Should you buy shares in your favourite sports team?

Consumers can invest in football, esports, Formula 1 and basketball, but is it a good idea?

12th November 2020 08:58

by Marc Shoffman from interactive investor

Consumers can invest in football, esports, Formula 1 and basketball, but can sports fans make money from it too?

Lewis Hamilton is gearing up for the biggest F1 event of his career at the Turkish Grand Prix this week, with a win guaranteeing him a place alongside Michael Schumacher with a record seven world titles.

Fans may not be allowed to watch this sort of sporting event in person due to Covid-19 restrictions, but you can still share in the highs and lows of your favourite sport – financially, at least. From TV rights to oligarch owners, season tickets, shirt sales and sponsorship deals, there is a phenomenal amount of money flowing into sport right now. And, while you may not get to hold the trophies or keep any medals, you can invest in sport – provided you are happy with the risks involved.

From Monaco to Wall Street

Unlike with football teams whose financial performance is directly linked to results on the pitch, the share price of motor manufacturers involved in F1 does not necessarily reflect success on the track.

- Invest with ii: Top UK Shares | Buy International Shares | Interactive investor Offers

Few companies are set up solely to race F1 cars. Most of these F1 teams are large multinationals whose bread and butter is getting you and I to buy the most expensive road car we can afford. That’s the true driver of their share price.

