SIPP Trends Snapshot launched by interactive investor

5th September 2022 09:49

by Rebecca O'Connor from interactive investor

Big decrease in tax-free lump sum withdrawals from pensions this year.

- New half-yearly SIPP Trends Snapshot reveals trends and behaviours among Self-Invested Personal Pension (SIPP) investors who are customers of interactive investor, both in accumulation (contributing to their pension) and in decumulation (taking an income from their pension)

- Snapshot aims to help people who are investing their own retirement funds make better informed decisions and boost confidence among an increasingly self-directed retirement investor population

- Compares the first half of 2022 (1 Jan to 30 June) with the second half of 2021 and year-on-year, with H1 2022; as well as comparing pre-pandemic trends and behaviours (H1 2018 to H2 2019) with overall data before the first half of this year, from H1 2018 to H2 2021*.

- Find out more: SIPPs explained | SIPP calculator | SIPP drawdown

Key findings:

1. There has been a big decrease in the size of the tax-free lump sum being withdrawn by the newly retired so far this year. The average amount of PCLS (Pension Commencement Lump Sum) taken has reduced by 27% among 55 to 64-year olds in the first half of 2022, compared with the same period last year, from £75,159 to £54,557 (figure 2).

Among those aged 65 to 74, the average amount taken as a lump sum in the first half of this year was £41,687, down from £64,305 in the first half of last year – 35% lower.

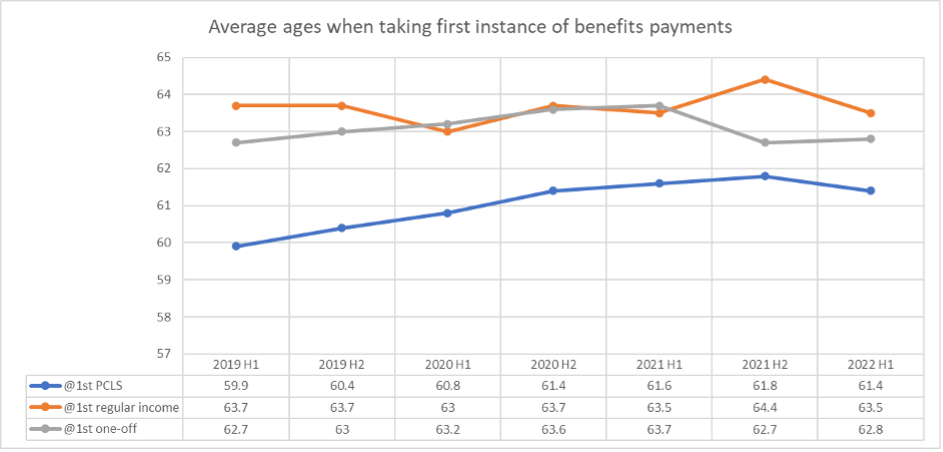

2. People also appear to be taking their tax-free lump sum later. The average age for a lump sum payment has gone up by 1.5 years since before the pandemic, from 59.9-years old in the first half of 2019 to 61.4-years old by the second half of 2020. It has remained higher since then and was 61.4 in the first half of this year (figure 4).

3. People have been withdrawing more income from their pensions in the first half of this year compared to previous periods, with an increase across all age groups in decumulation of 22% in the first half of 2022 to £17,268, up from an average of £14,108 across previous periods (figure 3).

4.. The age at which SIPP investors began to take an income from their pensions appears to have remained steady at around 63.5-years old, although it rose slightly to 64.4-years old in the second half of last year (figure 4). As the state pension entitlement age has changed from 65 to 66 over this period, it’s interesting to note that SIPP customers were starting to take an income 1.5 years before state pension entitlement age, but the same age is now 2.5 years before they receive the state pension. The age they start taking an income from their private pension therefore does not seem to have increased in line with the state pension age.

4. Contributions to SIPPs among the younger working-age population aged between 25 and 44-years old have fallen by 8%, from an average of £584 to £538 in the first half of this year compared to the same period a year earlier (figure 1). However older workers, aged 55+, who are approaching retirement, have managed to hold their contributions steady over the year.

