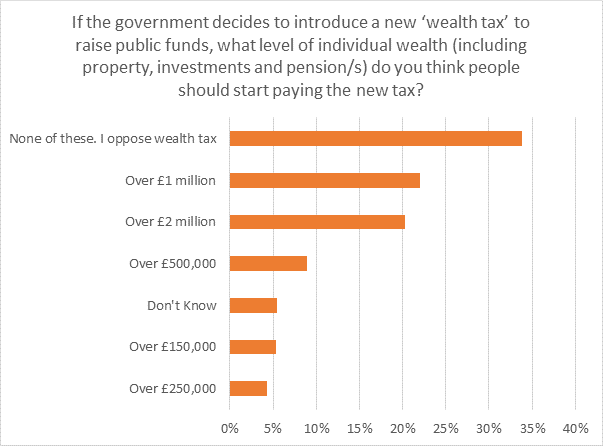

When asked who should pay for any new wealth tax/taxes to raise public funds, just over two-fifths (22%) said those with assets worth £1million or more, while 20% believe the starting threshold should be £2million and 9% said over £500,000. Only 5% said the new tax should apply to those with assets worth £150,000, and fewer (4%) prefer the £250,000 threshold.

However, the largest percentage of respondents, (34%) said they were opposed to any form of wealth tax. The remainder (5%) said they didn’t know.

Becky O’Connor, Head of Pensions and Savings at interactive investor, said: “With so many question marks around where the money will come from for this gigantic multi-billion pandemic bailout, investors will be waiting with bated breath for next year’s Spring Budget to see where the axe will fall.

“This could be a good time to make sure investments are as tax-efficient as possible, using ISAs and SIPPs and maximising any allowances if that’s possible – and with unemployment set to soar further, it’s time to start shoring up your finances if you haven’t yet started. If you can’t save more, it’s worth looking at areas where you can save money, by shopping around for better deals in all aspects of your life.

“Pay rises and falls through working life have a big impact on retirement outcomes. Those auto-enrolled in private sector schemes generally face a greater risk of a shortfall in retirement income than public sector workers, who benefit from typically more generous defined benefit pensions.

“If pay rises for the public sector continued to significantly outstrip the private sector over time, this could also lead to a greater disparity in retirement outcomes between these two groups.

“Private sector workers facing pay freezes, a reduction or a loss of income face a reduction in their pension pots as a result of the pandemic, particularly those in hospitality and retail; those aged 18 to 24 and older workers approaching retirement.

“One legacy of the pandemic could be a greater dependence on the state pension in years to come among workers who were unable to invest enough into their defined contribution schemes.”

Myron Jobson, Personal Finance Campaigner, interactive investor, says: “Savers and investors will be breathing a sigh of relief as the much-mooted ‘wealth tax’ failed to materialise in the Spending Review. However, it is surely a question of when, not if a tax hike will be announced as part of efforts to address the Government’s WW2-sized public borrowing bill for its Covid-19 economic support packages.

“The extent of the economic uncertainty means that the Chancellor focused on the direction of public spending for the next 12 months. A cocktail of spending cuts and tax rises to get the UK economy back on an even keel from the damage done by the coronavirus crisis remains on the cards. The announced public sector pay freezes is a tell-tale sign of the difficult measures to come.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.