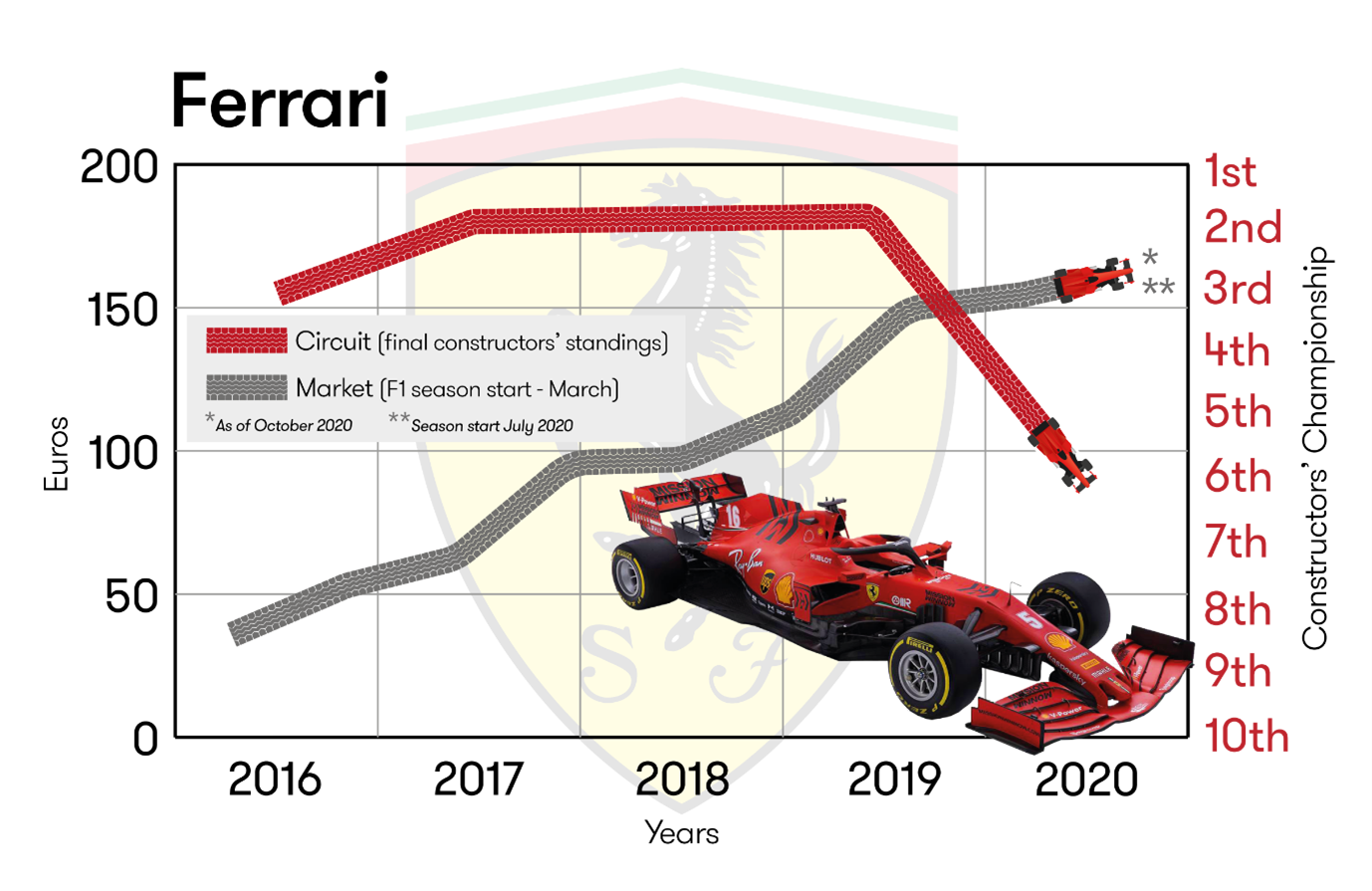

Just look at Ferrari (NYSE:RACE). They’re having their worst F1 season in living memory, stuck in the middle of the grid, and face a 26% reduction in annual sponsorship, brand and commercial revenue, largely due to underperformance on the track and disruption to the 2020 race calendar.

However, rich buyers are still queuing up to buy its expensive road cars, and the shares hit a record high in August.

Source: interactive investor. Chart shows place in Formula One constructor’s championship versus share price of parent company