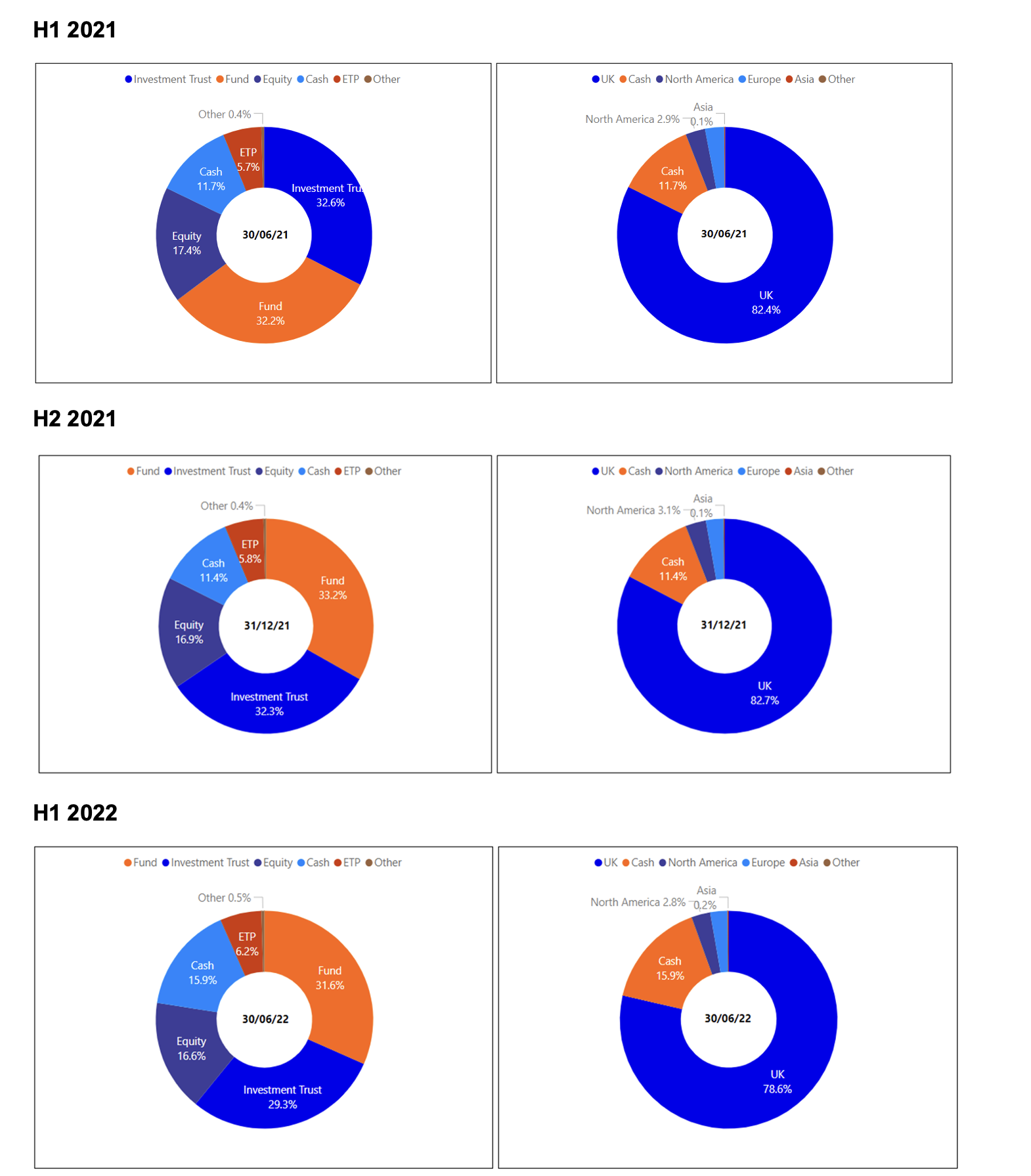

5. Across all age groups, the proportion of SIPP investors’ portfolios exposed to equities and investment trusts has decreased and the proportion exposed to cash and exchange-traded products has increased, since the first half of 2021.

Becky O’Connor, Head of Pensions and Savings at interactive investor, the UK’s second-biggest investment platform and SIPP provider, said: “There was a significant drop in the average size of tax-free lump sum taken out of Self-Invested Personal Pensions (SIPPs) held with interactive investor in the first half of 2022 compared to previous periods, as well as a rise in the amount of income taken out of people’s pensions, among those aged 55 and over, who are approaching, or already in retirement.

