SIPP cashback offer worth up to £3,000 extended

31st July 2023 12:34

by Jemma Jackson from interactive investor

interactive investor extends generous cashback offer into August.

- Customers who transfer or open an ii pension in August stand to receive cashback worth up to £3,000, extending July’s offer

- Interest in SIPPs is at a record high, according to Google keyword analysis

- Offer applies to both new customers and current ii customers

interactive investor, the UK’s biggest flat fee investment platform, is extending its offer of up to £3,000 to customers who transfer into its award-winning pension across the whole of August. Terms and conditions apply.

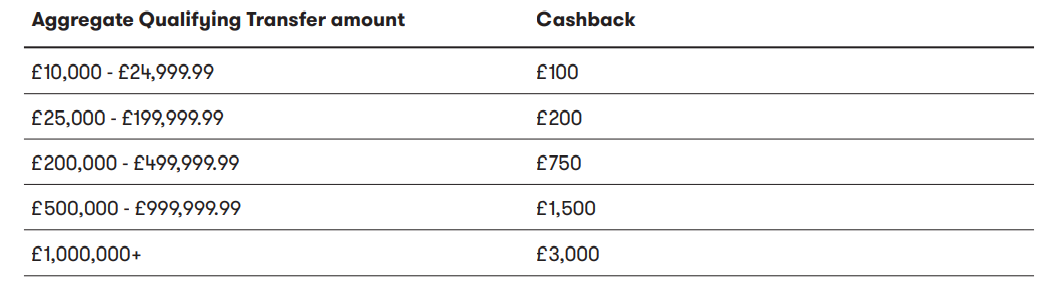

The offer, which ran throughout July, begins at £100 cashback for those who transfer the minimum qualifying amount of £10,000 - £24,999.

- Invest with ii: Open a SIPP | Best SIPP Investments | SIPP Cashback Offers

The cashback then scales up with the amount transferred, with £200 cashback on pension pots between £25,000 and £199,999 and a tempting £750 on assets between £200,000 and £499,999.

Cashback on assets between £500,000 to £999,999 is a generous £1,500, increasing to £3,000 on pots over £1 million.

The offer extension comes as ii is named a Which? recommended SIPP provider for 2023, the second year in a row it has achieved the accolade and less than 18 months since it launched its game-changing Pension Builder Plan.

It also arrives as consumer interest in pensions appears to be on the rise. According to Google Trends – which tracks spikes in ‘keyword’ searches – interest in ‘SIPP’ and ‘SIPP pension’ is the highest it has been for at least the past five years.

The cashback offer applies to both new customers, current ii customers who do not have a pension with ii, and current SIPP customers who transfer additional pensions to their existing SIPP accounts. It does not apply to investments already held in an ii account.

The power of pension investing

Pensions often fall to the bottom of many people’s to-do lists, but the benefits of getting started sooner or in paying attention to any existing pensions can be hugely beneficial in retirement.

The ii offer is a great incentive for people either thinking about setting up a pension for the first time or consolidating pensions and bringing them under one roof – and under one low-cost, flat fee.

Myron Jobson, Senior Persona Finance Analyst, interactive investor, says: “This is a great offer for a great value pension. It comes with free regular investing, the full fat range of choice, and a fair flat fee, which can save people tens of thousands of pounds over a lifetime of saving. So, while it is always important to scratch under the bonnet of any incentive, this is a genuinely fantastic offer which I am happy to stand behind.

“Interest in pensions is on the up and keyword analysis, which examines how often consumers are searching online for particular words or word combinations, suggests pensions are on customers’ minds, so we are happy to extend what we think is a great incentive to take action.

“Taking a little time to give your pension some TLC could pay dividends in the long run. Even modest contributions can add up to a large pension pot, especially with added pension tax relief on top. Saving £200 per month for 40 years, which increases to £250 after pension tax relief, could add up to an amazing £381,505 after 40 years, assuming annual average 5% investment growth, which is by no means guaranteed.

“Pension charges can really add up in the long run, and our flat fee can mean more of customers’ money is working for them, not their provider.”

SIPP cashback offer:

The offer will continue until 31 August 2023 and only applies to ii’s pension.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important information – SIPPs are aimed at people happy to make their own investment decisions. Investment value can go up or down and you could get back less than you invest. You can normally only access the money from age 55 (57 from 2028). We recommend seeking advice from a suitably qualified financial adviser before making any decisions. Pension and tax rules depend on your circumstances and may change in future.