Solid State: Striving to be a first rate business

20th July 2018 14:29

by Richard Beddard from interactive investor

Traders value Solid State like it's a third rate business, but while it may not be unequivocally first rate yet, analyst Richard Beddard believes the company is doing all the right things.

Solid State reported 16% revenue growth in the year to March 2018, yet adjusted profit fell 3%. In short, the company sold more of its less profitable products.

Solid State is both a distributor of electronic components and a manufacturer of rugged computers, portable battery packs, antenna and radios. The manufacturing side of the business, Steatite, is slightly bigger, and more profitable, but in the year to March 2018 it grew revenue more slowly than Solid State Supplies, the less profitable distribution business that supplies manufacturers with semiconductors, electronics and displays.

While Solid State Supplies increased revenue by 20% and profit by 15%, 13% extra manufacturing revenue actually reduced Steatite’s profit by 6%. That’s because the growth came largely from less profitable battery packs, probably bound for resurgent oil and gas companies.

Revenue fell at Steatite's computing division and its "world class" antenna business is making little headway in the USA, where Steatite anticipated new sales, because US Government funded programmes are favouring domestic suppliers. Steatite doesn’t say which customers it is pitching to, but antennas principally have military and meteorological applications.

Even though Solid State has a record order book, distribution is still doing most of the running, which may delay Solid State's ambition to improve profit margins further.

Scoring Solid State

As usual I'm scoring Solid State to determine whether it is profitable, adaptable, resilient, equitable, and cheap. Each criterion can achieve a maximum score of 2, and a minimum score of zero except the last one. The lowest score for companies trading at very high valuations is -2.

Profitable: Does it make good money?

Score: 1

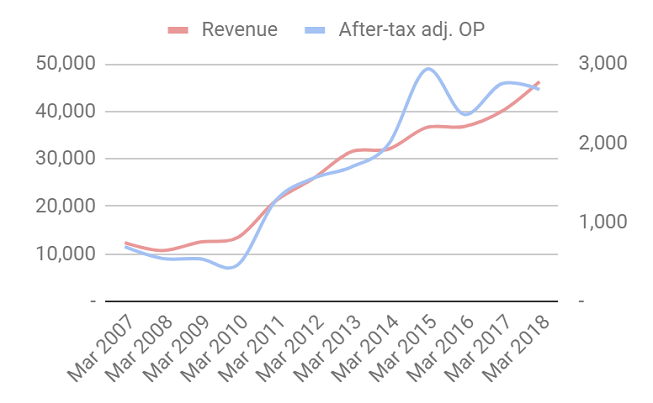

Unprofitable growth would be unusual for Solid State, which has grown both revenue and profit at a compound annual growth rate of 12% over the last 12 years:

Source: interactive investor

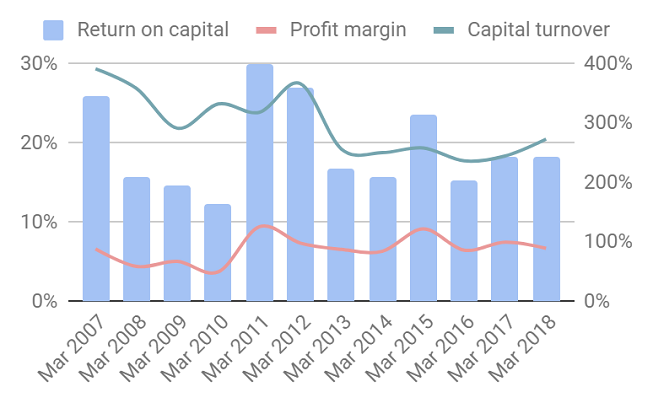

Taking in the big picture, the decline in profit margins in 2018 does not look particularly significant. Solid State's profit margin (pink line) was 7% (after tax), which is pretty close to the historical average. Its return on capital (blue bars) was a very healthy 18%, also pretty average for Solid State.

Source: interactive investor

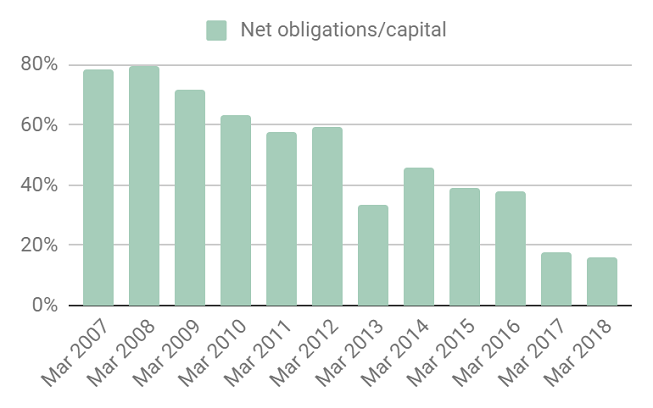

Even though cash flow is lumpy, these figures belong to a good business that has reduced its dependence on external financing over the years:

Source: interactive investor

Solid State says it achieves this level of profitability because it is a specialist working closely with customers to customise and design products, adding value whenever it can. Steatite supplies bespoke products that operate in harsh, often industrial or military, environments and Solid State Supplies offers technical support, pre-loads software onto the hardware it supplies, and prepares products so they can be introduced straight onto customers' product lines.