“This reflects the impact of both declines in the value of stocks and shares over the period, causing people to take a cautious approach to taking money out of their pension, but also the equal-and-opposite effect of people needing more cash to cover the rising cost of living.

“Many workers contributing to their SIPPs chose to scale back their pension payments in the first half this year, particularly those aged 25 to 44, who may have faced a higher burden from the rise in the cost of living, on top of usually higher mortgage and rent costs for this age group and the cost of having young families.

“Against a backdrop of stock market unpredictability, high inflation, rising interest rates and geopolitical instability, it seems SIPP investors at almost every stage of building up or drawing down their pension are battening down the hatches, whether that’s by reducing contributions, or withdrawing smaller lump sums when they start to access their pension, or by changing the mix of their investments.

“Who can blame them? The current economic situation is a recipe for disaster for the newly retired, who must navigate what they need now, which is going up every day with price rises, versus what they are going to need later in retirement, as their pot value faces further depletion from inflation and uncertain stock market outlooks.

“The data shows that responses vary depending on life stage, with younger investors appearing more willing to reduce their pension contributions in the face of rising living costs than older investors, perhaps as retirement remains some way off and they might hope to increase them again later.

“For older workers, for whom retirement is a more imminent prospect, the need to line their nests as much as possible before giving up work by taking full advantage of tax relief, appears to take precedence – we have not seen a drop in contributions so far this year among the over 55s.

“We are encouraged by the level of proactivity, but also caution, our data shows. Many of the changes customers are making appear well-considered, maintaining a balance between what they need now but also with one eye on making sure their pot goes the distance.

“The pandemic had a peculiar impact on the life choices of would-be retirees – some chose to take early retirement, perhaps accounting for the relatively high lump sums and withdrawals being taken by SIPP holders during this period. But what we can also see is some of that pandemic ‘Great Retirement’ effect wearing off this year, with the reality of higher prices and falling stock markets setting in and people possibly choosing to work for longer instead.

“While SIPP investors are not necessarily representative of the whole population of people with defined contribution pensions, because they are typically engaged and active investors, they may also be more responsive to market conditions and act sooner to inflationary pressures and looming recession than others.”

FIG 1: CHANGE IN MONTHLY CONTRIBUTIONS AMONG SIPP INVESTORS IN ACCUMULATION

Contributions | Age | |||

18 to 24 | 25 to 44 | 45 to 54 | 55+ | |

Average monthly since H1 2018 | £164 | £642 | £696 | £594 |

Average monthly pre-pandemic Jan 2018 to Dec 2019 | £164 | £714 | £744 | £628 |

H1 2021 | £174 | £584 | £644 | £555 |

H2 2021 | £148 | £578 | £666 | £564 |

H1 2022 | £166 | £538 | £634 | £557 |

Age/ % change in contributions | % CHANGE H2 2021 to H1 2022 | % CHANGE H1 2021 to H1 2022 | % CHANGE H1 2022 v AVERAGE SINCE 2018 | % CHANGE H1 2022 vs PRE-PANDEMIC |

18 to 24 | 12% | -5% | -1% | -1% |

25 to 44 | -7% | -8% | -16% | -25% |

45 to 54 | -5% | -2% | -9% | -15% |

55+ | -1% | 0% | -6% | -11% |

Contributions are lower across all ages so far this year compared to previous years. They are significantly lower compared with contributions made pre-pandemic among people aged 25 to 44.

The exceptions are those approaching retirement and young SIPP investors aged between 18 and 24 (this younger group are likely to have had SIPPs opened for them and their parents may be paying in). Contributions among those aged 55+ have held up the best in the first half of this year compared to a year ago.

