Six AIM shares for dividend income

20th May 2022 15:20

by Andrew Hore from interactive investor

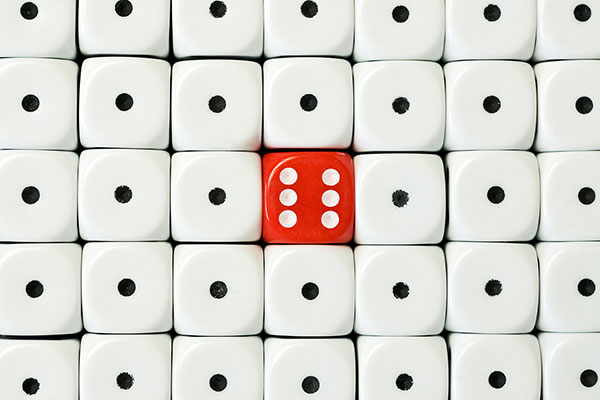

It’s not just the multinational FTSE 100 companies that can pay attractive dividends. These small-caps reward shareholders with high yields and potential for capital growth.

Plenty of dividends were passed or lowered during the pandemic in 2020, but most companies are back to paying dividends that are at least consistent with their levels prior to Covid. AIM provides many opportunities for investors that are keen to find shares where they can obtain income as well as benefiting from a growing share price.

More than 200 companies on AIM pay dividends - that’s around one-quarter of the companies on the junior market - and 53 of those companies have a current yield of 4% or more, according to data provider SharePad.

Some of these companies have been hit by trading problems and may not pay dividends this year, or will make a much lower level of distribution. There are also newer companies that promise dividends but have not paid any yet. Pharma labs and offices investor Life Science REIT (LSE:LABS) said it intends to pay a yield of 4% when it floated last year - based on the 100p subscription price – but it has not paid a dividend yet.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

This still leaves plenty of AIM-quoted companies to choose from if investors are seeking a 4%-plus yield.

Mining for income

One of the sectors not normally thought of in terms of dividends is mining. But there are AIM mining companies in production that are paying dividends and some of the yields are particularly attractive.

The trouble with commodities is that their prices can be volatile, and this can lead to a lack of consistency in profit and cash generation. There is also political risk dependent on the sites of mines. This means that there is not necessarily a steady growth in dividends. On the plus side, it can mean special dividends can be paid in the good times.

- Five AIM income stocks for your ISA in 2022

- Nasdaq vs AIM: key trends, performance and income

- How and where to invest £50k to £250k for income

Many of the mining sector dividends are declared in US dollars, so even if the payout is maintained the sterling value will change year to year depending on the exchange rate. The decline in the £/$ exchange rate over the past year could mean that unchanged dividends would be higher in pence per share.

Azerbaijan-focused gold and copper miner Anglo Asian Mining (LSE:AAZ) paid a special dividend of 1.5 cents a share in 2020, but if this is excluded the underlying dividend was maintained at 8 cents a share in 2021. That was despite pre-tax profit diving from $35.7 million to $12.6 million, while operating cash flow before working capital adjustments almost halved to $29.3 million.

That decline was mainly due to lower gold production, which was only partly offset by higher selling prices for copper. There are new projects that should come on stream in the second half of 2022, but production could be lower this year.

Anglo Asian Mining is investing in newer projects that will significantly enhance cash generation when they come into production. There was cash of $35.7 million at the end of 2021 and more is being generated, so the dividend may be maintained even if profit declines. At 81p, the shares yield around 6.7%.

Caledonia Mining Corp (LSE:CMCL) owns 64% of the Blanket gold mine in Zimbabwe. Investment in the mine is helping to increase gold production, which could reach 80,000 ounces in 2022. There is further exploration potential in the area.

Caledonia pays quarterly dividends. They are currently 14 cents a share and the 2022 total dividend should increase by 12% to 56 cents a share. That would be almost four times covered by earnings, and the company’s cash pile is forecast to rise from $17.2 million even though there will be significant capital spending.