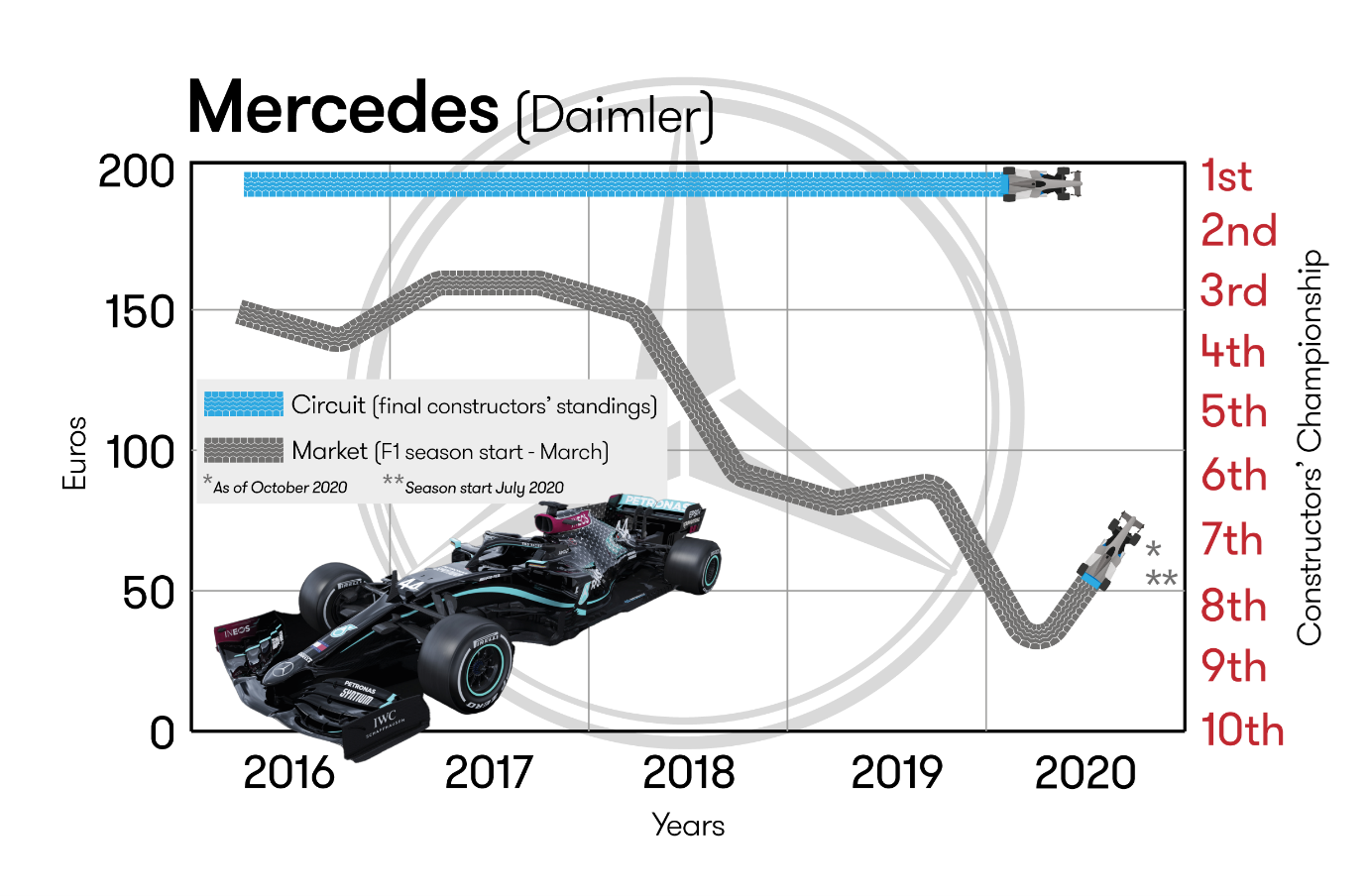

Conversely, shares in Mercedes-owner Daimler (XETRA:DAI), whose Lewis Hamilton-led team has dominated the sport since 2014, have been in decline for the past five years. They’re recovering now, but that’s not down to Hamilton’s success.

Source: interactive investor. Chart shows place in Formula One constructor’s championship versus share price of parent company