FIG. 2: CHANGE IN AMOUNT OF LUMP SUM TAKEN

Average Pension Commencement Lump Sum | 55-64 | 65-74 | 75+ |

2018 H1 | £70,612 | £57,182 | £20,750 |

2018 H2 | £85,739 | £69,994 | £18,063 |

2019 H1 | £71,274 | £44,542 | £55,893 |

2019 H2 | £82,135 | £56,401 | £54,021 |

2020 H1 | £77,958 | £50,035 | £52,066 |

2020 H2 | £78,465 | £70,404 | £44,125 |

2021 H1 | £75,159 | £64,305 | £43,222 |

2021 H2 | £80,646 | £61,713 | £50,783 |

2022 H1 | £54,557 | £41,687 | £34,017 |

Average PCLS H1 2018 to H2 2021 | £77,749 | £59,322 | £42,365 |

Average PCLS Pre-pandemic | £77,440 | £57,030 | £37,182 |

% CHANGE H2 2021 to H1 2022 | % CHANGE H1 2021 to H1 2022 | % CHANGE H1 2022 vs AVERAGE 2018 - 2021 | % CHANGE H1 2022 vs PRE-PANDEMIC | |

55 to 64 | -32% | -27% | -30% | -30% |

65 to 74 | -32% | -35% | -30% | -27% |

75+ | -33% | -21% | -20% | -9% |

There has been a significant decrease this year in the average size of tax-free lump sum being taken by SIPP investors – it is down by nearly a third (30%) for those in early retirement in the first half of this year, compared to previous time periods. The lump sum taken by older retirees aged 65 to 74 is down by the same proportion. For those aged 75 or more, the amount of tax-free lump sum taken is down by a smaller proportion – a decrease of 20% compared to the average for all previous periods and down 21% on a year earlier.

FIG. 3: CHANGE IN AVERAGE DRAWDOWN AMOUNTS AMONG SIPP INVESTORS TAKING AN INCOME

Average withdrawn over period | ||||

55-64 | 65-74 | 75+ | ||

2018 H1 | £16,124 | £15,844 | £12,557 | |

2018 H2 | £14,696 | £11,640 | £10,510 | |

2019 H1 | £17,914 | £15,319 | £16,669 | |

2019 H2 | £11,585 | £8,164 | £9,550 | |

2020 H1 | £15,611 | £13,412 | £10,334 | |

2020 H2 | £23,509 | £11,468 | £9,668 | |

2021 H1 | £18,819 | £14,026 | £16,668 | |

2021 H2 | £19,421 | £13,341 | £11,705 | |

2022 H1 | £21,496 | £17,136 | £13,173 | |

Average withdrawn H1 2018 to H2 2021 | £17,210 | £12,907 | £12,208 | |

Pre-pandemic average withdrawn over six months | £15,080 | £12,752 | £12,322 | |

% CHANGE H2 2021 to H1 2022 | % CHANGE H1 2021 to H1 2022 | % CHANGE H1 2022 VS ALL PREVIOUS PERIODS | % CHANGE H1 2022 VS PRE-PANDEMIC | |

55 to 64 | 11% | 14% | 25% | 43% |

65 to 74 | 28% | 22% | 33% | 34% |

75+ | 13% | -21% | 8% | 6% |

People aged between 55 (the minimum age for pensions access) and 64 - were taking out far more from their pension as income – both regular withdrawals and one-off payments, in the first half of this year. They took out 14% more than the same period a year earlier and 43% more than the pre-pandemic average withdrawal over a six-month period.

Retirees aged between 65 and 74 also took far more out than average in the first half of this year: 22% more than the same period a year earlier and 34% more than the pre-pandemic average.

The increase in amounts withdrawn was not as significant for those aged 75 or older. They took out less in the first half of this year compared to a year ago and only 6% more compared to the pre-pandemic average.

Compared to all previous periods for which we have data and across all age groups in drawdown, the average increase in the amount withdrawn in the first half of this year is 22%.

FIG 4: CHANGE IN AGE PEOPLE TAKE MONEY OUT: TAX-FREE LUMP SUM/ ONE-OFF PAYMENT/ REGULAR INCOME

- The key ages for starting to take money from a SIPP are between 61 and 63-years old.

- The average age a tax-free lump sum is taken has gone up by 1.5 years from 59.9 to 61.4-years old, since the same period in 2019.

- The average age to take a first regular income has virtually stayed the same, at 63.5-years old (63.7-years old in 2019).

- The average age of a first one-off payment has stayed virtually the same: 62.7-years old in 2019 and 62.8-years old in 2022.

- The age at which people took their first regular income and first one-off payment coalesced during the peak of lockdowns, perhaps as more people took early retirement.

