Six secrets to bagging the next Nvidia

If you’re kicking yourself for not investing in Nvidia and other rocketing stocks sooner, Theodora Lee Jospeh has good news. Other shares will multiply their value...

17th May 2024 09:34

by Theodora Lee Joseph from Finimize

- Contrary to popular belief, explosive growth isn’t mandatory for stock outperformance. History shows that many of the decade’s top performers grew at a modest pace, with about 72% of companies experiencing less than 20% annual revenue growth.

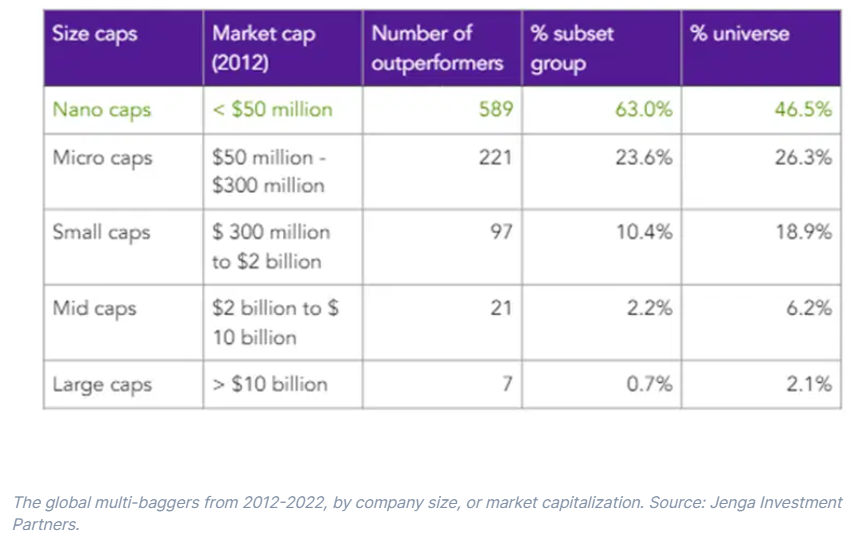

- Small-cap companies, especially nano caps, often outpace their larger counterparts, thanks to their potential for rapid scaling.

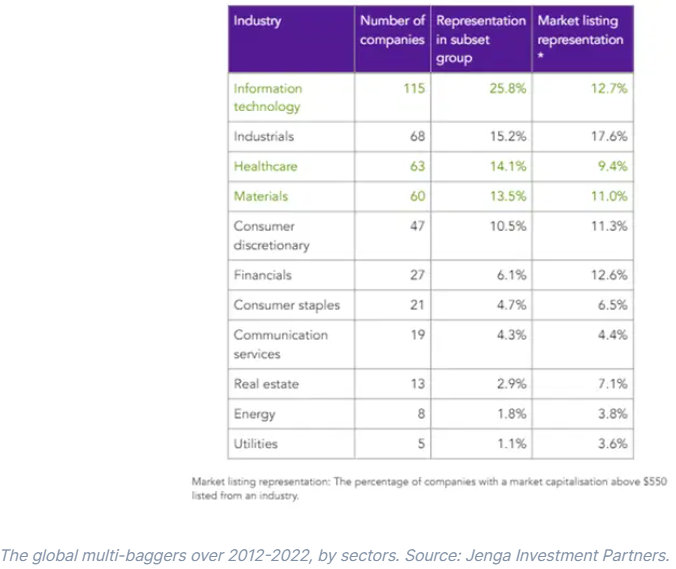

- Top-performing stocks were found in the technology, healthcare, and materials sectors, and from diverse geographical regions, underscoring the importance of looking beyond traditional markets and sectors for investment opportunities.

If you’re feeling a twinge of regret for missing out on Nvidia, which has soared over 2,000% in the past five years, don’t be so hard on yourself. Nvidia isn’t the only golden goose in the market. There are a ton of other stocks like Nvidia out there, the so-called multi-baggers. These are the shares that multiply their original value several times over, like the quadrupling four-baggers or the quintupling five-baggers.

And if you’re eager to invest in the next multi-bagger, you’re in luck: the folks at Jenga Investment Partners have done your homework. They analysed a decade of data, beginning in 2012, to spot the traits the best companies have in common.