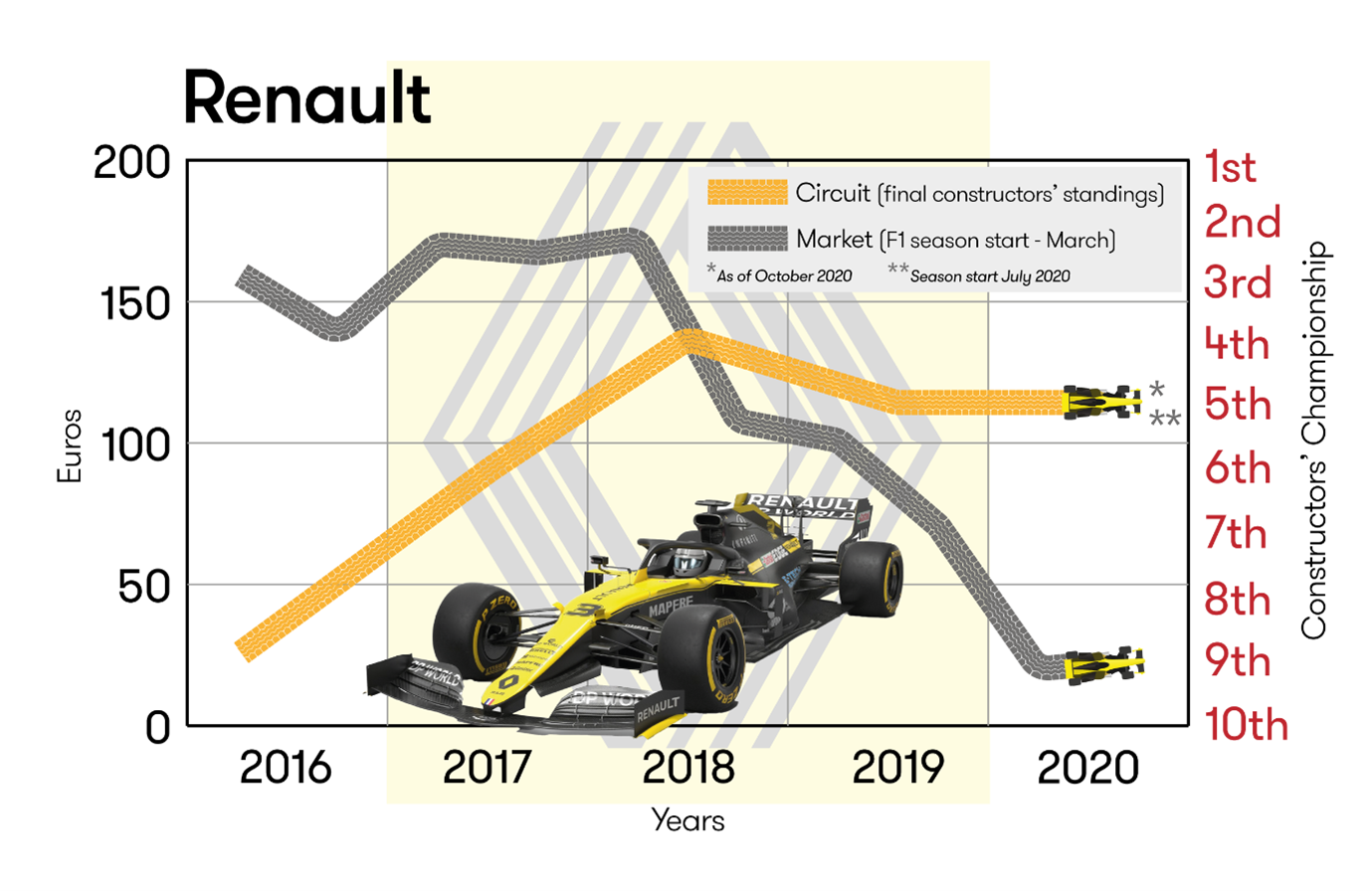

Elsewhere, Renault (EURONEXT:RNO) has a strong race team, but the shares are nowhere, while back row regulars Williams Grand Prix (XETRA:WGF1) watched their shares spike in August after being sold to American private equity firm Dorilton Capital, only for them to collapse shortly after. And don’t think F1 is the panacea for all Aston Martin's (LSE:AML) considerable woes. It isn’t.

Source: interactive investor. Chart shows place in Formula One constructor’s championship versus share price of parent company

The pandemic put a serious dent in sales of new cars. It’s why motor manufacturers wedded to F1, and who are becoming increasingly green in their approach, must slash costs and scale back investments in order to repair margins.

Of all of them, Ferrari and Renault currently have most fans in the Square Mile.

Motor racing followers can purchase shares in the Liberty Formula One Group (NASDAQ:FWONK), which controls the commercial rights of the sport. Its stock has also been hit during the pandemic as several races have had to be postponed, underlining its volatility.

The beautiful game

Away from motorsports, several football clubs are publicly listed. Although they may not always be winning trophies, they could still be a good pick for your portfolio due to being established and popular brands.