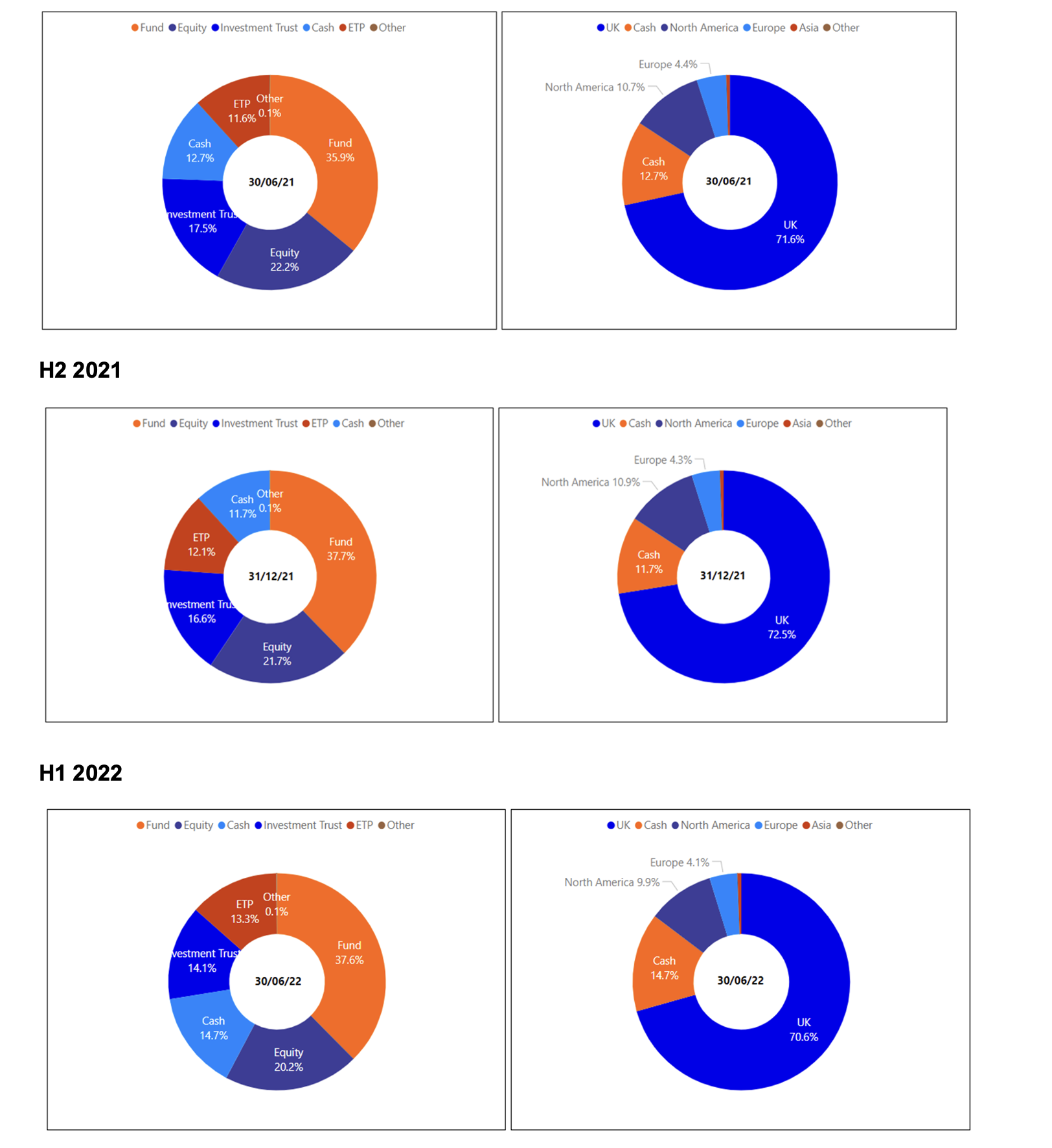

FIG 5: ASSET MIX, SIPPS IN ACCUMULATION, AGES 25 to 44

H1 2021

Among SIPP investors aged between 25 and 44, there has been a decrease in the proportion of equities in their portfolio and a decrease in investment trust holdings since the first half of 2021. However, they have increased their exposure to cash and exchange-traded products, as well as increasing the proportion of funds held over the course of last year. There has been a slight decrease in exposure to the UK and to North America and Europe.

