Should investors avoid China?

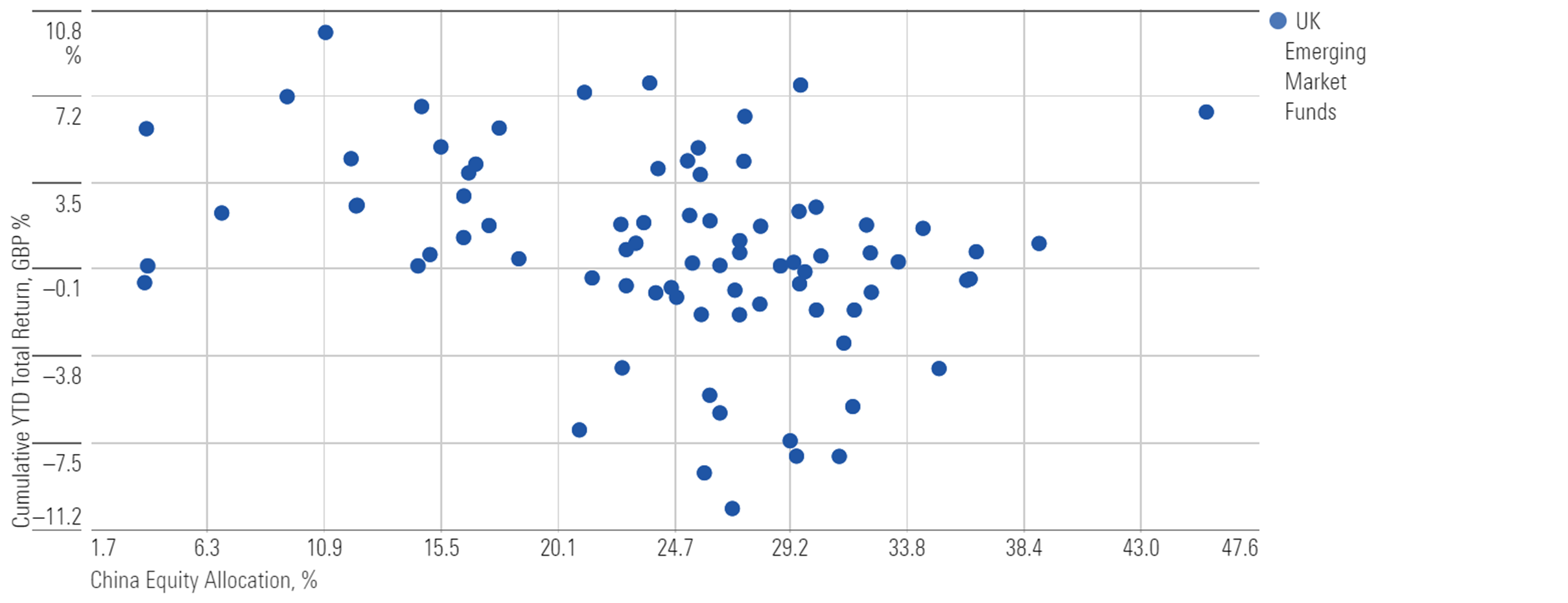

Unsurprisingly given the volatility in Chinese markets, funds with less China exposure have done better.

24th November 2021 11:27

by Briegel Leitao from ii contributor

Unsurprisingly given the volatility in Chinese markets, funds with less China exposure have done better.