Here are six secrets they discovered by studying 446 stocks that gained more than 1,000% over that period, making them the market’s strongest performers.

1. Growth isn’t always king. Surprisingly, rapid growth isn’t always necessary for outperformance. About 72% of the companies (279 out of 446) saw less than 20% annual revenue growth over ten years, and 33% saw both their revenue and operating profits grow below 20% annually. And that’s unexpected: conventional wisdom says you need faster growth rates to achieve big success.

2. Margins matter more. A noteworthy 367 out of 446 companies were operationally profitable in 2012, debunking the notion that only unprofitable, fast-growing companies can be global outperformers. In fact, margin expansion – a trend toward earning more than the firm spends – was crucial for the profitability of companies. In 2012, 48% of this group of companies had an earnings before interest and taxes (EBIT) margin of 10%, which increased to 85% by 2021.

3. Valuation inflation is real. Although purchasing a stellar company at a low multiple is ideal, many of the best-performing stocks started with substantial multiples. Of this group, 91% saw their enterprise-value-to-revenue (EV/R) multiples increase, and 72% saw an expansion in enterprise-value-to-EBIT (EV/EBIT) multiples. However, while it’s common for multiples to revalue as companies improve operationally, relying solely on this for investment decisions can be risky, particularly in hot markets.

4. Small is good. It’s way easier for a minnow to balloon from $10 million to $100 million than for a giant to leap from $100 billion to $1 trillion. Thanks to the magic of smaller numbers and roomier growth lanes, a hefty 63% of the market’s big winners were “nano caps”. That’s a chunky figure when you consider that they represented just 46.5% of the broader market back in 2012.

5. There can be some big geographical standouts. India, Japan, Sweden, Germany, and Israel took the top spots for stellar stock performances over the decade-long period. Tiny Sweden, for example, had 20 companies with returns over 1,000%. Sure, Sweden’s circle of overachievers might be smaller than China’s 34 high-flyers, but consider this: Sweden’s stock market is just a tiny slice of China’s, with only a twelfth of the listings. So, pound for pound, Sweden is actually knocking it out of the park compared to the giant that is China.

6. Tech, healthcare, and materials are where the action is. These industries are punching above their weight compared to their public market presence. On the flip side, the energy, utilities, and real estate sectors lagged behind in the race.

You know the old saying: past performance may not be the best predictor of future performance. But there are a few lessons you can take from these 446 high-flyers. Here are five of them.

Don’t forget Asia. A surprising number of investors overlook this region. And that can mean missed opportunities: 59% of the global outperformers over the past decade came from Asia, and yet, the region represents just 10% of global mutual fund portfolios.

Don’t over-rely on thematic investing. This kind of investing offers a structured way to find potential winners, but you have to be careful not to ignore the fundamentals. For every success story like Tesla or BYD, countless others have captivating themes but fail to deliver material gains. Effective investing involves more than fixating on a compelling theme: it’s about discerning the few undervalued companies with true potential.

Be open-minded. Sure, the US and tech have been the best-performing country and sector lately, but historically, winners have been more scattered, with top-notch investments popping up in the least expected corners. If you’d clung only to tech, healthcare, and consumer companies, you’d have waved goodbye to 40% of the other winners from the gritty world of materials and industrials. Similarly, limiting your investments to developed markets would have overlooked 37% of the world’s outperformers.

Be patient. The average holding period for stocks has dramatically fallen from eight years in the past to just 5.5 months today. While short-term trades can be profitable, investors generally benefit more from a long-term approach, ideally thinking in terms of years, not days or weeks. The best holding period for cyclical and turnaround companies ranges from three to five years. And for compounders (i.e. those multi-bagger stocks with improving returns and share prices) the best period could be five to ten years – or, if they remain attractively priced, even longer.

Turn over new rocks. Few companies manage to be top performers for decades at a time. Among those that returned over 1,000% from 2002 to 2012, only 23 were still excelling in the following decade. So, for you, the key is to seek new opportunities – continuously exploring fresh sectors and industries (particularly those undervalued by the market), considering innovative business models, and focusing on the new overlooked leaders.

Theodora Lee Joseph is an analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.