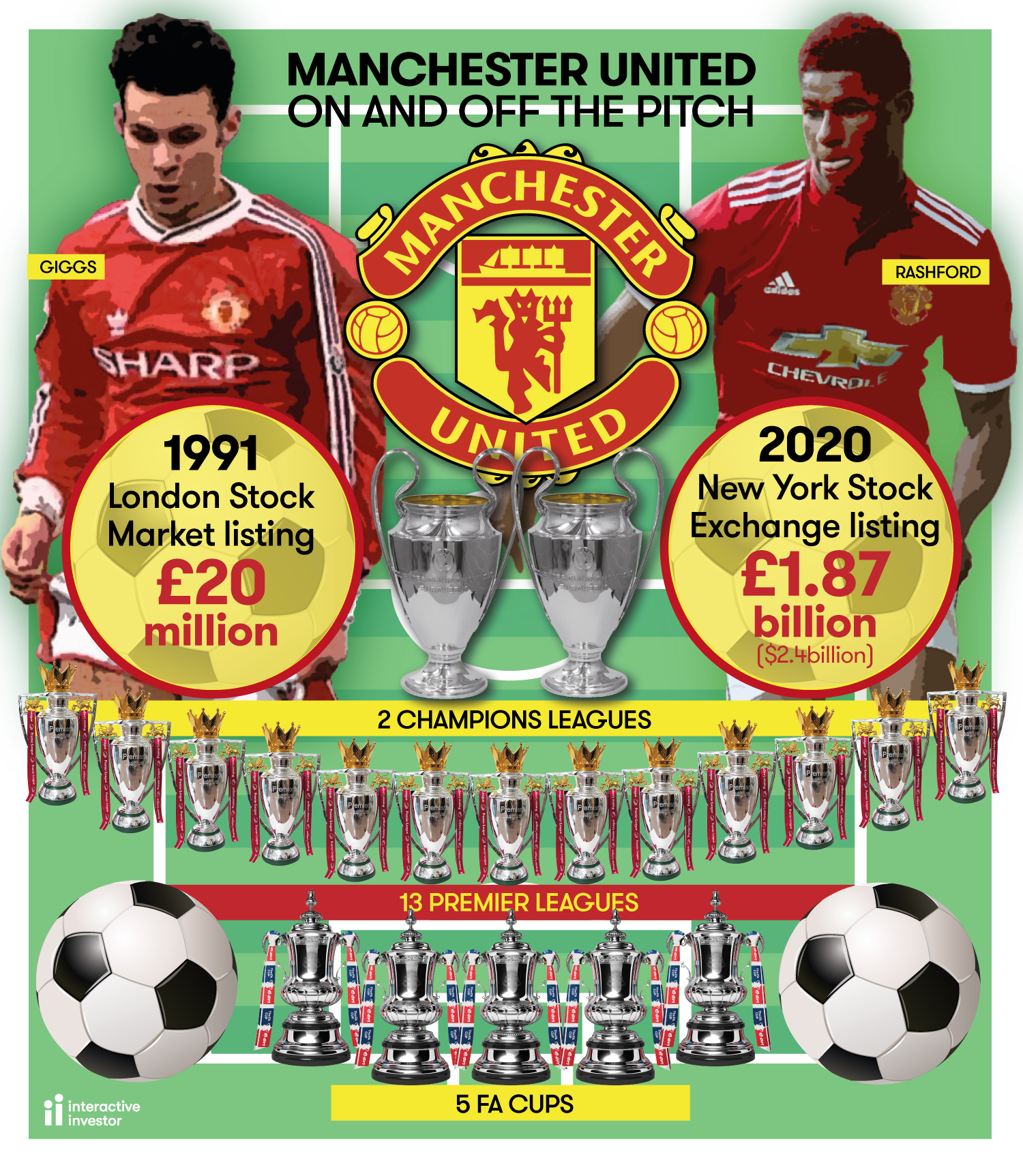

For example, Manchester United (NYSE:MANU) first listed in 1991 with a market value of £20 million. It’s now worth $2.4 billion (£1.87 billion) on the New York Stock Exchange after more than three decades that have included success in the Premier League, Champions League and FA Cup.

Strike it lucky with shares

Football stocks became popular in the 1990s as clubs needed to raise capital to meet new rules on providing all-seater stadia.

There was also pressure to raise wages to attract talent under the Bosman ruling that allowed teams to sign players from other clubs for free at the end of their contract.

There were once around 20 listed football teams, but most have gone private after takeovers and there are currently just seven.

Manchester United were listed on the London Stock Exchange (LSE) between 1991 and 2005, but joined the New York Stock Exchange (NYSE) in 2012 after a takeover by American businessman Malcolm Glazer.

Scottish giants Celtic (LSE:CCP) are listed on the LSE, and fans of Serie A will find AS Roma (MTA:ASR), Juventus Football (MTA:JUVE) and Lazio (MTA:SSL) on the Italian stock market.