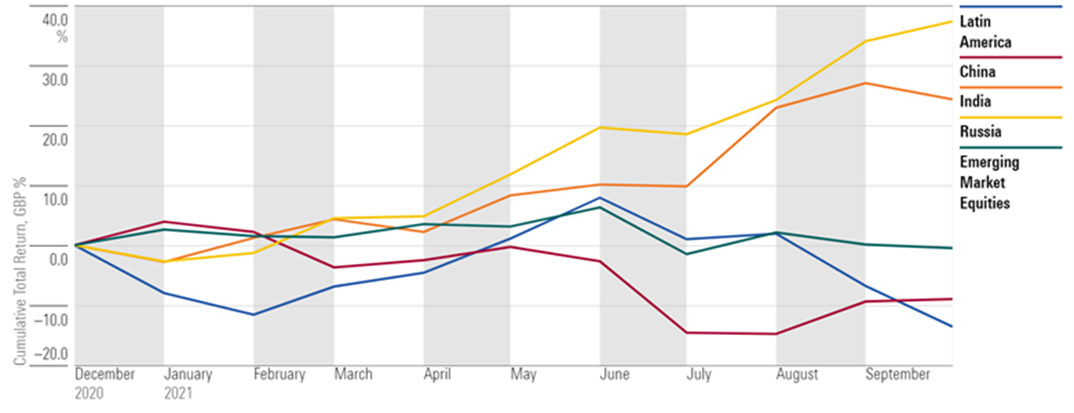

Emerging markets logged another difficult quarter at the end of September over what’s been a turbulent year so far for many of the major regions.

China has had a particularly challenging period, being caught in a series of regulatory crosswinds that have hurt equity markets and made investors reconsider the future of many of the country’s star companies. At around 35-40% of the underlying market, underperforming Chinese equities have been a major detractor for many emerging market portfolios.

While there was opportunity to be found in some corners of the Chinese equity market, communication services, consumers, and real estate have all taken massive hits over the year.

Communication services is where the first half of the Internet-of-Things companies that have led much of China’s return profile over the years can be found. While this sector includes telecommunication infrastructure, the headline companies are very much the interactive media and online entertainment companies which have been in the firing line of Chinese regulators looking to take a hard stance on limiting gaming hours for under-18s.

- Why China’s economic rise isn’t a reason to invest

- Is your S&P 500 ETF at risk of China slowdown?

- Get £100 cashback when you switch to an ii ISA in November. Terms apply

The second half, or group, of Chinese internet companies are the consumer cyclical companies that have come under fire from anti-trust regulators, which have been handing out fines to e-commerce platforms that pressure merchants into exclusive contracts. While anti-trust investigations date back to the end of 2020, the ongoing implications mean e-commerce giants need to find new ways to retain merchants, adding uncertainty to their growth prospects if this means things such as lowering platform costs.

Fresh fears gripped the market in September when property developer China Evergrande (SEHK:3333) warned investors of impending default risk. China Evergrande is only the tip of the iceberg of Chinese property developers struggling with the weak housing market and mounting debt, and the announcement prompted continued risk-off trades from investors fearing implications of contagion.

Unsurprisingly given the volatility in Chinese markets, there was a strong signal coming from funds in the global emerging market peer group that allocated away from China and stronger performance year-to-date. Exhibit 2 shows global emerging market strategies in the UK fund market, plotting their portfolio China allocation against their year-to-date performance.

Based on aggregate holdings data, high-quality consumer businesses have been a popular trade over the last 18 months, and strategies that were able to find opportunities outside China were generally well rewarded.

- US shares and Chinese bonds: the new 60/40 portfolio?

- Should your emerging market ETF strip out China?

Over the year, these opportunities were the strongest in emerging market economies such as India and south-east Asia. Fund managers who overweighted these countries effectively traded China’s struggling later-stage online and e-commerce names for consumer companies that are closer to first-time spenders. These sorts of companies range from emerging market retail banking to consumer staple goods that the emerging middle-class are fuelling demand for, and accordingly, allocations to these kinds of segments helped these sorts of funds avoid much of the drawdown coming from Chinese equities.

Latin America was less rewarding for investors as the region’s miners and materials companies didn’t escape the news from China. Much of the gains made earlier in the year from rising commodity prices were wiped after the news of China Evergrande and the resulting risk implications for future steel and iron ore demand.

Briegel Leitao is an associate analyst of manager research and passive strategies at Morningstar.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.