The investment could hold back further growth in the dividend, although it should at least be maintained. The forecast yield, on a share price of £10.55, is 4.5%.

A new dividend payer to consider

UK food wholesaler Kitwave (LSE:KITW) did better than expected in the year to October 2021, which were the first annual results since flotation. At that time, the 2021-22 pre-tax profit forecast was upgraded from £12.7 million to £13.5 million - the third upgrade since flotation. Demand from the catering and foodservice sector has bounced back following the ending of Covid restrictions.

North Shields-based Kitwave is the 14th largest UK grocery wholesaler. The customer base is mainly independent retailers, vending machine operators, leisure outlets and foodservice companies. Kitwave has a solid track record and moving into areas such as frozen food has improved margins.

The 2020-21 total dividend was 6.75p a share and this year’s dividend is expected to be 7p a share.

At 155.75p, which is above the 150p placing price, the share’s historic yield is 4.3% and the forecast yield is 4.5%. The shares are trading on 10 times prospective earnings.

Housing demand provides an income boost for this stock

Scotland-based housebuilder Springfield Properties (LSE:SPR) has consistently paid dividends since it floated in 2017, although it did not to pay an interim dividend originally announced in March 2020 due to Covid uncertainty. Taking 2019-20 as an aberration there has been an increasing trend for the dividend. In 2017-18, total dividends were 3.7p a share, rising to 4.4p a share the following year. Last year, the total was 4.75p a share.

The latest interim dividend has already been raised from 1.3p a share 1.5p a share. Singer Capital Markets expects a total dividend of 6.25p a share for the year to May 2022, with further rises in the following two years.

Springfield Properties has been able to grow its dividend through a combination of organic growth and acquisitions. There is a large contracted order book and strong demand for new housing in Scotland. There remains an under supply of housing in the country and the Scottish government has a target of 110,000 energy efficient affordable homes by 2032.

Springfield Properties builds a mix of affordable and private housing, while private rental housing is starting to make a more significant contribution.

Funding acquisitions and buying land is forecast to lead to an increase in net debt to £49.7 million at the end of May 2022, but the forecast dividend is still 2.7 times covered by earnings. The dividend cover is set to be more than 2.6 times for the forecast dividends.

At 132.5p a share, Springfield Properties has a yield of 4.3% and a forecast yield of 4.7%. The prospective 2022-23 multiple is seven.

A solid company with special attractions for income seekers

US-based concrete placing and levelling equipment supplier Somero Enterprises (LSE:SOM) consistently pays special dividends when its cash generation leaves it with more cash than it requires. This is another dividend that is declared in US cents. The total in 2021 was 50.7 cents a share, including a special dividend of 19.7 cents. finnCap forecasts a total dividend of 47.7 cents a share for 2022.

Pre-tax profit is likely to be flat this year at around $46 million. Net cash was $42.1 million at the end of 2021, and it is expected to be $39.9 million at the end of this year.

At 385p, the historic yield is 10%, including the special dividend. The forecast yield is expected to fall to 9.5%, which is still highly attractive, and the cash pile provides potential for more special dividends over the coming years.

Worth tracking this recovering dividend

Appreciate Group (LSE:APP), formerly Park Group, is paying a much lower dividend than three years ago, but it is increasing from a lower base. Last year’s total dividend was 1p a share and this is expected to be increased to 1.6p a share.

Appreciate offers a Christmas savings service to consumers, which receive multi-retailer redemption cards and vouchers, but the growth is coming from the corporate business. The corporate division provides incentive and reward products for customers and staff, including vouchers, VIP experiences and travel deals.

The company did better than expected in 2021-22 and pre-tax profit should be £8 million, although that is still below the level two years ago. There was free cash of £19.5 million at the end of March 2022, and investment in a new IT system should make the business more efficient.

Pre-tax profit should be more than £9 million this year. At 26p, the shares are trading on eight times prospective 2021-22 earnings, falling to less than seven the following year.

The historic yield is just under 4%, but the forecast yield is 6.8% and the dividend is expected to increase by around one-fifth each year for the next two years.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.