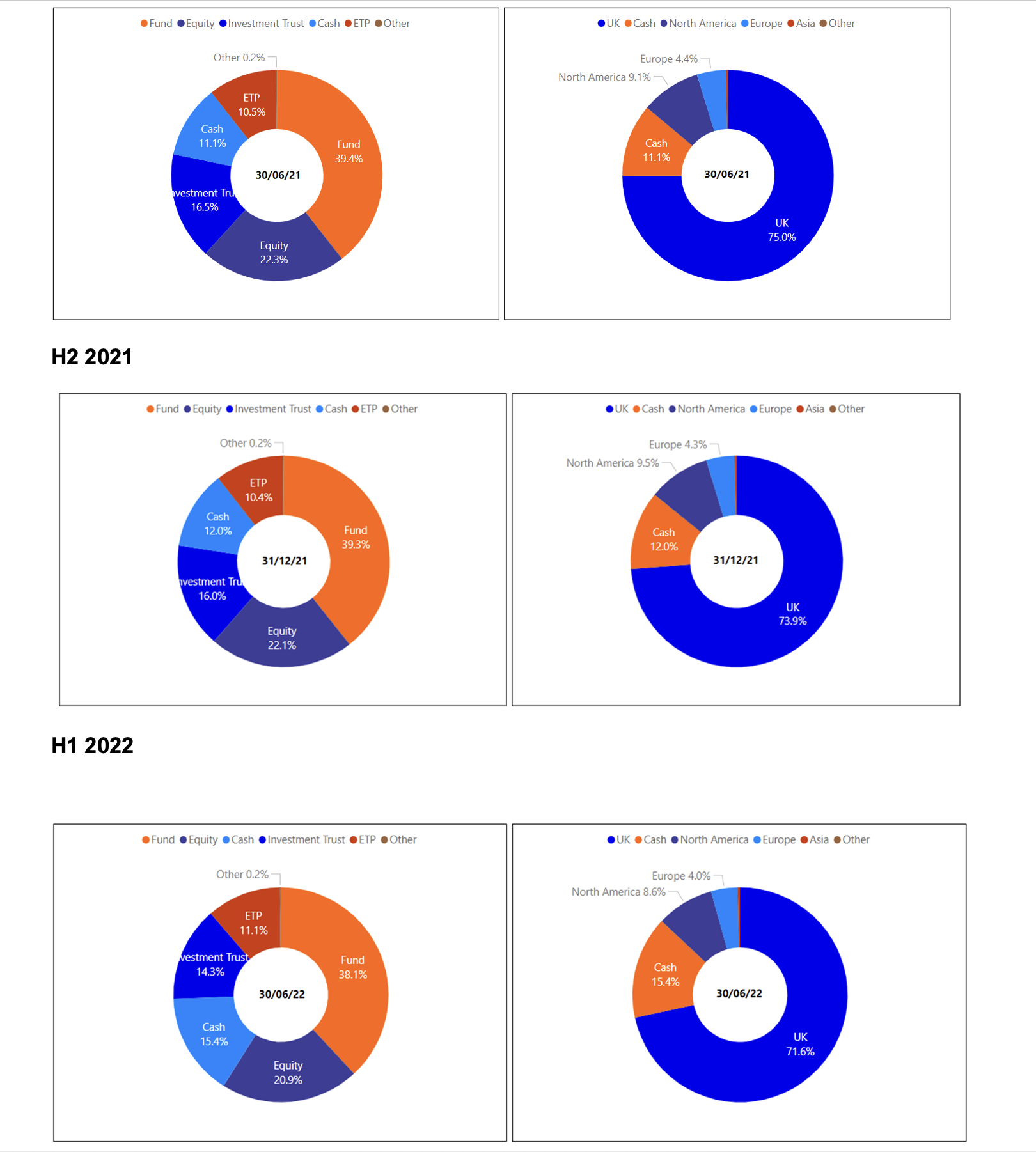

FIG. 6: ASSET MIX, SIPPS IN ACCUMULATION, AGE 45 to 54

H1 2021

Among SIPP investors aged 45 to 54, who are approaching the age at which they will first be able to access their pension, there has been an increase in the proportion of cash and exchange-traded products in their portfolios and a decrease in the proportion of funds, equities and investment trusts since the beginning of 2021. There has been a slight decrease in the proportion invested in the UK, North America and Europe.