The combination of specialist skills and accreditations required to transport dangerous materials like lithium and handle sensitive government data, mean that relatively few companies in the UK can do what it does.

Adaptable: How will it make more money?

Score: 2

The company's strategy is as straightforward as it gets: develop products and services using specialist talents and acquire complementary business enabling it to share costs and customers, become more efficient, and earn higher profit margins.

In pursuit of higher margins in 2018, Solid State Supplies developed a component sourcing and obsolescence service that sources, tests, and stores obsolete components for customers. At Steatite it closed a sales office and reorganised management teams to focus on higher margin products.

The one thing it didn't do was acquire a business. Although Solid State seeks to make an acquisition a year, the last one was loss-making battery manufacturer Creasefield in May 2016. The money saved is one of the reasons why Solid State is less indebted now, but the company says it is actively pursuing targets.

Past acquisitions have contributed heavily to growth. Solid State has typically bought small inefficient electronics businesses and brought them up to its own operating standards. The ambition to wring out more efficiency through scale seems to have gained impetus as it has welded disparate acquisitions into three manufacturing divisions: computing, power and communications, and as Solid State Supplies has grown sufficiently to secure distribution agreements with bigger suppliers, like VPT, a US manufacturer of power supplies.

Resilient: What could go wrong?

Score: 1

Arguably, we're seeing what could go wrong right now. Solid State's acquisition programme has stalled and its attempts to increase margins have yet to bear fruit.

The company may be struggling to find and evaluate larger acquisitions, which it must do as it grows, especially as doesn't like to pay very much for them. The fact that Solid State is discriminating is good, but if it means the pace of good acquisitions slows, so will growth.

Meanwhile, past investments in high margin products and technologies have yet to bear the anticipated fruit. Solid State built what it describes as a world class test chamber at its antenna factory at Leominster, hoping to win big orders from the USA. Now it says it is focusing on winning repeat business, which it will supplement with major system sales.

Previously as part of consortium, Solid State developed electronic tagging systems for the Ministry of Justice. It was a high-profile project but Solid State's consortium was wrongfooted when the Ministry of Justice opted for an off-the shelf system instead. Though Solid State was compensated by the Ministry of Justice, these episodes show that a bigger Solid State, bidding for bigger contracts, faces bigger risks and it is still learning how to deal with them.

The company tantalises us with new opportunities. A contract to supply batteries for autonomous robots bound for 'smart warehouses' may presage orders from other robotics customers, but shareholders should by now have become accustomed to the episodic and sometimes truncated nature of these contracts, which can add mightily to profit as they are rolled out and then subside to more mundane levels.

At Solid State Supplies, higher margins are proving hard to come by too. The sourcing and obsolescence service is earning "initial" revenue but has yet to have much impact on profit margins. Meanwhile, the company has increased stock levels to ensure 'continuity of supply' to customers. While this provides a better service, it also ties up more working capital. Solid State says it has mitigated the risk of obsolescence by securing the right to return stock to suppliers.

Equitable: Will we all benefit?

Score: 2

Solid State works closely with customers, and the company reports 98% of Solid State Supplies' orders are delivered on time. Without giving any precise figures, it says all the right things about motivating and equipping the workforce. It says it has "many" employees who have chalked up more than 10 years' service, and sponsors employees through training for professional credentials.

The board is extremely experiencedand not overpaid relative to current norms (don't get me started on whether current norms are right) and chief executive Gary Marsh has a substantial shareholding in the company. The evidence suggests the board is trying to build a better business, rather than gutting it for immediate personal profit.

Cheap: Is the firm's valuation modest?

Score: 2

Solid State has performed well over the years yet the shares only cost about 11 times adjusted profit in the year to March 2018. While it has anticipated a slow start in the current year, the low valuation probably underestimates Solid State's long-term potential.

Verdict: One for the contrarians

A score of 8/10 means Solid State should, in my opinion, be a good long-term investment. Its lowly valuation suggests traders think it is a third rate business. I think it is a decent but perhaps not quite first rate business striving to be unequivocally first rate.

If it becomes first rate, we'll all be laughing, but even if Solid State can't lift profit margins so they are, say, routinely in double figures, I think long-term shareholders will do well enough.

Here are Richard's recent articles:

- Trifast: Continuous improvement adds up

- Vp: An acquisition too far

- Air Partner: Talks a good business

- Sprue Aegis: Do this and they'll be 'dirt cheap'

- 16 conviction shares to consider

- Walker Greenbank: Cheap but fearful

- Hollywood Bowl close to joining exclusive club

- Anpario: Gearing up for growth

- Are Next shares a buy for the long term?

- 16 shares for the future

- Is Portmeirion in the 'buy' zone?

- XP Power shares: They're electrifying!

Contact Richard Beddard by email: richard@beddard.net or on Twitter:

@RichardBeddard

Richard owns shares in Solid State

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.