German club Borussia Dortmund (XETRA:BVB), once managed by current Liverpool boss Jurgen Klopp, is listed on the country’s stock market, and Dutch giants Ajax (EURONEXT:AJAX) can be found on European stock exchange Euronext.

But Richard Hunter, head of markets at interactive investor (ii), warns that these investments are “never for widows or orphans” due to their volatility.

He says: “The vast majority of them are quite simply hostage to their fortunes on the pitch, and the share price moves accordingly.”

Ajax shares dropped 20% when they were knocked out of the Champions League semi-finals by Tottenham Hotspur in May 2019. And it is not just team performance that can impact returns.

The share prices of most listed football clubs have also dropped during the pandemic as teams face losses from a lack of ticket sales.

Managing a shareholder database can also be expensive. Championship club Millwall were once one of the most commonly-traded stocks. However, it delisted from the Alternative Investment Market in 2011 after several fundraisings diluted holdings for investors and pushed its share price to below a penny.

Investing in sport gives you more involvement beyond shouting from the terraces, but most clubs are still controlled by a majority shareholder, so you are unlikely to get much say over how they are run.

Hunter adds: “These remain high risk investments and unsuitable for the majority of investors. In days gone by, investors or supporters could at least hang the share certificate on their wall, but that is no longer a realistic option.”

Away from football, investors can also back basketball team the New York Knicks and ice hockey’s New York Rangers on the NYSE.

A defensive approach

Investing solely in one or two sector-specific shares is particularly risky when much depends on results from week to week.

Instead, some funds offer exposure to sport, which helps diversify your investment.

Investing veteran Nick Train holds stakes in Manchester United, Juventus and Celtic through his Lindsell Train global and UK equity funds.

He described these stocks in an interview with ii as “unique global brands”.

Train says: “The value of sports franchises is going up and up, and it's easy to understand why when you see the billions of dollars or billions of pounds being pumped into the sports industry by these big media companies, and now by these giant internet companies all looking to muscle in on televising live sports.”

- Nick Train interview: one of the clearest bull markets in the world today

- Forget Tesla, check out these alternatives

- Aston Martin stuck in reverse as shares crash again

Investors can also get exposure to football team Ajax through the Invesco Continental European Small Cap fund.

Virtual sports

Another sporting trend that has emerged during lockdown is esports, or competitive computer games. Watching someone else play a game online may not sound as exciting as celebrating an FA Cup win in person, but esports is fast becoming a billion-dollar industry.

Former England football captain David Beckham is looking to score in this sector after taking a stake in Guild Esports (LSE:GILD), which floated in October.

Investors will be able to support Guild Esports in backing a team of gamers competing for cash prizes worth millions of pounds, as well as sponsorship deals, for winning games such as Fortnite and Fifa.

Investors can already back esports through the VanEck Vectors Video Gaming and eSports exchange-traded fund (ETF).

It was the first of its kind to launch on the LSE last year and follows an index of global video game and esports companies involved in the development of video games, esports and related hardware and software.

It holds companies such as games console maker Nintendo and Fifa creator EA Sports.

- David Beckham IPO and a tech entrepreneur to watch

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

The ETF had an annual return of 83% as of the end of August 2020 and Martijn Rozemuller, head of Europe for VanEck, says the pandemic continues to give the sector a boost.

He says: "We have seen strong growth in the video and esports industry, particularly during the coronavirus pandemic as people around the world compete and make digital contacts through video games due to a lack of personal contact and sports opportunities.

“The risks should not be ignored: these companies are heavily dependent on patent protection and may be subject to regulatory restrictions in terms of cybersecurity and data protection.”

Funny old game

Those interested in sports investing have more choice than ever, but should remember a famous saying by former England and Tottenham Hotspur striker Jimmy Greaves.

He described football as “a funny old game” due to its unpredictability. The same principle applies to sports investing - some weeks you may have a big win, but you also have to be prepared to weather the losses and heartbreak too.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.