Should you own a share with a place in the sun?

A company currently enjoying a good spell is in a highly volatile sector with a thin line between success and failure. Overseas investing expert Rodney Hobson gives his view on what investors should do now.

18th December 2024 10:26

by Rodney Hobson from interactive investor

Despite some belt-tightening in Europe and the UK and political uncertainty on the Continent, people seem as keen as ever to splash out on a holiday. Or perhaps it is because of gathering gloom that folk are desperate to get away from it all. Or more likely, sun-seekers are scaling down from expensive holidays and settling for cheaper package breaks.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Whatever the reason, German holiday company TUI AG (XETRA:TUI1) is basking in continuing sunshine. It has abandoned its listing on the London Stock Exchange and its shares are now available only on the Frankfurt bourse. The change has, as the saying goes, been as good as a rest.

Tui reported revenue up 12% to €23.2 billion in the year to 30 September with more than 20 million people travelling, up one million from the previous 12 months. Better still, underlying profits soared by a third to €1.3 billion, with the actual pre-tax figure surging 56% to €861 million.

The good news spread across all parts of the business. Hotels and resorts saw profits rise more than 20% to €668 million, while cruises and experiences grew strongly.

- IAG and easyJet among airline share tips for 2025

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Tui seemed remarkably downbeat about prospects for the current year, perhaps because the final quarter was less encouraging than the previous nine months. Revenue growth over the next 12 months is seen as 5-10% with underlying pre-tax profits up 7-10%. That growth is still more than reasonable, especially as Tui expects to be operating in a higher inflationary environment.

The winter season in the first half, always the weaker part for holiday companies in the northern hemisphere, will be held back by the need for higher investment ahead of the far more important summer season. Comparisons will also be distorted by Easter falling in April next year rather than March, as in 2024.

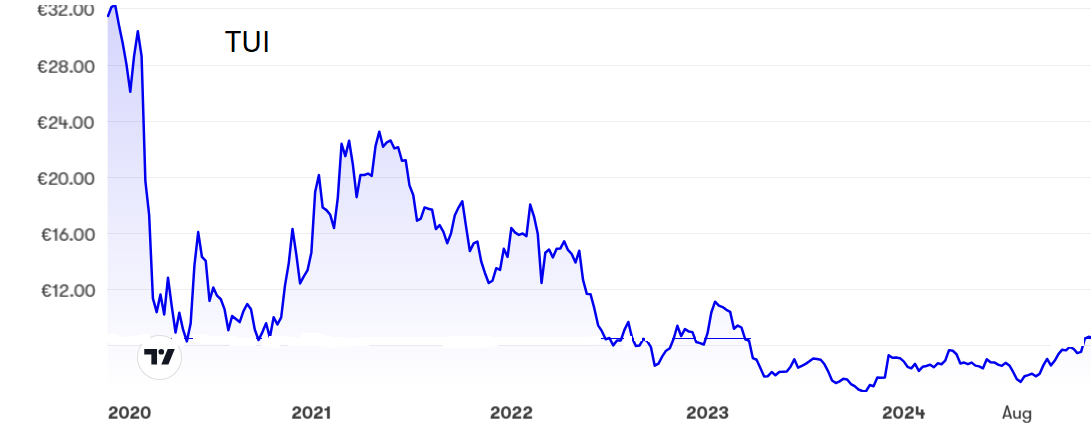

Source: interactive investor. Past performance is not a guide to future performance.

Any progress will depend on holidaymakers on the Continent rather than from the UK, where demand for winter breaks are flat on this stage last year and are down 3% for next summer.

Tui puts down its recent success to customers moving to lower-cost options. Even so, it managed to raise prices over the past 12 months and is currently selling future breaks priced 5% higher for winter and 3% higher for summer. Winter bookings at 62% of capacity are in line with the same time last year.

More expensive holidays are starting to sell again but most bookings are for short- and medium-haul destinations with demand as usual for Greece, Turkey and the Balearics leading the way.

Tui is strong enough to ride out the ups and downs of the package holiday market. It has more than 400 hotels and resorts, 17 cruise ships, 130 planes and 1,200 travel agencies. It has expanded over the years by buying struggling rivals such as Thomson and First Choice. Nonetheless, this is a highly volatile sector with a thin line between success and failure.

Tui shares fell off a cliff during the Covid crisis, dropping from €32 to below €9. A subsequent rally to €23 led to a further period of decline and a low of €4.70. So, the stock is still way below its recent best despite a rally after the better figures.

At €8.40 the price/earnings ratio is less than 5 but there is no dividend and it is difficult to forecast whether or when there ever will be.

Hobson’s choice: The sun never seems to shine for long on the holiday sector, and despite the recent better news, you cannot count on the good times continuing to roll. The tiny p/e is a warning. Holders should take this opportunity to get out. Sell.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.