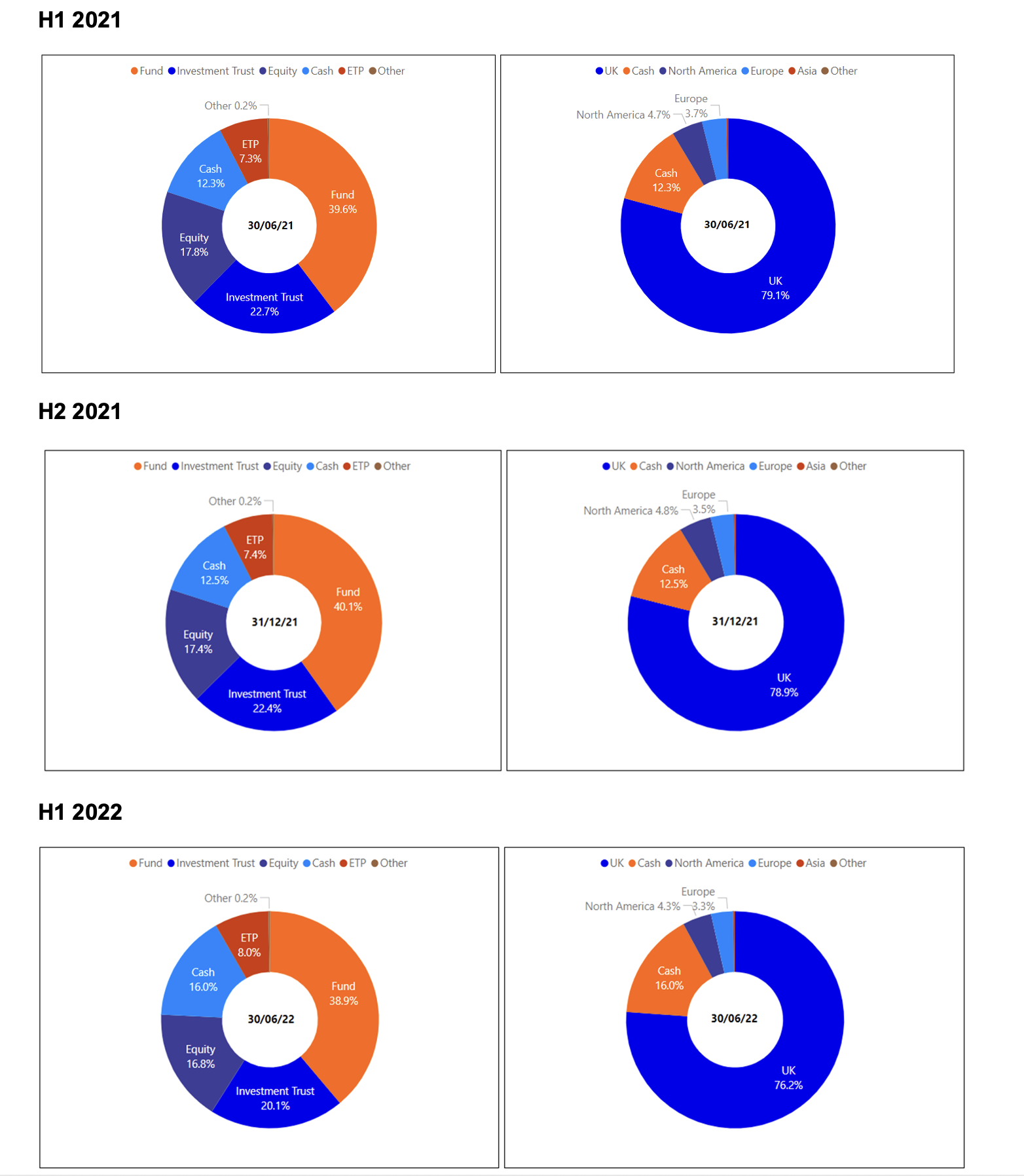

FIG. 7: ASSET MIX, SIPPS IN DECUMULATION, AGE 55 to 64

H1 2021

Among SIPP investors aged 55 to 64, who are able to access their pensions but have not yet reached state pension entitlement age, there has been an increase in the proportion of cash and exchange-traded products and a decrease in funds, investment trusts and equities since the first half of 2021. There has been a decrease in the proportion invested in the UK and a very slight decrease in North America and Europe.

FIG.8: ASSET MIX, SIPPS IN DECUMULATION, AGE 65+

H1 2021

Among SIPP investors aged 65 or older, who may now be entitled to the state pension as well as taking an income from their private pension and are more likely to have given up work entirely, there has been a decrease in the proportion of their portfolio invested in equities, investment trusts and funds, as well as a significant increase in cash held and a slight increase in the proportion of exchange-traded products. Although this age group tends to favour UK-based investments more than younger investors, the proportion exposed to the UK has fallen among this age group, too.

FIG. 9: TOP 10 HOLDINGS SIPPS IN ACCUMULATION, AGES 25 to 44 (by value of assets)

Jan to June 2021 | July to December 2021 | Jan to June 2022 | |

1. | |||

2. | |||

3. | |||

4. | |||

5. | |||

6. | |||

7. | |||

8. | |||

9. | |||

10. |

FIG. 10 TOP 10 HOLDINGS SIPPS IN ACCUMULATION,AGES 45 to 54 (by value of assets)

Jan to June 2021 | July to December 2021 | Jan to June 2022 | |

1. | |||

2. | |||

3. | |||

4. | |||

5. | |||

6. | |||

7. | |||

8. | |||

9. | |||

10. |

FIG. 11: TOP 10 HOLDINGS SIPPS APPROACHING OR IN DRAWDOWN, AGES 55 to 64

Jan to June 2021 | July to December 2021 | Jan to June 2022 | |

1. | |||

2. | |||

3. | |||

4. | |||

5. | |||

6. | |||

7. | |||

8. | |||

9. | |||

10. |

FIG.12: TOP 10 HOLDINGS SIPPS IN DECUMULATION, RETIREMENT, AGES 65+

Jan to June 2021 | July to December 2021 | Jan to June 2022 | |

1. | |||

2. | |||

3. | |||

4. | |||

5. | |||

6. | |||

7. | |||

8. | |||

9. | |||

10. |

Becky O’Connor says: “Older SIPP investors seem less inclined to make changes to their portfolio in response to market conditions than younger investors – we can see the top 10 has remained roughly the same for those already in retirement, whereas there appears to have been a little more chopping and changing among younger customers with their pension holdings.

“You would expect younger people, with their longer time horizons, to be more comfortable moving their holdings around a little more, just as you would expect older SIPP investors, who are most likely invested in income-producing holdings that they have owned for many years, to sit tight.

“Both younger and older SIPP investors hold stocks, however those still contributing to their pension are far more likely to be investing in Tesla (NASDAQ:TSLA), Amazon (NASDAQ:AMZN)and Apple (NASDAQ:AAPL), while older SIPP customers who are drawing an income prefer the likes of Lloyds (LSE:LLOY), BP (LSE:BP.) and GSK (LSE:GSK).

“The dominance of Scottish Mortgage (LSE:SMT) and Fundsmith Equity across all ages shows that sometimes, investments transcend the immediate growth and income concerns of the individual and where they are in relation to retirement.

“It’s interesting to note the Vanguard funds feature among portfolios in accumulation, but not among the retired population.

“However, across the board, we can see that cash and exchange-traded products have become more popular since the beginning of last year and even more since the beginning of 2022.”

On the slight decrease in the proportion of investment trusts held and slight increase in the proportion of exchange-traded products, Kyle Caldwell, Collectives Editor, interactive investor, said: “This may be reflective of some savvy investors knowing that investment trusts’ ability to gear will prove painful when stock markets are more volatile – as they have been in first half of 2022. Year-to-date like-for-like investment trusts have underperformed funds. This could also reflect investors positioning for further stock market pain by becoming more cautious – the increase in cash also indicates this.

“The increase in ETFs is another indication of the continued rise of passives – with some investors losing faith in active fund managers and perhaps unsatisfied with how their fund manager has performed as (most) stock markets declined in the first half of 2022.”

Notes to Editors

- *Interactive investor SIPP customer data as currently recorded goes back as far as 2018. All figures rounded to nearest full percentage point. Not adjusted for inflation.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important information – SIPPs are aimed at people happy to make their own investment decisions. Investment value can go up or down and you could get back less than you invest. You can normally only access the money from age 55 (57 from 2028). We recommend seeking advice from a suitably qualified financial adviser before making any decisions. Pension and tax rules depend on your circumstances and may change in future.